Smart Beds Market Size

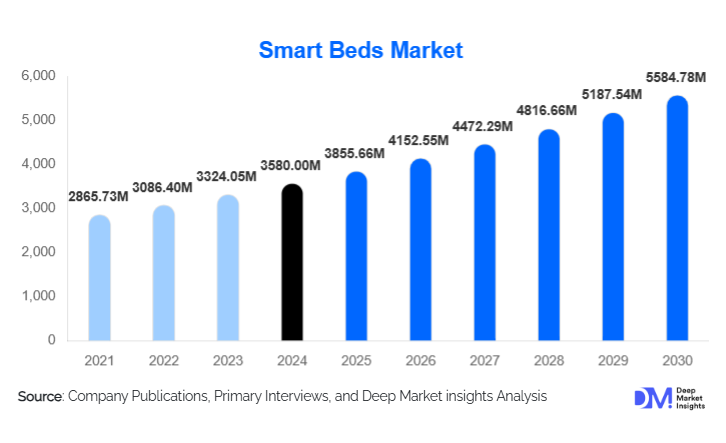

According to Deep Market Insights, the global smart beds market size was valued at USD 3,580.00 million in 2024 and is projected to grow from USD 3,855.66 million in 2025 to reach USD 5,584.78 million by 2030, expanding at a CAGR of 7.7% during the forecast period (2025–2030). The smart beds market growth is primarily driven by rising awareness around sleep health, increasing integration of IoT and AI technologies in home and healthcare furniture, and growing demand from hospitals, elderly care facilities, and premium residential consumers.

Key Market Insights

- Smart beds are rapidly transitioning from luxury products to essential health and wellness solutions, supported by increasing adoption in both residential and clinical environments.

- Healthcare applications are witnessing accelerated demand, driven by aging populations, rising chronic diseases, and hospital digitization initiatives.

- North America dominates the global market due to high disposable income, advanced healthcare infrastructure, and early adoption of smart home technologies.

- Asia-Pacific is the fastest-growing region, supported by expanding middle-class populations, hospital infrastructure investments, and local manufacturing capabilities.

- Mid-priced smart beds (USD 1,500–4,000) lead demand, balancing affordability with advanced features such as sleep monitoring and automated adjustment.

- Technology convergence, including AI-driven sleep analytics, app connectivity, and smart home integration, is reshaping product differentiation.

What are the latest trends in the smart beds market?

AI-Driven Sleep Monitoring and Personalization

One of the most prominent trends in the smart beds market is the integration of artificial intelligence for sleep tracking and personalized comfort optimization. Smart beds are increasingly equipped with biometric sensors that monitor heart rate, respiration, movement, and sleep cycles, enabling AI algorithms to automatically adjust firmness, elevation, and temperature. This trend is particularly attractive to health-conscious consumers and patients managing sleep disorders, chronic pain, or mobility limitations. Personalized sleep insights delivered via mobile applications are becoming a key differentiator, enhancing long-term user engagement and brand loyalty.

Smart Healthcare Infrastructure Integration

Hospitals and long-term care facilities are increasingly adopting smart beds as part of broader digital healthcare ecosystems. These beds integrate with electronic health records (EHRs), nurse call systems, and remote patient monitoring platforms, improving patient outcomes while reducing caregiver workload. Features such as fall detection, pressure ulcer prevention, and automated patient repositioning are gaining traction. This trend is further supported by government-led healthcare modernization initiatives and rising investments in smart medical infrastructure globally.

What are the key drivers in the smart beds market?

Rising Prevalence of Sleep Disorders and Aging Population

The increasing incidence of sleep disorders such as insomnia and sleep apnea, coupled with a rapidly aging global population, is a major driver for smart bed adoption. Elderly individuals and patients with mobility challenges benefit significantly from adjustable positioning, pressure relief, and automated support functions. As healthcare systems focus on improving patient comfort and reducing long-term care costs, demand for smart beds continues to rise across both residential and institutional settings.

Growth of Smart Homes and Connected Living

The expansion of smart home ecosystems has positively impacted the smart beds market. Consumers are increasingly seeking connected products that integrate seamlessly with voice assistants, wearable devices, and home automation systems. Smart beds that synchronize with fitness trackers, smartphones, and climate control systems align well with this trend, positioning them as integral components of modern connected living environments.

What are the restraints for the global market?

