Skateboard Market Size

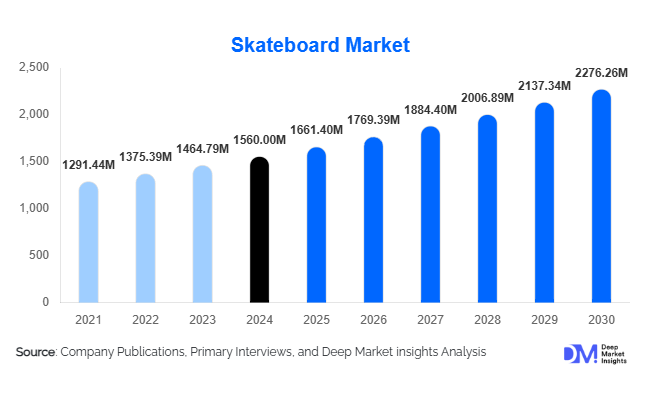

According to Deep Market Insights, the global skateboard market size was valued at USD 1,560 million in 2024 and is projected to grow from USD 1,661.40 million in 2025 to reach USD 2,276.26 million by 2030, expanding at a CAGR of 6.5% during the forecast period (2025–2030). The skateboard market growth is primarily driven by increasing youth participation, rising adoption of urban mobility e-skateboards, and the growing popularity of skateboarding as a lifestyle and recreational sport worldwide.

Key Market Insights

- Electric and urban mobility skateboards are creating new growth avenues, with adult commuters and city dwellers increasingly adopting motorized boards for short-distance travel and eco-friendly transportation.

- Emerging markets in Asia-Pacific and Latin America are witnessing rapid growth, fueled by rising disposable incomes, urbanization, and investment in recreational infrastructure like skateparks.

- Traditional street skateboards remain dominant, reflecting strong youth culture, affordability, and widespread availability in mature markets like North America and Europe.

- Online retail is transforming distribution, enabling direct-to-consumer sales and increasing accessibility for premium and limited-edition skateboard models.

- Sustainable and lifestyle-oriented skateboards are gaining traction, with eco-friendly materials and branded collector editions attracting niche consumer segments.

- Technological integration, including smart e-boards, app-enabled ride tracking, and connected safety features, is enhancing the user experience and driving market differentiation.

Latest Market Trends

Electric and Urban Mobility Skateboards on the Rise

Electric skateboards (e-skates) and longboards designed for commuting are driving growth in urban areas. Municipal investment in bike lanes and micro-mobility infrastructure has encouraged adoption among adults seeking efficient, eco-friendly last-mile transportation. Integration of smart features such as app-controlled speed, battery monitoring, and anti-theft mechanisms enhances convenience and safety. This trend is particularly strong in developed urban centers in North America, Europe, and emerging cities across the Asia-Pacific.

Sustainable and Lifestyle Boards Gaining Popularity

Eco-conscious materials, including recycled maple, bamboo, and composite boards, are increasingly used to manufacture skateboards. Lifestyle-oriented limited editions, artist collaborations, and branded boards are appealing to collectors and fashion-conscious youth. Sustainability initiatives and premiumized design elements allow manufacturers to command higher margins while targeting niche demographics that value environmental responsibility alongside cultural identity.

Skateboard Market Drivers

Growing Youth Culture and Sports Participation

Teenagers and young adults continue to dominate skateboard adoption, with skateboarding recognized as an Olympic sport and promoted through social media, video games, and youth-focused events. In 2024, teenagers (12–17 years) accounted for 40% of the market, driving demand for street/traditional skateboards and related accessories.

Expansion of Skateboarding Infrastructure

Urbanization and the establishment of skateparks, recreational zones, and skating programs have increased accessibility and safety for skateboarders. This has encouraged greater participation among both beginners and professional athletes. Infrastructure investments are particularly notable in North America, Europe, and rapidly urbanizing cities in the Asia-Pacific.

Product Innovation and Diversification

Innovations in board materials (e.g., carbon fiber, composite decks), e-skate technology, and smart features have broadened the market. Longboards for commuting, cruiser boards for casual rides, and electric boards for adults are increasingly popular. Manufacturers are also exploring sustainable production to cater to environmentally conscious consumers, enabling revenue expansion across segments.

Market Restraints

High Cost and Safety Concerns for Advanced Boards

Electric skateboards and premium longboards often have higher price points, limiting adoption among cost-sensitive consumers. Battery safety, maintenance requirements, and regulatory compliance pose challenges, particularly for first-time adult users and emerging markets.

