Sleep Mask Market Size

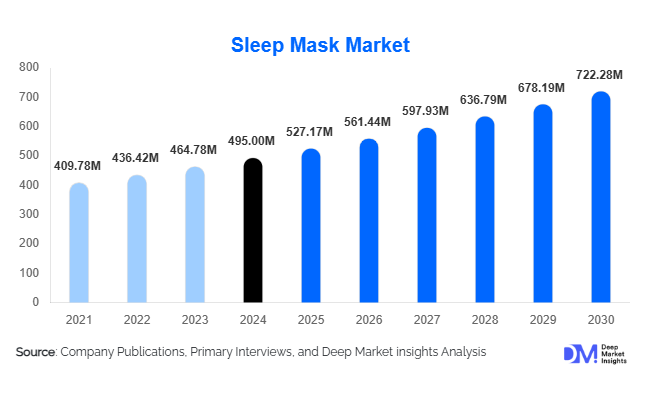

According to Deep Market Insights, the global sleep mask market size was valued at USD 495.00 million in 2024 and is projected to grow from USD 527.17 million in 2025 to reach USD 722.28 million by 2030, expanding at a CAGR of 6.5% during the forecast period (2025–2030). The market growth is primarily driven by increasing awareness of sleep hygiene, rising prevalence of sleep disorders, the adoption of premium and luxury materials, and the integration of smart technology in sleep masks.

Key Market Insights

- Smart and multifunctional sleep masks are gaining traction globally, with features like biometric monitoring, audio therapy, and Bluetooth connectivity enhancing the sleep experience.

- Luxury and silk-based masks are expanding, particularly in developed regions, appealing to consumers seeking comfort, skin-friendliness, and premium aesthetics.

- North America dominates the market due to high consumer awareness, disposable income, and wellness-oriented lifestyles.

- Asia-Pacific is the fastest-growing region, driven by urbanization, corporate wellness programs, and increased travel and tourism demand.

- Online retail and D2C channels are leading distribution, accounting for 40% of sales globally, supported by convenience and product variety.

- Healthcare, travel, and hospitality sectors are increasingly adopting sleep masks, expanding applications beyond personal use and creating export-driven demand.

What are the latest trends in the sleep mask market?

Rise of Smart and Technology-Enabled Sleep Masks

Smart sleep masks equipped with audio therapy, Bluetooth connectivity, and sleep-tracking sensors are becoming mainstream. These devices allow users to monitor sleep patterns, manage light exposure, and enhance relaxation through integrated music or guided meditation. Tech-savvy consumers, particularly in North America and Europe, are adopting these multifunctional products for their wellness benefits. Companies are also exploring AI-driven personalization and smartphone app integration to provide a tailored sleep experience, strengthening consumer engagement and increasing willingness to pay premium prices.

Premium Materials and Comfort-Driven Innovations

Luxury silk and gel-based masks are gaining popularity among consumers seeking comfort, skin benefits, and anti-aging properties. Weighted and memory foam masks are increasingly used for therapeutic purposes, helping with stress relief, eye strain, and insomnia. Manufacturers are emphasizing hypoallergenic, breathable, and eco-friendly materials to appeal to health-conscious buyers. Product differentiation through ergonomic design, adjustable straps, and innovative materials is supporting the growth of mid-range and premium segments globally.

What are the key drivers in the sleep mask market?

Increasing Prevalence of Sleep Disorders

Over 30% of adults globally experience sleep-related issues, such as insomnia or sleep apnea. Non-invasive solutions like sleep masks are gaining traction, especially in North America and Europe. The rising awareness of sleep hygiene and the therapeutic benefits of sleep masks is a significant driver, encouraging adoption among both personal and clinical users.

Growth of E-commerce and Direct-to-Consumer Channels

Online platforms have enabled greater product visibility, competitive pricing, and convenience, accounting for approximately 40% of global sales. Brands using D2C strategies are leveraging social media, influencer marketing, and subscription models to expand their reach. This trend is particularly strong in APAC and Europe, where digital adoption is high, and consumers seek personalized shopping experiences.

Rising Demand for Premium and Luxury Products

High-income consumers are increasingly willing to invest in silk, gel, and weighted masks for enhanced comfort, wellness, and aesthetics. Travel and hospitality industries are also contributing to this growth by providing premium sleep masks to customers, driving volume in both personal and B2B markets.

What are the restraints for the global market?

Price Sensitivity in Emerging Markets

While premium masks are growing in developed regions, emerging markets such as India and Latin America remain price-sensitive. Cost constraints limit the adoption of luxury and smart sleep masks, affecting the overall market growth potential in these regions.

