School Uniform Market Size

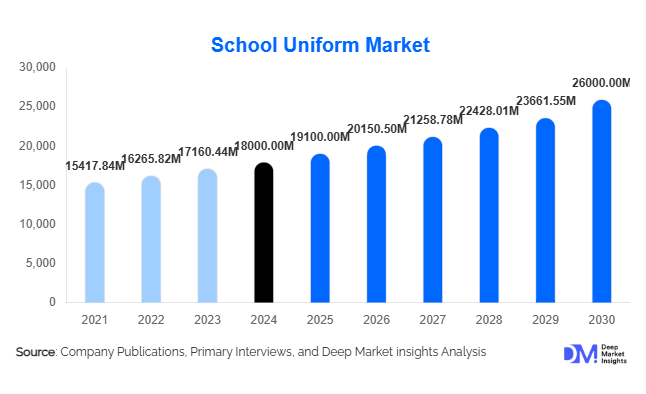

According to Deep Market Insights, the global school uniform market size was valued at USD 18,000 million in 2024 and is projected to grow from USD 19,100 million in 2025 to reach USD 26,000 million by 2030, expanding at a CAGR of 5.5% during the forecast period (2025–2030). Market growth is driven by rising global student enrollments, stricter uniform mandates across public and private schools, increasing demand for sustainable and customized fabrics, and the rapid expansion of e-commerce channels catering to parents and educational institutions worldwide.

Key Market Insights

- Asia-Pacific leads the global market, accounting for nearly 40% of total revenue in 2024, supported by large student populations and strong government-led uniform policies.

- Primary and secondary schools remain dominant end-users, representing over 45% of global demand due to compulsory uniform mandates and frequent replacement cycles.

- Polyester-based fabrics command the largest share (approximately 30%) owing to their affordability, durability, and suitability for mass production.

- Online and direct-to-school sales channels are expanding, driven by convenience, digital ordering platforms, and customization tools.

- Sustainability and comfort are emerging design priorities, leading to rising adoption of eco-friendly and performance fabrics such as organic cotton blends and moisture-wicking textiles.

- International schools and premium educational institutions are fueling growth in the higher-value uniform segment through branded, customized apparel.

Latest Market Trends

Sustainable and Eco-Friendly Uniform Fabrics

One of the strongest trends shaping the school uniform market is the shift toward sustainability. Educational institutions and parents are demanding eco-conscious fabrics such as organic cotton, recycled polyester, and low-impact dyes. Manufacturers are investing in performance textiles that are stain-resistant, breathable, and long-lasting to reduce waste and replacement frequency. Additionally, several school districts in Europe and Asia are adopting “green uniform” initiatives, encouraging suppliers to meet stringent environmental standards. This trend is reinforcing the move toward ethical sourcing and circular production models.

Digital Procurement and Customization Platforms

Schools and uniform suppliers are increasingly embracing digital procurement systems, enabling parents to order directly through school portals or specialized e-commerce platforms. Advanced tools such as virtual sizing, 3D garment visualization, and bulk order management have streamlined the buying experience. These platforms also allow for personalization, including embroidered logos and color variations aligned with school branding. The trend toward digitalization is transforming the distribution landscape, reducing manual errors, and improving logistics efficiency.

Rise of Subscription and Rental Uniform Models

In developed and cost-sensitive markets alike, rental and subscription-based uniform services are emerging as innovative solutions. These models allow parents to subscribe to an annual or term-based uniform supply that includes replacement options as children outgrow their clothes. This model not only supports affordability and sustainability but also ensures consistent quality and brand compliance across school systems.

School Uniform Market Drivers

Expanding Student Population and School Infrastructure

Rising global enrollment, particularly in emerging markets such as India, Nigeria, and Indonesia, is a fundamental growth driver. As more public and private schools open and expand, the number of students requiring uniforms increases proportionally. Governments in these regions are investing heavily in school infrastructure, often including uniform subsidies or mandates as part of education reforms.

Mandatory Uniform Policies Across Educational Systems

Uniform mandates in schools continue to ensure consistent demand, as institutions view standardized attire as a means to promote discipline, equality, and school identity. This policy-driven demand creates recurring replacement cycles, ensuring stable year-on-year consumption for manufacturers and distributors. Many countries, including the UK, Japan, and India, have deeply ingrained uniform traditions that support long-term market resilience.

Shift Toward Branded and Premium School Apparel

The market is witnessing a gradual shift from unbranded, low-cost uniforms to higher-quality, branded apparel. Schools increasingly prefer uniforms that enhance their institutional image and incorporate comfort, durability, and design. This trend has spurred partnerships between schools and specialized uniform manufacturers who offer premium collections with custom designs, leading to higher per-student spending.

Market Restraints

Price Sensitivity and Margin Pressures

The school uniform market is highly price-sensitive, particularly in developing regions where affordability drives purchase decisions. Rising textile and labor costs often squeeze margins for manufacturers, who face challenges in passing these costs to consumers. Commoditization and competition from local tailors also limit pricing flexibility, particularly in rural and public-school markets.

