Smart Jewelry Market Size

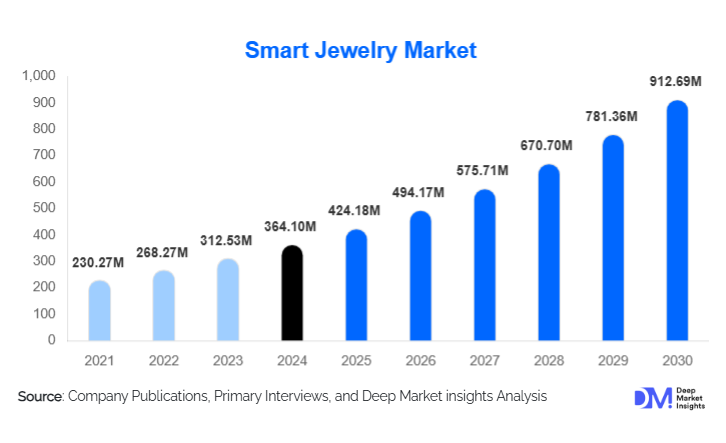

According to Deep Market Insights, the global smart jewelry market size was valued at USD 364.10 million in 2024 and is projected to grow from USD 424.18 million in 2025 to reach USD 912.69 million by 2030, expanding at a CAGR of 16.5% during the forecast period (2025–2030). The smart jewelry market growth is driven by rising demand for discreet wearable technology, increasing focus on personal safety and health monitoring, and the convergence of fashion, luxury, and consumer electronics.

Key Market Insights

- Smart rings represent the dominant product category, driven by compact form factors, long battery life, and advanced biometric tracking.

- Health and wellness monitoring remains the leading functionality, accounting for the largest share of global demand.

- North America leads the global market, supported by high wearable adoption and strong consumer spending.

- Asia-Pacific is the fastest-growing region, driven by rising disposable incomes and rapid digital adoption.

- Mid-premium priced smart jewelry (USD 100–300) dominates sales due to balanced pricing and feature offerings.

- Bluetooth Low Energy (BLE) is the most widely adopted connectivity technology, ensuring energy efficiency and smartphone compatibility.

What are the latest trends in the smart jewelry market?

Rising Adoption of Health-Centric Smart Jewelry

Smart jewelry is increasingly positioned as a health and wellness device rather than a simple fashion accessory. Products offering sleep tracking, heart rate variability monitoring, stress detection, and body temperature analysis are gaining popularity. Smart rings and bracelets are being adopted for preventive healthcare, remote patient monitoring, and fitness optimization. Integration with mobile health platforms and AI-driven analytics is enhancing data accuracy and long-term user engagement, particularly among health-conscious consumers and aging populations.

Fashion-Tech and Luxury Brand Integration

The convergence of luxury jewelry design with smart technology is a defining trend. Premium brands are collaborating with technology firms to create aesthetically refined products that appeal to affluent consumers. Customizable designs, precious materials, and limited-edition collections are elevating average selling prices and expanding the premium smart jewelry segment. This trend is also helping smart jewelry gain acceptance among users who previously resisted conventional wearables due to design limitations.

What are the key drivers in the smart jewelry market?

Demand for Discreet and Aesthetic Wearables

Consumers increasingly prefer wearables that blend seamlessly into daily attire. Unlike smartwatches, smart jewelry offers functionality without compromising personal style. This preference is particularly strong among women and professionals seeking unobtrusive technology, driving widespread adoption of rings, pendants, and bracelets.

Growing Focus on Personal Safety and Wellness

Rising awareness around personal safety and preventive healthcare is significantly boosting demand. Smart jewelry products with SOS alerts, location tracking, and health monitoring features are gaining traction in urban environments. Increased adoption among elderly users and women-focused safety initiatives further support market expansion.

What are the restraints for the global market?

High Product Costs in Premium Segments

Advanced smart jewelry products often carry high price points due to sensor miniaturization, premium materials, and design complexity. This limits adoption among price-sensitive consumers, particularly in emerging economies, and constrains volume growth.

Data Privacy and Security Concerns

Smart jewelry collects sensitive biometric and location data, raising concerns over data protection and cybersecurity. Compliance with global data regulations and ensuring user trust remains a key challenge for manufacturers.

What are the key opportunities in the smart jewelry industry?

Women-Centric Safety and Wellness Solutions

Smart jewelry designed for women’s safety, featuring discreet SOS alerts and real-time location sharing, presents a major growth opportunity. Government-backed safety initiatives and rising urbanization are accelerating adoption in developing and developed markets alike.

Healthcare and Enterprise Applications

Beyond consumer use, smart jewelry is increasingly being adopted in healthcare, assisted living, and enterprise authentication. Applications in remote patient monitoring, workforce safety, and secure access control offer high-volume, long-term revenue opportunities for manufacturers.

