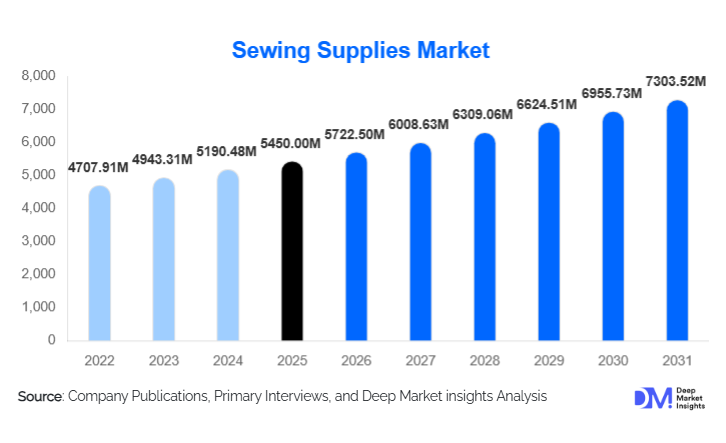

Sewing Supplies Market Size

According to Deep Market Insights, the global sewing supplies market size was valued at USD 5,450.00 million in 2025 and is projected to grow from USD 5,722.50 million in 2026 to reach USD 7,303.52 million by 2031, expanding at a CAGR of 5.0% during the forecast period (2026–2031). The market growth is primarily driven by rising apparel and technical textile production, increased DIY and crafting activities, and growing demand for sustainable and high-performance sewing materials across industrial and consumer segments.

Key Market Insights

- Threads and yarns dominate the market, driven by universal demand across apparel, footwear, home furnishings, and technical textiles, accounting for 40–45% of the global market in 2024.

- E-commerce channels are rapidly expanding, capturing 30% of global sales in 2024 due to ease of access, wider product variety, and direct-to-consumer engagement for hobbyists and small businesses.

- Apparel & fashion remains the largest end-use segment, contributing nearly 50% of consumption, fueled by fast-fashion cycles, global brand expansion, and customization trends.

- Asia-Pacific leads the global market, representing a 48–50% share, due to its dominant textile manufacturing and export-oriented garment hubs in China, India, Bangladesh, and Vietnam.

- Technical textiles and industrial applications are emerging growth segments, creating demand for high-performance threads, needles, and specialized fasteners in automotive, medical, and protective textiles.

- Technological adoption, including automated sewing tools, IoT-enabled inventory management, and digital ordering platforms, is enhancing production efficiency and product availability worldwide.

What are the latest trends in the sewing supplies market?

Sustainable and Eco-Friendly Materials

Manufacturers are increasingly integrating biodegradable threads, recycled materials, and eco-certified fasteners into their product lines. Sustainable innovations respond to consumer preferences and regulatory pressures in developed regions, allowing brands to command premium pricing. Trends include recycled polyester threads, organic cotton, FSC-certified notions, and low-impact packaging. These initiatives also enable companies to differentiate themselves in both industrial and hobbyist segments.

Digitalization and Smart Manufacturing

Advanced technologies are transforming production and distribution. IoT-enabled thread dispensers, AI-assisted cutting tools, and RFID-based inventory systems enhance operational efficiency and reduce waste. E-commerce platforms, direct-to-consumer websites, and mobile applications enable niche hobbyist markets to access specialized products globally. Smart factories and automation in industrial textile hubs further reinforce demand for precision sewing supplies while minimizing production downtime.

What are the key drivers in the sewing supplies market?

Rising Apparel and Footwear Production

Global apparel and footwear production growth drives consistent demand for threads, needles, fasteners, and trims. Fast-fashion cycles and e-commerce retail expansion require high volumes of sewing supplies, particularly in Asia-Pacific and emerging manufacturing regions. High-performance materials for technical and industrial textile applications further stimulate demand, ensuring sustained market growth.

Resurgence of DIY, Craft, and Small-Batch Customization

Hobbyist sewing and craft activities have seen a resurgence, particularly in North America and Europe. Platforms supporting handmade goods and tutorials encourage investment in sewing supplies for quilting, embroidery, and fashion customization. This trend diversifies the market beyond industrial production and reinforces the growth of retail and e-commerce channels.

