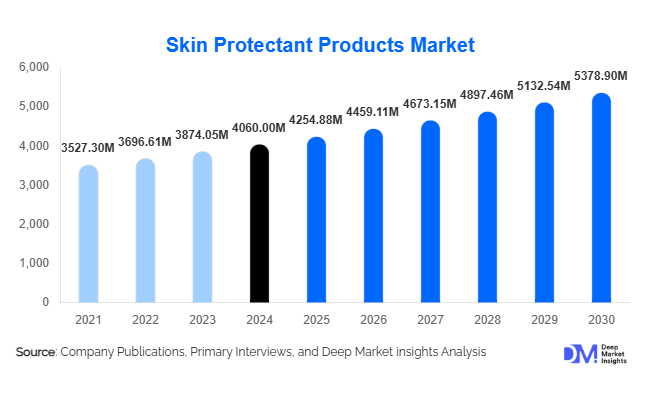

Skin Protectant Products Market Size

According to Deep Market Insights, the global skin protectant products market size was valued at USD 4,060.00 million in 2024 and is projected to grow from USD 4,254.88 million in 2025 to reach USD 5,378.90 million by 2030, expanding at a CAGR of 4.8% during the forecast period (2025–2030). The growth of the skin protectant products market is primarily driven by rising awareness of preventive skincare, increasing prevalence of chronic skin conditions, growing infant and geriatric populations, and expanding usage of skin barrier products across healthcare, personal care, and occupational settings.

Key Market Insights

- Petrolatum- and zinc oxide-based formulations remain the clinical gold standard, widely used in hospitals and long-term care facilities for pressure ulcer and dermatitis prevention.

- Silicone-based and breathable barrier technologies are gaining rapid adoption, particularly in professional healthcare and occupational safety applications.

- North America leads global demand, supported by high healthcare expenditure, strong brand penetration, and premium personal care consumption.

- Asia-Pacific is the fastest-growing regional market, driven by expanding infant care demand, hospital infrastructure growth, and rising disposable incomes.

- Retail pharmacies and drugstores dominate distribution, while e-commerce is the fastest-growing channel globally.

- Natural and botanical skin protectants are gaining traction, especially among consumers seeking clean-label and hypoallergenic formulations.

What are the latest trends in the skin protectant products market?

Shift Toward Advanced Barrier Technologies

Manufacturers are increasingly developing advanced skin barrier technologies that offer long-lasting protection while allowing breathability. Silicone-based polymers, film-forming agents, and moisture-resistant yet non-occlusive formulations are being widely adopted, particularly in clinical and occupational applications. These products reduce the need for frequent reapplication and improve patient comfort, making them attractive for hospital protocols and professional use environments. The trend is also extending into premium consumer products, where cosmetic elegance and performance are equally prioritized.

Rising Demand for Natural and Clean-Label Formulations

Consumer preference is steadily shifting toward skin protectant products formulated with natural, plant-based, and dermatologically tested ingredients. Botanical oils, beeswax, shea butter, and lanolin alternatives are increasingly replacing petroleum-heavy formulations in personal care segments. This trend is particularly strong in Europe and North America, where regulatory scrutiny and sustainability concerns are shaping purchasing behavior. Brands are positioning natural protectants as safer for infants, sensitive skin users, and long-term daily application.

What are the key drivers in the skin protectant products market?

Rising Incidence of Skin Disorders and Chronic Conditions

The increasing prevalence of eczema, dermatitis, pressure ulcers, and incontinence-associated skin damage is a major growth driver. Aging populations and longer hospital stays are significantly increasing demand for preventive skin barrier solutions in clinical and homecare settings. Hospitals and long-term care facilities are adopting standardized skin protection regimens, driving recurring institutional purchases and stable demand growth.

Growth in Infant and Geriatric Care Spending

Infant skin care, particularly diaper rash prevention, remains a high-volume application for skin protectants. At the same time, global demographic aging is accelerating demand for geriatric skin protection products that prevent bed sores, dryness, and irritation. Increased healthcare spending and caregiver awareness are supporting sustained growth across both age groups.

What are the restraints for the global market?

Pricing Pressure and Private Label Competition

The market faces significant pricing pressure from private-label brands and low-cost regional manufacturers, particularly in mature markets. This limits margin expansion for branded players and intensifies competition in mass-market segments, especially within retail pharmacy and supermarket channels.

