Ski Touring Bindings Market Size

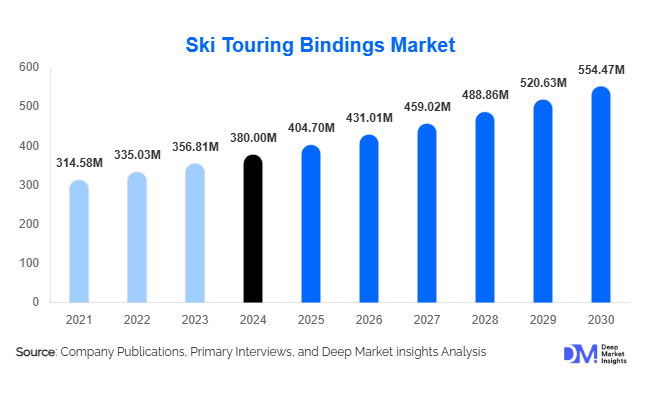

According to Deep Market Insights, the global ski touring bindings market size was valued at USD 380 million in 2024 and is projected to grow from USD 404.70 million in 2025 to reach USD 554.47 million by 2030, expanding at a CAGR of 6.5% during the forecast period (2025–2030). The market growth is primarily driven by the rising popularity of backcountry skiing, increasing consumer interest in adventure sports, and technological advancements in lightweight, high-performance bindings for both recreational and professional use.

Key Market Insights

- Tech/pin bindings are emerging as the most preferred type, offering lightweight construction and superior performance for uphill skiing, attracting both professional and recreational skiers.

- Europe dominates the market, led by countries such as France, Switzerland, and Austria, which benefit from well-established ski infrastructure and winter sports culture.

- North America maintains significant demand, particularly in the U.S. and Canada, driven by ski tourism and adventure sports.

- APAC is the fastest-growing region, with Japan and China showing strong adoption due to new ski resorts and increasing winter sports awareness.

- Sustainability and eco-friendly materials are becoming important differentiators, with aluminum recycling and biodegradable polymer usage gaining traction among consumers.

- Technological innovations, including smart bindings with IoT integration and advanced safety release mechanisms, are reshaping product offerings in the market.

What are the latest trends in the ski touring bindings market?

Rise of Tech/Pin Bindings

Tech/pin bindings are increasingly preferred for backcountry and alpine touring due to their lightweight design, efficient uphill mobility, and reliable safety features. Skiers are favoring these bindings over traditional frame types for both recreational and professional use. This trend is especially prominent in Europe and North America, where ski mountaineering and off-piste skiing continue to gain popularity. The growing adoption is also driven by technological upgrades such as adjustable toe heights, multi-axis rotation, and enhanced release mechanisms to prevent injuries.

Integration of Smart and IoT-Enabled Bindings

Emerging smart technologies are being integrated into bindings, offering real-time performance tracking, avalanche alerts, and connection to ski mobile apps. Ski enthusiasts and professional mountaineers increasingly rely on smart bindings to monitor uphill efficiency, speed, and terrain adaptation. IoT-enabled features also allow for better safety management, attracting tech-savvy consumers who seek both performance and security. Manufacturers are exploring partnerships with wearable tech and ski apps to expand this segment further.

What are the key drivers in the ski touring bindings market?

Growing Popularity of Backcountry and Adventure Skiing

Rising interest in off-piste skiing and backcountry tours is a major driver for the market. Skiers are investing in specialized bindings that allow for longer uphill climbs without compromising safety during descents. This has led to increased demand for tech/pin bindings in Europe, North America, and emerging APAC markets. Adventure tourism initiatives and ski mountaineering events have further strengthened adoption rates.

Technological Advancements in Safety and Performance

Innovations such as lightweight aluminum frames, improved heel release mechanisms, and hybrid binding designs enhance skier safety and performance. These developments have encouraged consumers to upgrade from older bindings to advanced tech/pin or hybrid models. Professional and recreational skiers both benefit from enhanced precision, weight reduction, and durability, fueling market expansion.

Increased Disposable Income and Ski Tourism

Higher disposable income in Europe, North America, and APAC has expanded the premium consumer base for ski touring bindings. Ski resorts, adventure tourism operators, and recreational consumers are increasingly purchasing high-performance bindings, driving revenue growth in both retail and e-commerce channels. The expansion of ski tourism infrastructure globally is further accelerating adoption.

What are the restraints for the global market?

High Product Costs

Premium tech/pin and hybrid bindings remain expensive, limiting adoption in price-sensitive regions. Recreational consumers in emerging markets often opt for budget options, which restricts overall revenue potential. High material costs, such as aluminum and steel, further contribute to premium pricing.