What are the restraints for the global market?

Raw Material Price Volatility

Fluctuations in raw material costs, particularly polyester and cotton, can compress manufacturers' margins and create uncertainty in pricing strategies. SMEs are particularly affected by these variations, which may limit investment in new product lines and restrict overall market expansion.

Substitution from Alternative Assembly Technologies

Advanced textile assembly methods such as ultrasonic welding, heat bonding, and high-performance adhesives pose partial substitution risks. Adoption of these technologies in industrial apparel and technical textiles could reduce reliance on traditional sewing, especially for cost-sensitive or specialized applications.

What are the key opportunities in the sewing supplies industry?

Sustainable Product Lines

The market offers significant opportunities for manufacturers to expand eco-friendly threads, recycled fasteners, and sustainable packaging solutions. Growing consumer awareness of environmental impact and stricter regulatory requirements in North America and Europe create a strong market for green innovations. Companies adopting sustainable product strategies can achieve premium positioning and improved profitability.

Emerging Markets and Regional Manufacturing Hubs

Emerging economies such as India, Bangladesh, Vietnam, and Ethiopia are witnessing rapid textile sector growth. Rising domestic consumption, export-oriented garment factories, and favorable government policies create opportunities for local and international sewing supply manufacturers to scale operations and penetrate new markets effectively.

Digitalization and Smart Manufacturing Integration

Advanced manufacturing technologies, including IoT-enabled sewing equipment, automated cutting and threading systems, and real-time inventory management, enhance efficiency and reduce operational costs. Manufacturers integrating these technologies can meet demand from high-volume industrial users while providing enhanced quality and traceability.

Product Type Insights

Threads and yarns dominate the global sewing supplies market, accounting for 40–45% of total revenue in 2024. The primary driver for this dominance is their universal applicability across apparel, footwear, home furnishings, and technical textiles. Synthetic threads, particularly polyester, remain the most consumed due to their superior durability, colorfastness, ease of handling, and versatility across industrial and consumer applications. Natural threads such as cotton and silk maintain steady demand for premium apparel and artisanal craft markets. Other product categories, needles and pins, zippers, buttons, trims, and notions, follow as essential supplies, each catering to specific applications from industrial textile production to DIY crafts. Specialty threads, including fire-retardant, high-tenacity, and conductive variants, are gaining traction in technical textiles, automotive interiors, protective clothing, and medical textiles, reflecting the growing demand for performance-oriented materials. The consistent growth of threads and yarns is further supported by innovation in sustainable and eco-friendly materials, which is attracting both industrial users and hobbyists globally.

Application Insights

Apparel & fashion continues to be the leading application, driven by mass production, fast-fashion cycles, and increasing consumer demand for customization and small-batch production. This segment alone accounts for nearly 50% of global sewing supply consumption. Technical and industrial textiles are emerging rapidly, with high-performance threads and specialized fasteners being essential in automotive interiors, protective clothing, and medical textiles. The growth of hobbyist sewing and craft markets in North America and Europe is another strong application driver, fueled by online communities, craft subscription boxes, and DIY content platforms. Home furnishings and upholstery remain steady contributors, supported by urbanization, residential renovation projects, and the expansion of furniture manufacturing in emerging economies. Overall, the applications highlight a balance between traditional apparel-driven demand and emerging opportunities in technical, industrial, and hobbyist sectors.

Distribution Channel Insights

E-commerce has emerged as the dominant distribution channel, offering unmatched accessibility, competitive pricing, and direct-to-consumer reach. Consumers increasingly rely on online marketplaces and brand websites to purchase niche and specialty sewing supplies, including threads, trims, and high-performance technical products. Retail specialty stores, hypermarkets, and craft outlets maintain relevance in regional markets by providing immediate availability and personalized service. Wholesale channels continue to serve large garment manufacturers, industrial textile producers, and OEMs, ensuring bulk supply efficiency. Digital platforms enable small businesses, hobbyists, and crafters to access specialized products worldwide, bridging the gap between professional industrial demand and home sewing enthusiasts. Growth in online channels is also driven by rising consumer confidence in digital payments, increased mobile penetration, and the availability of value-added services like subscription kits and curated craft packages.

