Smart Home Automation Market Size

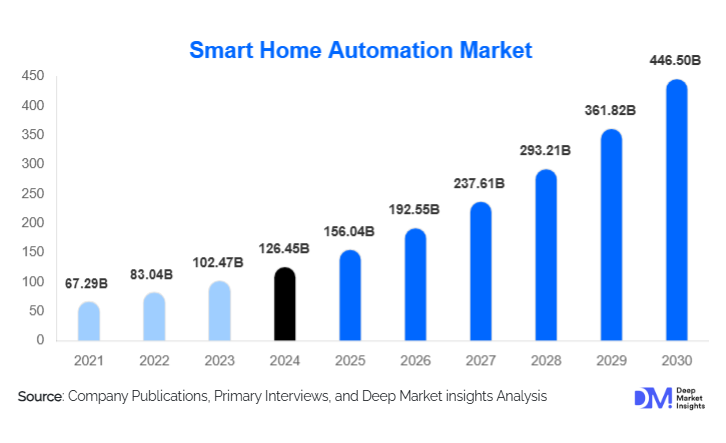

According to Deep Market Insights, the global smart home automation market size was valued at USD 126.45 billion in 2024 and is projected to grow from USD 156.04 billion in 2025 to reach USD 446.5 billion by 2030, expanding at a CAGR of 23.40% during the forecast period (2025–2030). Market growth is primarily driven by rising consumer demand for convenience, security, and energy efficiency, combined with rapid advancements in IoT connectivity, AI-driven automation, and decreasing hardware costs. The proliferation of smart speakers, connected appliances, and interoperable home ecosystems is accelerating global adoption across both new construction and retrofit applications.

Key Market Insights

- Smart security systems remain the largest product category, driven by growing adoption of smart locks, connected surveillance, and real-time monitoring solutions.

- Wireless connectivity dominates the ecosystem, with Wi-Fi, Zigbee, and Bluetooth capturing over half of all device integrations due to ease of installation and rapid retrofitting.

- North America leads global market share, supported by high disposable incomes, strong broadband penetration, and mature smart home platforms.

- Asia-Pacific is the fastest-growing region, driven by rising middle-class adoption, new housing developments, and national smart city initiatives.

- AI-driven automation and predictive analytics are reshaping the market, enabling devices to optimize energy use, security, and user comfort automatically.

- Interoperability standards such as Matter are reducing fragmentation and improving cross-brand compatibility, a major catalyst for mass-market adoption.

What are the latest trends in the smart home automation market?

AI-Driven Predictive Automation

Smart home automation is rapidly transitioning from rule-based controls to AI-powered predictive ecosystems. Devices are increasingly capable of learning user behavior, adjusting HVAC and lighting systems autonomously, and predicting security risks. Smart thermostats, for example, now optimize heating and cooling based on occupancy patterns, weather forecasts, and energy pricing. Similarly, AI-enabled home security systems can differentiate between normal and abnormal activity, reducing false alerts and improving user trust. This move toward intelligent, self-learning automation is redefining the smart home experience by emphasizing efficiency, personalization, and seamless everyday functionality.

Expansion of Interoperable Platforms and Connectivity Standards

The introduction of universal standards like Matter is significantly reducing ecosystem fragmentation. Historically, smart homes were hindered by proprietary systems that restricted device compatibility. The rapid adoption of unified frameworks is now enabling cross-device communication, improving setup simplicity, and lowering consumer friction during installation. This trend is particularly important for emerging markets, where plug-and-play compatibility accelerates adoption. Additionally, growth in wireless technologies, ranging from Wi-Fi 6 to low-energy mesh networks, is enhancing device reliability, coverage, and energy performance across large homes and multi-unit buildings.

What are the key drivers in the smart home automation market?

Growing Demand for Convenience and Connected Living

Consumers are increasingly seeking centralized control over home functions such as lighting, climate, security, and entertainment. Voice assistants and mobile app ecosystems have normalized connected living, allowing residents to manage their homes remotely or through automated routines. This shift toward seamless digital control is particularly strong among younger demographics and tech-forward households.

Rising Focus on Energy Efficiency and Sustainability

Smart home automation, particularly HVAC automation and energy monitoring systems, is becoming a cornerstone of sustainable living. Smart thermostats and connected lighting systems reduce household energy consumption by 10–20% in many use cases. With rising energy prices and climate regulations, the appeal of smart energy savings is a major market driver across residential and commercial sectors.

What are the restraints for the global market?

Cybersecurity and Data Privacy Concerns

Despite widespread adoption, smart home devices remain vulnerable to hacking, unauthorized data access, and network breaches. Consumers increasingly express concerns about sharing personal data through cloud-based systems. Manufacturers must adopt stronger encryption, localized processing, and transparent privacy protocols to overcome this restraint.

