Skill Gaming Market Size

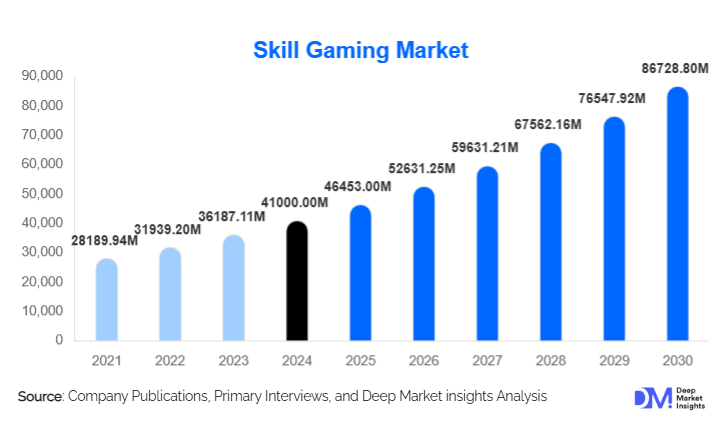

According to Deep Market Insights, the global skill gaming market size was valued at USD 41,000.00 million in 2024 and is projected to grow from USD 46,453.00 million in 2025 to reach USD 86,728.80 million by 2030, expanding at a CAGR of 13.3% during the forecast period (2025–2030). The market’s expansion is driven by rising global smartphone penetration, growing acceptance of competitive digital experiences, regulatory clarity distinguishing skill from chance-based gaming, and rapid integration of AI, cloud gaming, and blockchain technologies into interactive game ecosystems.

Key Market Insights

- Mobile-based skill gaming accounts for over 60% of global usage, driven by affordable smartphones, high-speed internet, and low-friction app ecosystems.

- Strategy and puzzle skill games dominate global revenue share, benefiting from high replay value and strong user monetization characteristics.

- APAC is the fastest-growing region, fueled by India, China, and Southeast Asia’s expanding youth populations and digital payment adoption.

- North America leads premium skill gaming spending, supported by mature digital ecosystems and high ARPU levels.

- AI and blockchain technologies are reshaping competitive fairness, user retention, and anti-fraud mechanisms across skill-based tournaments.

- Regulatory clarity in regions such as the U.S., India, and parts of Europe is expanding operator confidence and attracting institutional investment.

What are the latest trends in the skill gaming market?

AI-Driven Personalization and Fair-Play Systems

AI integration is becoming central to skill gaming evolution. Platforms increasingly use machine learning to optimize matchmaking, maintain fair competition, and recommend customized tournaments. Advanced fraud detection systems now analyze user patterns in real time, reducing cheating and enhancing trust. AI-driven difficulty adjustment in puzzle and logic games is also improving user retention by maintaining optimal cognitive challenge. As players demand transparent competition, explainable-AI matchmaking is emerging as a key differentiator for market leaders.

Blockchain and Tokenized Competitive Ecosystems

Blockchain adoption is accelerating as platforms seek transparent reward mechanisms, verifiable tournament results, and digital ownership models. Token-based in-game economies allow players to monetize skills, trade digital items, and participate in decentralized tournaments. Smart contracts automate prize distribution and enhance user trust. Additionally, NFTs are being tested as proof-of-skill collectibles for competitive achievements. These blockchain-integrated ecosystems are attracting gamers seeking verifiable fairness and new revenue streams.

What are the key drivers in the skill gaming market?

Explosive Growth of Mobile and 5G Connectivity

Rising global smartphone penetration and low-latency 5G networks have transformed the accessibility of real-time competitive skill gaming. Over 60% of all skill gaming revenue is now mobile-driven. Seamless connectivity enables precise gameplay, fair matchmaking, and large-scale tournaments, significantly boosting user participation in emerging and developed markets alike.

Shift Toward Competitive, Reward-Based Digital Entertainment

Younger demographics prefer interactive, challenge-based digital experiences over passive entertainment. Skill gaming appeals strongly to Millennials and Gen Z, who value measurable progress, rankings, and cognitive engagement. The growing mainstream popularity of esports further accelerates interest in skill-based tournaments, driving higher user retention and stronger monetization.

Corporate & Educational Adoption of Cognitive Skill Platforms

Beyond entertainment, organizations are increasingly using skill gaming for cognitive assessment, employee training, and gamified learning. Educational institutions adopt logic and problem-solving games to improve student engagement. These additional applications broaden market opportunities and create recurring revenue models.

What are the restraints for the global market?

Regulatory Ambiguity in Select Markets

While many nations differentiate skill gaming from gambling, some regions maintain unclear or outdated legal frameworks. Sudden regulatory shifts may restrict operations or require additional licensing. This ambiguity creates barriers for new entrants and complicates multi-country expansion for established operators.

High Customer Acquisition Costs (CAC)

As competition intensifies, platforms increasingly rely on influencer partnerships, digital ads, and promotional incentives to acquire players. This pushes CAC upward, making profitability challenging, especially for early-stage operators. High churn rates in gaming also mean that marketing efficiency and retention strategies are more critical than ever.

