Smart Home Cameras Market Size

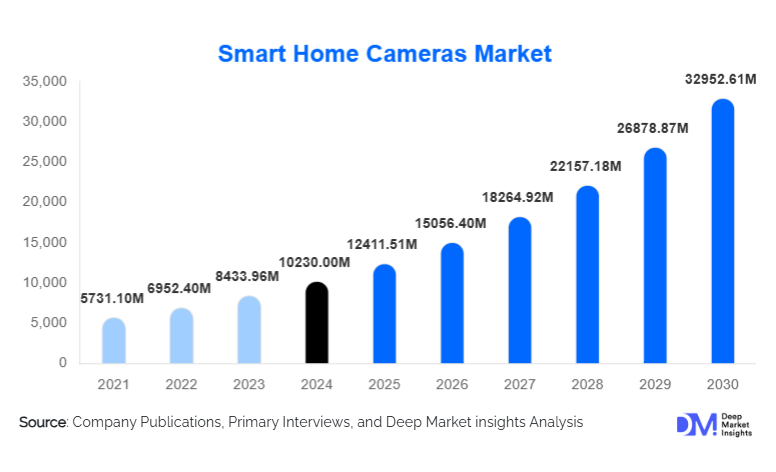

According to Deep Market Insights, the global smart home cameras market size was valued at USD 10,230.00 million in 2024 and is projected to grow from USD 12,411.51 million in 2025 to reach USD 32,952.61 million by 2030, expanding at a CAGR of 21.31% during the forecast period (2025–2030). Market growth is primarily driven by rising home security concerns, increasing penetration of smart homes, rapid advancements in AI-enabled video analytics, and growing consumer preference for connected and remotely accessible surveillance solutions.

Key Market Insights

- Residential applications dominate the smart home cameras market, accounting for over 70% of total demand, driven by single-family homes and urban apartments.

- Outdoor and video doorbell cameras represent the largest product categories, reflecting rising concerns around perimeter security and package theft.

- Cloud-based storage models are becoming the industry standard, enabling recurring revenue streams for manufacturers.

- North America leads global demand, supported by high smart home penetration and strong consumer awareness.

- Asia-Pacific is the fastest-growing region, driven by rapid urbanization, rising disposable incomes, and expanding broadband infrastructure.

- AI-powered features such as facial recognition and object detection are reshaping product differentiation and pricing strategies.

What are the latest trends in the smart home cameras market?

AI-Enabled Smart Surveillance Becoming Mainstream

Artificial intelligence has emerged as a defining trend in the smart home cameras market. Modern devices increasingly incorporate AI-driven capabilities such as facial recognition, pet and package detection, anomaly alerts, and behavioral analysis. These features reduce false alerts, enhance security accuracy, and significantly improve user experience. AI processing at the edge is also gaining traction, enabling faster response times while addressing privacy concerns by limiting cloud dependency. As consumers increasingly expect intelligent functionality rather than basic video recording, AI-enabled cameras are rapidly becoming the market norm.

Shift Toward Subscription-Based Cloud Ecosystems

Manufacturers are increasingly bundling smart home cameras with cloud storage subscriptions, extended warranties, and premium monitoring services. This shift supports predictable recurring revenues and higher lifetime customer value. Subscription tiers now offer advanced analytics, longer video retention, and integration with insurance and emergency services. While some consumers show resistance to mandatory subscriptions, hybrid and flexible pricing models are gaining acceptance, particularly in developed markets.

What are the key drivers in the smart home cameras market?

Rising Home Security Awareness

Increasing incidents of burglary, porch piracy, and unauthorized access are driving strong consumer demand for real-time surveillance solutions. Smart home cameras offer affordable, DIY-friendly security systems with remote monitoring and instant alerts, making them highly attractive to homeowners and renters alike.

Expansion of Smart Home Ecosystems

The rapid adoption of smart speakers, connected locks, lighting systems, and home automation hubs is accelerating demand for interoperable smart cameras. Cameras are increasingly positioned as central control points within smart home ecosystems, driving higher adoption and replacement cycles.

What are the restraints for the global market?

Privacy and Data Security Concerns

Concerns around data misuse, hacking, and unauthorized surveillance remain a major restraint. Regulatory requirements such as GDPR in Europe impose strict compliance costs, potentially slowing market expansion in privacy-sensitive regions.

Subscription Fatigue Among Consumers

Mandatory cloud subscription fees can deter price-sensitive buyers, particularly in emerging markets. Vendors must balance feature differentiation with affordability to sustain long-term growth.

What are the key opportunities in the smart home cameras industry?

Growth in Emerging Economies

Asia-Pacific, Latin America, and parts of the Middle East remain underpenetrated markets for smart home cameras. Rising middle-class incomes, improving internet connectivity, and government-led smart city initiatives present strong growth opportunities for both global and regional manufacturers.

Integration with Insurance and Smart City Infrastructure

Partnerships with home insurance providers and smart city programs create opportunities for value-added services. Cameras linked with insurance incentives or community security networks can drive adoption while enhancing public safety outcomes.

Product Type Insights

Outdoor smart cameras account for the largest share of the global smart home cameras market, representing approximately 31% of total revenue in 2024. Their leadership is primarily driven by the growing emphasis on perimeter security, rising incidents of burglary and trespassing, and increasing consumer preference for proactive outdoor surveillance solutions. Outdoor cameras are typically the first point of installation in residential security setups, making them a foundational product category. Advancements in weather-resistant enclosures, long-range night vision, floodlight integration, and AI-enabled motion detection further strengthen demand. Battery-powered and solar-assisted outdoor cameras are also expanding adoption by reducing installation complexity.