Competition from Alternative Sleep Solutions

Alternative solutions, including blackout curtains, sleep apps, noise-canceling headphones, and specialized bedding, act as substitutes. Manufacturers must differentiate through innovation and added functionality to mitigate market cannibalization.

What are the key opportunities in the sleep mask market?

Integration with Smart Technologies

The integration of IoT, AI, and Bluetooth technology presents opportunities to develop sleep masks that monitor sleep quality, play relaxing audio, and connect to wellness apps. This trend appeals to tech-savvy consumers and enables partnerships with healthcare providers, fitness apps, and wearable tech companies.

Corporate Wellness and Employee Programs

As companies invest in employee well-being, sleep masks are being incorporated into corporate wellness kits to enhance productivity and mental health. This presents recurring B2B demand for manufacturers, especially in North America, Europe, and APAC urban centers.

Expansion in Travel and Hospitality

Airlines, hotels, and resorts are increasingly offering premium or branded sleep masks to enhance customer experience. Customization and bulk procurement opportunities in this sector are attractive for new entrants and established manufacturers alike.

Product Type Insights

Smart sleep masks dominate the market with a 25% share in 2024, driven by multifunctionality, technological integration, and consumer preference for health-monitoring devices. Silk masks lead the premium material segment with an 18% share, reflecting growing interest in comfort, hypoallergenic properties, and luxury aesthetics. Standard cotton masks continue to capture the mass-market segment, while gel and weighted masks see rising adoption in therapeutic and travel-focused applications.

Application Insights

Individual consumers are the largest end-use segment, accounting for 60% of demand. Healthcare and wellness centers are rapidly adopting sleep masks for therapeutic purposes, while travel and hospitality sectors provide additional growth through branded and premium offerings. Corporate wellness programs are emerging as a niche segment, enabling recurring B2B revenue streams. Photographic content, meditation, and mindfulness apps integrated with sleep masks are new application avenues that expand market reach.

Distribution Channel Insights

Online retail dominates, accounting for 40% of global sales, followed by D2C platforms. Offline retail, including pharmacies, specialty stores, and lifestyle outlets, remains significant for premium and luxury masks. Subscription-based services and membership models are emerging, offering curated sleep mask kits, personalized features, and wellness-focused packages.

End-Use Insights

Individual consumers remain the largest segment, with travel and hospitality as fast-growing contributors. Healthcare facilities are adopting masks for therapy, stress management, and sleep improvement. Export-driven demand is notable from China and India to North America and Europe. The individual consumer segment is expected to grow at an 8.5% CAGR, while healthcare and wellness adoption grow at 7.2% CAGR, supporting overall market expansion.

| By Product Type | By Material Type | By Distribution Channel | By End Use | By Price Segment |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America accounts for 35% of the market, driven by high awareness of sleep disorders, disposable income, and premium product adoption. The USA leads, followed by Canada. Smart and luxury masks dominate this region, and corporate wellness adoption is rapidly expanding.

Europe

Europe accounts for 25% of the market, led by Germany, the UK, and France. Consumers prioritize sustainable, hypoallergenic, and premium sleep masks. Rapid adoption of corporate wellness programs and luxury travel-driven demand support market growth. Europe is also a hub for smart mask innovation.

Asia-Pacific

APAC is the fastest-growing region with a CAGR of 9.5%, driven by China, India, Japan, and Australia. Urbanization, corporate wellness programs, travel, and increasing disposable income are key drivers. Online retail penetration and social media marketing significantly enhance adoption.

Latin America

Brazil leads the LATAM market, followed by Argentina and Mexico. Growth is driven by rising urbanization, wellness awareness, and demand for affordable mid-range masks. Outbound travel to premium markets also fuels demand.

Middle East & Africa

UAE and Saudi Arabia are key markets, primarily driven by the luxury, travel, and hospitality sectors. Africa, being a raw material source for silk and cotton, also plays a minor role in production and regional adoption.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Sleep Mask Market

- Tempur-Pedic

- MZOO

- Alaska Bear

- Slip

- Brookstone

- Bedtime Bliss

- Nidra

- Bucky

- Dream Essentials

- Lewis N. Clark

- Sleep Master

- Hynes Eagle

- Cozy Night

- Unimi

- Mindfold

Recent Developments

- In March 2025, MZOO expanded its smart sleep mask portfolio with AI-driven audio therapy and smartphone integration for North American consumers.

- In April 2025, Slip launched a silk sleep mask range targeting luxury hotels and resorts across Europe and Asia-Pacific.

- In May 2025, Tempur-Pedic introduced gel-infused memory foam masks for therapeutic use in healthcare and wellness centers in the USA and Canada.