Sanitary Pads Market Size

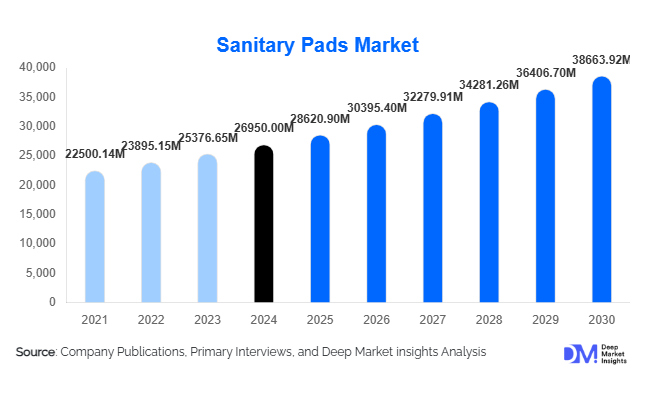

According to Deep Market Insights, the global sanitary pads market size was valued at USD 26,950 million in 2024 and is projected to grow from USD 28,620.90 million in 2025 to reach USD 38,663.92 million by 2030, expanding at a CAGR of 6.2% during the forecast period (2025–2030). The market growth is driven by rising awareness of menstrual hygiene, government initiatives promoting sanitary health, increasing urbanization, and expanding product accessibility across emerging economies.

Key Market Insights

- Growing menstrual hygiene awareness is significantly boosting product adoption in both developed and developing regions.

- Biodegradable and organic sanitary pads are gaining traction as consumers shift toward sustainable menstrual products.

- Asia-Pacific dominates the global market, supported by large populations, improving health infrastructure, and strong government campaigns for women’s hygiene.

- North America and Europe show high brand penetration and premium product adoption driven by technological advancements and sustainability concerns.

- Online retail growth and D2C models are reshaping sales channels by improving convenience and privacy for consumers.

- Innovation in materials and comfortsuch as ultra-thin, odor-control, and reusable pad variantscontinues to differentiate market leaders.

What are the latest trends in the sanitary pads market?

Rise of Eco-Friendly and Biodegradable Pads

As environmental awareness grows, consumers are increasingly adopting biodegradable and organic sanitary pads made from bamboo fiber, cotton, or corn starch. Brands such as Saathi, Carmesi, and Organyc are leading the sustainable product wave. Governments and NGOs are also endorsing eco-friendly alternatives to reduce plastic waste from conventional pads. These products not only appeal to environmentally conscious users but also address growing concerns about the long-term ecological impact of menstrual waste.

Technology-Driven Product Innovation

Manufacturers are leveraging advanced absorbent technologies, breathable materials, and odor-neutralizing innovations to enhance comfort and hygiene. Smart packaging and subscription-based delivery models are being introduced to improve convenience. AI-driven personalization and menstrual tracking apps are emerging to guide consumers in selecting suitable products, linking hygiene management with digital health ecosystems. These innovations are enhancing customer loyalty and product differentiation in a competitive market.

What are the key drivers in the sanitary pads market?

Increasing Government and NGO Initiatives

Public health programs promoting menstrual hygiene, especially in rural and underserved regions, are significantly increasing product accessibility. Initiatives like India’s “Menstrual Hygiene Scheme” and similar projects across Africa and Southeast Asia are boosting awareness and subsidizing sanitary pad distribution. Global NGOs are working to normalize menstrual health discussions and eliminate stigma, which further supports market expansion.

Rising Female Workforce and Urbanization

As more women enter the workforce and urban living standards improve, the demand for convenient and reliable menstrual hygiene solutions is rising. Busy lifestyles and higher disposable incomes are encouraging premium product purchases, while increasing education and health awareness ensure long-term adoption. The ongoing urbanization trend also enables better retail and online access to sanitary pads, further accelerating growth.

What are the restraints for the global market?

Environmental Concerns and Disposal Issues

Conventional sanitary pads are primarily composed of non-biodegradable plastic materials, contributing significantly to landfill waste and pollution. Improper disposal practices, especially in developing countries, exacerbate environmental and public health risks. These concerns are pushing manufacturers to innovate with biodegradable options, but higher production costs continue to limit widespread adoption.

Affordability and Accessibility Challenges

Despite growing awareness, affordability remains a major barrier in low-income regions. Many women in rural areas still rely on cloth alternatives due to high product prices or limited availability. Supply chain inefficiencies, distribution gaps, and social stigma around menstruation also hinder market penetration in developing economies.

What are the key opportunities in the sanitary pads industry?

Expansion of Biodegradable Product Lines

The rising demand for sustainable menstrual hygiene products presents a significant opportunity for manufacturers. R&D investments to produce cost-effective biodegradable pads can attract eco-conscious consumers and help brands gain regulatory support in markets implementing plastic bans. Governments providing tax incentives for eco-friendly products further enhance growth potential in this segment.

