Second-Hand Footwear Market Size

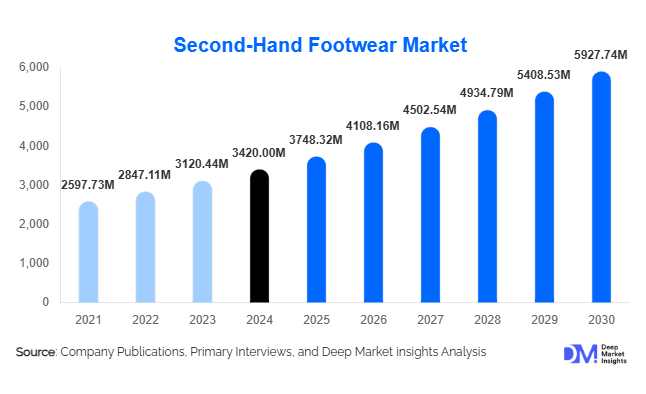

According to Deep Market Insights, the global second-hand footwear market size was valued at USD 3,420.00 million in 2024 and is projected to grow from USD 3,748.32 million in 2025 to reach USD 5,927.74 million by 2030, expanding at a CAGR of 9.6% during the forecast period (2025–2030). The market growth is primarily driven by rising consumer inclination toward sustainable fashion, increasing prices of new footwear, rapid expansion of digital recommerce platforms, and the growing acceptance of circular economy models across developed and emerging economies.

Key Market Insights

- Athletic and sneaker resale dominate the second-hand footwear ecosystem, supported by strong brand loyalty, limited-edition releases, and high resale value retention.

- Online recommerce platforms account for over 60% of global sales, driven by convenience, authentication services, and cross-border reach.

- North America remains the largest market, led by the U.S. sneaker resale culture and mature digital resale infrastructure.

- Europe is the fastest-growing developed region, supported by strict sustainability regulations and high consumer awareness.

- Asia-Pacific is emerging as the fastest-growing region globally, fueled by urbanization, smartphone penetration, and demand for affordable branded footwear.

- Technology adoption, including AI-based condition grading and digital authentication, is reshaping trust and pricing in resale footwear.

What are the latest trends in the second-hand footwear market?

Rise of Sneaker Culture and Collectible Resale

Sneakers have become the most traded category in the second-hand footwear market, driven by limited-edition launches, celebrity collaborations, and strong demand from younger demographics. Collectible sneakers often appreciate, positioning resale footwear as both a fashion and investment asset. Platforms specializing in sneaker authentication and real-time pricing have accelerated liquidity in this segment, making it the backbone of global resale growth.

Technology-Enabled Authentication and Refurbishment

Advanced technologies such as AI-driven condition assessment, automated cleaning systems, and digital product passports are increasingly being adopted. These innovations improve hygiene standards, enhance buyer confidence, and enable premium pricing for like-new footwear. Technology adoption is particularly strong in luxury and athletic resale, where counterfeiting risks are higher.

What are the key drivers in the second-hand footwear market?

Growing Sustainability and Circular Fashion Adoption

Environmental concerns around waste generation and carbon emissions from footwear manufacturing are driving consumers toward second-hand options. Resale footwear significantly reduces landfill waste and extends product lifecycles, aligning with global sustainability goals and corporate ESG commitments.

Rising Footwear Prices and Inflationary Pressures

Increasing costs of raw materials, labor, and logistics have pushed up prices of new footwear. Second-hand alternatives offer cost savings of 30–60%, making them attractive during periods of economic uncertainty and supporting sustained demand growth.

What are the restraints for the global market?

Hygiene and Quality Perception Challenges

Despite improvements in refurbishment and cleaning processes, hygiene concerns remain a key barrier, particularly for children’s and formal footwear segments. Overcoming trust issues requires continued investment in quality assurance and transparency.

Regulatory Barriers in Cross-Border Trade

Import restrictions on used goods in several countries limit international trade flows of second-hand footwear. Compliance costs and inconsistent regulations can slow market expansion, especially in emerging economies.

What are the key opportunities in the second-hand footwear industry?

Brand-Owned Resale and Circular Programs

Footwear brands launching in-house resale platforms can capture secondary market value while strengthening customer loyalty. Brand-controlled refurbishment and resale improve margin control and support sustainability positioning.

Emerging Market Demand Expansion

Rapid urbanization and middle-class growth in Asia-Pacific, Latin America, and Africa present strong opportunities for affordable branded footwear through resale channels. Cross-border digital platforms are well-positioned to serve this demand.

Product Type Insights

Athletic and sports footwear dominate the market, accounting for approximately 38% of the global market in 2024, driven by sneaker culture and frequent product refresh cycles. Casual footwear represents a significant share due to everyday wear demand, while luxury and designer footwear, though smaller in volume, commands higher average selling prices and margins. Outdoor and utility footwear remains a niche but stable segment supported by durability and long product lifecycles.

Condition Grade Insights

Like-new and refurbished footwear leads the market with nearly 46% share, as consumers prioritize minimal wear and hygiene assurance. Gently used footwear follows, offering value-conscious options, while heavily used footwear caters to price-sensitive consumers in developing regions.

Distribution Channel Insights

Online recommerce platforms dominate with over 62% market share, driven by global reach, secure payments, and authentication services. Offline thrift and specialty resale stores remain relevant in local markets, while brand-owned resale channels are gaining traction among premium consumers.

End-User Insights

Women account for approximately 41% of global demand, driven by higher purchase frequency and fashion variety. Men follow closely, particularly in athletic and sneaker resale, while children’s footwear remains a smaller but growing segment due to rapid size changes and cost considerations.

| By Product Type | By Condition Grade | By Sales Channel | By Price Band | By End-User |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America accounts for approximately 34% of the global market, led by the U.S. The region benefits from a mature sneaker resale ecosystem, high consumer spending power, and advanced digital platforms.

Europe

Europe holds nearly 29% market share, with strong demand from the U.K., Germany, and France. Sustainability regulations and consumer awareness significantly support market growth.

Asia-Pacific

Asia-Pacific is the fastest-growing region, expanding at over 14.6% CAGR, driven by China, India, and Southeast Asia. Rising urban populations and digital commerce adoption are key growth drivers.

Latin America

Brazil and Mexico lead regional demand, supported by increasing access to global resale platforms and affordability-driven consumption.

Middle East & Africa

Growth is driven by the UAE, Nigeria, and South Africa, supported by import-driven resale markets and rising youth demand for branded footwear.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Second-Hand Footwear Market

- StockX

- GOAT Group

- ThredUp

- The RealReal

- Vestiaire Collective

- Fashionphile

- Rebag

- Depop

- Grailed

- KLEKT

- Reflaunt

- Trove

- White Rabbit Japan

- Cash Converters

- Percentil