Sleep Patches Market Size

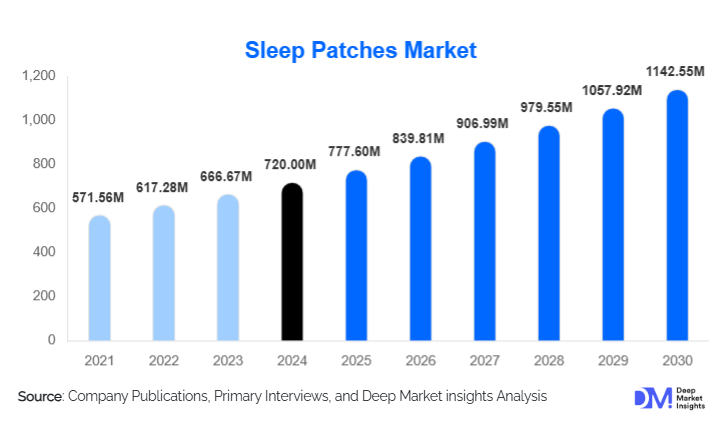

According to Deep Market Insights, the global sleep patches market size was valued at USD 720.00 million in 2024 and is projected to grow from USD 777.60 million in 2025 to reach USD 1,142.55 million by 2030, expanding at a CAGR of 8.0% during the forecast period (2025–2030). The sleep patches market growth is primarily driven by the rising prevalence of sleep disorders, increasing consumer preference for non-invasive and non-addictive sleep aids, and growing adoption of transdermal drug delivery technologies within the global wellness and healthcare ecosystem.

Key Market Insights

- Sleep patches are gaining popularity as an alternative to oral sleep aids, offering controlled-release, improved bioavailability, and reduced gastrointestinal side effects.

- Melatonin-based formulations dominate the market, supported by strong clinical acceptance and regulatory familiarity across major economies.

- Direct-to-consumer (DTC) and online channels lead distribution, accounting for nearly half of global sales due to subscription models and digital wellness marketing.

- North America dominates the global market, driven by high insomnia prevalence, strong spending power, and advanced wellness infrastructure.

- Asia-Pacific is the fastest-growing region, supported by urbanization, rising middle-class income, and increasing awareness of sleep health.

- Innovation in clean-label, herbal, and CBD-infused patches is reshaping product differentiation and premium pricing strategies.

What are the latest trends in the sleep patches market?

Rising Adoption of Clean-Label and Herbal Sleep Patches

Consumers are increasingly gravitating toward clean-label, plant-based, and chemical-free sleep solutions. Herbal and botanical ingredient patches containing valerian, chamomile, lavender, and passionflower are witnessing strong demand, particularly among health-conscious consumers and those seeking long-term sleep management without dependency risks. Manufacturers are responding by eliminating synthetic additives, artificial fragrances, and harsh adhesives, positioning sleep patches as a holistic wellness product rather than a pharmaceutical aid. This trend is particularly pronounced in Europe and the Asia-Pacific region, where natural remedies have strong cultural acceptance.

Growth of Personalized and Technology-Integrated Sleep Solutions

The integration of sleep patches with digital health ecosystems is emerging as a key trend. Companies are developing patches designed to complement wearable sleep trackers and mobile health applications, enabling personalized sleep regimens based on stress levels, sleep cycles, and circadian rhythm data. This convergence of transdermal delivery and digital therapeutics is enhancing user engagement and enabling premium pricing. Personalized dosage delivery and extended-release technologies are also gaining traction, especially among chronic insomnia patients and frequent travelers.

What are the key drivers in the sleep patches market?

Rising Global Prevalence of Sleep Disorders

The increasing incidence of insomnia, circadian rhythm disruptions, and stress-related sleep issues is a primary driver of the sleep patches market. Long working hours, excessive screen exposure, mental health challenges, and frequent travel have significantly impacted sleep quality across age groups. Sleep patches offer a convenient, non-prescription solution that aligns with the growing self-care and preventive healthcare movement, driving widespread adoption.

Shift Toward Non-Invasive and Non-Addictive Sleep Aids

Growing concerns over dependency, side effects, and long-term health risks associated with prescription sleep medications are accelerating the shift toward non-invasive alternatives. Sleep patches provide sustained and controlled delivery of active ingredients, reducing the need for repeated dosing and minimizing systemic side effects. This driver is particularly strong among geriatric populations and consumers managing chronic sleep conditions.

