Self-Heating Instant Hot Pot Market Size

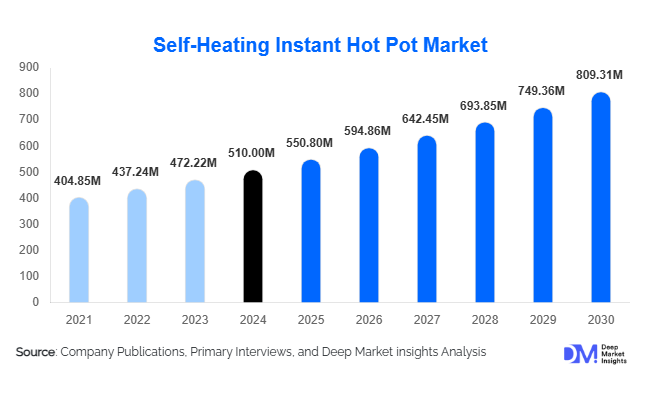

According to Deep Market Insights, the global self-heating instant hot pot market size was valued at USD 510.00 million in 2024 and is projected to grow from USD 550.80 million in 2025 to reach USD 809.31 million by 2030, expanding at a CAGR of 8.00% during the forecast period (2025–2030). The market’s growth is primarily driven by rising consumer demand for convenient hot-meal solutions, the global popularity of authentic Asian flavors, rapid expansion of e-commerce distribution, and advancements in self-heating technology and sterilized retort packaging.

Key Market Insights

- Self-heating meals are becoming a global convenience trend, especially among urban consumers, students, travelers, and outdoor enthusiasts.

- APAC dominates production and consumption, with China accounting for the largest global share due to a strong cultural affinity for hot pot cuisine and significant manufacturing scale.

- North America and Europe are the fastest-growing import regions, driven by diaspora demand, novelty consumption, and the increasing availability of premium restaurant-branded products.

- Technological innovation in heater packs and retort packaging is improving product safety, heating efficiency, and shelf stability.

- E-commerce and cross-border retail are the strongest distribution channels, accounting for nearly 60% of global retail sales.

- Premiumization is expanding the value pool, as restaurant-branded self-heating hot pots gain traction in global markets.

What are the latest trends in the Self-Heating Instant Hot Pot Market?

Premium Restaurant-Branded Products Rising in Global Demand

Restaurant chains, especially well-known Chinese hot pot brands, are increasingly extending their signature soups and flavors into self-heating retail products. These branded SKUs offer higher authenticity, taste consistency, and premium packaging, appealing strongly to international consumers seeking restaurant-quality meals at home. This trend is reshaping the competitive landscape as chains leverage their culinary trademarks and loyal customer bases to enter global retail shelves, online marketplaces, and specialty grocery stores. The move toward premium SKUs is also influencing ingredient sourcing, with more emphasis on high-quality broths, branded spice packs, and clean-label formulations.

Technology-Enhanced Safety and Sustainability Improvements

Advancements in exothermic heating elements, low-emission chemical blends, and safer compartmentalized packaging are improving the reliability and sustainability of self-heating hot pots. Manufacturers are adopting recyclable multilayer pouches, reduced-ash heater formulations, and improved latch/valve systems to meet international regulatory requirements. Sustainability-conscious consumers in Europe and North America are driving demand for eco-friendlier packaging, while brands are investing in R&D to reduce environmental impact without compromising heating performance or shelf life. Enhanced labeling, QR-based traceability, and tamper-evident packaging are also emerging as new consumer expectations.

What are the key drivers in the Self-Heating Instant Hot Pot Market?

Growing Demand for Convenient and Portable Hot Meals

Urban lifestyles, student populations, and increased reliance on ready-to-eat food solutions are driving strong demand for portable meal formats that require no electricity or external heat source. Self-heating hot pots fill this need by offering flavorful, authentic, and quick-preparation meals suitable for work, home, or travel. The rise of hybrid work and the preference for quick lunch options are further strengthening demand in developed markets.

Innovation in Heating Technology and Packaging

New-generation magnesium-iron heater packs, improved thermal efficiency, retort sterilization methods, and durable multi-compartment containers are enhancing product quality and safety. These innovations expand the market’s addressable regions by meeting diverse food safety standards and allowing longer shelf-life and more complex recipes. Packaging innovation also reduces shipping risks associated with heater packs, unlocking international export opportunities.

Brand Globalization and Cross-Border E-Commerce

Rapid expansion of Asian grocery chains, global e-commerce platforms, and cross-border logistics has made self-heating hot pot products widely accessible internationally. Countries like the U.S., Canada, the U.K., Australia, and Japan are seeing increased availability of Sichuan, Chongqing, and regional Chinese flavors. The appeal of authentic Asian cuisine, amplified by social media and culinary influencers, drives premium pricing power and repeat purchase behavior.

What are the restraints for the global market?

Regulatory Constraints and Heater Pack Restrictions

Exothermic chemical heater packs face strict regulations in several countries, particularly concerning air shipping. Safety concerns include heat emissions, steam pressure, and potential misuse. These regulatory barriers increase compliance costs for manufacturers and limit rapid distribution expansion, especially for exporters targeting North America and Europe.

