Shaving Lotions and Creams Market Size

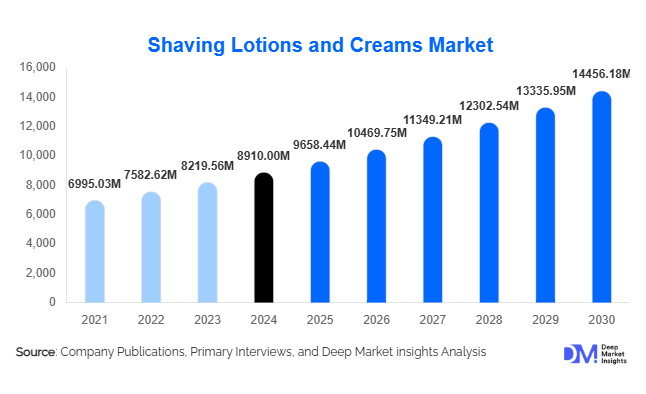

According to Deep Market Insights, the global shaving lotions and creams market size was valued at USD 8,910 million in 2024 and is projected to grow from USD 9,658.44 million in 2025 to reach USD 14,456.18 million by 2030, expanding at a CAGR of 8.4% during the forecast period (2025–2030). Market growth is driven by increasing consumer focus on personal grooming, expanding men’s skincare awareness, and the rising adoption of premium and natural shaving formulations.

Key Market Insights

- Rising male grooming consciousness is reshaping demand for advanced shaving products with moisturizing and skin-protection benefits.

- Natural and organic ingredients are gaining traction as consumers shift toward plant-based and chemical-free grooming products.

- Asia-Pacific dominates market growth, led by large millennial populations, rapid urbanization, and expanding e-commerce penetration.

- North America remains a major market for premium men’s grooming and niche brands emphasizing vegan, cruelty-free, and dermatologically tested formulations.

- Technological innovation in product formulation, including foaming technology and cooling agents, enhances the overall shaving experience.

- Online and direct-to-consumer (D2C) brands are transforming the competitive landscape through personalized subscription models and social media marketing.

Latest Market Trends

Shift Toward Natural and Sustainable Formulations

Consumers are increasingly favoring shaving lotions and creams that feature natural, botanical, and ethically sourced ingredients. Manufacturers are responding by introducing formulations with aloe vera, shea butter, coconut oil, and essential oils, avoiding parabens, sulfates, and synthetic fragrances. The trend aligns with broader clean beauty movements and growing environmental consciousness. Brands are also adopting sustainable packaging solutions, including recyclable aluminum tubes and biodegradable containers, reinforcing eco-friendly positioning in a competitive market.

Rise of Men’s Grooming and Unisex Branding

Shaving creams and lotions are no longer limited to traditional male demographics. The rise of unisex grooming products and gender-neutral marketing is broadening the consumer base. Simultaneously, increased social media influence and celebrity-driven grooming campaigns have elevated men’s skincare awareness. Premium brands are capitalizing on this shift by introducing multi-functional products that combine shaving comfort with hydration and post-shave protection, blurring lines between grooming and skincare.

Market Drivers

Growing Focus on Personal Care and Grooming

The growing global emphasis on self-care and professional appearance is a primary driver of market expansion. Consumers are increasingly investing in skincare-focused shaving products that deliver irritation-free and hydrating benefits. The influence of grooming tutorials, lifestyle influencers, and e-commerce platforms has amplified awareness and accessibility, propelling consistent demand for both mass-market and premium shaving products.

Expansion of E-commerce and Subscription-Based Sales

Online sales channels are becoming pivotal for shaving product distribution. Subscription models from brands such as Harry’s, Dollar Shave Club, and Bevel are transforming purchase patterns by offering convenience and customization. Personalized recommendations based on skin type, fragrance preferences, and shaving frequency are enhancing customer retention. Digital-first marketing strategies and influencer partnerships further drive online conversion and brand loyalty.

Market Restraints

Competition from Electric Shaving and Trimming Devices

The growing adoption of electric razors and trimmers, particularly among younger consumers, is moderating demand for traditional shaving creams and lotions. Convenience, speed, and reduced irritation offered by electric grooming alternatives present a key restraint to market expansion. However, niche segments emphasizing premium shaving experiences and wet-shaving rituals continue to sustain steady growth.

