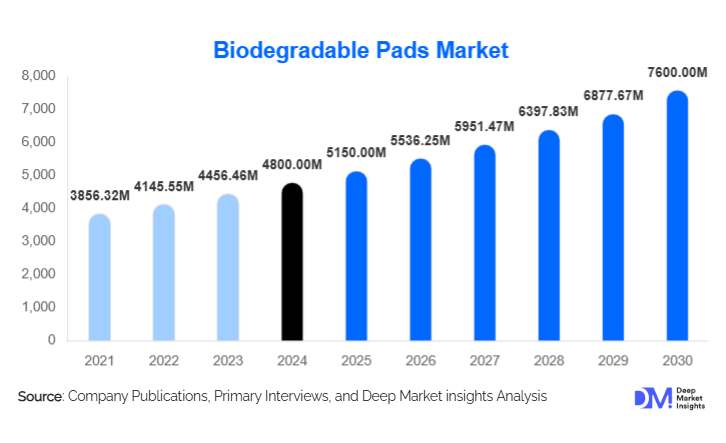

Biodegradable Pads Market Size

According to Deep Market Insights, the global biodegradable pads market size was valued at USD 4,800 million in 2024 and is projected to grow from USD 5,150 million in 2025 to reach USD 7,600 million by 2030, expanding at a CAGR of 7.5% during the forecast period (2025–2030). The biodegradable pads market growth is primarily driven by increasing consumer preference for sustainable and eco-friendly hygiene products, rising awareness of menstrual and personal care hygiene, and the adoption of plant-based biodegradable materials across healthcare and personal care sectors.

Key Market Insights

- Growing demand for eco-friendly hygiene solutions is driving manufacturers to develop biodegradable pads using bamboo, sugarcane, and corn starch fibers, appealing to environmentally conscious consumers.

- Government regulations and sustainability initiatives across Europe, North America, and Asia-Pacific are accelerating the shift from conventional synthetic pads to biodegradable alternatives.

- Personal care dominates the end-use segment, accounting for over 55% of the market, driven by urban adoption and premium consumer preferences.

- Online retail is emerging as the fastest-growing distribution channel, providing subscription services, discreet delivery, and direct-to-consumer convenience.

- Asia-Pacific is the fastest-growing regional market, with India and China leading demand due to large populations, rising hygiene awareness, and government-led programs.

- Technological innovation in biodegradable materials, including ultra-thin, highly absorbent plant-based fibers, is enhancing product performance and consumer adoption globally.

Latest Market Trends

Shift Toward Sustainable and Biodegradable Materials

Manufacturers are increasingly adopting sustainable materials such as bamboo fiber, corn starch, and sugarcane fiber, which offer high absorbency and biodegradability. These eco-friendly innovations respond to consumer demand for low-waste products while maintaining performance comparable to conventional pads. Biodegradable pads are being marketed as premium personal care products, emphasizing environmental responsibility and safety for sensitive skin. Subscription-based and e-commerce models have facilitated wider access to these products, especially in urban areas.

Integration of Technology and Product Innovation

Technological advancements have led to ultra-thin designs, improved absorption, and hybrid plant-fiber compositions that enhance comfort and sustainability. Innovations include naturally infused antimicrobial pads and ergonomic designs for overnight use. Mobile apps and online platforms allow consumers to track subscriptions, compare products, and access educational content on sustainable hygiene practices, further enhancing market penetration.

Biodegradable Pads Market Drivers

Rising Environmental Awareness

Increasing global concern about plastic pollution and environmental degradation has led consumers to prefer biodegradable hygiene products. Surveys indicate that 45–50% of urban consumers are willing to pay a premium for sustainable pads, fueling market expansion. The shift is particularly notable in Europe and North America, where regulations and awareness campaigns reinforce eco-conscious purchasing behavior.

Government Initiatives and Regulations

Policies banning single-use plastics and promoting sustainable alternatives in Europe, Asia-Pacific, and North America are accelerating adoption of biodegradable pads. Government-backed programs targeting menstrual hygiene in India and China are also increasing institutional procurement and driving large-scale demand for eco-friendly pads.

Technological Advancements in Materials

Innovations in bamboo fiber, sugarcane fiber, and corn starch materials have improved pad softness, absorption, and biodegradability, reducing consumer resistance to switching from traditional synthetic products. Improved performance and comfort have led to broader market acceptance and premium positioning.

Market Restraints

Higher Production Costs

Biodegradable pads are more expensive to produce than conventional pads due to specialized raw materials and certifications. High production costs limit affordability for price-sensitive consumers in emerging markets, potentially constraining adoption.

