Skin Barrier Patches Market Size

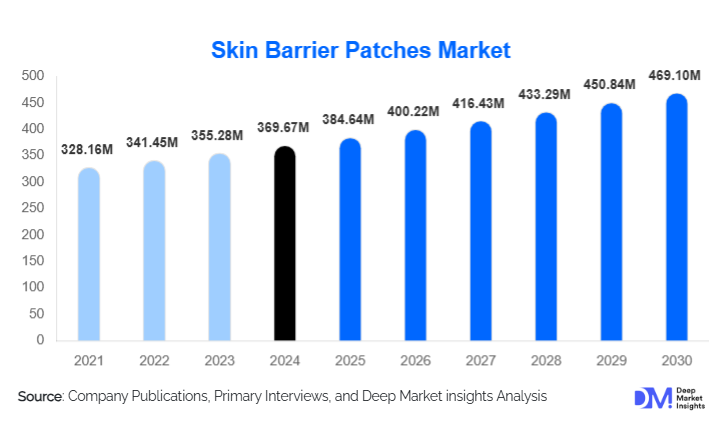

According to Deep Market Insights, the global skin barrier patches market size was valued at USD 369.67 million in 2024 and is projected to grow from USD 384.64 million in 2025 to reach USD 469.10 million by 2030, expanding at a CAGR of 4.05% during the forecast period (2025–2030). The skin barrier patches market growth is driven by the rising prevalence of chronic wounds and ostomy procedures, increasing use of wearable medical devices, and the growing shift toward home healthcare and self-managed patient care.

Key Market Insights

- Ostomy care remains the largest application segment, accounting for over 40% of global demand due to recurring and long-term product usage.

- Hydrocolloid-based skin barrier patches dominate the product landscape owing to their moisture management, adhesion, and cost-effectiveness.

- North America leads the global market, supported by advanced healthcare infrastructure, strong reimbursement frameworks, and high adoption of medical wearables.

- Asia-Pacific is the fastest-growing region, driven by expanding healthcare access, rising surgical volumes, and large aging populations.

- Home healthcare is the fastest-growing end-use segment, fueled by patient preference for convenience and reduced hospital stays.

- Technological innovation in materials, including silicone adhesives and multi-layer breathable films, is improving patient comfort and compliance.

What are the latest trends in the skin barrier patches market?

Expansion of Home Healthcare and Self-Care Solutions

The global shift toward home-based care is significantly reshaping demand for skin barrier patches. Patients managing ostomies, chronic wounds, and long-term medical devices increasingly rely on easy-to-apply, extended-wear barrier patches that minimize skin trauma and reduce hospital visits. Manufacturers are responding by designing user-friendly products with longer wear durations and simplified application processes. Subscription-based supply models and direct-to-consumer sales are also gaining traction, improving product accessibility and adherence in home settings.

Advanced Material and Multi-Layer Patch Innovations

Technological advancements in polymers, silicone adhesives, and hydrocolloid formulations are driving innovation across the market. Multi-layer patches offering breathability, antimicrobial protection, and moisture vapor control are becoming standard. These innovations enhance patient comfort, reduce infection risks, and support longer wear times, making them particularly suitable for chronic care and medical device protection. Compatibility with wearable medical electronics, such as glucose monitors and infusion pumps, is emerging as a key design focus.

What are the key drivers in the skin barrier patches market?

Rising Prevalence of Chronic Wounds and Ostomy Procedures

The increasing incidence of diabetes, obesity, colorectal cancer, and age-related conditions has led to a growing population requiring ostomy care and chronic wound management. Skin barrier patches play a critical role in preventing moisture-associated skin damage and peristomal dermatitis, making them essential consumables in long-term patient care. Longer patient lifespans and improved surgical outcomes further reinforce recurring demand.

Growth of Wearable and Implantable Medical Devices

The rapid adoption of wearable medical devices such as continuous glucose monitors, insulin pumps, and cardiac sensors has expanded the application scope of skin barrier patches. These devices require reliable skin protection to ensure adhesion, comfort, and uninterrupted functionality. Medical device manufacturers increasingly consider skin barrier solutions as complementary products, driving cross-industry demand.

What are the restraints for the global market?