What are the restraints for the global market?

Regulatory Uncertainty for Certain Ingredients

Regulatory ambiguity surrounding CBD-based and combination sleep patches remains a key restraint. Variations in ingredient approval, labeling requirements, and dosage regulations across countries increase compliance costs and delay product launches. Manufacturers operating globally must navigate fragmented regulatory frameworks, which can slow down market expansion.

Skin Sensitivity and Adhesive-Related Issues

Skin irritation and adhesive intolerance among certain users can limit repeat adoption of sleep patches. Addressing these concerns requires significant investment in dermatologically tested adhesives and hypoallergenic materials, increasing production costs and potentially impacting pricing competitiveness.

What are the key opportunities in the sleep patches industry?

Expansion into Emerging Markets and New Use Cases

Emerging economies in Asia-Pacific, Latin America, and the Middle East present significant growth opportunities due to rising disposable income, urban stress, and growing awareness of sleep health. Additionally, the use of sleep patches for jet lag management, shift workers, and travel-related sleep disruptions represents an underpenetrated application area with strong growth potential.

Integration with Corporate and Travel Wellness Programs

Corporate wellness initiatives and the travel industry are increasingly adopting sleep health solutions to improve productivity and traveler comfort. Partnerships with airlines, hotels, and corporate wellness providers offer manufacturers opportunities to expand distribution and build brand credibility through institutional adoption.

Product Type Insights

Melatonin-based sleep patches dominate the market, accounting for approximately 42% of global revenue in 2024 due to their proven efficacy in sleep induction and circadian rhythm regulation. Herbal and botanical patches represent a fast-growing segment, supported by clean-label trends. Vitamin and mineral-based patches, particularly those containing magnesium and vitamin B6, are gaining traction for sleep maintenance, while CBD-based patches occupy a niche but rapidly expanding premium segment in regions with favorable regulations.

Application Insights

Sleep induction applications lead demand, driven by consumers seeking faster sleep onset. Sleep maintenance patches are increasingly adopted by individuals experiencing frequent night awakenings. Stress and relaxation-driven sleep patches are gaining popularity among working professionals, while jet lag and circadian rhythm regulation applications are expanding rapidly within the travel and aviation sector.

Distribution Channel Insights

Online and direct-to-consumer platforms dominate distribution, accounting for approximately 46% of global sales in 2024. Pharmacies and drug stores remain critical for consumer trust and credibility, particularly among older demographics. Specialty wellness clinics and sleep centers are emerging as high-value channels for clinically endorsed products.

End-Use Insights

Individual home use represents the largest end-use segment, accounting for nearly 72% of total consumption. Hospitals and sleep clinics are adopting sleep patches as adjunct therapies, while wellness centers and spas are incorporating them into holistic sleep and stress management programs. The travel industry is emerging as a new end-use segment with strong growth potential.

| By Product Composition | By Functionality | By Distribution Channel | By Age Group | By End Use |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America holds approximately 39% of the global sleep patches market in 2024, led by the United States. High insomnia prevalence, strong DTC penetration, and consumer willingness to spend on wellness products support regional dominance.

Europe

Europe accounts for around 27% of global demand, with Germany, the U.K., and France leading adoption. Strong preference for natural and regulated wellness products supports steady growth.

Asia-Pacific

Asia-Pacific represents the fastest-growing region with a CAGR of nearly 19%, driven by China, Japan, South Korea, and India. Urbanization, work stress, and rising middle-class income are key growth drivers.

Latin America

Latin America holds approximately 7% market share, with Brazil and Mexico leading regional demand. Growth is supported by expanding e-commerce penetration and wellness awareness.

Middle East & Africa

The Middle East & Africa account for about 5% of global revenue, led by the UAE, Saudi Arabia, and South Africa. Rising healthcare investment and wellness adoption are driving growth.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Sleep Patches Market

- The Good Patch

- PatchMD

- NutriPatch

- Klova Sleep

- Natural Patch Co

- Pure Patch

- LifeWave

- Vita Sciences

- Better Patch

- Vital Sleep

- Zleep Patches

- Longevity Wellness

- Herbal Health Patch Co

- SnoozeTech Labs

- Barrière Sleep Solutions