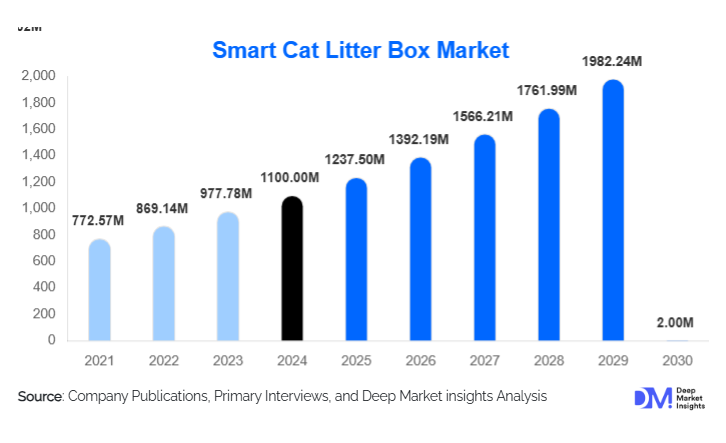

Smart Cat Litter Box Market Size

According to Deep Market Insights, the global smart cat litter box market size was valued at USD 1,100.00 million in 2024 and is projected to grow from USD 1,237.50 million in 2025 to reach USD 2,230.02 million by 2030, expanding at a CAGR of 12.5% during the forecast period (2025–2030). The smart cat litter box market growth is driven by rising pet humanization, increasing adoption of smart home technologies, and growing demand for automated hygiene solutions among urban pet owners.

Key Market Insights

- Fully automatic self-cleaning litter boxes dominate the market, supported by strong consumer preference for hands-free, hygienic pet care solutions.

- IoT- and app-connected smart litter boxes account for the majority of sales, reflecting the growing integration of pet products within smart home ecosystems.

- North America leads global demand, driven by high disposable incomes, premium pet spending, and strong penetration of smart pet technologies.

- Asia-Pacific is the fastest-growing region, fueled by rapid urbanization, rising middle-class pet adoption, and expanding e-commerce platforms.

- Multi-cat households represent the largest end-user segment, as automated litter management significantly reduces maintenance burden.

- Premium-priced products generate the highest revenue share, despite lower unit volumes, due to advanced AI, sensor, and health-monitoring features.

What are the latest trends in the smart cat litter box market?

AI-Enabled Pet Health Monitoring

Smart cat litter boxes are increasingly incorporating AI-driven health analytics to monitor weight changes, urination frequency, and waste patterns. These features enable early detection of potential health issues such as urinary tract infections or kidney disorders, transforming litter boxes into preventive healthcare tools. Integration with mobile apps and cloud platforms allows real-time alerts and long-term health tracking, driving higher consumer willingness to pay for advanced models.

Sustainability and Eco-Compatible Designs

Manufacturers are focusing on compatibility with biodegradable, plant-based, and low-dust litter types to align with sustainability trends. Energy-efficient motors, recyclable materials, and reduced waste designs are becoming key differentiators, particularly in Europe and Asia-Pacific. This trend supports both regulatory compliance and environmentally conscious consumer preferences.

What are the key drivers in the smart cat litter box market?

Rising Pet Humanization and Premium Pet Spending

Pet owners increasingly view cats as family members, leading to higher spending on premium care products. Smart litter boxes offer convenience, cleanliness, and health insights, aligning with this emotional and financial investment in pet well-being. This driver is particularly strong in North America, Europe, and developed Asia-Pacific markets.

Expansion of Smart Home Ecosystems

The widespread adoption of smart home devices has normalized app-based monitoring and automation. Smart cat litter boxes seamlessly integrate into connected home environments, benefiting from consumer familiarity with IoT-enabled products and subscription-based digital services.

What are the restraints for the global market?

High Initial Product Cost

Premium smart cat litter boxes often retail above USD 600, limiting adoption among price-sensitive consumers and emerging markets. While long-term convenience offsets manual labor, upfront pricing remains a barrier to mass-market penetration.

Maintenance and Reliability Concerns

Mechanical complexity, sensor calibration issues, and cleaning requirements can impact user experience. Negative reviews related to durability or after-sales support can slow repeat purchases and brand adoption if not addressed effectively.

What are the key opportunities in the smart cat litter box industry?

Subscription-Based Health and Data Services

Manufacturers have opportunities to introduce recurring revenue models by offering subscription-based health analytics, veterinary consultations, and consumables. This approach enhances customer lifetime value and positions smart litter boxes as part of a broader digital pet healthcare ecosystem.

Rapid Growth in Asia-Pacific Urban Markets

Rising pet ownership in China, Japan, South Korea, and urban India presents a significant growth opportunity. Smaller living spaces and high-density housing drive demand for odor-controlled, automated litter solutions. Localized manufacturing and pricing strategies can accelerate adoption.

Product Type Insights

Fully automatic self-cleaning litter boxes dominate the market, accounting for approximately 62% of global revenue in 2024. These systems are favored for their ability to reduce daily maintenance and improve hygiene. Semi-automatic smart litter boxes serve budget-conscious consumers, particularly in emerging markets, offering sensor-based alerts and partial automation at lower price points.

Technology Insights

IoT- and app-connected systems lead technology adoption, representing nearly 58% of total market value. AI-enabled systems with multi-cat recognition and health analytics are the fastest-growing sub-segment, reflecting rising demand for data-driven pet care. Sensor-only systems remain relevant in entry-level and mid-range products.

Distribution Channel Insights

E-commerce platforms and direct-to-consumer websites dominate distribution, accounting for over 54% of global sales. Online channels enable product comparison, subscription integration, and customer education. Pet specialty stores and veterinary clinics continue to play an important role in premium product recommendations and trust-building.

End-Use Insights

Multi-cat households represent the largest end-use segment, contributing approximately 48% of total market revenue in 2024. Single-cat households remain a significant segment, particularly in urban apartments. Commercial users such as pet boarding facilities, shelters, and veterinary clinics are emerging adopters, driven by labor cost reduction and hygiene requirements.

| By Product Type | By Technology | By Waste Handling Mechanism | By Litter Compatibility | By Distribution Channel |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America accounted for approximately 38% of the global smart cat litter box market in 2024, led by the United States. High disposable incomes, strong smart home adoption, and premium pet care spending support sustained demand. The region also leads in early adoption of AI-enabled and subscription-based solutions.

Europe

Europe represented around 27% of the market, with strong demand in Germany, the U.K., and France. Sustainability-focused purchasing behavior and preference for eco-compatible litter systems are key growth drivers. Regulatory emphasis on product safety and energy efficiency also shapes product development.

Asia-Pacific

Asia-Pacific held approximately 24% of global revenue in 2024 and is the fastest-growing region, with a CAGR exceeding 18%. China and Japan lead adoption, supported by urbanization, rising middle-class incomes, and strong e-commerce penetration. South Korea and India are emerging growth markets.

Latin America

Latin America accounted for about 7% of the market, driven primarily by Brazil and Mexico. Growth is supported by increasing pet ownership and the gradual adoption of premium pet products among urban consumers.

Middle East & Africa

The Middle East & Africa region contributed approximately 4% of global demand. The UAE and South Africa lead regional adoption, supported by premium pet care trends and growing awareness of automated hygiene solutions.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|