End-Use Industry Insights

Apparel & fashion remains the largest end-use segment, contributing 50% of the global market in 2024. Its growth is fueled by high-volume garment manufacturing, fast-fashion cycles, and increasing consumer demand for affordable yet quality clothing. Footwear and leather goods are emerging growth segments, driven by lifestyle changes, sportswear expansion, and technical material adoption. Home furnishings and upholstery continue to contribute steadily, supported by urbanization, real estate development, and growing disposable incomes in emerging regions. Technical textiles, including automotive interiors, protective and medical textiles, represent high-value opportunities, with performance threads and specialized fasteners meeting stringent durability and safety standards. Export-oriented demand, particularly from Asia-Pacific manufacturing hubs, reinforces global supply chain integration and stimulates consumption across multiple end-use industries.

| By Product Type | By Application | By Distribution Channel | By End-Use Industry |

|---|---|---|---|

|

|

|

|

Regional Insights

Asia-Pacific

Asia-Pacific leads the global sewing supplies market with a 48–50% share in 2024. Key countries driving growth include China, India, Bangladesh, and Vietnam. The region’s dominance is fueled by robust textile manufacturing ecosystems, export-focused garment hubs, low labor costs, and government incentives for industrial growth. Rising domestic consumption in China and India further boosts demand for threads, trims, and technical sewing supplies. Southeast Asia, including Vietnam and Bangladesh, is experiencing rapid expansion in industrial apparel production, supported by foreign direct investment, trade agreements, and growing export volumes to Europe and North America. Innovation in specialty and performance threads for automotive and protective textiles also contributes to regional growth. Increasing adoption of automated production systems and e-commerce platforms further supports both industrial and consumer segments.

North America

North America accounts for 18–20% of the global market. Growth is driven by high disposable income, a strong hobbyist and craft culture, and the adoption of technical textiles in automotive, protective, and medical industries. The U.S. and Canada lead demand for high-quality sewing supplies, premium threads, and performance fasteners. Drivers include the expansion of home sewing and DIY markets, the rise of e-commerce and subscription-based craft kits, and steady industrial textile consumption. Additionally, sustainability trends encourage the use of eco-friendly threads and materials, increasing the adoption of premium and specialty products. The combination of industrial demand and hobbyist growth reinforces North America’s position as a key market.

Europe

Europe represents 20% of the global market, with Germany, Italy, and France as leading contributors. Growth drivers include strong industrial textile production, a high-value fashion industry, and increasing consumer demand for sustainable and premium sewing supplies. The adoption of eco-certified threads, specialty needles, and high-performance fasteners in technical textiles further supports market expansion. Additionally, hobbyist sewing and crafting are popular across the region, especially among younger demographics seeking DIY personalization. Regulatory focus on sustainability and quality standards also drives the adoption of certified materials, contributing to the region’s robust market performance.

Latin America

Latin America accounts for 7–8% of the global market, led by Brazil and Mexico. Growth is driven by expanding local apparel manufacturing, increasing exports, and rising consumer interest in quality sewing products. Economic development and urbanization encourage investment in home sewing, small-scale manufacturing, and craft sectors. Improvements in distribution infrastructure, combined with rising e-commerce penetration, facilitate access to a wide range of sewing supplies, further stimulating regional market growth.

Middle East & Africa

The Middle East & Africa account for 5% of the market. Africa acts as a key production and consumption hub for textiles, while the Middle East contributes through high-income consumers demanding premium and craft sewing products. Growth drivers include industrial textile production, rising disposable incomes, increased fashion-conscious consumer spending, and government initiatives promoting textile manufacturing. Additionally, e-commerce adoption and specialty craft markets are gradually expanding, particularly in urban centers, enhancing access to high-quality sewing supplies.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Sewing Supplies Market

- Coats Group Plc

- Amann Group

- Gütermann GmbH

- New England Thread Company

- Madeira USA

- Organ Needles

- Schmetz Needles

- Prym Consumer USA

- YKK

- Lenzing Group

- Texpa Industries

- Bernina International AG

- Singer

- Brother Industries Ltd

- Coats Digital/Automation Products