Scuba Diving Equipment Market Size

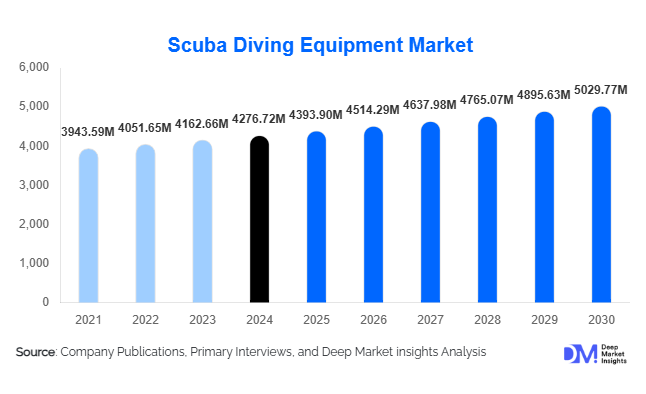

According to Deep Market Insights, the global scuba diving equipment market size was valued at USD 4,276.72 million in 2024 and is projected to grow from USD 4,393.90 million in 2025 to reach USD 5,029.77 million by 2030, expanding at a CAGR of 2.74% during the forecast period (2025–2030). Growth is driven by rising participation in recreational diving, an expanding global dive tourism industry, and rapid advancements in digital dive technologies, including AI-enabled dive computers, lightweight cylinders, and integrated safety systems.

Key Market Insights

- Recreational diving accounts for the largest demand share globally, supported by expanding marine tourism and rising interest in underwater adventure sports.

- Premium and technologically advanced dive equipment is gaining market share, driven by consumer preference for improved safety, durability, and digital integration.

- Asia-Pacific is the fastest-growing regional market, fueled by growth in coastal tourism and increasing diver certifications in Southeast Asia, India, and China.

- North America and Europe collectively dominate global revenue, supported by high equipment replacement cycles and strong demand for specialized technical gear.

- Sustainability trends are reshaping equipment manufacturing, with brands adopting eco-friendly materials, recycled plastics, and carbon-neutral production methods.

- Online retail is rapidly expanding as divers increasingly compare prices, review specs, and purchase gear through digital marketplaces.

What are the latest trends in the scuba diving equipment market?

Advanced Smart Diving Technologies

Technology integration is redefining the scuba diving equipment industry. AI-enhanced dive computers, wireless pressure transmitters, real-time biometrics, and environmental sensors are becoming mainstream. These devices enable safer dives, accurate tracking, and seamless post-dive analysis through mobile apps. Cloud-syncing of dive logs, GPS underwater navigation, and predictive decompression algorithms are attracting both beginners and professionals. As consumers increasingly demand data-driven experiences, manufacturers are focusing on innovation cycles shorter than five years to maintain competitiveness. The integration of heads-up displays (HUDs) and augmented-reality training tools is also beginning to emerge, further elevating diver safety and situational awareness.

Sustainable and Eco-Conscious Equipment

Divers, often environmental enthusiasts, are gravitating toward eco-friendly gear. Manufacturers are shifting to neoprene alternatives, recycled polymers in BCDs, biodegradable packaging, and carbon-neutral production models. Sustainable wetsuit textiles, reef-safe materials, and long-life modular components are becoming differentiators in the premium equipment category. Dive resorts and training agencies increasingly promote sustainable gear use, reinforcing this trend. Equipment rental operators are also adopting durability-focused gear to minimize waste and lifecycle cost, encouraging manufacturers to develop long-wear-resistant materials.

What are the key drivers in the scuba diving equipment market?

Growth of Global Marine & Adventure Tourism

Strong expansion in marine tourism across Southeast Asia, Australia, the Caribbean, and the Red Sea has substantially stimulated equipment demand. Divers, both beginners and advanced, are increasing annually, driven by the popularity of adventure tourism and social media’s influence on underwater experiences. Coastal destinations are investing in marine parks, dive centers, and certification facilities, creating a steady pipeline of new divers who purchase entry-level gear and progressively upgrade to premium devices.

Advancements in Dive Safety & Technology

Rapid improvements in life-support systems, including buoyancy compensators, regulators, and dive computers, are encouraging divers to replace older equipment sooner than in previous cycles. Enhanced safety algorithms, improved air integration, and AI-driven monitoring tools reduce perceived risks and expand adoption. Technical and professional diving communities, commercial, naval, rescue, and scientific, are also upgrading to high-capacity cylinders and ruggedized gear, contributing significantly to market value.

Rising Certification Enrollment & Training Infrastructure

Global certifications from PADI, SSI, and NAUI continue to grow, with emerging markets experiencing double-digit increases in diver enrollments. Dive schools increasingly bundle basic equipment purchases with training programs, accelerating first-time buyer acquisitions. Resorts and liveaboards are partnering with OEMs to provide specialized gear, further increasing visibility and consumer trust in branded equipment.

