Scoliosis Traction Chair (STC) Market Size

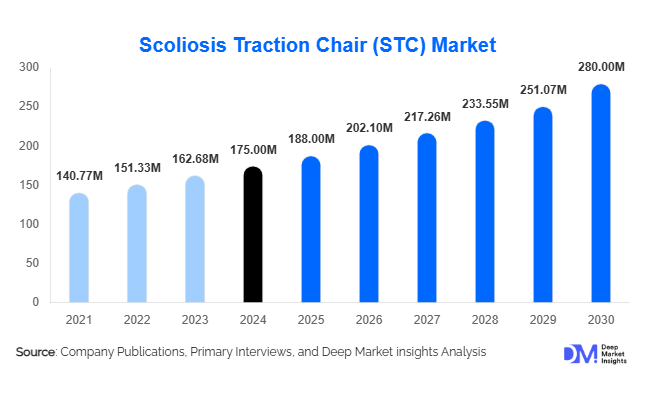

According to Deep Market Insights, the global scoliosis traction chair (STC) market size was valued at USD 175 million in 2024 and is projected to grow from USD 188 million in 2025 to reach USD 280 million by 2030, expanding at a CAGR of 7.5% during the forecast period (2025–2030). The market growth is primarily driven by the rising prevalence of scoliosis, increasing demand for non-invasive treatment options, and technological advancements in motorized and smart traction chair systems that enhance therapy outcomes and patient convenience.

Key Market Insights

- Motorized scoliosis traction chairs are gaining preference, offering precise spinal adjustments, ease of use, and automation, which enhances clinical efficiency and patient compliance.

- Home healthcare applications are expanding, as patients increasingly prefer at-home therapy solutions to avoid frequent clinical visits.

- North America dominates the market, accounting for approximately 38% of global revenue in 2024, driven by advanced healthcare infrastructure and high adoption of non-invasive scoliosis treatments.

- Asia Pacific is the fastest-growing region, fueled by rising medical infrastructure investments, increasing awareness, and government healthcare initiatives in China and India.

- Europe maintains steady demand, supported by reimbursement policies for non-surgical spinal therapies and growing clinical adoption of motorized traction chairs.

- Technological integration, including IoT-enabled and AI-assisted traction systems, is reshaping patient monitoring and therapy personalization, enhancing the overall market appeal.

Latest Market Trends

Non-Invasive Treatment Adoption

There is a growing preference for non-surgical scoliosis interventions, driving demand for STCs. Patients and clinicians are increasingly seeking effective alternatives to costly surgical procedures, and traction chairs provide a safer, non-invasive option. Hospitals, clinics, and home users are adopting both manual and motorized chairs for continuous therapy, demonstrating a shift toward conservative scoliosis management. Technological improvements in motorized traction systems have enhanced precision and treatment efficacy, increasing patient compliance and reducing therapy times.

Smart and Automated Traction Systems

Innovations such as motorized adjustments, sensor-based therapy monitoring, and IoT integration are transforming the STC market. These advancements allow real-time tracking of spinal correction, personalized therapy settings, and remote monitoring by clinicians. As a result, motorized and hybrid traction chairs are increasingly preferred in hospitals, clinics, and high-income home users. Smart systems also enable better adherence to therapy schedules, reducing manual intervention and increasing treatment outcomes.

Scoliosis Traction Chair Market Drivers

Rising Prevalence of Scoliosis

The increasing incidence of scoliosis, particularly among adolescents and adults, is driving demand for traction-based corrective solutions. Early detection and non-invasive treatment approaches are critical, creating a steady requirement for STCs in both clinical and home settings. Rising awareness campaigns and preventive spinal health programs have further increased adoption globally.

Preference for Non-Surgical Treatments

Patients and healthcare providers are increasingly opting for conservative spinal correction methods to avoid surgical risks. STCs offer a practical, non-invasive solution for both clinical and home use, enhancing their appeal among physiotherapists, chiropractors, and patients seeking long-term spinal care without invasive procedures.

