Smart Musical Instruments Market Size

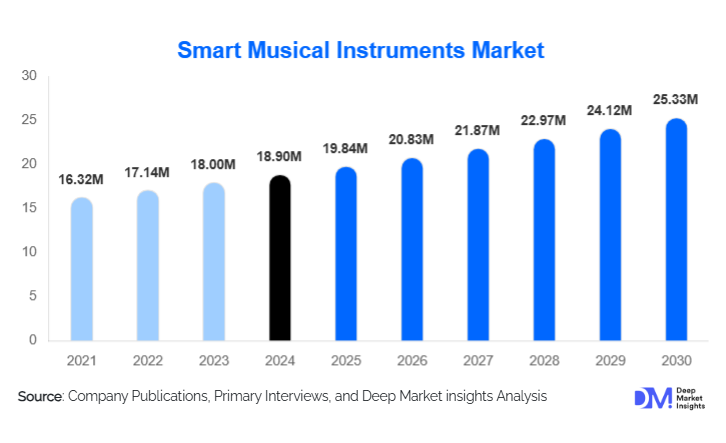

According to Deep Market Insights, the global smart musical instruments market size was valued at USD 18.90 million in 2024 and is projected to grow from USD 19.84 million in 2025 to reach USD 25.33 million by 2030, expanding at a CAGR of 5.00% during the forecast period (2025–2030). The growth of the smart musical instruments market is primarily driven by rising adoption of connected music devices, increasing integration of sensors and IoT technologies in modern instruments, and a surge in digital music creation, e-learning, and home-studio setups worldwide.

Key Market Insights

- Smart keyboards and smart pianos dominate the market, driven by strong adoption in learning, home practice, and digital studio workflows.

- Connected instruments with embedded sensors and IoT capabilities lead the technology segment, accounting for over half of the global revenue in 2024.

- North America accounts for the largest regional share, supported by advanced music production ecosystems and high purchasing power.

- Asia-Pacific remains the fastest-growing region, driven by rising middle-class wealth, music education demand, and the expansion of digital content creation.

- Bluetooth and app-integrated instruments hold the highest connectivity share, supported by mobile-first music creation trends.

- Professionals and studio artists account for the highest revenue contribution, as they invest in advanced gear, DAW-compatible devices, and sensor-enabled instruments.

What are the latest trends in the smart musical instruments market?

AI-Enhanced Music Learning & Performance

Smart musical instruments are increasingly integrating AI-driven learning platforms that offer real-time feedback, gesture recognition, and adaptive learning modules. Instruments such as smart pianos, digital wind instruments, and sensor-enabled guitars now allow players to evaluate accuracy, timing, and dynamics through companion apps. These AI-assisted systems are being adopted by schools, online academies, and self-learners, revolutionizing how musicians practice and master instruments. Embedded analytics also support educators by tracking progress and customizing lessons, turning smart instruments into comprehensive digital learning ecosystems.

App-Integrated & IoT-Enabled Instruments Transforming User Experience

With growing demand for mobile-based music creation, manufacturers are integrating Bluetooth, Wi-Fi, and cloud connectivity into instruments. These features enable seamless synchronization with DAWs, backing tracks, digital effects, and recording applications. App-integrated smart keyboards, drums, and MIDI-enabled wearables allow musicians to compose, record, and edit on the go. Real-time tuning, dynamic sound libraries, and cloud-based sound-sharing platforms are becoming key differentiators. This technology-driven evolution appeals strongly to Gen Z and millennial musicians who favor portability, personalization, and platform connectivity.

What are the key drivers in the smart musical instruments market?

Surging Demand for Digital Music Creation & Home Studios

The democratization of music production has created unprecedented demand for smart instruments that integrate seamlessly with digital audio workstations (DAWs). Home studios, YouTube creators, live streamers, and independent artists increasingly rely on connected keyboards, smart guitars, and app-based controllers for compact, high-quality production. These devices eliminate bulky setups and deliver studio capabilities through software-driven workflows. As content creation scales globally, smart instruments are becoming essential tools for affordable, flexible, and portable music production.

Growth of Music Education & E-Learning Ecosystems

The rise of remote learning, digital academies, and self-paced music courses is driving the adoption of smart instruments worldwide. Schools, teachers, and ed-tech platforms prefer instruments that offer real-time feedback, learning metrics, and gamified practice modules. Smart pianos, connected violins, and digital wind instruments simplify learning and appeal to beginners who seek structured digital guidance. This trend is further supported by educational institutions adopting tech-enabled teaching frameworks.

What are the restraints for the global market?

High Product Costs & Limited Affordability

Smart instruments incorporate embedded sensors, wireless modules, processors, and companion software, significantly increasing their cost compared to traditional instruments. Price-sensitive regions such as Latin America, Southeast Asia, and Africa face adoption barriers due to affordability challenges. Limited financing options, high import duties, and premium pricing hinder the broader adoption of smart musical instruments among hobbyists and students.

Competition from Traditional Instruments & Software-Based Music Tools

Traditional acoustic instruments remain deeply embedded in professional performance and cultural music ecosystems. Simultaneously, low-cost software tools such as VST plugins and virtual instruments offer inexpensive alternatives to physical smart instruments. These competing solutions slow the adoption of smart instruments, especially among budget-conscious segments.

What are the key opportunities in the smart musical instruments industry?

