Skin Care Supplements Market Size

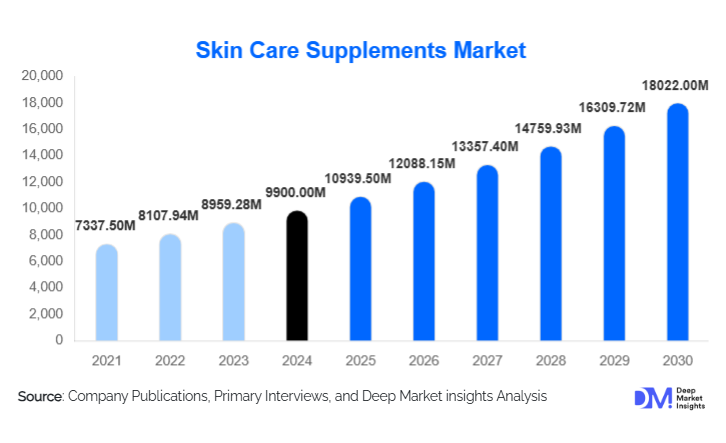

According to Deep Market Insights, the global skin care supplements market size was valued at USD 9,900 million in 2024 and is projected to grow from USD 10,939.50 million in 2025 to reach USD 18,022.24 million by 2030, expanding at a CAGR of 10.5% during the forecast period (2025–2030). Market expansion is driven by rising consumer adoption of “beauty-from-within” products, increasing clinical evidence supporting ingestible skincare ingredients, and accelerated demand for collagen, probiotics, botanical blends, and antioxidant supplements. Growing wellness consciousness, social media influence, innovations in nutricosmetics, and wider access to e-commerce channels are strengthening the global market outlook.

Key Market Insights

- Collagen supplements lead the global market, accounting for the largest share due to strong scientific validation and consumer trust.

- Plant-based and vegan skin supplements are rapidly expanding as clean-label and sustainability preferences rise among millennials and Gen Z.

- Online distribution channels dominate, holding over 40% share in 2024, driven by D2C brands, influencers, and subscription models.

- Asia-Pacific is the fastest-growing regional market, supported by large young populations, rising beauty awareness, and growing disposable incomes.

- Anti-aging supplements remain the largest application segment, representing over one-third of global demand.

- Dermatologist-led and clinic-based supplement prescriptions are increasing globally, strengthening medical acceptance of ingestible skincare.

Latest Market Trends

Scientific-Backed Nutricosmetics Are Gaining Mainstream Acceptance

Consumers increasingly prefer supplements backed by clinical studies validating benefits such as improved skin elasticity, hydration, and reduced pigmentation. Brands are investing heavily in R&D and partnering with dermatologists to publish clinical trials on collagen peptides, vitamin C blends, probiotics for gut–skin balance, and botanical antioxidants. This surge in scientific credibility is elevating consumer trust and driving premium-product adoption. Advanced formulations featuring microencapsulation, liposomal delivery, and bioactive peptides are becoming industry standards, appealing to health-conscious buyers seeking proven results.

Personalized Skin Supplements and D2C Customization

Personalized nutrition is transforming the skin care supplements market. AI-driven skin analysis tools, DNA-based health tests, and personalized quiz-based assessments are enabling brands to deliver customized supplement regimens. These solutions are increasingly offered through subscription models, ensuring long-term consumer retention. Digital-native D2C brands are integrating skin tracking apps, progress dashboards, and expert consultations. As personalization becomes central to the beauty industry, data-driven supplement planning is expected to redefine consumer expectations and reshape competitive dynamics.

Skin Care Supplements Market Drivers

Increasing Prevalence of Skin Aging and Dermatological Concerns

Accelerated skin aging due to pollution, UV exposure, stress, and poor diet is driving consumers toward ingestible solutions that support collagen synthesis and cellular repair. Younger demographics are beginning anti-aging routines earlier, significantly expanding market demand. Supplements addressing wrinkles, pigmentation, dryness, and inflammation are experiencing high adoption in both developed and emerging markets.

Growing Influence of Social Media and Beauty Culture

Social media platforms such as Instagram, TikTok, and YouTube have amplified interest in ingestible beauty products. Influencers, celebrities, and dermatologists regularly promote collagen powders, beauty gummies, and vitamin-infused blends, shaping consumer choices globally. Viral trends around “glowing skin supplements,” “collagen coffee,” and “skin hydration gummies” are driving mass-market adoption and fueling brand competition in the digital space.

Market Restraints

Regulatory Variability and Product Standardization Issues

Regulatory frameworks for supplements vary widely across countries, creating compliance challenges for global brands. Differences in allowable health claims, ingredient limits, and safety certifications can delay product launches and hinder cross-border expansion. Limited oversight in some markets also fuels counterfeit products, impacting consumer trust and slowing adoption.

High Competition and Pricing Sensitivity

The market faces heavy competition from multinational nutraceutical companies, D2C startups, and low-cost private-label manufacturers. Price-sensitive consumers often hesitate to buy premium collagen or probiotic blends, while rising costs of marine collagen, botanical extracts, and specialized ingredients pressure product margins. Building differentiation through branding, clinical validation, and sustainable sourcing is now essential.