Technological Advancements in STCs

Motorized and hybrid scoliosis traction chairs with ergonomic designs, adjustable tension controls, and IoT-enabled monitoring are creating new growth opportunities. Automation, digital tracking, and remote therapy monitoring enhance patient comfort, improve therapy precision, and differentiate high-end products from conventional manual chairs.

Market Restraints

High Equipment Costs

Advanced motorized and hybrid traction chairs involve significant investment, limiting adoption in price-sensitive markets and smaller clinics. The high upfront cost remains a barrier to wider penetration, especially in emerging economies.

Requirement for Skilled Operators

Operating STCs effectively requires trained physiotherapists or clinicians. The lack of skilled personnel in certain regions can slow market growth, particularly for motorized and advanced traction systems that require specialized setup and supervision.

Scoliosis Traction Chair Market Opportunities

Expansion in the Home Healthcare Segment

The growing trend of home-based rehabilitation provides a major growth opportunity for STCs. Compact, user-friendly chairs designed for personal use are attracting patients who prefer at-home therapy. This trend is driven by rising awareness of scoliosis management and convenience-seeking behavior, particularly in developed markets such as the U.S. and Europe.

Integration of Advanced Technologies

Incorporating AI, IoT, and sensor-based monitoring in STCs offers premium features that enhance therapy precision, real-time progress tracking, and remote clinician supervision. Early adoption of these technologies allows manufacturers to create differentiated products, capture higher margins, and expand market share in hospitals and high-income home segments.

Untapped Regional Markets

Emerging economies in the Asia Pacific, Latin America, and the Middle East offer high growth potential due to increasing medical infrastructure, healthcare investments, and rising awareness of scoliosis treatments. Government initiatives, such as “Made in China 2025” and healthcare modernization in India, are supporting adoption and domestic manufacturing, enabling first-mover advantages for early entrants.

Product Type Insights

Motorized scoliosis traction chairs dominate the market, accounting for approximately 55% of global revenue in 2024. Their automated adjustments, precision, and ease of use make them highly preferred in hospitals and rehabilitation centers. The growth of motorized STCs is primarily driven by rising demand for user-friendly, technology-enabled rehabilitation solutions that streamline therapy sessions and improve patient outcomes. Manual chairs remain popular in home care settings due to their affordability, while hybrid models are emerging as niche solutions that combine automation with cost-effectiveness, appealing to smaller clinics and high-income home users seeking advanced therapy options without high capital investment.

Application Insights

Clinical and medical applications account for 60% of the market, as hospitals and clinics integrate STCs into structured scoliosis treatment programs. The demand in rehabilitation centers is growing due to increased focus on long-term therapy beyond initial hospital treatment, emphasizing continuous correction and patient-centric outcomes. Home care applications are expanding rapidly in developed regions, driven by patient preference for consistent therapy without frequent clinical visits, and by the rising availability of user-friendly, automated chairs suitable for self-administered therapy. Research institutions and academic centers represent niche demand, mainly for scoliosis studies, device testing, and clinical trials.

Distribution Channel Insights

Direct sales dominate the market, representing 45% of 2024 revenue, as hospitals and clinics often prefer direct engagement with manufacturers for product customization, maintenance contracts, and training support. Online sales and e-commerce platforms are witnessing accelerated adoption, particularly in the home care segment, fueled by increased consumer comfort with purchasing specialized medical devices online, a trend amplified post-COVID. Distributors remain relevant for smaller clinics and physiotherapy centers, where they facilitate local service and device availability.

End-User Insights

Hospitals and clinics lead STC adoption, accounting for 65% of market share, due to high patient throughput and clinical preference for automated motorized chairs. Home users and physiotherapy centers are growing rapidly, driven by convenience, at-home rehabilitation demand, and rising awareness of non-invasive scoliosis therapy. Pediatric adoption is increasing with early intervention programs in schools, while research institutes remain a specialized segment focused on clinical validation and scoliosis studies.

