Salon Furniture Market Size

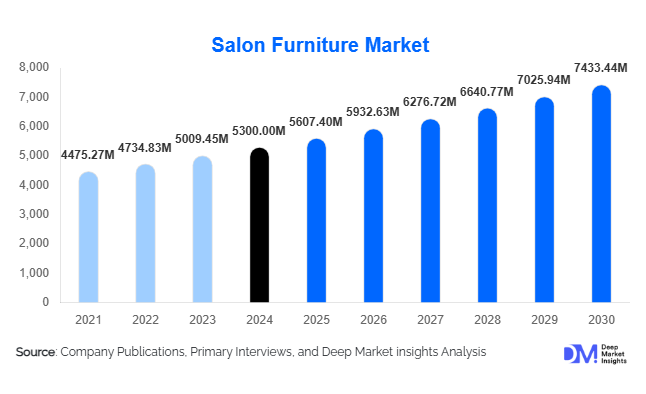

According to Deep Market Insights, the global salon furniture market size was valued at USD 5,300 million in 2024 and is projected to grow from USD 5,607.40 million in 2025 to reach USD 7,433.44 million by 2030, expanding at a CAGR of 5.8% during the forecast period (2025–2030). The salon furniture market growth is primarily driven by the expansion of professional grooming services, rapid salon modernization, and rising consumer preference for premium, ergonomic, and aesthetic salon interiors.

Key Market Insights

- Styling and all-purpose chairs dominate the market, accounting for approximately 27% of total sales in 2024, reflecting their central role in daily salon operations.

- North America leads the global market with around 39% share in 2024, driven by premium salon density and advanced interior refurbishment trends.

- Asia-Pacific is the fastest-growing regional market, led by India and China, where urbanization and disposable incomes are boosting new salon openings.

- Indirect sales channels account for over 56% of revenue, supported by distributor networks, showrooms, and online retail growth.

- Premiumization and sustainability are shaping product design, encouraging innovation in eco-friendly materials and modular configurations.

- Rising investment in smart furniture, including hydraulic chairs, water-saving shampoo stations, and integrated LED styling mirrors, signals growing technological adoption.

Latest Market Trends

Premium and Ergonomic Design Demand Rising

Modern salons are emphasizing comfort, durability, and aesthetic appeal, leading to a surge in demand for ergonomically designed, multi-functional furniture. Adjustable styling chairs with lumbar support, hydraulic lifts, and high-quality upholstery are becoming industry standards. Premium reception desks and modular cabinetry help create cohesive salon environments that elevate brand perception. This trend also drives replacement demand, as salons upgrade interiors to remain competitive and align with customer expectations for comfort and luxury.

Sustainable and Modular Furniture Solutions

Growing environmental awareness is prompting manufacturers to focus on eco-friendly materials such as recycled wood, bamboo, and low-VOC laminates. Modular furniture systems, allowing reconfiguration for various salon services, are also gaining traction. The modular trend supports small and medium salons looking to optimize space while maintaining aesthetics. Furniture designed for easy installation, water efficiency in backwash units, and recyclable components is increasingly favored by both operators and customers seeking sustainable business models.

Salon Furniture Market Drivers

Expansion of Professional Grooming and Wellness Services

As grooming and personal care services become mainstream across genders, salons and spas are multiplying globally. This surge in professional outlets creates recurring demand for new and replacement furniture, particularly in urban centers and malls. The integration of salon and spa services within hotels and resorts also amplifies the need for specialized, high-quality furniture pieces.

Premiumization of Salon Experiences

Salons are evolving into lifestyle destinations where comfort and visual appeal directly influence customer satisfaction and brand loyalty. The shift toward premium experiences drives investment in designer furniture, smart styling units, and bespoke interior solutions. This trend has spurred growth in high-margin product lines and boosted demand for technologically advanced and custom-made salon furniture.

Urbanization and Rising Disposable Income in Emerging Markets

Rapid economic growth in Asia-Pacific and Latin America has increased disposable income and urban lifestyles, expanding the customer base for salon services. Markets like India and China are witnessing double-digit growth in organized salon chains, which in turn stimulates large-scale procurement of modern salon furniture for new and franchised outlets.

Market Restraints

Supply Chain Disruptions and Raw Material Cost Volatility

Fluctuating costs of key materials such as metal frames, hydraulic components, leather, and ceramics increase production expenses. Transportation bottlenecks and global logistics delays further constrain timely supply and price stability, especially for small and mid-tier manufacturers dependent on imported inputs.