Restraints: High Equipment Costs & Maintenance Requirements

Premium dive gear can be expensive, particularly for new divers. Many components require periodic servicing, such as regulators, BCDs, and tanks, adding to ownership costs. Budget-conscious customers often rely on rentals, slowing direct sales growth. Limited affordability in emerging markets also restricts penetration.

Restraint: Environmental Regulations & Material Limitations

Regulations on neoprene disposal, marine pollution, and plastics use are increasing production complexities. Compliance raises material costs and may constrain design flexibility. Manufacturers must innovate sustainable alternatives without compromising safety or performance, which requires significant R&D investment.

Product Type Insights

Core life-support & safety systems lead the global market with an estimated 42% share in 2024, driven by the necessity of regulators, BCDs, tanks, and dive computers for all certified divers. Dive computers, in particular, are experiencing the highest growth due to digital transformation trends. Exposure suits, wetsuits, and drysuits account for roughly 28% of global revenue, supported by cold-water diving and rental fleet replacements. Accessories such as underwater lights, knives, and bags account for the remainder, with steady demand from frequent divers and travel-focused buyers seeking lightweight gear.

Application Insights

Recreational divers represent the largest application segment, accounting for nearly 65% of global demand. Growth is linked to tourism and certification programs. Professional and technical divers, including commercial divers, rescue teams, and scientific divers, drive approximately 25% of the market and favor premium, durable equipment. Military and naval applications contribute the remaining share, demanding ruggedized, mission-specific gear. New applications such as underwater filmmaking, research expeditions, and marine conservation projects are creating niche but fast-growing demand pockets. Export-driven demand is rising, particularly in Asia-Pacific and Europe, where dive centers and rental shops import large volumes of essential life-support gear.

Distribution Channel Insights

Online retail leads global sales with an estimated 39% share in 2024, supported by extensive product availability, transparent pricing, and consumer reliance on technical specifications. Specialist dive stores remain influential with about 35% share, especially for premium and custom-fitted gear. Sports and outdoor superstores maintain steady mid-range demand, while direct OEM sales to resorts, defense agencies, and training facilities represent a growing niche channel.

Traveler / Diver Type Insights

Recreational hobby divers and holiday-oriented divers dominate equipment purchases, often upgrading gear as skills advance. Solo divers and travel groups purchase modular and lightweight equipment suitable for frequent transport. Technical divers, though a smaller population, contribute disproportionately to premium product sales, especially in advanced regulators, computers, and drysuits. Families and young learners represent a rising demographic as more dive schools offer junior certification programs, stimulating demand for entry-level and safety-enhanced gear.

Age Group Insights

Divers aged 25–45 account for the largest share of equipment purchases due to higher disposable income and active participation in adventure travel. The 18–25 age group increasingly drives demand for budget-friendly and rental-oriented equipment. The 45–65 demographic is the strongest purchaser of premium and technologically advanced products, prioritizing safety and durability. Senior divers above 65 represent a small niche but show high interest in advanced monitoring equipment and ergonomic gear.

| By Product Type | By Application / End Use | By Distribution Channel |

|---|---|---|

|

|

|

Regional Insights

North America

North America accounts for roughly 32% of the global market in 2024, driven by strong participation in recreational and technical diving in the U.S., Canada, and Caribbean travel circuits. High adoption of premium digital gear and robust certification infrastructure support leading demand.

Europe

Europe holds approximately 28% of the global share, driven by established diving communities in the U.K., Germany, France, Spain, and Italy. Cold-water diving in Northern Europe supports demand for drysuits and advanced regulators.

Asia-Pacific

APAC is the fastest-growing region with a CAGR above 7%, owing to explosive tourism growth in Thailand, Indonesia, the Philippines, Malaysia, India, China, and Australia. Rising adventure tourism and expanding dive resorts are transforming APAC into a future global demand leader.

Latin America

Countries such as Brazil, Mexico, and Costa Rica are witnessing steady demand growth, driven by coastal tourism and rising diver certifications. The region relies heavily on imported equipment, elevating opportunities for global OEMs.

Middle East & Africa

The Red Sea (Egypt, Jordan, Saudi Arabia) and East Africa (Tanzania, Mauritius, Seychelles) are major diving hubs. Growing tourism infrastructure and high-income consumer segments in the Gulf states continue to support steady equipment sales.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Scuba Diving Equipment Market

- Aqualung

- Scubapro (Johnson Outdoors)

- Mares

- Cressi

- Apeks

- Oceanic

- Hollis

- Tusa

- Suunto

- Shearwater Research

- Fourth Element

- Poseidon Diving Systems

- Atomic Aquatics

- Zeagle

- Omer

Recent Developments

- In March 2025, Shearwater Research launched a new AI-driven dive computer line featuring real-time biometric tracking and cloud connectivity.

- In January 2025, Aqualung announced a sustainability initiative focusing on recyclable BCD components and low-carbon manufacturing.

- In 2024, Cressi expanded its APAC distribution network to meet rising demand in Southeast Asian diving hotspots.