Age Group Insights

The adult segment (19–60 years) dominates with a 50% share, reflecting the high prevalence of postural and progressive scoliosis in working-age populations. Pediatric use is growing steadily due to early diagnosis and intervention programs implemented in schools, which encourage the adoption of non-invasive scoliosis treatments. Geriatric applications remain niche but important, particularly for age-related spinal deformities requiring long-term, non-surgical therapy management.

| By Product Type | By Application | By End-User | By Age Group / Target Demographic | By Distribution Channel |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America dominates the STC market with a 38% share in 2024. The U.S. leads adoption due to high healthcare expenditure, advanced rehabilitation infrastructure, and strong insurance coverage for non-surgical scoliosis treatments. Motorized STCs are particularly popular in hospitals, specialized clinics, and physiotherapy centers. Canada also contributes significantly, driven by home care adoption and growing physiotherapy services. The region’s growth is further supported by increasing awareness of non-invasive scoliosis therapies and widespread adoption of smart, automated traction solutions.

Europe

Europe holds a 30% market share, with Germany, France, and the U.K. leading demand. Favorable reimbursement policies, increasing clinical adoption of patient-centric orthopedic solutions, and technological advancements in motorized STCs are key growth drivers. Hospitals and rehabilitation centers are actively integrating STCs into long-term scoliosis therapy programs, emphasizing precision and patient comfort. Germany and France, in particular, serve as hubs for motorized chair adoption due to strong healthcare infrastructure and supportive government initiatives promoting non-surgical spinal treatments.

Asia-Pacific

Asia-Pacific is the fastest-growing region with a CAGR of ~9%, driven by rapid urbanization, increasing incidence of scoliosis among school-aged children, and growing middle-class affordability. China and India lead demand as hospitals, home care segments, and rehabilitation centers expand rapidly, supported by government healthcare initiatives and rising awareness of non-invasive therapies. The market is further bolstered by the increasing availability of automated STCs that cater to technology-savvy users seeking convenient, home-based solutions.

Latin America

Brazil and Mexico are key markets, showing moderate growth due to expanding private healthcare sectors and increasing awareness of scoliosis management beyond surgical interventions. Adoption is supported by rising investments in physiotherapy and rehabilitation centers and the growing availability of motorized STCs for home and clinical use. Outbound demand for imported traction chairs is rising among high-income segments seeking advanced, non-invasive treatment options. Increased patient education and awareness campaigns are also fueling regional growth.

Middle East & Africa

The region accounts for ~7% market share but is growing steadily, particularly in the UAE, Saudi Arabia, and South Africa. Growth is driven by rising healthcare investments, expansion of specialized orthopedic care centers, and increasing awareness of non-invasive scoliosis management. Hospitals and rehabilitation facilities are adopting automated STCs to improve treatment precision, patient comfort, and therapy outcomes. Private healthcare expansion and regional government initiatives focused on advanced medical devices are key drivers supporting long-term market growth.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Scoliosis Traction Chair Market

- Chinesport S.p.A

- SpineTech

- EkoSkeletal

- DJO Global

- Theratronics

- ScoliCare

- MTS Medical

- Corrective Traction Co.

- OrthoTrax

- MedLine

- Axis Spine Systems

- CareTraction Inc.

- ScoliMed

- RehabTech

- FlexTraction

Recent Developments

- In May 2025, SpineTech launched a motorized smart traction chair for home use with IoT-based therapy tracking and remote clinician monitoring.

- In March 2025, Chinesport S.p.An expanded production in China under the “Made in China 2025” initiative to meet growing APAC demand.

- In January 2025, DJO Global introduced a hybrid scoliosis traction chair combining manual and automated features for hospitals and physiotherapy centers.