Skiing Facilities Market Size

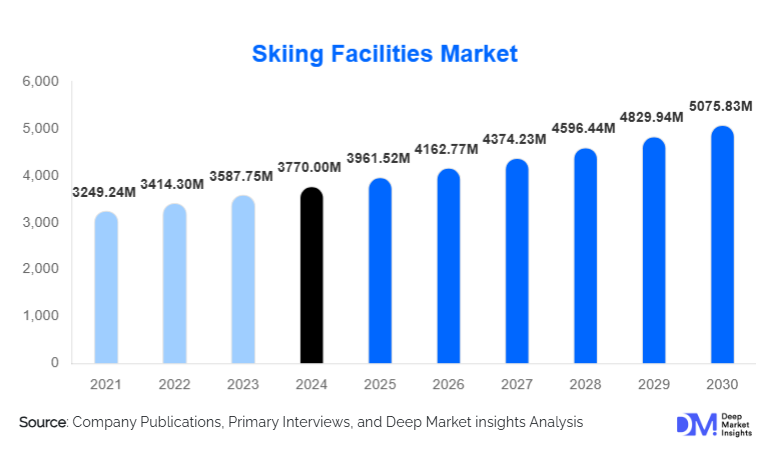

According to Deep Market Insights, the global skiing facilities market size was valued at USD 3,770.00 million in 2024 and is projected to grow from USD 3,961.52 million in 2025 to reach USD 5,075.83 million by 2030, expanding at a CAGR of 5.08% during the forecast period (2025–2030). The market growth is primarily driven by rising global winter tourism, increasing participation in recreational and professional skiing, and sustained investments in modern ski infrastructure, including lifts, snowmaking systems, and hospitality facilities.

Key Market Insights

- Alpine ski resorts dominate the global market, accounting for more than half of total revenue due to their integrated offerings of slopes, lifts, lodging, and entertainment.

- Europe leads the global skiing facilities market, supported by the Alps region and a strong culture of winter sports tourism.

- Asia-Pacific is the fastest-growing region, driven by government-backed winter tourism initiatives and the rapid expansion of indoor ski facilities in China and Japan.

- Indoor skiing facilities are gaining traction, enabling year-round operations and expanding skiing access to urban populations.

- Technology adoption, including automated ski lifts, AI-enabled slope management, and advanced snowmaking systems, is improving operational efficiency and safety.

- Sustainability initiatives, such as renewable energy usage and eco-friendly snow production, are becoming critical differentiators for ski facility operators.

What are the latest trends in the skiing facilities market?

Growth of Indoor and Urban Skiing Facilities

Indoor skiing facilities are emerging as a major trend, particularly in regions with limited natural snowfall. Climate-controlled ski domes in China, the Middle East, and parts of Europe are enabling year-round skiing experiences. These facilities cater to first-time skiers, recreational users, and training professionals, significantly expanding the addressable market beyond traditional mountain resorts.

Smart and Digitally Integrated Ski Resorts

Ski resorts are increasingly integrating digital technologies such as IoT-enabled ski passes, real-time crowd management systems, and AI-driven snow grooming solutions. Mobile apps offering live slope conditions, digital ticketing, and personalized recommendations are enhancing customer engagement and improving capacity utilization during peak seasons.

What are the key drivers in the skiing facilities market?

Rising Winter Tourism and Recreational Sports Participation

Global interest in winter tourism continues to rise, with skiing remaining a core attraction. Increasing disposable incomes, experiential travel preferences, and international sporting events are encouraging more tourists to visit ski destinations. Recreational skiers account for approximately 65% of total demand, making leisure tourism the primary growth engine.

Public and Private Infrastructure Investments

Governments and private developers are investing heavily in ski infrastructure to promote tourism-led economic growth. Investments in high-capacity ski lifts, snowmaking equipment, access roads, and hospitality assets are enhancing resort competitiveness and attracting international visitors.

Technological Advancements in Ski Operations

Advancements in snowmaking, slope safety systems, and lift automation have reduced weather dependency and improved operational reliability. These innovations allow facilities to extend ski seasons and maintain consistent service quality, supporting revenue growth.

What are the restraints for the global market?

High Capital and Operating Costs

Skiing facilities require significant upfront capital investments and ongoing maintenance expenses. Costs associated with lift systems, snowmaking equipment, energy consumption, and skilled labor can impact profitability, particularly for smaller or seasonal operators.

Climate Change and Snow Reliability

Rising global temperatures and unpredictable snowfall patterns pose a major challenge to outdoor skiing facilities. Resorts increasingly rely on artificial snow, which raises operational costs and environmental concerns, potentially limiting long-term expansion in lower-altitude regions.

What are the key opportunities in the skiing facilities industry?

Expansion in Emerging Markets

Asia-Pacific and Latin America present significant growth opportunities as governments promote winter sports tourism and invest in new ski infrastructure. China’s focus on winter sports participation and Japan’s strong inbound tourism demand are creating attractive entry points for new operators.

Sustainable and Eco-Friendly Resort Development

There is a growing demand for environmentally responsible ski facilities. Resorts that invest in renewable energy, water-efficient snowmaking, and low-impact construction can attract eco-conscious travelers and secure long-term regulatory and community support.