Supply Chain Challenges

Sourcing plant-based raw materials consistently and maintaining quality across production facilities remain key challenges. Climate variability and agricultural supply fluctuations can disrupt production and impact market growth, particularly for smaller manufacturers.

Biodegradable Pads Market Opportunities

Expansion in Emerging Markets

Asia-Pacific, especially India and China, presents a major growth opportunity due to large populations, rising hygiene awareness, and government programs promoting sustainable menstrual products. Localized products and culturally relevant campaigns can further accelerate adoption.

Technological and Material Innovation

Investment in research and development for advanced biodegradable fibers, ultra-thin pads, and antimicrobial features offers differentiation. Companies focusing on innovation can command premium pricing and establish brand loyalty while meeting consumer demand for high-performance, sustainable products.

Institutional and Government Programs

Public health initiatives, school and NGO programs, and bulk procurement contracts offer high-volume sales potential. Governments in India, China, and Europe incentivize biodegradable pad production, providing a favorable landscape for manufacturers to scale operations.

Product Type Insights

Sanitary pads dominate the market, accounting for 60% of 2024 revenue, due to rising awareness of menstrual hygiene and strong urban adoption. Ultra-thin and overnight pads are gaining popularity, offering comfort and performance. Adult incontinence pads and baby diapers represent niche segments, growing steadily due to aging populations and rising eco-conscious parenting trends.

Material Type Insights

Bamboo fiber pads lead with a 40% share, favored for softness, high absorbency, and environmental sustainability. The market is witnessing a gradual shift from conventional wood pulp to plant-based hybrid materials. Corn starch and sugarcane fiber options are emerging, particularly in Europe and APAC.

Distribution Channel Insights

Online retail represents 35% of the market, driven by subscription models, direct-to-consumer engagement, and discreet delivery options. Supermarkets, pharmacies, and specialty stores continue to serve as key channels, particularly for mass-market adoption in North America and Europe. Institutional procurement through NGOs and government programs is steadily increasing, supporting bulk sales and market penetration.

End-Use Insights

Personal care dominates with a 55% share, driven by individual consumer adoption. Healthcare and hospitals are expanding buyers, especially in government-backed programs. Hospitality, airlines, and corporate wellness initiatives are emerging end-use sectors. Export-driven demand is significant, with Europe, North America, and Japan importing biodegradable pads in bulk from India and Southeast Asia.

| By Material Type | By Product Type | By Usage Mode | By Distribution Channel | By End-User |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America accounts for 25% of the market, led by the U.S. due to strong environmental awareness, disposable income, and online retail penetration. Consumers prefer premium eco-friendly pads and subscription services. Canada also shows steady adoption, particularly in urban centers.

Europe

Europe holds a 30% market share, with Germany, the UK, and France leading demand. Regulatory pressure against single-use plastics and strong consumer preference for eco-friendly products are driving growth. Germany exhibits the fastest growth (8% CAGR), fueled by government-led environmental programs and widespread awareness campaigns.

Asia-Pacific

APAC is the fastest-growing region (9–10% CAGR), driven by India and China. Large populations, government-backed menstrual hygiene programs, and growing urban awareness support adoption. Social media campaigns and e-commerce expansion further accelerate market penetration.

Latin America

Brazil and Mexico are gradually adopting biodegradable pads. Outbound travel, rising disposable income, and environmental awareness support niche demand. Group and family-oriented packages for eco-conscious consumers are emerging.

Middle East & Africa

MEA shows moderate adoption. South Africa, the UAE, and Saudi Arabia are key markets, supported by urban population awareness and disposable income. Institutional and NGO-led programs in Africa drive bulk procurement, particularly for schools and healthcare centers.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Biodegradable Pads Market

- Procter & Gamble

- Kimberly-Clark

- Unicharm

- Johnson & Johnson

- Hengan International

- Essity

- Sofy

- Naty

- Organyc

- Evy

- Bambo Nature

- Seventh Generation

- SCA

- Lil-lets

- Ecofemme

Recent Developments

- In May 2025, Procter & Gamble launched a new bamboo fiber-based biodegradable pad range in India, targeting urban consumers with eco-conscious preferences.

- In March 2025, Unicharm expanded its biodegradable pad production capacity in China with advanced plant-fiber technology, supporting government-led menstrual hygiene initiatives.

- In January 2025, Kimberly-Clark introduced an online subscription service in North America for biodegradable pads, leveraging e-commerce to reach environmentally conscious consumers directly.