Sauna Market Size

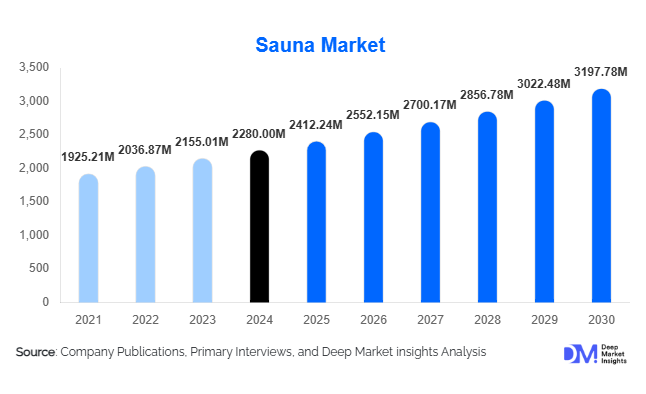

According to Deep Market Insights, the global sauna market size was valued at USD 2,280.00 million in 2024 and is projected to grow from USD 2,412.24 million in 2025 to reach USD 3,197.78 million by 2030, expanding at a CAGR of 5.8% during the forecast period (2025–2030). The sauna market growth is driven by rising health and wellness awareness, increasing adoption of home-based wellness solutions, expanding wellness tourism infrastructure, and technological advancements such as infrared heating systems and smart sauna controls.

Key Market Insights

- Traditional and electric saunas continue to dominate global demand, supported by ease of installation, regulatory acceptance, and widespread use across residential and commercial settings.

- Residential saunas are the fastest-growing segment, fueled by luxury housing development, remote work lifestyles, and rising disposable incomes.

- Europe remains the largest regional market, driven by deep-rooted sauna culture in Nordic and Central European countries.

- Asia-Pacific is the fastest-growing region, supported by expanding hospitality infrastructure, urbanization, and growing middle-class spending on wellness.

- Infrared sauna adoption is accelerating due to lower energy consumption, therapeutic benefits, and suitability for medical and institutional use.

- Smart and connected sauna solutions, including IoT-enabled temperature control and energy monitoring, are reshaping product differentiation.

What are the latest trends in the sauna market?

Smart and Energy-Efficient Sauna Systems

One of the most prominent trends in the sauna market is the rapid integration of smart technologies and energy-efficient systems. Manufacturers are increasingly offering digitally controlled saunas with mobile app connectivity, programmable heating cycles, and energy monitoring features. These innovations appeal strongly to tech-savvy consumers and commercial operators seeking to optimize operational efficiency and reduce energy costs. Smart saunas also allow personalized wellness experiences, enhancing user comfort and supporting premium pricing strategies.

Growing Demand for Infrared and Hybrid Saunas

Infrared saunas are gaining significant traction due to their lower operating temperatures, reduced power consumption, and perceived therapeutic benefits such as improved circulation and muscle recovery. Hybrid saunas that combine traditional and infrared heating technologies are also emerging, catering to diverse user preferences. This trend is particularly strong in residential, healthcare, and rehabilitation settings, where safety, comfort, and energy efficiency are critical decision factors.

What are the key drivers in the sauna market?

Rising Health and Wellness Awareness

Global awareness regarding preventive healthcare and mental well-being has increased substantially in recent years. Saunas are increasingly viewed as lifestyle wellness investments rather than luxury add-ons, supported by growing evidence linking regular sauna use to cardiovascular health, stress reduction, and muscle recovery. This shift in consumer perception is driving adoption across residential households, gyms, and wellness centers worldwide.

Expansion of Wellness Tourism and Hospitality Infrastructure

The rapid growth of wellness tourism is another key driver for the sauna market. Hotels, resorts, cruise ships, and destination spas are integrating saunas as standard amenities to enhance guest experiences and increase retention. Luxury hospitality projects across Europe, Asia-Pacific, and the Middle East are particularly contributing to rising commercial sauna installations.

What are the restraints for the global market?