What are the key opportunities in the skill gaming industry?

Regulatory Standardization and Compliance-Driven Expansion

Growing legal recognition of skill gaming, particularly in North America, India, and Europe, presents strong opportunities for market expansion. Clear governance frameworks enhance investor confidence, reduce compliance costs, and enable multi-region scaling. Operators that proactively align with emerging standards, responsible gaming guidelines, and transparent algorithms will gain a long-term competitive advantage.

High-Growth Demand from Emerging Digital Economies

India, Brazil, Indonesia, Vietnam, and the Philippines are experiencing rapid growth fueled by youth demographics, increasing digital payments, and low-cost mobile internet. Localization of content, vernacular gaming formats, and community-based tournaments can help operators tap into markets expected to contribute nearly half of global incremental growth by 2030.

Product Type Insights

Strategy-based skill games dominate the market, accounting for nearly 24% of the global 2024 share. These games offer high replay value, competitive depth, and strong monetization potential through tournaments and in-app enhancements. Puzzle and logic games follow closely due to their universal appeal and cognitive engagement, while arcade, trivia, and card-based tournaments attract niche skill communities. eSports-style skill gaming is rapidly emerging, supported by professionalized tournaments and influencer-led game formats.

Application Insights

Casual entertainment holds the largest share at 57% of the 2024 market, driven by widespread mobile adoption and short-session gaming preferences. Competitive gaming applications are experiencing rapid growth as platforms introduce ranked ladders, seasonal competitions, and reward-based events. Educational and corporate applications are expanding at double-digit CAGRs, integrating skill gaming for cognitive training, assessment, and engagement. New applications, including neuro-learning rehabilitation, gamified hiring assessments, and professional skill simulations, are emerging as additional revenue channels.

Distribution Channel Insights

Mobile app stores dominate distribution globally, accounting for the majority of downloads and revenue. Direct-to-consumer (D2C) platforms are gaining traction as companies build proprietary ecosystems with lower commission fees and stronger data ownership. Online gaming portals, cloud platforms, and subscription-based services offer curated tournaments and premium perks. Social media and influencer-driven promotions significantly influence user acquisition, especially among Gen Z and younger Millennials.

Traveler Type (User Type) Insights

Players aged 18–34 represent the largest and most active user base, contributing 48% of total global demand. This group values competitive experiences, personalization, and reward-based gaming. Teenagers (13–17) show growing engagement through free-to-play formats and casual tournaments. Adults aged 35–50 increasingly participate in puzzle, trivia, and strategy games as cognitive leisure activities. Older users, while a smaller segment, are adopting brain-training and skill-enhancing applications at accelerating rates.

Age Group Insights

The 18–34 age group dominates due to high digital literacy and strong interest in competitive skill gaming. The 35–50 group contributes meaningfully to paid tournaments and subscription models. Younger segments (13–17) drive viral trends and social gaming engagement. The 50+ demographic is gradually embracing cognitive skill games for mental stimulation, positioning this group as a future growth opportunity for developers.

| By Game Type | By Platform | By Revenue Model | By End-Use / Application | By Distribution Channel |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America holds 34% of the global market share (2024), led by the U.S. Users in this region exhibit high ARPU and strong interest in premium competitive formats. Favorable regulatory distinctions between skill and chance gaming support market expansion. Canada contributes a steady demand through esports and hobbyist skill categories.

Europe

Europe accounts for 27% of the market, driven by the U.K., Germany, France, and the Nordic region. Strong consumer protection laws, mature gaming cultures, and rising adoption of subscription-based skill titles strengthen Europe's position. The U.K. alone accounts for nearly 9% of global demand.

Asia-Pacific

APAC is the fastest-growing region with a projected 15.8% CAGR. India leads with 11% global share, driven by mass mobile adoption and digital payment systems. China remains a powerhouse for skill gaming development, while Indonesia, Vietnam, and Japan contribute rapidly expanding user bases.

Latin America

Brazil and Mexico anchor regional growth. Rising smartphone penetration and growing interest in competitive digital experiences drive adoption. Localized game formats and affordable tournament models appeal strongly to young users.

Middle East & Africa

MEA is growing steadily, supported by high-income players in the UAE, Qatar, and Saudi Arabia. Africa’s digital expansion, particularly in Nigeria, Kenya, and South Africa, is fostering regional skill gaming participation and local content development.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Skill Gaming Market

- Skillz Inc.

- Mobile Premier League (MPL)

- Zynga

- Roblox Corporation

- Miniclip

- Epic Games

- Tencent Gaming (Skill Division)

- DraftKings – Skill Formats

- FanDuel – Skill Formats

- Blizzard Entertainment

- Scopely

- Ubisoft

- Riot Games

- Niantic

- Playrix

Recent Developments

- In March 2025, Skillz Inc. launched an AI-driven matchmaking engine designed to enhance fair play and reduce skill gaps in competitive tournaments.

- In January 2025, MPL expanded into Europe with a localized strategy and puzzle titles tailored for EU regulations and player preferences.

- In June 2025, Miniclip announced the acquisition of a cloud gaming startup to accelerate server-side low-latency competitive gaming experiences.