High Initial Costs and Limited Insurance Coverage

Despite strong demand, the high upfront cost of smart beds remains a key restraint, particularly in price-sensitive and emerging markets. Premium models can exceed USD 5,000, limiting adoption among middle-income households. Additionally, limited reimbursement or insurance coverage for smart beds in many regions restricts faster penetration in healthcare settings.

Data Privacy and Cybersecurity Concerns

Smart beds collect and process sensitive health-related data, raising concerns around data security and privacy. Compliance with stringent healthcare data regulations increases operational complexity for manufacturers. Cybersecurity risks may also deter adoption among institutional buyers unless robust data protection measures are implemented.

What are the key opportunities in the smart beds industry?

Expansion in Emerging Markets

Emerging economies in the Asia-Pacific, Latin America, and the Middle East present significant growth opportunities. Rapid urbanization, expanding private healthcare infrastructure, and rising disposable incomes are driving demand for technologically advanced bedding solutions. Localized manufacturing and cost-optimized smart bed models can unlock large untapped consumer bases in these regions.

Subscription-Based and Digital Health Ecosystems

Manufacturers are increasingly exploring subscription-based models linked to sleep analytics, health insights, and software upgrades. Integrating smart beds with digital health platforms, insurers, and wellness applications creates recurring revenue streams and strengthens customer retention. This ecosystem-based approach is expected to enhance lifetime value per customer.

Product Type Insights

Adjustable smart beds dominate the global market, accounting for approximately 34% of total revenue in 2024. Their popularity is driven by versatility, comfort, and applicability across residential and healthcare environments. Fully integrated multi-feature smart beds represent the fastest-growing category, benefiting from demand for AI-driven personalization and premium wellness experiences. Pressure-relief and therapeutic smart beds maintain strong demand in hospitals and elder-care facilities, while climate-controlled models are gaining traction in premium residential segments.

Application Insights

The residential segment leads the smart beds market with an estimated 46% share in 2024, driven by direct-to-consumer sales and increasing consumer focus on sleep health. Healthcare facilities represent the fastest-growing application, supported by hospital bed replacement cycles and digital healthcare investments. The hospitality segment is emerging as a niche growth area, particularly among luxury hotels and resorts seeking to enhance guest experience and differentiation.

Distribution Channel Insights

Direct-to-consumer channels dominate distribution, accounting for nearly 38% of global sales. Brand-owned websites and experiential showrooms enable manufacturers to educate consumers and offer customization options. Specialty retailers and healthcare equipment suppliers remain their critical channels, particularly for institutional buyers. Online marketplaces are expanding their reach in emerging markets, while institutional procurement drives bulk sales volumes.

Price Range Insights

Mid-priced smart beds (USD 1,500–4,000) hold the largest market share at approximately 44%, offering a balance between affordability and advanced features. Premium smart beds command strong margins and are favored by affluent consumers and healthcare institutions, while entry-level models are gaining traction in developing regions through simplified feature sets.

| By Product Type | By Application | By Technology Integration | By Distribution Channel | By Price Range |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America accounts for approximately 38% of the global smart beds market in 2024, led by the United States. High healthcare spending, widespread smart home adoption, and the strong presence of leading manufacturers support regional dominance. Demand is particularly strong in hospitals and residential wellness-focused consumers.

Europe

Europe represents around 22% of global demand, driven by Germany, the UK, and France. The region benefits from advanced healthcare systems, aging populations, and regulatory emphasis on patient safety and comfort.

Asia-Pacific

Asia-Pacific holds nearly 27% market share and is the fastest-growing region with a CAGR exceeding 14%. China, Japan, South Korea, and India are key contributors, supported by healthcare infrastructure expansion and growing middle-class consumption.

Latin America

Latin America is witnessing steady growth, led by Brazil and Mexico. Increasing private healthcare investments and rising awareness of sleep health are supporting gradual market expansion.

Middle East & Africa

The Middle East & Africa region shows strong growth potential, driven by healthcare modernization in GCC countries and increasing demand for premium residential products. Saudi Arabia and the UAE are key markets.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Smart Beds Market

- Sleep Number Corporation

- Stryker Corporation

- Hill-Rom Holdings (Baxter)

- Tempur Sealy International

- Paramount Bed Holdings

- LINET Group

- Arjo

- Invacare Corporation

- Joerns Healthcare

- Leggett & Platt