Facility Type Insights

Alpine ski resorts account for approximately 55% of the global skiing facilities market in 2024, making them the dominant facility type worldwide. Their leadership is driven by fully integrated ecosystems that combine extensive skiable terrain, high-capacity lift infrastructure, on-site lodging, retail, dining, and entertainment offerings. These resorts generate higher average revenue per visitor through bundled services, season passes, premium accommodations, and ancillary activities such as snowboarding parks, après-ski experiences, and winter festivals. Strong brand recognition, repeat visitation, and international tourism flows further reinforce the dominance of alpine resorts, particularly in Europe and North America.

Cross-country ski trails represent a significant secondary segment, especially across Europe and North America, where participation in endurance and fitness-oriented winter sports continues to rise. This segment benefits from comparatively lower capital and operating costs, minimal lift infrastructure requirements, and strong government and municipal support due to its environmental sustainability. Growing interest in health-conscious and low-impact outdoor recreation is supporting steady adoption of cross-country skiing among local and regional tourists.

Service Type Insights

Ski lift services constitute the largest revenue-generating service segment, contributing nearly 30% of total market value in 2024. This dominance is driven by the essential role of lifts in maximizing slope accessibility, skier throughput, and overall resort capacity. Continuous investments in high-speed gondolas, detachable chairlifts, and automated safety systems allow resorts to improve operational efficiency, reduce wait times, and accommodate higher visitor volumes, directly influencing ticket sales and season-pass revenue.

Equipment rental services and ski training programs are experiencing steady growth, supported by rising participation among beginners, tourists, and younger demographics. Resorts are increasingly offering bundled rental-and-training packages to reduce entry barriers for first-time skiers, particularly in emerging markets. Professional instruction services also benefit from growing interest in competitive skiing, youth academies, and recreational skill development.

End-Use Insights

Recreational tourists dominate end-use demand for skiing facilities, accounting for the majority of global visits and revenue generation. Growth in this segment is driven by experiential travel trends, rising disposable incomes, and increased participation in winter sports as a lifestyle activity. Family travelers, couples, and leisure tourists increasingly seek destination resorts offering comprehensive entertainment beyond skiing, supporting higher per-capita spending.

Professional athletes and sports training institutions represent a stable and specialized end-use segment, supported by national sports programs, international competitions, and high-altitude training requirements. Purpose-built training facilities and performance-focused resorts are particularly prominent in Europe, North America, and Japan.

| By Facility Type | By Service Type | By End Use |

|---|---|---|

|

|

|

Regional Insights

Europe

Europe accounts for approximately 40% of the global skiing facilities market, led by France, Switzerland, Austria, and Italy. The region’s dominance is underpinned by the Alps’ extensive natural terrain, high snow reliability, and a deeply ingrained skiing culture. Strong international tourism inflows, advanced lift infrastructure, and premium hospitality offerings support Europe’s leadership. Additionally, government-backed tourism promotion, cross-border ski pass integration, and sustained investments in sustainable resort development continue to reinforce long-term growth across the region.

North America

North America holds around 25% of the global market share, with the United States and Canada serving as the primary demand centers. High disposable incomes, strong domestic travel demand, and a well-established resort ecosystem drive regional growth. North American resorts are also leaders in technological adoption, including dynamic pricing, digital season passes, and automated lift systems. Growing demand for premium experiences, luxury lodging, and destination-style resorts further supports market expansion.

Asia-Pacific

Asia-Pacific is the fastest-growing region, expanding at an estimated 8–9% CAGR through 2030. China and Japan are key contributors, supported by government-led winter sports development programs, rising middle-class participation, and increasing exposure to global skiing culture. China’s focus on expanding winter sports participation and the rapid growth of indoor skiing facilities in urban centers are transforming regional demand dynamics. Japan continues to attract strong inbound tourism due to its powder snow quality and mature resort infrastructure.

Latin America

Latin America’s skiing facilities market is primarily concentrated in Chile and Argentina, supported by favorable natural snow conditions in the Andes and increasing international tourist inflows. Growth is driven by rising interest from North American and European travelers seeking counter-seasonal skiing opportunities. Infrastructure upgrades, improved air connectivity, and targeted tourism promotion are strengthening the region’s position as a niche but expanding skiing destination.

Middle East & Africa

The Middle East & Africa region represents an emerging growth frontier, led by indoor skiing facilities in the UAE and niche mountain resorts in Morocco and South Africa. In the Middle East, high-income consumer bases, luxury tourism demand, and large-scale entertainment infrastructure investments are driving indoor skiing adoption. In Africa, government tourism diversification strategies and adventure tourism promotion are supporting the gradual development of outdoor skiing facilities, positioning the region as a niche experiential market.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Skiing Facilities Market

- Vail Resorts

- Alterra Mountain Company

- Compagnie des Alpes

- Aspen Skiing Company

- Intrawest Resort Holdings

- Whistler Blackcomb

- Zermatt Bergbahnen

- Les 3 Vallées

- Kitzbühel Group

- St. Moritz Resorts

- Niseko United

- Hakuba Valley Resorts

- Verbier Resorts

- Powder Mountain

- Ski Dubai