Interoperability Challenges and Fragmentation

Although improving, the market still faces compatibility issues among brands and platforms. Non-standardized systems can frustrate consumers and increase installation complexity. Fragmentation remains a barrier to mass adoption in developing regions, where technical expertise may be limited.

What are the key opportunities in the smart home automation industry?

AI-Enhanced Services and Subscription-Based Models

The increasing integration of artificial intelligence is creating new monetization avenues, such as predictive maintenance, home energy analytics, and enhanced automation routines. Companies are shifting toward recurring revenue streams through premium service bundles, remote diagnostics, and integrated cloud-based automation.

Expansion in Emerging Residential Markets

Urbanization and rising disposable incomes in Asia-Pacific, Latin America, and the Middle East are opening lucrative opportunities. Affordable retrofit devices, simplified installation processes, and growing smartphone penetration support rapid adoption. These regions also benefit from government-led smart city programs that prioritize connected home infrastructure.

Product Type Insights

Smart Security & Access Control dominates the market, accounting for approximately 28% of global revenue in 2024. Growing concerns over home safety, increasing adoption of video doorbells, and real-time monitoring systems are fueling demand. Smart locks and connected surveillance systems have become entry-level automation products for new users. Meanwhile, smart lighting, HVAC automation, and smart appliances are expanding steadily as consumers upgrade existing home environments and prioritize energy efficiency and convenience.

Application Insights

Residential applications account for nearly 70% of the market, driven by growing adoption of smart appliances, climate control systems, and home security solutions. Commercial applications, including offices, hospitality, and retail, are growing rapidly as enterprises adopt smart lighting and energy management systems to reduce operating costs. Industrial and utility sectors use automation primarily for facility monitoring and energy optimization. New applications in elder care monitoring, health integration, and wellness automation are emerging as major growth segments, supported by aging populations and healthcare digitization.

Distribution Channel Insights

Online sales channels, including D2C brand stores and e-commerce platforms, dominate smart home product distribution due to product variety, transparent pricing, and consumer reviews. Specialist integrators and smart home installation companies continue to thrive in complex, multi-device installations, especially for high-end custom homes and commercial buildings. Retail electronics stores and telecom operator bundles also play an important role, particularly in emerging markets where consumers prefer assisted purchasing. Subscription-based automation bundles and app-based upselling are becoming new channels for recurring revenue.

End User Type Insights

Homeowners constitute the largest share of smart home adoption, leveraging automation for convenience, comfort, and security. Renters are increasingly adopting portable smart devices such as smart speakers and smart plugs. Families represent a strong demand segment, prioritizing safety monitoring and energy savings. Tech-savvy young adults (ages 25–40) are the fastest-growing demographic, driven by digital lifestyle integration. Seniors are emerging as a key market for assisted-living automation solutions, including fall detection, health monitoring, and remote caregiver access.

| By Product Type | By Connectivity Technology | By System Architecture | By Installation Type | By End User |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America leads the global market with approximately 38–40% share in 2024. The U.S. dominates due to high adoption of smart security systems, strong purchasing power, and a mature home connectivity infrastructure. Canada shows rising demand in residential retrofits and commercial energy management applications.

Europe

Europe holds 25–28% of global share, driven by strong sustainability regulations, energy efficiency mandates, and adoption in Germany, the U.K., France, and the Nordics. Consumer demand for low-energy smart homes and interoperable systems drives regional growth.

Asia-Pacific

Asia-Pacific is the fastest-growing region, led by China, India, South Korea, and Japan. Rapid urban expansion, new housing projects, and national smart city programs are accelerating adoption. China leads in manufacturing scale and consumer volume, while India shows significant growth in budget-friendly automation and retrofit devices.

Latin America

Brazil and Mexico are key growth markets within Latin America, with rising adoption of smart security, entertainment systems, and connected appliances. Economic recovery and improved broadband penetration are gradually supporting market expansion.

Middle East & Africa

MEA markets, led by the UAE, Saudi Arabia, and South Africa, are experiencing strong uptake driven by luxury residential developments and commercial smart building projects. Energy-efficient automation is gaining traction due to climate conditions and government sustainability programs.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Smart Home Automation Market

- Amazon

- Apple

- Samsung Electronics

- Siemens AG

- Honeywell International

- Schneider Electric

- Bosch

- LG Electronics

- Johnson Controls

- Assa Abloy

- Panasonic Corporation

- Signify (Philips)

- ADT Inc.

- Sony Corporation

Recent Developments

- In June 2024, Amazon expanded its Alexa-enabled smart home ecosystem with AI-driven predictive routines for HVAC and lighting optimization.

- In April 2024, Google introduced cross-platform interoperability updates for Nest devices under the Matter standard, improving device compatibility across brands.

- In January 2024, Samsung launched an integrated SmartThings energy management suite for residential customers, offering real-time consumption tracking and optimization.