Rising Competition from At-Home Grooming Services

The proliferation of DIY grooming and home-based beauty services is slightly reducing the need for large-scale salon investments. Mobile beauty technicians and compact salon setups require fewer or smaller furniture units, potentially moderating the growth rate in traditional salon infrastructure spending.

Salon Furniture Market Opportunities

Emerging Market Expansion

Developing economies present high-growth potential for salon furniture manufacturers. Countries like India, Vietnam, and Indonesia are witnessing a surge in urban salon chains catering to the middle class. Companies focusing on affordable, modular furniture and localized distribution partnerships can gain early-mover advantages in these underpenetrated regions.

Premiumization and Experiential Salon Interiors

As salons differentiate themselves through ambience and customer comfort, demand for luxurious, ergonomically advanced, and visually striking furniture continues to rise. Manufacturers offering bespoke solutions, customizable materials, and integrated lighting or smart features are well-positioned to capture this expanding premium market segment.

Sustainable and Smart Furniture Innovation

There is a growing opportunity to integrate IoT-based monitoring (temperature, water usage, customer comfort), energy-efficient components, and recycled materials. Eco-certified furniture and water-saving shampoo stations are rapidly becoming key selling points, aligning with global sustainability goals and attracting eco-conscious salon operators.

Product Type Insights

Styling and all-purpose chairs hold the largest share, around 27% of the global salon furniture market in 2024. Their dominance stems from their universal application across salon services such as cutting, coloring, and makeup. Continuous innovations in hydraulic systems, comfort ergonomics, and material design have sustained this segment’s leadership. Additionally, frequent upgrades and shorter replacement cycles compared to other furniture categories maintain consistent revenue generation.

Distribution Channel Insights

Indirect sales channels account for approximately 56% of global revenue, encompassing distributors, dealers, and online marketplaces. Many salon owners prefer physical showrooms for product trials and installations, while the growing e-commerce segment enables competitive pricing and broader access. Manufacturers are increasingly leveraging omnichannel strategies to balance showroom presence with digital reach.

| By Product Type | By Material | By Distribution Channel | By End Use |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America remains the largest regional market, holding roughly 39% of the global share in 2024. The U.S. dominates with a mature salon infrastructure, high per-capita beauty service spending, and frequent interior renovations. Adoption of premium and smart salon furniture is strongest here, particularly among chain and boutique salons seeking brand differentiation.

Europe

Europe ranks second in market share, with Germany, the U.K., France, and Italy leading. Consumer preference for design-led, ergonomic, and sustainable furniture drives growth. The region’s emphasis on wellness and eco-friendly materials further reinforces demand for high-quality, durable furnishings.

Asia-Pacific

Asia-Pacific is the fastest-growing region, projected to achieve a CAGR above 8%. India and China are at the forefront, supported by rapid salon chain expansion and rising youth grooming trends. The increasing establishment of training academies and franchise salons further contributes to large-scale furniture procurement.

Latin America

Latin America, led by Brazil and Mexico, is witnessing growing demand driven by urbanization and the popularity of unisex salons. Although relatively smaller in value, the region offers high potential for affordable modular furniture manufacturers entering local partnerships.

Middle East & Africa

Rising luxury tourism and hospitality investments in the UAE, Saudi Arabia, and South Africa are fueling demand for high-end salon furniture. The expansion of premium spa resorts and wellness centers makes this region a niche but lucrative growth area.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Salon Furniture Market

- Takara Belmont Corporation

- Maletti Group

- Minerva Beauty, Inc.

- Collins Manufacturing Company

- Pietranera S.r.l.

- Gamma & Bross

- Salon Ambience

- Nelson Mobilier

- AGVGroup S.r.l.

- Keller International

- DIR Salon Furniture

- REM UK Ltd.

- Hokwerda

- Belava LLC

- Veeco Salon Furniture + Design

Recent Developments

- June 2025: Takara Belmont unveiled its new “Smart Chair Series,” integrating hydraulic lift sensors and Bluetooth connectivity for ergonomic adjustments.

- April 2025: Maletti Group introduced an eco-line of salon furniture made from 80% recycled wood and biodegradable upholstery materials.

- February 2025: Minerva Beauty expanded its U.S. manufacturing facility to enhance modular furniture production capacity for domestic and export markets.