Expansion of Music EdTech & Interactive Learning Programs

The global shift toward digital learning presents a significant opportunity for smart instrument manufacturers. Schools and music academies are increasingly integrating technology-driven teaching modules that use app-linked, sensor-enabled keyboards, guitars, and percussion systems. These instruments provide measurable progress-tracking and immersive learning experiences. Partnerships between ed-tech companies and instrument manufacturers can accelerate adoption, especially in emerging markets with young populations.

Growth of Content Creation, Live Streaming & Digital Performance

The explosion of social media platforms, short-video apps, and online performance venues has created demand for compact, versatile, and visually engaging instruments. Musicians, influencers, and virtual performers prefer smart instruments that sync with audio effects, visualizers, and live-stream technologies. This segment presents huge growth potential, as creators increasingly seek tools that enhance audience engagement and simplify digital production workflows.

Product Type Insights

Smart keyboards and smart pianos dominate the product landscape, contributing approximately 32% of the global market in 2024. These instruments remain the first choice for learners, hobbyists, and studio professionals due to their intuitive interfaces, integrated learning tools, and compatibility with DAWs. Smart guitars follow, appealing strongly to performers and independent artists seeking portable digital recording tools. Smart drums and wind instruments are emerging faster but still represent smaller revenue shares, largely driven by niche musicians and experimental creators exploring hybrid sound experiences.

Application Insights

Smart instruments are widely adopted in music education, supporting structured and interactive learning with real-time feedback systems. In digital music production, smart keyboards, MIDI controllers, and connected guitars integrate seamlessly with software-based workflows, making them essential tools for independent musicians. Live performance applications are expanding as artists incorporate motion sensors, wireless controllers, and smart sound modulation tools into stage setups. Social media content creation has emerged as the fastest-growing application, driven by younger musicians producing short-form performance videos using app-linked instruments.

Distribution Channel Insights

E-commerce and direct-to-consumer (D2C) platforms dominate sales, enabling customers to compare features, watch demos, and review creator endorsements before purchase. Offline retail stores remain important for high-end purchases, where customers prefer hands-on trials. Music academies, educational distributors, and institutional procurement channels are also expanding, especially in Asia-Pacific and North America. Subscription-based access to sound libraries, firmware updates, and learning platforms is emerging as a new distribution model for smart instruments.

User Type Insights

Professional musicians and studio artists hold the highest revenue share, contributing nearly 48% of the market in 2024 as they invest in advanced DAW-compatible and sensor-enabled instruments. Hobbyists and learners represent the fastest-growing user segment, supported by rising interest in at-home music creation. Music educators and institutions are steadily adopting smart keyboards, smart pianos, and digital wind instruments for interactive teaching environments. Content creators and online performers form an emerging high-growth category, driven by demand for visually engaging, portable, and app-linked tools.

| By Product Type | By Technology | By Connectivity Type | By User Type | By Distribution Channel |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America is the largest regional market, accounting for about 39% of global revenue in 2024. The U.S. leads adoption due to its advanced music production ecosystem, strong demand for connected instruments, and high home studio penetration. The presence of major manufacturers and widespread digital content creation significantly contributes to regional dominance. Music education institutions and private academies are key buyers of smart keyboards and app-integrated instruments.

Europe

Europe represents a mature market with strong demand from Germany, the U.K., and France. Consumers show high interest in technologically advanced learning instruments and eco-friendly digital devices. Professional musicians in Europe are early adopters of hybrid digital instruments, while the region’s high income levels support premium product purchases. Integration with electronic music production, a strong European trend, further accelerates smart instrument adoption.

Asia-Pacific

Asia-Pacific is the fastest-growing region, with rising adoption in China, India, Japan, and South Korea. Strong growth in music education, e-learning, and digital content creation drives demand. China and India, with large youth populations and booming creator economies, are expected to be key contributors to future market expansion. Increasing smartphone penetration and social media influence encourage widespread use of app-integrated instruments in this region.

Latin America

Latin America is a small but emerging market, led by Brazil, Mexico, and Argentina. Growth is driven by rising interest in music as a hobby and increasing digital music production among younger demographics. Limited affordability and high import costs slow adoption, but expanding e-commerce and rising music culture are gradually strengthening market presence.

Middle East & Africa

MEA represents a nascent market with growing uptake in the UAE, Saudi Arabia, and South Africa. Rising income levels, improved access to global brands, and expanding music education programs support demand. African regions show increasing interest in music tech products, though affordability and distribution remain challenges.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Smart Musical Instruments Market

- Yamaha Corporation

- Roland Corporation

- Casio Computer Co., Ltd.

- Fender Musical Instruments Corporation

- Korg Inc.

- ROLI Ltd.

- Native Instruments GmbH

- Moog Music Inc.

- Ableton AG

- Artiphon Inc.

- Expressive E

- Audiotonix Ltd.

- Keith McMillen Instruments

- Alesis (inMusic Brands)

- Teenage Engineering

Recent Developments

- In April 2025, Yamaha introduced its new generation of AI-enhanced smart pianos with adaptive learning features and cloud-based performance analytics.

- In February 2025, Roland launched a Bluetooth-integrated smart guitar series with real-time effects processing and DAW connectivity.

- In January 2025, Artiphon announced an upgraded version of its modular smart instrument “Orba,” featuring expanded gesture control and creator community integrations.