Video doorbell cameras represent the second-largest product segment, supported by the rapid growth of e-commerce deliveries and rising concerns around package theft, particularly in urban and suburban areas. These devices benefit from high visibility, ease of installation, and frequent integration with smartphones and voice assistants. Their role as both a security and convenience device has accelerated penetration across single-family homes and apartments.

Application Insights

Residential security remains the dominant application segment in the smart home cameras market, accounting for approximately 72% of total market demand in 2024. This leadership is driven by increasing adoption of DIY smart home solutions, declining device prices, and growing awareness of home security risks. Homeowners and renters alike are investing in smart cameras to enable real-time monitoring, remote access, and instant alerts, particularly in urban residential environments.

Small commercial applications, including home offices, neighborhood retail stores, clinics, and small warehouses, are emerging as the fastest-growing application segment. Rising concerns related to theft, vandalism, and unauthorized access are encouraging small businesses to adopt affordable smart camera solutions as alternatives to traditional CCTV systems. These users value cloud access, AI-based alerts, and scalability without the need for complex infrastructure.

Distribution Channel Insights

Online distribution channels dominate the global smart home cameras market, contributing approximately 64% of total revenue in 2024. The leadership of online channels is driven by the rapid expansion of e-commerce platforms, direct-to-consumer (D2C) brand strategies, and the growing preference for price transparency and product comparison. Online channels enable manufacturers to reach a global customer base, offer frequent promotions, and educate consumers through reviews and digital content.

Direct-to-consumer brand websites play a critical role in driving higher margins and customer engagement by bundling cameras with subscriptions, accessories, and extended warranties. Meanwhile, major e-commerce marketplaces accelerate adoption through flash sales, bundled offers, and fast delivery models. Offline retail channels continue to hold strategic importance, particularly for premium smart camera products and professionally installed smart home solutions. Electronics retail chains, home improvement stores, and specialized smart home integrators remain relevant in developed markets, where consumers seek in-person demonstrations, installation support, and bundled home automation services.

End-User Insights

Individual households represent the largest end-user segment in the smart home cameras market, supported by strong DIY installation trends, improving user interfaces, and declining hardware costs. Consumers increasingly view smart cameras as essential home appliances rather than optional security add-ons. Demand is particularly strong among urban homeowners, renters, and families seeking continuous remote visibility of their living spaces.

Small commercial users constitute the fastest-growing end-user segment, driven by the need for affordable and scalable security solutions. Small businesses benefit from smart cameras that provide real-time alerts, cloud-based footage access, and minimal maintenance requirements. This segment is expected to gain increasing relevance as hybrid work models and decentralized retail formats expand.

| By Product Type | By Application | By Distribution Channel | By Connectivity | By Storage Type |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America leads the global smart home cameras market with approximately 38% market share in 2024. The United States dominates regional demand due to high smart home penetration, strong broadband and Wi-Fi infrastructure, and widespread consumer awareness of connected security technologies. Rising incidents of package theft, high adoption of video doorbell cameras, and strong integration with voice assistants and smart home ecosystems are key regional growth drivers. In addition, favorable consumer spending capacity and the presence of leading technology companies accelerate product innovation and adoption.

Europe

Europe accounts for around 18% of the global market, led by Germany, the United Kingdom, and France. Growth in this region is driven by increasing urbanization, rising apartment living, and strong demand for energy-efficient and digitally connected homes. European consumers show a high preference for quality, data security, and privacy-focused designs, influencing purchasing behavior. However, stringent data protection regulations, including GDPR compliance, moderate growth rates by increasing development and operational costs for vendors.

Asia-Pacific

Asia-Pacific holds nearly 34% market share and is the fastest-growing region, expanding at close to 19% CAGR. China, Japan, South Korea, and India are key growth engines, supported by rapid urbanization, expanding middle-class populations, and rising disposable incomes. Cost-competitive manufacturing, widespread smartphone penetration, and government-backed smart city initiatives further fuel demand. In emerging economies such as India and Southeast Asia, falling device prices and improving internet connectivity are accelerating first-time adoption of smart home cameras.

Latin America

Latin America represents a smaller but steadily growing market, led by Brazil and Mexico. Growth is driven by rising urban crime rates, increasing residential security awareness, and improving broadband access. Adoption is strongest in urban centers, where consumers seek affordable and easy-to-install smart surveillance solutions. Price sensitivity remains a key consideration, encouraging demand for entry-level and mid-range products.

Middle East & Africa

The Middle East & Africa region is witnessing gradual growth, supported by smart city initiatives and infrastructure modernization programs in countries such as the UAE and Saudi Arabia. High-income households, luxury residential developments, and increased investments in smart buildings are driving demand for advanced surveillance solutions. In Africa, adoption is emerging in select urban markets, supported by improving connectivity and rising awareness of residential security needs.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Smart Home Cameras Market

- Google Nest

- Amazon Ring

- Arlo Technologies

- Xiaomi

- TP-Link

- Hikvision

- Dahua Technology

- Eufy

- Wyze Labs

- Netgear

- Ezviz

- Bosch

- Honeywell

- Panasonic

- Samsung Electronics