Digital Commerce and Subscription Models

Direct-to-consumer brands leveraging e-commerce and subscription models are gaining traction. These models offer discreet delivery, regular supply, and personalized product recommendations. Startups like Nua, The Honey Pot, and Lola are capitalizing on this trend by combining convenience, sustainability, and brand transparency. Growing digital literacy and mobile commerce adoption in emerging economies will amplify these opportunities.

Product Type Insights

Disposable sanitary pads continue to dominate the global market, accounting for the largest share due to their convenience, affordability, and widespread availability. These factors make them the preferred choice for both urban and rural consumers. In contrast, reusable sanitary pads are witnessing increasing adoption, primarily driven by environmental concerns and cost-effectiveness, appealing to eco-conscious and budget-sensitive users. Cotton-based pads are gaining traction due to a preference for natural materials and sensitivity concerns, particularly in developed markets. Biodegradable sanitary pads are emerging as a key growth segment, reflecting the global trend toward environmental sustainability. Additionally, organic cotton pads and menstrual underwear are carving out niche opportunities within premium consumer segments seeking enhanced comfort and hypoallergenic properties.

Distribution Channel Insights

Offline retail channelsincluding supermarkets, pharmacies, and convenience storesremain the primary source of sanitary pads, especially in emerging markets where physical retail penetration is higher. However, online sales are the fastest-growing distribution channel, driven by factors such as convenience, discreet purchasing options, wider product variety, and subscription-based delivery models. Social commerce and D2C platforms are further reshaping the market, particularly among younger, tech-savvy consumers who value personalized recommendations, recurring deliveries, and direct engagement with brands.

| By Product Type | By Material Type | By Distribution Channel | By End User |

|---|---|---|---|

|

|

|

|

Regional Insights

Asia-Pacific

Asia-Pacific holds the largest share of the global sanitary pads market, fueled by rapid urbanization, rising disposable incomes, and a large female population. India, China, and Indonesia are key contributors, where government programs, NGO-led hygiene campaigns, and subsidy initiatives have increased awareness and adoption in rural regions. The demand for premium and organic sanitary products is also growing in urban centers due to higher health consciousness and lifestyle upgrades. Rising e-commerce penetration and increasing digital literacy further enhance accessibility, making online channels a strong growth driver in the region.

North America

North America is characterized by high product penetration and innovation-driven growth. The region benefits from strong retail infrastructure, high consumer awareness, and a preference for chemical-free or organic products. Companies such as Seventh Generation and Rael are spearheading sustainable product innovations, including biodegradable and ultra-thin options. Online retail and subscription-based services are increasingly shaping purchasing patterns, driven by convenience, privacy concerns, and the desire for curated product selections. Awareness campaigns around menstrual health and sustainability further reinforce adoption in this mature market.

Europe

Europe is a mature and highly sustainable market. Stringent environmental regulations, coupled with consumer preference for biodegradable and eco-friendly sanitary pads, are major growth drivers. The U.K., Germany, and France are leading the adoption of organic and chemical-free pads, with retailers emphasizing ethical sourcing, plastic-free packaging, and sustainable production practices. Premiumization trends and growing awareness of menstrual health contribute to strong demand for innovative products, while online channels are expanding, particularly among younger, eco-conscious consumers.

Latin America

Latin America is witnessing steady growth, with Brazil and Mexico emerging as leading markets. Key growth drivers include increasing consumer awareness, improved distribution channels, and expanding retail infrastructure. Rising middle-class populations and higher female workforce participation are further boosting adoption. Challenges such as affordability and limited rural penetration persist, but initiatives by NGOs and local manufacturers to distribute low-cost and biodegradable products are helping to expand market reach. Online sales are gradually gaining traction in urban areas due to convenience and discreet purchasing options.

Middle East & Africa

The Middle East and Africa present significant growth potential, particularly in countries such as South Africa, Kenya, and Nigeria. Cultural shifts, increasing access to menstrual hygiene products, and NGO-led educational initiatives are key drivers of growth. The region benefits from emerging local manufacturing and distribution networks, while premium consumer segments in the Middle East are adopting high-end organic and reusable sanitary products. Expansion of retail chains, growing e-commerce adoption, and government-led menstrual health programs further support market development across this region.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Sanitary Pads Market

- Procter & Gamble (Always, Whisper)

- Kimberly-Clark (Kotex)

- Edgewell Personal Care (Stayfree, Carefree)

- Unicharm Corporation (Sofy)

- Ontex Group

- Hengan International Group

- Rael

- Carmesi

- Saathi

Recent Developments

- In June 2025, Procter & Gamble announced its expansion into biodegradable sanitary pad production under its “Whisper Green” line to reduce plastic waste in India and Southeast Asia.

- In April 2025, Kimberly-Clark introduced new organic cotton pads under the Kotex brand, featuring compostable packaging to meet European sustainability standards.

- In February 2025, Indian startup Carmesi secured funding to scale its eco-friendly menstrual care products across Asia-Pacific through e-commerce and D2C channels.