Dependency on Seasonal and Weather Conditions

Ski touring is inherently seasonal, and inconsistent snowfall or shorter winter seasons due to climate change can reduce binding sales. Mild winters in key regions like Europe and North America pose a risk to overall market growth.

What are the key opportunities in the ski touring bindings industry?

Expansion in Emerging APAC Markets

Asia-Pacific, led by China and Japan, is emerging as a high-potential growth market. Investments in new ski resorts, increased winter sports awareness, and growing disposable income are driving demand. Manufacturers can leverage regional preferences for lightweight, durable, and technologically advanced bindings to capture market share in these untapped areas.

Smart and IoT-Enabled Binding Adoption

The integration of sensors and IoT technology in ski touring bindings presents a strong growth opportunity. Features such as performance tracking, safety alerts, and connectivity with mobile apps appeal to tech-savvy skiers. This trend enables manufacturers to differentiate their products and target a premium segment of the market seeking both safety and performance analytics.

Sustainable and Eco-Friendly Product Development

Consumers increasingly prefer eco-conscious products, creating an opportunity for manufacturers to adopt aluminum recycling, biodegradable polymer use, and low-carbon manufacturing practices. Sustainability initiatives can improve brand perception and attract environmentally aware skiers, particularly in Europe and North America.

Product Type Insights

Tech/pin bindings dominate the market, accounting for approximately 42% of global market share in 2024, driven by their lightweight construction and superior uphill performance. Frame bindings continue to serve traditional alpine skiers, while hybrid bindings are gaining popularity due to their versatility in both uphill and downhill skiing. Aluminum alloy bindings lead the material segment with a 38% share due to their strength-to-weight advantage, particularly among professional and premium users.

Application Insights

The primary applications of ski touring bindings include recreational skiing, professional alpine touring, and ski mountaineering. Recreational users form a growing base due to increased ski tourism and adventure sports participation. Professional skiers rely on high-performance bindings for safety and competitive advantage, particularly in Europe and North America. Ski resorts and adventure tourism operators are increasingly bulk-purchasing bindings for rental and training purposes, creating institutional demand.

Distribution Channel Insights

Offline retail stores continue to hold a dominant position with 50% market share, especially for premium and high-performance bindings. E-commerce platforms are rapidly expanding, offering global accessibility and customization options. Direct-to-consumer (DTC) brand stores are emerging as niche channels for premium manufacturers, enabling personalized services, tech-enabled demos, and bundling with other ski equipment.

Traveler Type Insights

Professional and expert skiers account for 35% of demand, driven by performance-critical requirements. Amateur and recreational skiers represent a significant portion of the mid-range and budget binding market. Seasonal and institutional buyers, including ski schools and resorts, are expanding demand, particularly in Europe and North America.

| By Type | By Material | By Ski Type | By User Type | By Sales Channel |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

The U.S. and Canada together account for 28% of the global market in 2024. High disposable income, well-established ski resorts, and strong adventure tourism trends support demand. Customized packages and ski mountaineering events further drive binding adoption.

Europe

Europe dominates with a 45% market share. France, Switzerland, Austria, and Italy are major contributors due to extensive ski infrastructure and winter sports culture. France is the fastest-growing country at 6.8% CAGR, fueled by ski resort expansion and adoption of tech/pin bindings.

Asia-Pacific

Japan and China are emerging markets, collectively contributing 5% market share but growing at a 7–8% CAGR. Expansion of ski resorts, winter sports promotion, and increasing disposable income drive growth.

Latin America

Chile, Argentina, and Brazil are emerging markets, primarily for adventure tourism, collectively accounting for 3% share. Demand is niche but growing steadily due to ski tourism development.

Middle East & Africa

South Africa and the UAE represent emerging markets with 2% share. Ski tourism in UAE malls and adventure resorts presents growth potential, while South Africa shows gradual adoption in adventure sports segments.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Ski Touring Bindings Market

- Marker

- Salomon

- Dynafit

- Atomic

- Fritschi

- G3

- Black Diamond

- Rossignol

- Look

- Head

- Volkl

- Scott

- Tecton

- Plum

- Kästle

Recent Developments

- In March 2025, Salomon launched a new lightweight tech binding series integrating IoT sensors for performance monitoring and avalanche safety alerts.

- In January 2025, Dynafit expanded its hybrid binding portfolio with enhanced release mechanisms for professional alpine touring.

- In February 2025, Marker introduced eco-friendly bindings made from recycled aluminum alloys, targeting environmentally conscious consumers in Europe.