Market Saturation in Mature Regions

In markets such as North America and Western Europe, skateboarding is well-established. Incremental growth is moderate, with high competition among established brands leading to pricing pressure. Mature market dynamics require innovation and niche targeting to maintain growth.

Skateboard Market Opportunities

Expansion in Urban Mobility and Commuter Segments

The rising popularity of e-skates and longboards as alternatives to bicycles and scooters opens a significant growth opportunity. Manufacturers can target urban commuters seeking convenient, eco-friendly, and stylish transport solutions. Partnerships with micro-mobility sharing services and integration of smart features are likely to boost adoption further.

Emerging Market Growth

Asia-Pacific and Latin America present untapped potential, driven by growing youth populations, rising disposable income, and developing skateboarding infrastructure. Entry into these markets allows brands to establish first-mover advantages and adapt products for local preferences, such as affordable longboards or culturally themed designs.

Sustainable and Lifestyle Boards

Brands focusing on eco-friendly materials, collectible designs, and limited-edition boards can command premium pricing while attracting environmentally conscious and fashion-forward consumers. This creates differentiation and higher profit margins, reinforcing brand loyalty and positioning products as lifestyle statements rather than purely recreational tools.

Product Type Insights

Street/traditional skateboards dominate the market (44% of 2024 revenue) due to their affordability, wide availability, and core connection to youth skate culture. Cruiser and longboards are gaining momentum for casual rides and commuting, while e-skateboards are expanding in urban adult demographics. Accessories and replacement parts represent a secondary revenue stream supporting overall market growth.

Application Insights

Recreational skating remains the primary application (65% of revenue in 2024), driven by teenagers and hobbyists. Sports/competitive skateboarding maintains strong engagement through events, tournaments, and professional sponsorships. Urban mobility applications, particularly for adults, are emerging rapidly in developed and urbanized regions. Lifestyle and collector applications add niche revenue, emphasizing fashion, brand collaborations, and limited editions.

Distribution Channel Insights

Offline retail (55% of 2024 sales) remains significant due to specialty skate shops and sporting goods stores offering physical engagement, fitting, and expertise. Online channels (45%) are growing rapidly via brand websites and e-commerce platforms, providing access to premium boards, limited editions, and customizable options. Shared mobility and rental models are emerging as supplementary channels in urban areas.

End-User Insights

Teenagers are the largest segment (40% share), followed by adult hobbyists and urban commuters. Professional skateboarders represent a smaller but high-value segment, often driving sales of high-end boards and accessories. New segments include urban commuters using e-skates, lifestyle collectors, and fashion-focused buyers. Export demand is significant, with Asia-Pacific manufacturing supplying North America and Europe.

| By Product Type | By Material / Construction | By End User | By Distribution Channel | By Application / Use Case |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America remains the largest market (40% share in 2024, USD 1.32 billion) due to entrenched skate culture, extensive retail networks, and disposable income. Demand is driven by both teenagers and adult hobbyists, with a strong interest in e-skateboards and competitive boards.

Europe

Europe (25% share, USD 825 million) shows steady growth, with Western Europe (UK, Germany, France, Netherlands) leading adoption. Recreational and competitive skating are key drivers, with emerging eco-conscious and lifestyle trends further expanding market appeal.

Asia-Pacific

Asia-Pacific (20% share, USD 660 million) is the fastest-growing region, led by China, India, Japan, and Australia. Urbanization, increasing youth population, and rising disposable income support growth. Demand for e-skates and longboards for commuting is particularly strong in cities.

Latin America

Latin America (8% share, USD 264 million) is emerging, with Brazil and Mexico leading demand. Adventure and recreational skating are primary drivers, supported by a growing interest in youth sports and lifestyle boards.

Middle East & Africa

MEA (7% share, USD 231 million) is nascent but growing, particularly in GCC countries and South Africa. Investments in recreational infrastructure and youth engagement programs are creating incremental demand.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Skateboard Market

- Element Skateboards

- Plan B Skateboards

- Zero Skateboards

- Almost Skateboards

- Blind Skateboards

- Birdhouse Skateboards

- Santa Cruz Skateboards

- Krown Skateboards

- Enjoi

- Toy Machine

- Chocolate Skateboards

- Powell Peralta

- Control Skateboards

- Skate One

- Alien Workshop

Recent Developments

- In May 2025, Element Skateboards launched a new line of eco-friendly boards using recycled maple and bamboo composites, targeting environmentally conscious consumers.

- In April 2025, Plan B Skateboards expanded online direct-to-consumer sales in Europe and North America, emphasizing limited-edition artist collaborations.

- In February 2025, Zero Skateboards introduced electric longboards for urban commuters, integrating app-based speed control and safety monitoring features.