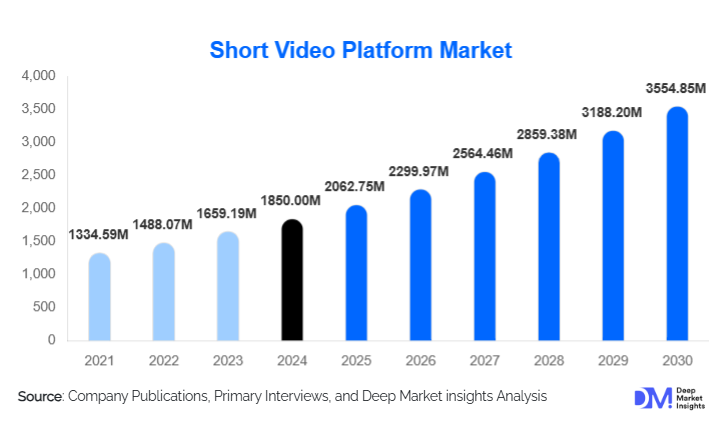

Short Video Platform Market Size

According to Deep Market Insights, the global short video platform market size was valued at USD 1,850.00 million in 2024 and is projected to grow from USD 2,062.75 million in 2025 to reach USD 3,554.85 million by 2030, expanding at a CAGR of 11.5% during the forecast period (2025–2030). The short video platform market growth is primarily driven by rapid smartphone penetration, expanding creator economies, increased advertiser preference for high-engagement formats, and continuous innovation in AI-driven content discovery and monetization technologies.

Key Market Insights

- Advertising-based monetization dominates the market, accounting for more than 60% of total platform revenues globally.

- Asia-Pacific represents the largest user base, driven by India, China, Indonesia, and Southeast Asia’s mobile-first digital ecosystems.

- North America leads in revenue generation, supported by high ARPU, advanced ad-tech adoption, and strong brand spending.

- Creator monetization tools are expanding rapidly, strengthening platform loyalty and professionalizing content creation.

- Short video commerce is gaining momentum, enabling in-app purchases, affiliate marketing, and influencer-led sales.

- AI-powered recommendation engines remain the core competitive differentiator across leading platforms.

What are the latest trends in the short video platform market?

Rise of Social Commerce and Shoppable Videos

Short video platforms are increasingly evolving into commerce-enabled ecosystems, allowing users to discover and purchase products directly within video feeds. Influencer-led product demonstrations, live shopping events, and affiliate integrations are driving higher conversion rates, particularly in Asia-Pacific and Latin America. Platforms are embedding secure payment gateways, logistics partnerships, and creator storefronts to capture value beyond advertising. This trend is transforming short video platforms from pure content channels into end-to-end digital retail environments.

AI-Driven Content Creation and Discovery

Advanced artificial intelligence is reshaping how content is created, distributed, and consumed on short video platforms. AI tools now assist creators with automated editing, background removal, music synchronization, captioning, and language translation. On the user side, sophisticated recommendation algorithms deliver hyper-personalized feeds, significantly increasing watch time and engagement. The continuous refinement of AI models is enabling platforms to scale content moderation, improve brand safety, and optimize monetization efficiency.

What are the key drivers in the short video platform market?

Expansion of the Global Creator Economy

The rapid growth of the creator economy is a major driver of the short video platform market. Platforms offer low barriers to entry, instant reach, and multiple monetization pathways, attracting millions of independent creators worldwide. Revenue-sharing programs, virtual gifting, brand collaborations, and subscription features are enabling creators to generate sustainable income, increasing content supply and platform stickiness.

Shift of Advertising Budgets Toward Performance Media

Brands are increasingly reallocating advertising budgets from traditional media and long-form digital content toward short video formats due to superior engagement rates and measurable ROI. Short video ads enable precise audience targeting, real-time performance tracking, and interactive formats, making them highly attractive for both global enterprises and small-to-medium businesses.

What are the restraints for the global market?

Regulatory and Data Privacy Challenges

Short video platforms face growing regulatory scrutiny related to data privacy, misinformation, and content moderation. Compliance with region-specific regulations increases operational complexity and costs, particularly for global platforms operating across multiple jurisdictions. Restrictions on data localization and algorithm transparency can also limit scalability.

Monetization Gaps in Emerging Markets

While user growth is strong in emerging economies, monetization remains relatively low due to limited advertiser spending and lower purchasing power. This imbalance pressures platforms to rely heavily on scale rather than profitability, potentially slowing margin expansion.

