Seamless Clothing Market Size

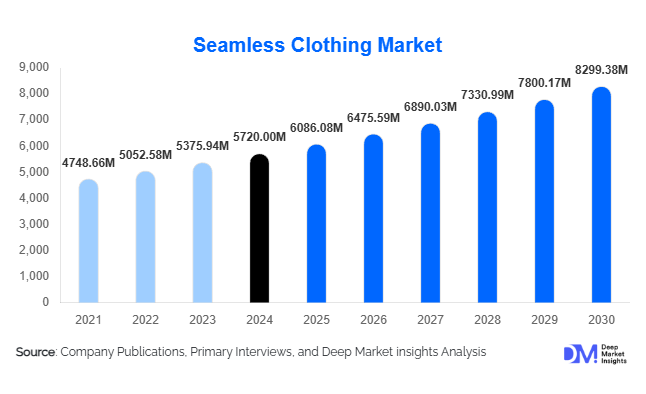

According to Deep Market Insights, the global seamless clothing market size was valued at USD 5,720.00 million in 2024 and is projected to grow from USD 6,086.08 million in 2025 to reach USD 8,299.38 million by 2030, expanding at a CAGR of 6.4% during the forecast period (2025–2030). The market growth is primarily driven by increasing consumer demand for comfortable and performance-oriented apparel, rising adoption of athleisure and activewear, and technological innovations in seamless knitting and sustainable fabrics.

Key Market Insights

- Seamless clothing is increasingly preferred for comfort and fit, particularly in innerwear, shapewear, and activewear segments, reducing friction and enhancing body-conforming performance.

- Synthetic and blended fabrics dominate, offering stretch, durability, and suitability for advanced seamless knitting techniques.

- North America and Europe hold significant market shares, with strong consumer preference for premium seamless garments, particularly in the women’s apparel segment.

- Asia-Pacific is emerging as the fastest-growing region, driven by rising disposable incomes, fitness culture, and expanding manufacturing hubs in China, India, and Southeast Asia.

- E-commerce and direct-to-consumer channels are increasingly critical, enabling consumers to access seamless clothing globally, with virtual fit technologies and customisation enhancing adoption.

- Technological integration in seamless manufacturing, including 3D knitting, body mapping, and smart fabrics, is enhancing garment functionality and opening premium pricing opportunities.

What are the latest trends in the seamless clothing market?

Sustainable and Eco-friendly Fabric Adoption

Seamless clothing manufacturers are increasingly incorporating sustainable and recycled fabrics such as bamboo, organic cotton, and recycled polyester. Circular knitting techniques reduce fabric waste, making seamless garments inherently more eco-friendly. Regulatory pressures and consumer preference for sustainable products are accelerating this trend. Brands are actively marketing garments with reduced environmental impact, including low-energy dyeing, reduced chemical use, and biodegradable packaging, reinforcing sustainability as a core differentiator.

Technology-Driven Seamless Innovations

Advanced knitting technologies, including 3D knitting, body-mapping for compression zones, and integrated ventilation, are transforming the seamless clothing market. Smart fabrics embedded with sensors for moisture management, temperature regulation, and posture monitoring are emerging. These innovations particularly appeal to activewear consumers and premium apparel buyers. Additionally, virtual try-on solutions and AI-driven custom sizing enhance the direct-to-consumer experience, increasing adoption and reducing returns.

What are the key drivers in the seamless clothing market?

Rising Demand for Comfort and Performance

Consumers increasingly prioritize comfort, mobility, and fit in daily wear and activewear. Seamless garments deliver friction-free, body-conforming apparel, particularly in women’s innerwear, shapewear, and performance leggings. Growing fitness awareness and athleisure adoption further boost demand for seamless performance apparel globally.

Advances in Knitting Machinery and Manufacturing Efficiency

Technological improvements in circular and 3D knitting machines reduce production time, material waste, and labor costs. Manufacturers can produce complex knit patterns, integrated compression zones, and variable designs in a single garment. These efficiencies have made seamless clothing commercially viable and scalable, enabling rapid adoption across both mass-market and premium segments.

Expansion of Athleisure and Active Lifestyles

The rise of athleisure and fitness-oriented lifestyles fuels seamless garment adoption. Leggings, sports bras, and casual performance wear are increasingly worn as everyday apparel. Seamless garments combine aesthetics with function, meeting dual consumer needs for performance and style.