Uneven Adoption and Informal Supply Chains

In several developing nations, informal tailoring shops and unorganized suppliers dominate uniform production, resulting in fragmented markets and inconsistent quality. The lack of uniform mandates in certain regions also restricts potential demand. Furthermore, longer replacement cycles in cost-conscious households slow the growth of uniform refresh purchases.

School Uniform Market Opportunities

Emerging Market Expansion

Rapidly growing student populations in South Asia, Sub-Saharan Africa, and parts of Latin America offer vast untapped opportunities for uniform producers. Governments in these regions are formalizing education systems and introducing nationwide school uniform programs. Manufacturers who establish local production hubs and public-private partnerships are well-positioned to capture early market share.

Innovation in Technical and Sustainable Fabrics

There is a growing opportunity for fabric producers to innovate with materials that improve student comfort and reduce maintenance costs. Moisture-wicking, wrinkle-resistant, and antimicrobial fabrics are being integrated into uniform design, providing long-term durability and comfort. Eco-certifications and traceable sourcing are also becoming major differentiators in institutional contracts.

Digital Transformation and Omnichannel Distribution

As digital commerce accelerates, uniform brands can leverage e-commerce, school portals, and mobile apps to expand reach. The integration of AI-based inventory systems and data analytics will enable suppliers to manage demand forecasting and reduce overproduction. Omnichannel models combining online ordering and offline fitting centers offer the best of both convenience and assurance for parents.

Product Type Insights

Shirts and blouses hold the largest share of the global market, accounting for approximately 30% of total revenue in 2024. They are core components of both male and female student attire across all school levels. Trousers, skirts, sweaters, and sportswear collectively represent the remaining majority. The shirt/blouse segment is expected to maintain its lead through 2030 due to its universal requirement and frequent replacement cycle, especially among younger students.

Material Insights

Polyester and polyester-cotton blends dominate the material segment, representing about 30% of market share in 2024. Their superior durability, ease of maintenance, and low production cost make them the preferred choice for institutional contracts. However, demand for blended and sustainable fabrics is projected to grow faster (CAGR 7–8%) as eco-friendly initiatives and comfort preferences gain traction in Europe and Asia.

End-User Insights

Primary schools accounted for over 45% of total demand in 2024, making them the largest end-user segment. Uniforms are strictly enforced at this level, and the frequent replacement cycle due to child growth sustains steady revenue. International and private schools are expected to post the fastest growth rates (around 7% CAGR), driven by premiumization and branding trends.

Distribution Channel Insights

Offline retail and direct-to-school supply dominated the market with approximately 50% of total sales in 2024. However, online platforms are growing at more than 10% CAGR, driven by ease of ordering and home delivery options. Hybrid models combining online selection with school-based fittings are increasingly common, particularly in North America and Europe.

| By Product Type | By Material | By End-User | By Distribution Channel |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America represented about 36% of global revenue in 2024. The United States dominates this region due to the prevalence of uniforms in private, charter, and parochial schools. Demand growth remains steady, supported by online distribution and premium uniform trends. Canada contributes a smaller share but exhibits rising interest in sustainable uniform options.

Europe

Europe held roughly 30% of the global market share in 2024, led by the United Kingdom, Germany, and France. The region’s focus on eco-friendly fabrics and high design quality drives demand for premium products. Eastern Europe is emerging as a growth frontier due to expanding private schooling and uniform standardization initiatives.

Asia-Pacific

Asia-Pacific is the largest and fastest-growing regional market, accounting for approximately 40% of total global demand in 2024. Massive student populations in India, China, Indonesia, and Japan, coupled with strong cultural adherence to uniform policies, are propelling growth. India and China are forecast to experience the fastest expansion through 2030, supported by rising household incomes and large-scale education reforms.

Latin America

Latin America accounted for around 6% of the global market in 2024, with Brazil and Mexico leading demand. Government uniform programs and increasing private education enrollment are key drivers. Manufacturers are expanding partnerships with regional distributors to meet growing local needs.

Middle East & Africa

This region contributed roughly 3% of total global revenue in 2024 but is expected to post the highest relative growth rates (CAGR ~8%) through 2030. Strong education investments in the Gulf Cooperation Council (GCC) countries and expanding school infrastructure in Africa, particularly South Africa, Kenya, and Nigeria, are driving the adoption of standardized uniforms.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the School Uniform Market

- VF Corporation

- Trutex Limited

- Perry Uniform (Uniform Schoolwear Ltd.)

- Dennis Uniform Manufacturing Company

- Elder Manufacturing Company

- French Toast School Uniforms

- Lands’ End, Inc.

- Flynn & O’Hara Uniforms

- Zeco Limited

- Schoolbelles

- The Uniform Company

- Flash Uniforms

- Dean Clothing Ltd.

- Gogna Schoolwear & Sports Ltd.

- Brigade Clothing Ltd.

Recent Developments

- In June 2025, Trutex Limited launched a new line of uniforms made from 100% recycled polyester, strengthening its commitment to sustainable schoolwear solutions.

- In April 2025, VF Corporation announced plans to expand its educational apparel division in Asia-Pacific, leveraging digital direct-to-school procurement systems.

- In February 2025, Lands’ End introduced an AI-powered sizing tool for school uniform orders, enhancing fit accuracy and reducing product returns.