Sleep Aid Instrument Market Size

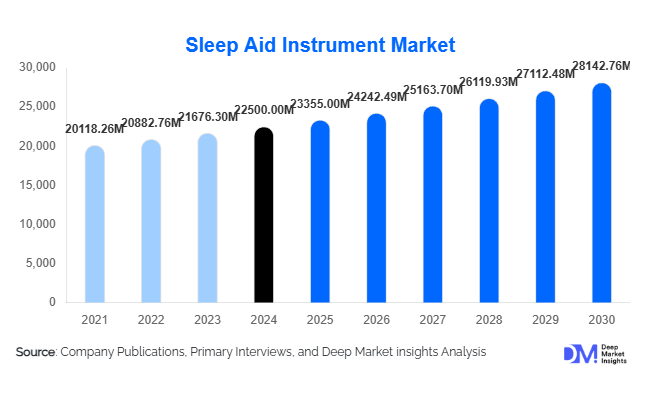

According to Deep Market Insights, the global sleep aid instrument market size was valued at USD 22,500 million in 2024 and is projected to grow from USD 23,355 million in 2025 to reach USD 28,142.76 million by 2030, expanding at a CAGR of 3.8% during the forecast period (2025–2030). The market’s expansion is driven by rising awareness of sleep disorders, increasing consumer adoption of smart and connected devices, and growing emphasis on preventive health and wellness technologies worldwide.

Key Market Insights

- The rising prevalence of sleep disorders such as insomnia and sleep apnea is fueling demand for both clinical and consumer-grade sleep aid instruments globally.

- Wearable and smart home-based sleep aid devices dominate the market, supported by advances in sensor technology, IoT integration, and AI-based analytics.

- North America leads the global market, while Asia-Pacific is emerging as the fastest-growing region due to increasing disposable incomes and digital health adoption.

- Online retail channels are expanding rapidly, enabling direct-to-consumer sales and broader accessibility of smart sleep products.

- Government initiatives and preventive healthcare programs recognizing sleep health as a key wellness factor are supporting institutional and clinical device demand.

What are the latest trends in the Sleep Aid Instrument Market?

AI and IoT Integration in Sleep Monitoring

Artificial intelligence and Internet of Things (IoT) technologies are transforming the sleep aid instrument market. Modern sleep devices now feature biometric sensors, data-driven insights, and real-time analytics that offer personalized recommendations for better sleep hygiene. Smart beds, under-mattress sensors, and wearable trackers synchronize with mobile applications to generate comprehensive sleep reports. These insights enable users to modify their lifestyle or seek medical consultation. The integration of cloud-based analytics and voice-assistant compatibility is also driving engagement and long-term product loyalty.

Shift Toward Non-Invasive and Wellness-Oriented Devices

Consumer preference is shifting from purely medical-grade devices to non-invasive, wellness-oriented products. Devices such as smart pillows, aroma diffusers, sound therapy machines, and ambient light systems are gaining traction. These innovations appeal to younger consumers who prefer natural, drug-free sleep solutions. Additionally, the fusion of design aesthetics with functionality, such as compact, travel-friendly formats and app-based controls, has expanded the market into the lifestyle and wellness sectors.

Emerging Market Expansion

Rapid urbanization and growing awareness of sleep health in Asia-Pacific, Latin America, and the Middle East are driving new market demand. Local manufacturing initiatives under “Make in India” and “Made in China 2025” are promoting cost-effective production, enabling regional brands to compete with international players. The affordability of mid-range devices and widespread internet retailing are boosting product accessibility, while hospitals and clinics are increasingly integrating sleep diagnostic instruments into preventive health programs.

What are the key drivers in the Sleep Aid Instrument Market?

Increasing Prevalence of Sleep Disorders

Rising incidences of insomnia, sleep apnea, and restless leg syndrome are key drivers of the sleep aid instrument market. Lifestyle-related stress, obesity, and digital device usage are contributing to poor sleep quality across demographics. The increased clinical diagnosis of sleep disorders has spurred demand for CPAP, BiPAP, and other therapeutic instruments. Furthermore, consumer awareness of the link between quality sleep and mental and cardiovascular health is supporting long-term market growth.

Technological Advancements and Smart Sleep Ecosystems

Continuous innovation in wearable technology and sensor-based systems has propelled the market forward. Companies are leveraging machine learning algorithms for advanced sleep analytics and integrating connectivity with broader digital health ecosystems. The proliferation of health apps and AI-driven insights allows consumers to manage sleep data seamlessly, thereby enhancing device value and retention. This convergence of hardware and software is a major growth catalyst in the premium segment.

Rising Demand for Home Healthcare and Preventive Wellness

As consumers prioritize home healthcare and wellness, there is a growing demand for sleep aid instruments designed for personal use. The post-pandemic emphasis on self-care and health monitoring has encouraged individuals to invest in smart devices that promote recovery and well-being. Combined with expanding online distribution and telehealth partnerships, this trend supports sustainable, recurring demand across developed and emerging markets.

What are the restraints for the global market?

High Device Cost and Limited Access in Developing Economies

Advanced sleep aid instruments, particularly smart beds and CPAP systems, remain costly for price-sensitive markets. Limited healthcare infrastructure, low reimbursement coverage, and insufficient awareness hinder mass adoption in developing economies. These factors restrict market penetration beyond affluent consumer groups, slowing growth in emerging regions.