What are the restraints for the global market?

High Initial Investment in Machinery

Seamless clothing production requires specialized knitting machines and skilled labor. High capital expenditure and design expertise limit new entrants and small-scale manufacturers. This barrier can slow market penetration, particularly in emerging regions without access to advanced knitting technology.

Raw Material Price Volatility

Fluctuating prices of synthetic fibres such as nylon, elastane, and spandex impact production costs. Additionally, the adoption of sustainable or recycled fabrics often increases costs, affecting profit margins and pricing strategies.

What are the key opportunities in the seamless clothing industry?

Emerging Market Penetration

Growing disposable incomes and urbanization in Asia-Pacific, Latin America, and parts of Africa present new demand for seamless garments. India, China, and Southeast Asia are particularly promising, where fitness culture, activewear, and lifestyle apparel adoption are increasing. Localized product designs and regional marketing strategies can capture first-mover advantage.

Sustainable and Eco-Friendly Garments

Brands investing in sustainable fabrics and low-waste manufacturing can differentiate in a competitive market. Eco-conscious consumers, government regulations, and corporate sustainability programs drive demand for sustainable seamless apparel. Companies integrating recyclable fibers and water/energy-efficient production processes can capture premium pricing and regulatory incentives.

Integration of Smart Textiles and Wearable Tech

The convergence of smart textiles with seamless construction presents a significant opportunity. Compression garments, fitness monitoring apparel, and adaptive clothing for temperature regulation cater to performance-focused consumers. These innovations allow brands to enter high-value, premium segments while creating new business models such as subscription-based or custom-fit garments.

Product Type Insights

Innerwear dominates the seamless clothing market, offering friction-free, body-conforming garments such as bras, underwear, and shapewear. The primary driver for this segment is the demand for comfort, invisible fit, and body-contouring features, which results in high repeat purchase frequency. Activewear and performance wear are experiencing the fastest growth due to rising athleisure adoption and consumer preference for moisture-wicking, stretchable, and chafe-free garments. Seamless construction enhances performance by improving mobility and reducing friction, which is particularly valued in sports and fitness apparel. Loungewear is gaining traction in post-pandemic, home-centric lifestyles, driven by demand for comfort and versatile single-piece styling. Hosiery and swimwear are emerging opportunities, with seamless technologies improving fit and aesthetics, while medical and compression garments rely on precise knit control to deliver functional benefits. Synthetic fabrics, particularly polyester-elastane blends, remain the leading material due to their stretch, durability, and compatibility with seamless knitting techniques. Natural and blended fibers such as organic cotton and merino are gaining traction in sustainable segments, while smart and performance fibers, offering UV protection, antimicrobial properties, and temperature regulation, cater to premium consumer demands. Online channels, especially D2C platforms and digital-first brands, continue to drive the highest growth, leveraging virtual fit technologies, personalization, and rapid trend response.

Application Insights

Seamless clothing applications span intimate apparel, activewear, athleisure, loungewear, and specialized sports garments. Women’s innerwear and activewear segments lead global demand, driven by fit, comfort, and aesthetic appeal. Emerging applications, such as smart fitness garments, wellness wear, and corporate wellness uniforms, are creating additional avenues for growth. The incorporation of seamless construction into these applications allows for advanced shaping, ventilation, and compression zones, delivering both functional and performance benefits. Corporate wellness and athleisure applications are particularly gaining traction as office-to-gym hybrid lifestyles grow in urbanized markets.

Distribution Channel Insights

Direct-to-consumer e-commerce platforms dominate the market, driven by personalized offerings, fast trend response, and higher margins for brands. Specialty and sports retail outlets maintain significance by providing product expertise, fitting experiences, and access to premium seamless products. Mass retail channels, though price-sensitive, allow volume penetration but can compress margins unless private-label strategies are employed. B2B and contract manufacturing support brand outsourcing, private-label growth, and bulk supply for fast-fashion or retail chains, particularly in markets with high manufacturing capacity, such as Asia-Pacific.