Price Sensitivity and Counterfeit Products

In emerging markets, the availability of low-cost, counterfeit shaving creams undermines brand reputation and revenue. Price-sensitive consumers often opt for inexpensive local products, limiting the penetration of premium international brands. This challenge is prompting leading companies to localize production, offer smaller packaging, and enhance distribution partnerships to balance affordability and authenticity.

Market Opportunities

Premiumization and Personalized Grooming Solutions

The global trend toward personalization and luxury self-care presents a major opportunity. Brands are investing in dermatologically tested, hypoallergenic, and fragrance-customizable shaving lotions to cater to diverse skin types and preferences. Limited-edition scents, seasonal launches, and partnerships with skincare specialists are expanding product differentiation, allowing brands to tap into high-margin segments.

Growth in Emerging Markets

Emerging economies across Asia-Pacific, Latin America, and the Middle East represent significant untapped potential. Rising disposable incomes, urban lifestyle adoption, and Western grooming influences are accelerating demand for branded shaving products. Regional players are collaborating with e-commerce platforms and grooming salons to boost distribution, while global brands are focusing on affordability and localized marketing campaigns.

Product Type Insights

Shaving creams hold the largest market share, favored for their rich lathering properties and skin-soothing effects. Shaving lotions are gaining traction due to their quick absorption, non-greasy texture, and suitability for post-shave hydration. Gel-based formulations are witnessing rising demand among younger consumers for their transparency and cooling effects. The ongoing shift toward alcohol-free and organic variants is reshaping product innovation strategies.

Distribution Channel Insights

Online retail dominates the growth trajectory, fueled by subscription services, influencer-led branding, and targeted digital advertising. Supermarkets and hypermarkets remain key offline distribution channels, particularly in developed markets. Specialty grooming stores and pharmacies are seeing increasing traction for dermatology-backed shaving products. The expansion of D2C models is enabling brands to offer exclusive bundles, customized gift sets, and loyalty-based incentives.

| By Product Type | By Application | By Distribution Channel |

|---|---|---|

|

|

|

Regional Insights

North America

North America leads the market in premium shaving lotions and creams, driven by established grooming cultures and innovative D2C brands. The U.S. market is dominated by both heritage players and digitally native startups emphasizing vegan, paraben-free, and dermatologist-approved products. Increased marketing toward inclusive, gender-neutral grooming is reinforcing regional leadership.

Europe

Europe maintains a strong demand for natural and sustainable shaving products, especially in the U.K., Germany, and France. Consumers prioritize ethical sourcing, recyclable packaging, and eco-certifications. The revival of traditional wet-shaving culture, along with artisanal brands focusing on handmade and organic products, adds momentum to regional market growth.

Asia-Pacific

Asia-Pacific is projected to register the fastest CAGR through 2030. Rapid urbanization, rising disposable incomes, and exposure to Western grooming trends are key contributors. Markets such as India, China, and South Korea are witnessing surging demand for men’s skincare and shaving creams, supported by influencer marketing and e-commerce expansion.

Latin America

Latin America is emerging as a promising market led by Brazil and Mexico, where personal grooming awareness and retail modernization are accelerating product adoption. Local and regional brands are increasingly focusing on herbal and affordable formulations to capture middle-income consumers.

Middle East & Africa

Growing male grooming awareness, coupled with the expansion of modern retail channels, is supporting steady growth in this region. The presence of high-income consumers and luxury-oriented retail environments in GCC countries further supports the adoption of premium shaving creams and lotions.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Shaving Lotions and Creams Market

- Procter & Gamble (Gillette)

- Edgewell Personal Care

- Beiersdorf AG (Nivea Men)

- L’Oréal S.A.

- Unilever (Dove Men+Care)

- The Art of Shaving

- Harry’s Inc.

- Godrej Consumer Products Ltd.

- Truefitt & Hill

- Bevel

Recent Developments

- In August 2025, Gillette introduced its new Pro Series Hydrating Shave Cream, featuring aloe and vitamin E, targeting sensitive skin consumers seeking smoother shaving experiences.

- In June 2025, Beiersdorf launched an eco-friendly Nivea Men shaving cream line packaged in 100% recyclable aluminum tubes, reducing plastic use by 85%.

- In March 2025, Harry’s Inc. announced its expansion into the Asia-Pacific region through partnerships with major e-commerce platforms in India and Japan.

- In January 2025, Unilever’s Dove Men+Care brand launched a plant-based shaving lotion enriched with shea butter, aligning with the company’s sustainability goals.