High Initial Installation Costs

Despite long-term benefits, the high upfront cost of sauna installation, especially for premium and customized solutions, remains a major barrier, particularly in price-sensitive markets. This limits mass adoption in emerging economies and among middle-income households.

Regulatory and Safety Compliance Challenges

Sauna manufacturers must comply with varying electrical, fire safety, and building regulations across regions. Differences in standards increase certification costs and slow international market entry, particularly for smaller manufacturers.

What are the key opportunities in the sauna industry?

Medical and Therapeutic Applications

Increasing acceptance of sauna therapy in healthcare and sports rehabilitation presents a significant opportunity. Infrared saunas are being adopted in hospitals, physiotherapy centers, and sports academies due to their safety profile and therapeutic benefits. Long-term institutional contracts can provide stable revenue streams for manufacturers.

Emerging Market Penetration

Rapid urbanization, rising disposable incomes, and expanding luxury real estate in the Asia-Pacific and the Middle East offer untapped growth potential. Localized product designs and region-specific partnerships can significantly enhance market penetration in these high-growth regions.

Product Type Insights

Traditional Finnish saunas account for the largest share of the market, representing approximately 42% of global revenue in 2024, driven by cultural acceptance and widespread use in commercial wellness facilities. Infrared saunas are the fastest-growing product type, supported by residential demand and therapeutic applications. Steam and hybrid saunas cater to niche segments, particularly in luxury spas and hotels.

Heat Source Insights

Electric saunas dominate the market with nearly 55% share due to ease of installation, safety, and compatibility with urban infrastructure. Wood-fired saunas retain cultural relevance in Nordic regions, while gas-heated systems remain limited to specific commercial applications.

End-Use Insights

Commercial applications account for around 52% of global demand, led by hotels, spas, gyms, and wellness resorts. Residential saunas are growing at the fastest rate, exceeding 8.5% CAGR, driven by home wellness trends and premium housing development. Institutional demand from hospitals and sports facilities is emerging as a high-potential niche.

Distribution Channel Insights

Direct manufacturer sales dominate commercial and premium residential projects, accounting for approximately 40% of the market. Online and D2C platforms are rapidly expanding, particularly for compact residential saunas. Specialty wellness retailers continue to play a critical role in mid-range product sales.

| By Sauna Type | By Heat Source | By Installation Type | By End Use | By Distribution Channel |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

Europe

Europe leads the global sauna market with approximately 38% share in 2024. Finland, Germany, Sweden, and Austria drive demand due to cultural integration, established wellness infrastructure, and high per-capita sauna ownership.

North America

North America holds around 27% of the market, led by the United States. Growth is driven by residential installations, fitness culture, and rising interest in home-based wellness solutions.

Asia-Pacific

Asia-Pacific accounts for nearly 22% of global demand and is the fastest-growing region. China, Japan, South Korea, and Australia are key contributors, supported by expanding hospitality sectors and urban lifestyle changes.

Latin America

Latin America represents a developing market, with Brazil and Mexico showing rising adoption in luxury hotels and fitness centers.

Middle East & Africa

The Middle East is witnessing growing demand from luxury hospitality projects in the UAE and Saudi Arabia, while Africa remains a niche market focused on high-end tourism infrastructure.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Sauna Market

- Harvia Plc

- KLAFS GmbH

- TyloHelo Group

- Sauna360

- EOS Saunatechnik

- Sawo Inc.

- HUUM

- Effegibi

- Narvi Oy

- Finnleo

- Almost Heaven Saunas

- Sunlighten

- Amerec

- Nordic Sauna Group

- SAWO Asia

Recent Developments

- In 2025, Harvia expanded its smart sauna portfolio with IoT-enabled controls and energy-efficient heaters targeting premium residential markets.

- In 2024, KLAFS introduced hybrid sauna systems combining infrared and traditional heating technologies for commercial wellness centers.

- In 2024, TyloHelo Group invested in manufacturing automation and sustainability upgrades to improve production efficiency and reduce carbon footprint.