End-User Insights

Women aged 18–45 represent the largest end-user segment, primarily driving demand for intimate wear, shapewear, and activewear. Design innovation, comfort, and fit are the primary adoption drivers. Men’s demand is rising, fueled by athleisure and performance basics, while children’s segments prioritize comfort, durability, and moderate price sensitivity. Senior consumers form a niche segment focused on ease of wear, medical compression, and functional garments. Overall, lifestyle-conscious, fitness-oriented, and professional consumers are increasingly adopting seamless clothing across multiple age groups, contributing to sustained market expansion.

| By Product Type | By End User | By Material Type | By Technology / Production Method | By Distribution Channel |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America, led by the U.S. and Canada, accounts for approximately 25–30% of the global seamless clothing market (USD 1,200–1,400 million in 2024). Growth is driven by premiumization trends, where consumers are willing to pay a premium for fit, performance, and advanced textiles. E-commerce adoption is rapid, supporting direct-to-consumer sales and enabling brands to launch differentiated, seamless performance wear lines with rapid replenishment cycles. Urban lifestyles, fitness culture, and rising interest in sustainable materials further propel seamless clothing demand. Brands continue to invest heavily in marketing, product innovation, and exclusive D2C offerings, strengthening market leadership.

Europe

Europe represents 20–25% of the market (USD 1,000–1,200 million in 2024). The region’s growth is primarily driven by sustainability awareness, regulatory pressure, and the demand for premium technical apparel. Germany, the U.K., and France lead demand, with consumers preferring low-waste seamless production, recycled fibers, and advanced performance wear. Established fitness and athleisure cultures, coupled with high digital adoption for online shopping, reinforce seamless clothing penetration. Brands are increasingly integrating circular knitting technologies and sustainable fibers to align with European consumer and government expectations, creating opportunities for differentiation.

Asia-Pacific

Asia-Pacific is the largest and fastest-growing region, accounting for 40–45% of the market (USD 1,900–2,100 million in 2024), with a CAGR of 8–9%. Drivers include the region’s manufacturing scale, skilled knitting workforce, and rapid adoption of new knit technologies. Rising middle-class demand for activewear, intimate apparel, and athleisure fuels domestic consumption, while export-oriented manufacturing hubs in China, India, Vietnam, and Indonesia support global supply chains. Urbanization, increasing disposable incomes, and growing fitness culture are accelerating the adoption of performance-oriented seamless garments. Investments in 3D knitting and circular seamless technologies are enabling high-throughput production and cost efficiencies, reinforcing APAC’s global leadership.

Latin America

Latin America accounts for 5–7% of the market (USD 250–350 million). Growth is driven by increasing urbanization, rising middle-class income, and expanding active lifestyles. Countries like Brazil, Argentina, and Mexico are adopting seamless garments in activewear, casualwear, and athleisure. Slow but steady adoption of manufacturing technologies, along with private-label investments by local and global brands, is creating differentiation opportunities. Consumer demand for comfort and functional fashion, combined with digital retail penetration in urban centers, supports moderate but consistent market expansion.

Middle East & Africa (MEA)

The MEA region represents 5% of the market (USD 200–250 million). High-potential urban pockets in the UAE, Saudi Arabia, Qatar, and South Africa show strong interest in premium seamless apparel, particularly activewear, intimate wear, and lifestyle garments. Broader adoption is constrained by lower awareness, limited distribution networks, and underdeveloped retail infrastructure in many countries. However, rising affluence, luxury brand penetration, and growing fitness culture in urban centers are creating opportunities for niche premium and performance-oriented seamless offerings. Investments in retail, e-commerce, and marketing awareness campaigns are expected to gradually expand market penetration across the region.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Seamless Clothing Market

- Adidas AG

- Nike, Inc.

- Lululemon Athletica Inc.

- Under Armour, Inc.

- Hanesbrands Inc.

- Spanx, Inc.

- Wolford AG

- Calvin Klein (PVH Corp.)

- Uniqlo

- Triumph International

- Jockey International, Inc.

- Fruit of the Loom

- Puma SE

- Columbia Sportswear Company

- Patagonia

Recent Developments

- In 2025, Lululemon expanded its seamless activewear line globally, integrating new body-mapping and smart textile technologies.

- In 2025, Adidas introduced sustainable seamless garments using recycled yarns and water-efficient production processes across Europe and Asia-Pacific.

- In 2024, Spanx launched premium seamless shapewear with advanced compression and moisture-wicking fabrics, targeting global women’s apparel markets.