Product Type Insights

Smart rings dominate the global smart jewelry market, accounting for approximately 38% of revenue in 2024. Their leadership is driven by a combination of compact design, comfort, and advanced health tracking capabilities such as sleep monitoring, heart rate variability, and stress management. These rings appeal to consumers seeking discreet, multifunctional wearables that blend seamlessly into daily life. Following smart rings, smart bracelets and bangles hold significant market share, largely due to their affordability, larger display areas for notifications, and broader consumer appeal, making them popular among fitness enthusiasts and urban professionals. Smart necklaces and pendants are gaining traction, particularly for safety-focused applications like SOS alerts and location tracking, while smart earrings and brooches remain niche but growing segments within the fashion-tech space, favored by consumers prioritizing aesthetics and luxury integration.

Functionality Insights

The health and wellness monitoring segment leads the market with nearly 42% share, underpinned by increasing global health awareness and integration with digital health platforms and telemedicine. Features such as biometric sensing, activity tracking, and sleep analytics are key growth drivers, appealing to both consumers and healthcare providers. The safety and emergency alert segment is rapidly expanding in urban and high-risk regions, fueled by growing demand for personal security solutions. Additionally, notification, communication, and payment-enabled smart jewelry is gaining traction as users seek multifunctional devices that combine convenience with lifestyle utility, driving adoption across younger, tech-savvy demographics.

Distribution Channel Insights

Online direct-to-consumer (D2C) channels dominate sales, leveraging brand websites and e-commerce platforms that offer customization, subscription-based health insights, and loyalty programs. These channels enable brands to reach global consumers efficiently while maintaining higher margins. Offline retail channels, including jewelry boutiques and electronics stores, remain critical for premium and luxury smart jewelry purchases, where consumers value in-person trial and brand experience. Institutional and B2B sales channels are expanding steadily, driven by enterprises adopting smart jewelry for authentication, access control, and employee safety monitoring, providing a stable and high-value revenue stream for manufacturers.

End-Use Insights

The consumer segment accounts for approximately 68% of the market, driven by lifestyle adoption, fashion integration, and the rising popularity of wearable technology as a daily accessory. Healthcare and assisted living are the fastest-growing end-use segments, benefiting from the aging population, chronic disease monitoring needs, and remote patient care solutions. Smart jewelry in this segment helps track vital signs, prevent falls, and deliver telehealth data, supporting adoption in hospitals and home care. Enterprise and defense applications are emerging as high-value segments, particularly for workforce safety, access control, and employee wellness, offering predictable long-term contracts and driving innovation in multi-function devices.

| By Product Type | By Functionality | By Distribution Channel | By End-Use |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America accounts for approximately 36% of the global smart jewelry market in 2024. The United States dominates regional demand, fueled by high consumer spending power, early adoption of wearable technology, and strong integration of health-monitoring features in wellness programs. Drivers for growth include increasing awareness of preventive healthcare, urban safety concerns, and rising interest in discreet luxury wearables. Canada also shows robust demand, particularly in healthcare applications and tech-savvy consumer segments, supported by digital health initiatives and government-backed wellness programs.

Asia-Pacific

Asia-Pacific holds around 30% market share and is the fastest-growing region, with a CAGR exceeding 21%. Growth is primarily driven by expanding middle-class populations, rising disposable incomes, rapid urbanization, and high adoption of e-commerce and mobile technologies. China leads adoption through strong electronics manufacturing ecosystems and integration of smart jewelry into fitness and wellness apps. Japan and South Korea are seeing growth in premium fashion-tech smart jewelry, while India is emerging as a key market for safety-focused devices targeting women and urban commuters. Regional growth is also supported by local government initiatives promoting digital health and wearable technology adoption.

Europe

Europe accounts for approximately 22% of global demand, with Germany, the U.K., and France as leading markets. Growth drivers include strong consumer interest in premium and fashion-oriented smart jewelry, increasing adoption of wearable health devices, and strict data privacy regulations that enhance trust in connected devices. Sustainability and multifunctionality trends are influencing purchase decisions, while urban safety and wellness awareness are boosting demand for devices with integrated health monitoring and emergency alert features.

Latin America

Latin America represents an emerging market, led by Brazil and Mexico. Demand is driven by rising urban safety concerns, growing digital literacy, and increasing penetration of affordable smart jewelry products. Consumers are showing strong interest in multifunctional devices that combine style, health monitoring, and safety features. Expansion of e-commerce infrastructure and mobile payment ecosystems further supports growth in this region, allowing brands to reach younger, tech-savvy demographics efficiently.

Middle East & Africa

The Middle East & Africa region shows steady growth, led by the UAE and South Africa. Key drivers include high disposable incomes, growing luxury consumption, rising demand for women’s safety solutions, and increasing digital adoption. Smart jewelry is being integrated into lifestyle and health-conscious segments, while enterprise adoption for workforce safety and authentication is gaining momentum. Government initiatives supporting wearable technology and smart city infrastructure are also contributing to regional market expansion.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Top Companies in the Smart Jewelry Market

- Oura Health

- Samsung Electronics

- Apple Inc.

- Garmin Ltd.

- Google (Fitbit)

- Xiaomi Corporation

- Fossil Group

- Bellabeat

- Ringly

- Motiv Inc.

- Circular

- Zepp Health (Amazfit)

- Sony Corporation

- Huawei Technologies

- Misfit