What are the key opportunities in the short video platform industry?

Enterprise and Educational Adoption

Short video formats are increasingly being adopted for corporate training, internal communications, and digital education. Platforms that develop secure, private, and analytics-driven solutions for enterprises and educational institutions can unlock new revenue streams and reduce dependence on consumer advertising cycles.

Regional Localization and Vernacular Content

Localization presents a major growth opportunity, particularly in India, the Middle East, Africa, and Southeast Asia. Platforms offering vernacular content, region-specific creator incentives, and culturally relevant moderation frameworks are better positioned to capture untapped user bases and comply with local regulations.

Platform Type Insights

Standalone short video applications dominate the market, accounting for approximately 48% of total revenue in 2024, driven by focused user experiences and superior recommendation algorithms. Integrated social media short video platforms follow closely, leveraging existing user bases and cross-platform advertising synergies. Embedded short video modules within e-commerce and streaming apps are emerging rapidly, supported by the rise of video-led digital commerce and content discovery.

Monetization Model Insights

Advertising-based monetization remains the leading revenue model, contributing nearly 62% of total market value in 2024. Creator monetization and revenue-sharing models are growing at a faster pace, supported by subscriptions, tipping, and virtual gifting. Shoppable videos and affiliate commerce are emerging as high-growth monetization avenues, particularly in mobile-first markets.

End-User Insights

Individual consumers represent the largest end-user group, forming the foundation of platform engagement and ad inventory. Brands and advertisers are the fastest-growing segment, with demand rising for influencer marketing, performance advertising, and integrated commerce campaigns. Media companies and educational institutions are increasingly adopting short video platforms for audience engagement and content distribution.

| By Platform Type | By Monetization Model | By Content Category | By End User | By Device Type |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

Asia-Pacific

Asia-Pacific accounts for approximately 41% of the global short video platform market in 2024, led by China, India, Indonesia, and Japan. The region benefits from deep smartphone penetration, low-cost mobile data, and a large, mobile-first user base. Strong creator ecosystems, high daily engagement levels, and rapid adoption of in-app commerce and live-streaming features continue to support sustained growth. India remains the fastest-growing country in the region, recording a CAGR exceeding 18%, driven by regional language content and expanding rural internet access.

North America

North America holds around 26% of the global market share, driven primarily by the United States. The region leads in revenue generation due to high advertising budgets, mature influencer marketing frameworks, and advanced monetization tools. Strong brand participation, integration with e-commerce, and high CPM rates support steady platform profitability. User growth is moderate, but revenue per user remains among the highest globally.

Europe

Europe represents approximately 18% of the market, with the U.K., Germany, and France as key contributors. Growth is supported by increasing adoption of influencer-led campaigns, localized content strategies, and regulatory-aligned advertising models. Short video platforms are gaining traction among older demographics, expanding beyond youth-driven consumption. Brand partnerships and creator monetization are gradually strengthening across Western and Northern Europe.

Latin America

Latin America accounts for nearly 9% of global revenue, led by Brazil and Mexico. The region is characterized by rapid user base expansion, high engagement rates, and strong social media penetration. Brands are increasingly leveraging short video formats for performance marketing, while creator-led commerce and live content are improving monetization depth. Mobile-first consumption patterns continue to drive platform adoption.

Middle East & Africa

The Middle East & Africa region contributes about 6% of the market, with Saudi Arabia, the UAE, and South Africa emerging as key growth markets. High mobile usage, a young population, and rising digital ad spending support market expansion. Platforms are seeing increased adoption in lifestyle, entertainment, and retail marketing, while localized content and Arabic-language creators are strengthening regional engagement.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Top Companies in the Short Video Platform Market

- ByteDance

- Meta Platforms

- Tencent

- Kuaishou

- Snap Inc.

- X Corp.

- ShareChat

- Moj

- Likee

- Triller

- Roposo

- Zynn

- Lomotif

Recent Developments

- In April 2025, TikTok announced expanded AI-powered content discovery and creator safety tools, aiming to improve recommendation transparency and brand suitability for advertisers.

- In March 2025, YouTube Shorts rolled out enhanced monetization options, including broader ad revenue sharing and improved analytics for short-form creators.

- In February 2025, Meta expanded Reels distribution and cross-posting capabilities across Instagram and Facebook to strengthen engagement and compete more aggressively in short-form video.