Price Sensitivity in Emerging Markets

Advanced skin barrier patches are often priced higher than conventional dressings, limiting adoption in cost-sensitive regions where reimbursement coverage is limited. Hospitals and patients in emerging economies may prioritize lower-cost alternatives, slowing market penetration despite rising clinical need.

Risk of Skin Irritation and Improper Usage

Incorrect application or prolonged use of skin barrier patches can cause skin maceration or allergic reactions. This necessitates continuous clinician training, patient education, and strict regulatory compliance, increasing operational and post-market surveillance costs for manufacturers.

What are the key opportunities in the skin barrier patches industry?

Integration with Smart and Wearable Healthcare Technologies

The convergence of skin protection solutions with digital health technologies presents a significant opportunity. Skin barrier patches designed to work seamlessly with biosensors and wearable electronics can unlock new partnerships with medtech companies and create differentiated product offerings in chronic disease management.

Untapped Demand in Emerging Healthcare Markets

Countries such as India, China, Brazil, and Indonesia are witnessing rapid expansion in healthcare infrastructure and surgical volumes. Localization of manufacturing, affordable product variants, and public-private partnerships can help companies capture this underpenetrated demand while achieving scale.

Product Type Insights

Hydrocolloid skin barrier patches dominate the market, accounting for approximately 38% of global revenue in 2024, due to their superior moisture absorption and cost efficiency. Silicone-based patches are gaining momentum as a premium segment, driven by improved skin friendliness and reduced adhesive trauma. Polyurethane film and foam-based patches cater to specialized wound care and device protection needs, while hybrid multi-layer patches represent a growing innovation-driven segment.

Application Insights

Ostomy care is the largest application segment, contributing nearly 42% of total market revenue, supported by consistent and recurring usage patterns. Wound care and post-surgical protection represent the second-largest application, followed by medical device-related skin protection. Dermatology and cosmetic applications are emerging as niche but fast-growing areas, particularly in aesthetic clinics.

Distribution Channel Insights

Hospital pharmacies remain the dominant distribution channel, accounting for about 44% of global sales. Retail pharmacies continue to play a key role in outpatient care, while online and e-commerce platforms are the fastest-growing channels, driven by home healthcare adoption and direct-to-consumer sales models.

End-Use Insights

Hospitals account for approximately 40% of total demand, driven by surgical procedures and acute wound care. Home healthcare is the fastest-growing end-use segment, expanding at over 14% CAGR, as patients increasingly manage chronic conditions outside institutional settings. Ambulatory surgical centers and long-term care facilities also contribute steadily to market growth.

| By Product Type | By Application | By End Use | By Distribution Channel | By Wear Duration |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America leads the global skin barrier patches market with around 36% share in 2024. The United States alone accounts for more than 28% of global demand, supported by high healthcare spending, strong reimbursement policies, and widespread adoption of advanced wound care products.

Europe

Europe holds approximately 27% of the market, led by Germany, the UK, and France. Aging populations, stringent skin protection protocols, and strong regulatory standards support stable demand across the region.

Asia-Pacific

Asia-Pacific is the fastest-growing region, expanding at over 14.5% CAGR. China, Japan, and India are key contributors, driven by large patient populations, rising healthcare expenditure, and increasing awareness of advanced wound care solutions.

Latin America

Latin America accounts for around 6% of global demand, with Brazil and Mexico leading regional consumption. Improving healthcare access and growing private hospital networks are supporting gradual market expansion.

Middle East & Africa

The Middle East & Africa region represents approximately 5% of the market. Growth is supported by expanding private healthcare sectors in Saudi Arabia and the UAE, along with rising surgical volumes in South Africa.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Skin Barrier Patches Market

- Coloplast

- ConvaTec Group

- 3M

- Hollister Incorporated

- Smith & Nephew

- Mölnlycke Health Care

- B. Braun

- Paul Hartmann

- Medline Industries

- Nitto Denko

- Lohmann & Rauscher

- BSN Medical

- Integra LifeSciences

- Winner Medical

- Derma Sciences

Recent Developments

- In 2025, leading manufacturers expanded silicone-based skin barrier portfolios to address growing demand from wearable medical device users.

- In 2024, multiple companies invested in automated manufacturing lines in the Asia-Pacific region to support cost-efficient production and regional supply.

- In early 2025, partnerships between wound care companies and home healthcare providers increased, strengthening direct-to-patient distribution models.