Skin Care Supplements Market Opportunities

Expansion in Emerging Markets

Rapid urbanization and rising beauty consciousness across Asia-Pacific, Latin America, and the Middle East present strong growth opportunities. Consumers in India, Indonesia, Brazil, and Vietnam are shifting from traditional skincare to clinically backed ingestible beauty solutions. Brands tailoring products to regional skin concerns, such as pigmentation, pollution stress, and hydration, can tap into substantial untapped demand. Growing e-commerce penetration in these markets further accelerates consumption.

Innovation in Vegan, Clean-Label, and Sustainable Formulations

Demand for plant-based and eco-friendly skin supplements is accelerating as consumers prioritize transparency, cruelty-free sourcing, and sustainable manufacturing. Vegan collagen boosters, herbal antioxidant blends, fermented botanicals, and probiotic formulations appeal strongly to health-conscious buyers. Brands adopting mercury-free marine collagen, biodegradable packaging, and transparent supply chains are capturing premium consumer segments and expanding brand loyalty.

Product Type Insights

Collagen supplements dominate the market, holding a 31% share in 2024, driven by extensive clinical evidence supporting improved elasticity, hydration, and wrinkle reduction. Vitamin and antioxidant blends are widely adopted for brightening and pigmentation control, while herbal supplements appeal to consumers seeking natural solutions. Probiotics, addressing the gut–skin axis, represent one of the fastest-growing categories. Multifunctional nutricosmetic blends combining collagen, vitamins, and botanicals are increasingly popular among consumers seeking comprehensive benefits in a single product.

Application Insights

Anti-aging remains the largest application segment, representing 36% of global demand. Skin-brightening supplements show strong growth in Asia-Pacific, driven by consumer focus on even skin tone and radiance. Acne-management supplements, particularly probiotics and zinc-based formulations, are gaining traction among teenagers and young adults. Hydration and UV-protection supplements continue to expand as consumers seek everyday preventive skincare. Detox-focused supplements are popular among urban consumers exposed to pollution and lifestyle-induced oxidative stress.

Distribution Channel Insights

Online channels dominate with 41% market share, supported by D2C brands, influencer marketing, and subscription-based models. Pharmacies and specialty beauty retailers remain crucial offline channels, especially in Europe and North America, where dermatologist-backed products drive credibility. Clinic-based and practitioner-recommended supplements are increasingly adopted within dermatology and aesthetic treatment plans, boosting premium product sales.

End-User Insights

Adults aged 18–45 represent the largest consumer group, accounting for 49% of total demand due to preventive skincare adoption and strong online engagement. Middle-aged consumers (46–65) increasingly seek anti-aging supplements, while teenagers drive growth in acne-support products. Older consumers prioritize collagen and hydration supplements that address dryness and elasticity loss. Growing wellness culture across all age groups is expanding cross-generational adoption.

| By Product Type | By Form | By Application (Skin Concern) | By Distribution Channel | By End User |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America holds 28% of the global market, driven by strong adoption of premium collagen, probiotics, and clean-label formulations. The U.S. leads regional demand, supported by high wellness spending, strong influencer marketing, and D2C brand expansion. Canada shows increasing interest in natural and vegan supplements, contributing to steady growth.

Europe

Europe represents 25% of the global share, with Germany, France, Italy, and the U.K. serving as major consumption hubs. Consumers prioritize clinically validated and sustainably sourced ingredients, making Europe a leader in premium and clean-label supplements. Anti-pollution and antioxidant skincare supplements are especially popular in urban regions.

Asia-Pacific

Asia-Pacific is the fastest-growing region with over 12% CAGR, driven by booming beauty culture and rising disposable incomes in China, India, South Korea, and Japan. Collagen drinks, hydration powders, and brightening supplements dominate consumer preferences. Japan and South Korea remain global trendsetters for advanced nutricosmetic innovation.

Latin America

Brazil and Mexico drive regional growth, with the rising popularity of collagen powders, herbal blends, and antioxidant supplements. Economic fluctuations limit the adoption of premium formulations, but mid-range products continue to thrive. Brazil’s strong wellness culture supports steady expansion.

Middle East & Africa

The UAE, Saudi Arabia, and South Africa are key growth markets, with consumers showing high interest in anti-aging, brightening, and hydration-focused supplements. Rising wellness spending, expanding e-commerce penetration, and increasing adoption of premium imported brands support growth.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Skin Care Supplements Market

- Amway

- Herbalife Nutrition

- Nestlé Health Science

- Shiseido

- Nature’s Bounty

- Vital Proteins

- GNC

- Swisse Wellness

- NeoCell

- Fancl Corporation

- HUM Nutrition

- Blackmores

- Oriflame

- Life Extension

- Olly Nutrition

Recent Developments

- In March 2025, Vital Proteins launched a new marine-collagen line utilizing mercury-free, sustainably sourced fish scales with enhanced bioavailability.

- In January 2025, HUM Nutrition introduced personalized monthly supplement packs developed through AI-powered skin and diet analysis.

- In August 2024, Nestlé Health Science expanded its nutricosmetics portfolio with probiotic-infused anti-aging supplements targeting the gut–skin axis.