Smart Chair Market Size

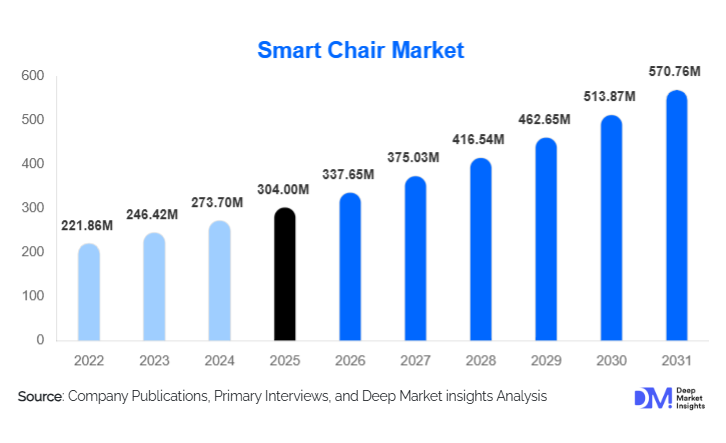

According to Deep Market Insights, the global smart chair market size was valued at USD 304.00 million in 2024 and is projected to grow from USD 337.65 million in 2025 to reach USD 570.76 million by 2030, expanding at a CAGR of 11.07% during the forecast period (2025–2030). The smart chair market growth is primarily driven by rising awareness of workplace ergonomics, increasing prevalence of sedentary lifestyles, rapid adoption of smart workplace solutions, and growing integration of IoT- and AI-enabled furniture across corporate, healthcare, and residential environments.

Key Market Insights

- Smart chairs are evolving from ergonomic furniture into connected wellness platforms, integrating posture monitoring, biometric sensing, and AI-driven analytics.

- Corporate and commercial offices dominate demand, supported by hybrid work models, ESG initiatives, and employer-led wellness programs.

- North America leads the global market due to high enterprise spending on smart workplace infrastructure and early technology adoption.

- Asia-Pacific is the fastest-growing region, driven by rapid IT workforce expansion, cost-efficient manufacturing, and rising disposable incomes.

- Mid-range smart chairs account for the largest revenue share, balancing affordability with advanced functionality.

- Integration of AI, cloud analytics, and mobile applications is reshaping product differentiation and customer engagement.

What are the latest trends in the smart chair market?

AI-Driven Ergonomics and Personalized Seating

One of the most prominent trends in the smart chair market is the integration of artificial intelligence to enable personalized ergonomic support. AI-powered smart chairs analyze posture patterns, sitting duration, and pressure distribution to automatically adjust lumbar support, seat height, and recline angles. Over time, these systems learn user behavior and provide tailored posture recommendations through connected mobile applications. This trend is particularly strong in corporate environments, where employers are using aggregated, anonymized data to assess workforce ergonomics and improve productivity while reducing health-related absenteeism.

Connected Smart Workspaces and IoT Integration

Smart chairs are increasingly being integrated into broader IoT-enabled smart office ecosystems. Chairs now connect with height-adjustable desks, lighting systems, and building management platforms to create adaptive work environments. Bluetooth-enabled chairs dominate individual usage, while Wi-Fi-enabled models are gaining traction in enterprise settings where centralized monitoring and analytics are required. This trend aligns with the rise of smart buildings and digital workplaces, positioning smart chairs as a core component of connected infrastructure rather than standalone furniture.

What are the key drivers in the smart chair market?

Rising Prevalence of Sedentary Lifestyles and Musculoskeletal Disorders

The increasing amount of time spent sitting due to desk-based work, remote employment, and gaming has led to a surge in musculoskeletal disorders such as back pain and spinal issues. Smart chairs directly address these concerns through real-time posture correction, pressure mapping, and movement reminders. This health-driven demand is a major factor accelerating adoption across offices, homes, and healthcare facilities.

Enterprise Investment in Employee Wellness and ESG Compliance

Organizations are increasingly investing in employee well-being as part of broader ESG strategies. Smart chairs enable employers to demonstrate measurable improvements in workplace ergonomics and health outcomes. Large-scale corporate procurement, particularly in North America and Europe, has significantly contributed to market expansion, making enterprise demand a key growth driver.

What are the restraints for the global market?

High Upfront Costs

Despite declining sensor and connectivity costs, smart chairs remain significantly more expensive than traditional ergonomic chairs. Premium models can cost several times more than conventional alternatives, limiting adoption among small enterprises and price-sensitive residential consumers. This cost barrier is particularly evident in emerging markets.