Price Sensitivity and Raw Material Volatility

Consumers in the mass-market segment are highly price-sensitive. Fluctuating prices of meat, seafood, spices, and multilayer packaging materials directly impact product margins. Manufacturers targeting value-tier segments face challenges balancing affordability with ingredient quality and heating technology costs. This constraint may slow adoption in price-sensitive emerging markets.

What are the key opportunities in the Self-Heating Instant Hot Pot Industry?

Premium Product Extensions & Culinary Innovation

Brands can capture new value by introducing enhanced recipes, region-specific flavors, and dietary variants such as low-sodium, gluten-free, vegetarian, and high-protein options. Restaurant-to-retail collaborations provide an opportunity to capitalize on established brand loyalty. Premium flavors and signature broths unlock higher ASPs and international traction.

Military, Emergency, and Outdoor Application Expansion

Self-heating meals are ideal for defense, disaster relief, and field operations, where access to cooking fuel is limited. Governments and NGOs are increasingly exploring compact, long shelf-life, heater-enabled meals for crisis response. This institutional opportunity provides large-volume, long-term procurement potential for manufacturers who meet shelf-life and safety certifications.

Product Type Insights

Mid-range self-heating hot pots dominate global consumption due to their balance of affordability, portion size, and dependable heating performance. Premium self-heating hot pots, often branded by well-known restaurant chains, are rapidly expanding, particularly in North America, Europe, and Japan. Value-tier products remain the backbone of APAC consumption, especially in China and Southeast Asia, where mass-market affordability drives scale. Product differentiation is increasingly influenced by flavor complexity, ingredient quality, and heater efficiency.

Application Insights

Retail household consumption remains the largest application segment, representing roughly 65% of total demand. Outdoor and travel use is emerging quickly, driven by camping and long-distance travel trends. On-the-go consumption, especially among students and office workers, accounts for rapid growth globally. Institutional applications, including emergency food supply and military rations, present high-volume opportunities but require strict compliance with durability and safety regulations.

Distribution Channel Insights

Online channels dominate the market, contributing nearly 60% of global revenue. Cross-border e-commerce platforms significantly boost international accessibility, especially for Chinese brands. Supermarkets, hypermarkets, and specialty Asian grocery stores remain essential offline channels, particularly in urban centers. Convenience stores capture impulse buyers and travelers, while niche outdoor-retail and defense procurement operate through specialized distribution contracts.

End-User Insights

Students, young professionals, and urban workers form the core consumer base, valuing portability and quick meal preparation. Outdoor enthusiasts, campers, and hikers represent a fast-growing segment as self-heating formats eliminate the need for stoves. Families purchasing pantry-ready convenience meals also contribute to rising household consumption. The market is increasingly attracting premium buyers seeking restaurant-quality flavors at home through branded SKUs.

| By Product Type | By Heating Technology | By Packaging Format | By Distribution Channel | By Application |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America is one of the fastest-growing import regions for self-heating hot pot products, driven by diaspora demand, cultural exploration, and widespread e-commerce adoption. The U.S. accounts for the majority of regional consumption, supported by strong Asian grocery distribution and influencer-driven trends. Consumers show a high willingness to pay for premium, restaurant-branded varieties.

Europe

Europe is experiencing growing adoption, especially across the U.K., Germany, France, and the Netherlands. Sustainability and clean-label preferences influence purchasing decisions, encouraging demand for recyclable packaging solutions. Premium variants and spicy Asian flavors are gaining traction among younger consumers and food trend enthusiasts.

Asia-Pacific

APAC dominates the global market with ~55% share. China remains the production and consumption epicenter, supported by an extensive manufacturing base, cultural preference for hot pot, and widespread retail penetration. Japan, South Korea, and Southeast Asian countries are growing steadily due to increasing convenience-food adoption and premium product imports.

Latin America

Latin America is an emerging market for self-heating hot pots, with Brazil and Mexico leading adoption through online imports and specialty stores. Consumers are attracted to novel Asian flavors and portable meal formats. Growth is gradual but promising in urban centers.

Middle East & Africa

The Middle East, especially the UAE and Saudi Arabia, shows rising demand driven by high disposable income, appetite for premium imported foods, and strong expatriate populations. In Africa, regions with limited cooking infrastructure, such as mining camps and remote communities, are exploring self-heating meals as a practical solution.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Self-Heating Instant Hot Pot Market

- Haidilao International Holding Ltd.

- Mo Xiaoxian (Shanghai Moxiaoxian Food Co., Ltd.)

- Xiaolongkan Hot Pot

- Chongqing Ruya Technology Co., Ltd.

- OR-RIGHT Foods

- Hong Phat Food Export

- Bashuan King

- HeatGenie (self-heating technology)

- Tempra Technology

- Thermotic Systems

- HMG International

- PanPan Foods

- Oriental Prime Choices

- Major Chinese OEM/Private Label Manufacturers

- Large Restaurant Chains with Retail Extensions

Recent Developments

- In March 2025, Haidilao introduced a new premium self-heating hot pot line for overseas markets featuring upgraded heater packs and recyclable packaging.

- In January 2025, leading OEM manufacturers in Chongqing announced investments in high-speed retort lines to expand export capacity.

- In September 2024, HeatGenie partnered with Asian food brands to deploy next-generation eco-heater cartridges for European markets.