Regulatory Uncertainty and Data Privacy Concerns

The lack of standardized regulatory frameworks distinguishing medical-grade devices from consumer wellness products poses challenges. Additionally, sleep data collected by connected devices raises privacy and cybersecurity concerns. Inconsistent compliance requirements across regions complicate product approval and limit cross-border scalability for manufacturers.

What are the key opportunities in the Sleep Aid Instrument Industry?

Integration with Digital Health Platforms

Linking sleep aid instruments with telemedicine, wellness applications, and electronic health records (EHRs) presents a major opportunity. This integration enables real-time patient monitoring, remote diagnosis, and personalized treatment plans. Companies that build interoperable ecosystems will benefit from subscription-based services and long-term customer engagement.

Expanding into Corporate Wellness and Hospitality Sectors

Corporate wellness programs and premium hospitality chains are incorporating sleep technology into employee well-being and guest experiences. Smart bedding, noise therapy systems, and room-lighting controls are being marketed as differentiating amenities in hotels and offices. This creates new institutional sales channels and boosts brand visibility beyond traditional consumer markets.

Localized Manufacturing and Affordable Smart Devices

Government-backed manufacturing programs and increasing R&D investments in Asia are fostering cost-effective production of sleep aid instruments. Localized assembly and component sourcing reduce import dependency, making devices more affordable. This trend offers lucrative opportunities for global brands to partner with domestic producers and scale distribution in high-growth markets.

Product Type Insights

Wearable sleep devices hold the largest market share, accounting for approximately 35% of the total market value in 2024. These include sleep tracker bands, rings, and headbands that offer real-time monitoring of sleep cycles, heart rate, and breathing patterns. Their affordability, ease of use, and integration with smartphones have made them the preferred choice for consumers. Meanwhile, smart mattresses and pillows are rapidly growing, supported by increasing adoption in premium home and hospitality sectors.

Application Insights

Insomnia management represents the largest application segment, capturing nearly 32% of the global market in 2024. With over one-third of adults reporting inadequate sleep, demand for devices offering behavioral and environmental improvements is surging. Smart lighting systems, sound machines, and AI-driven coaching applications are being widely adopted for non-clinical treatment of insomnia.

Distribution Channel Insights

Online retail dominates the global sleep aid instrument distribution network, representing around 60% of sales in 2024. E-commerce and direct-to-consumer platforms allow brands to reach wider audiences with minimal logistical barriers. Influencer marketing, digital advertising, and product subscription models are fueling continued online growth. Offline retail remains relevant for hospital-grade and regulated devices, where professional guidance is required.

End-Use Insights

The home and personal use segment is the fastest-growing end-use category, contributing approximately 60% of total market revenue in 2024. Consumers are increasingly purchasing devices for self-monitoring and wellness improvement. The hospital and sleep clinic segment continues to rely on therapeutic instruments like CPAP and diagnostic systems. Emerging sectors such as corporate wellness programs and sleep-optimized hospitality rooms are opening additional avenues for market expansion.

| By Product Type | By Application | By End-User Setting | By Distribution Channel |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America leads the global sleep aid instrument market, accounting for nearly 38% of the total value in 2024. The U.S. dominates regional demand with strong adoption of CPAP therapy devices and consumer wearables. High healthcare expenditure, favorable reimbursement frameworks, and established telehealth infrastructure underpin continued market leadership.

Europe

Europe represents about 22% of global revenue, led by Germany, the U.K., and France. Strict medical device regulations have encouraged product quality and safety compliance, while rising consumer awareness of sleep wellness supports the adoption of non-clinical devices. The region also exhibits steady growth in hospital-based sleep diagnostics and corporate wellness programs.

Asia-Pacific

Asia-Pacific is the fastest-growing region, projected to expand at a 6–7% CAGR through 2030. Rising middle-class income, increasing health awareness, and localization of production in China, Japan, and India are driving growth. Online retail penetration and affordable smart device options are propelling mass-market accessibility. China is likely to emerge as the region’s largest national market, while India remains a key growth frontier.

Latin America

Latin America holds roughly 7% of the global market, driven by growing wellness culture and urbanization in Brazil and Mexico. Despite limited healthcare infrastructure, online access to imported sleep devices is increasing consumer adoption.

Middle East & Africa

The region accounts for about 5% of global revenue. GCC countries, especially the UAE and Saudi Arabia, are witnessing strong uptake of luxury sleep products due to high-income levels and growing hospitality investments. Africa’s emerging sleep diagnostics programs present future opportunities for affordable clinical devices.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Sleep Aid Instrument Market

- ResMed Inc.

- Koninklijke Philips N.V.

- Fisher & Paykel Healthcare

- Medtronic Plc

- Sleep Number Corporation

- Garmin Ltd.

- Fitbit (Google LLC)

- Withings SA

- Tempur Sealy International, Inc.

- Omron Healthcare Co., Ltd.

- Bose Corporation

- Itamar Medical Ltd.

- Natus Medical Incorporated

- Compumedics Limited

- Somnox BV

Recent Developments

- In June 2025, ResMed launched an AI-powered CPAP monitoring platform integrating cloud-based analytics for remote patient management.

- In April 2025, Philips introduced a new range of smart sleep headbands featuring EEG-based sensors for personalized sleep cycle tracking.

- In March 2025, Sleep Number unveiled an upgraded smart bed line with temperature-adaptive comfort zones and sleep-stage optimization technology.