Data Privacy and Interoperability Challenges

Smart chairs collect posture, usage, and sometimes biometric data, raising concerns around data privacy and cybersecurity. Enterprises must ensure compliance with data protection regulations, while manufacturers face challenges in ensuring interoperability with diverse IT systems. These issues can slow enterprise-scale deployment.

What are the key opportunities in the smart chair industry?

Healthcare and Rehabilitation Applications

Smart medical and rehabilitation chairs represent a significant growth opportunity. Hospitals, eldercare facilities, and physiotherapy centers are adopting smart seating to prevent pressure ulcers, monitor patient movement, and support long-duration care. Aging populations in Europe, Japan, and China are accelerating demand, supported by government healthcare infrastructure investments.

Gaming, Esports, and Performance Seating

The rapid growth of gaming and esports presents another major opportunity. Smart gaming chairs equipped with posture analytics, haptic feedback, and performance tracking are gaining popularity among professional gamers and streamers. This segment is expected to grow at a faster pace than the overall market, driven by younger demographics and digital entertainment trends.

Product Type Insights

Ergonomic smart office chairs dominate the global market, accounting for approximately 38% of total revenue in 2024. Their leadership is driven by enterprise procurement and replacement demand in corporate offices. Smart gaming chairs represent the fastest-growing product type, supported by the expansion of esports and content creation. Smart medical and rehabilitation chairs are gaining steady traction, particularly in developed healthcare systems, while smart recliners and home chairs are expanding adoption in residential settings as remote work becomes more permanent.

Connectivity Insights

Bluetooth-enabled smart chairs hold the largest market share, representing nearly 46% of global demand in 2024. Their dominance is attributed to lower costs, ease of use, and suitability for individual consumers. Wi-Fi-enabled chairs are increasingly adopted in large enterprises and healthcare facilities, where centralized data collection and analytics are required. Hybrid connectivity models are emerging as a premium offering in advanced smart workplaces.

End-Use Insights

Corporate and commercial offices account for roughly 44% of the global smart chair market, driven by hybrid work models and ergonomic compliance requirements. Healthcare facilities represent a rapidly expanding end-use segment as hospitals and eldercare centers adopt smart seating solutions. Residential demand is growing steadily, supported by remote work trends, while gaming and esports represent the fastest-growing end-use category with strong adoption among younger consumers.

Distribution Channel Insights

Direct-to-enterprise sales dominate the market by value, accounting for approximately 35% of global revenue due to bulk procurement and customization requirements. Online retail channels are growing rapidly, driven by direct-to-consumer brand strategies and increasing consumer comfort with purchasing high-value furniture online. Specialty furniture stores and healthcare equipment suppliers continue to play an important role in regional markets.

| By Product Type | By Connectivity Type | By Feature Integration | By End Use | By Distribution Channel |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America leads the global smart chair market with an estimated 34% share in 2024. The United States accounts for the majority of regional demand, driven by high corporate spending on smart office infrastructure, strong awareness of workplace ergonomics, and the presence of leading manufacturers. Adoption is particularly strong among large enterprises and technology firms.

Europe

Europe represents approximately 23% of the global market, supported by strict workplace ergonomics regulations and strong adoption of sustainable and employee-centric office solutions. Germany, the U.K., and France are the leading markets, with growing investments in smart healthcare infrastructure further supporting demand.

Asia-Pacific

Asia-Pacific holds around 29% of the global market share and is the fastest-growing region, expanding at nearly 14.8% CAGR. China, Japan, South Korea, and India are key contributors, driven by rapid urbanization, expanding IT workforces, and increasing adoption of smart workplace technologies.

Latin America

Latin America represents a smaller but growing market, led by Brazil and Mexico. Demand is primarily driven by multinational corporate offices and the gradual adoption of ergonomic workplace standards.

Middle East & Africa

The Middle East & Africa region is witnessing steady growth, supported by commercial real estate development and healthcare investments. The UAE and Saudi Arabia are emerging as key markets due to smart city initiatives and premium office infrastructure development.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Smart Chair Market

- Herman Miller

- Steelcase

- Haworth

- Humanscale

- Okamura

- Kinnarps

- Vitra

- Sedus

- HÅG

- Secretlab

- Autonomous

- Teknion

- Dauphin

- Global Furniture Group

- Ergonofis