Regulatory and Ingredient Compliance Challenges

Stricter regulations related to ingredient safety, allergens, and labeling standards pose challenges for manufacturers. Reformulation requirements, particularly for preservatives and petroleum derivatives, increase R&D costs and may delay product launches, acting as a restraint on rapid innovation.

What are the key opportunities in the skin protectant products industry?

Expansion in Emerging Healthcare Markets

Rapid healthcare infrastructure development in Asia-Pacific, Latin America, and the Middle East presents strong growth opportunities. Increasing hospital capacity, rising birth rates in certain regions, and improving access to dermatological care are driving institutional demand for skin protectant products. Local manufacturing initiatives and government healthcare spending further support market expansion.

Occupational and Industrial Skin Protection

Rising awareness of occupational skin diseases in industries such as manufacturing, healthcare, food processing, and construction is creating new demand for professional-grade skin protectants. Regulatory emphasis on workplace safety and preventive care is encouraging employers to adopt barrier creams and protective formulations, opening a high-growth, premium-margin segment.

Product Type Insights

Petrolatum-based skin protectants dominate the market, accounting for approximately 34% of global revenue in 2024, due to their proven efficacy, low cost, and widespread clinical acceptance. Zinc oxide-based products hold a strong position in infant care and dermatitis management. Silicone-based and combination formulations are the fastest-growing product types, driven by superior performance and improved user experience. Natural and botanical protectants, while smaller in share, are expanding rapidly in premium consumer segments.

Application Insights

Diaper rash and infant skin protection represent the largest application segment, contributing nearly 29% of total market revenue in 2024. Pressure ulcer prevention and wound protection are significant clinical applications, supported by hospital demand. Occupational skin protection is an emerging application, gaining traction in professional and industrial environments where prolonged exposure to moisture and chemicals is common.

Distribution Channel Insights

Retail pharmacies and drugstores lead distribution with approximately 36% market share, benefiting from consumer trust and pharmacist recommendations. Hospital pharmacies dominate institutional sales, while online platforms are the fastest-growing channel due to convenience, subscription models, and direct-to-consumer brand strategies. Supermarkets and mass merchandisers play a key role in high-volume personal care sales.

End-User Insights

Adult personal care is the largest end-user segment, accounting for about 31% of global demand. Pediatric care remains a stable, high-volume segment, while geriatric care is the fastest-growing due to aging populations. Clinical and hospital use is expanding rapidly, supported by preventive healthcare protocols and rising inpatient volumes.

| By Product Type | By Formulation Format | By Application | By Distribution Channel | By End User |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America accounts for approximately 32% of the global skin protectant products market in 2024. The United States dominates regional demand, driven by advanced healthcare infrastructure, high awareness of preventive skincare, and strong penetration of premium brands. Institutional demand from hospitals and long-term care facilities is particularly strong.

Europe

Europe holds around 27% of the global market, led by Germany, the U.K., and France. Demand is shaped by aging demographics, strict healthcare standards, and growing preference for natural and dermatologically tested products. Sustainability and clean-label trends are especially influential in this region.

Asia-Pacific

Asia-Pacific represents approximately 26% of the market and is the fastest-growing region. China and India are major contributors, driven by expanding infant populations, improving healthcare access, and rising disposable incomes. Japan and South Korea show strong demand for premium and technologically advanced formulations.

Latin America

Latin America accounts for about 9% of global demand, led by Brazil and Mexico. Growth is supported by increasing healthcare spending and expanding retail pharmacy networks, although pricing sensitivity remains a key market characteristic.

Middle East & Africa

The Middle East & Africa region holds roughly 6% of the market. Growth is driven by improving healthcare infrastructure, rising hospital investments, and increasing adoption of clinical skin protection protocols, particularly in Gulf Cooperation Council countries.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Leading Players in the Skin Protectant Products Market

- Johnson & Johnson

- Beiersdorf AG

- Procter & Gamble

- Unilever

- 3M

- Smith & Nephew

- Coloplast

- Kimberly-Clark

- Reckitt

- Galderma

- Bausch Health

- Perrigo

- Edgewell Personal Care

- Kao Corporation

- Himalaya Wellness