Sailing Yacht Market Size

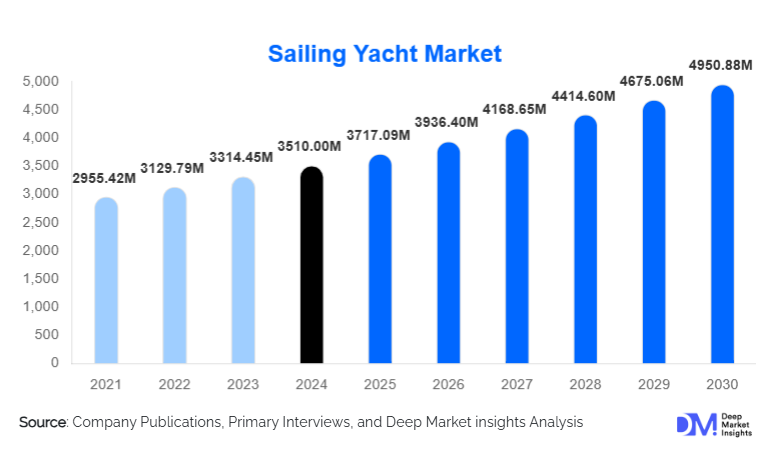

According to Deep Market Insights, the global sailing yacht market size was valued at USD 3,510 million in 2024 and is projected to grow from USD 3,717.09 million in 2025 to reach USD 4,950.88 million by 2030, expanding at a CAGR of 5.9% during the forecast period (2025–2030). The sailing yacht market growth is primarily driven by increasing demand for luxury and eco-friendly marine experiences, rising popularity of yacht chartering and fractional ownership models, and technological advancements in hybrid propulsion and smart sailing systems.

Key Market Insights

- Eco-friendly and hybrid sailing yachts are gaining prominence, as governments and consumers push for sustainable alternatives to traditional motorized yachts.

- Luxury yacht chartering is reshaping ownership patterns, enabling wider adoption of sailing yachts through leasing and fractional ownership, particularly in Europe, the Caribbean, and Asia-Pacific.

- North America dominates sailing yacht ownership, with the U.S. and Canada leading the market due to high disposable income and established marina infrastructure.

- Europe remains the fastest-growing region, driven by environmental regulations favoring sail-powered vessels and a strong culture of recreational boating.

- Asia-Pacific is emerging as a critical growth market, led by rising high-net-worth populations in China, India, and Southeast Asia, and increasing demand for premium yachts and charter services.

- Technological integration, including AI-assisted navigation, hybrid propulsion, and advanced sail materials, is enhancing yacht performance, safety, and user experience.

What are the latest trends in the sailing yacht market?

Hybrid and Smart Sailing Technologies

Yacht manufacturers are increasingly integrating hybrid sail-electric and diesel-electric propulsion systems to reduce fuel consumption and emissions. Advanced smart sail systems, automated rigging, and AI-assisted navigation are making yachts easier to operate, even for smaller crews or recreational users. These innovations not only improve efficiency but also attract eco-conscious buyers who prioritize sustainability alongside luxury. Carbon-fiber and composite hulls are becoming more common, allowing for lightweight construction without compromising durability.

Growth of Charter and Fractional Ownership Models

The charter market is rapidly expanding as consumers seek flexibility and lower capital commitment. Fractional ownership programs, yacht clubs, and leasing options allow multiple users to access high-end yachts without full ownership costs. Emerging tourist destinations in Southeast Asia, the Middle East, and Latin America are creating new demand for charter fleets. Fleet operators and OEMs are responding with yachts optimized for charter efficiency, standardized maintenance, and modular layouts to appeal to multiple customer segments.

What are the key drivers in the sailing yacht market?

Rising Demand from High-Net-Worth Individuals

The global increase in high-net-worth individuals is driving growth in luxury sailing yacht ownership. Buyers seek exclusive experiences, customization, and privacy, favoring yachts in the 20–40 meter range. This demand is especially strong in North America and Europe, where yacht ownership is seen as both a status symbol and a lifestyle investment. The rise of bespoke services, private charters, and ultra-luxury yacht designs is reinforcing the premium segment.

Technological Advancements Enhancing Accessibility

Automated sail handling, AI-assisted navigation, and hybrid propulsion systems are making sailing yachts more accessible to non-professional sailors. These technologies reduce operational complexity and enhance safety, attracting a broader audience, including younger buyers and first-time yacht owners. Digital integration also allows remote monitoring, maintenance scheduling, and fleet management, supporting charter operators and private owners alike.

Expansion of Marine Tourism and Coastal Infrastructure

Marine tourism is growing globally, with new marinas, yacht clubs, and coastal resorts expanding in Asia-Pacific, the Middle East, and Latin America. Improved coastal infrastructure is enabling longer cruising routes, attracting both private owners and charter customers. Growth in experiential tourism, eco-friendly travel, and adventure-oriented leisure activities is further driving the adoption of sailing yachts as recreational and lifestyle assets.

What are the restraints for the global market?

High Acquisition and Maintenance Costs

Luxury sailing yachts involve significant upfront investment and ongoing maintenance expenses, including dockage, crew, and equipment upkeep. These costs limit adoption among mid-tier buyers and constrain growth in emerging markets with lower disposable incomes.

Limited Skilled Labor and Marina Availability

Skilled crew, maintenance personnel, and modern marinas are concentrated in developed regions. Emerging markets often lack sufficient infrastructure and trained professionals, which can slow market penetration and increase operational costs for charter and private yacht owners.

What are the key opportunities in the sailing yacht market?

Eco-Luxury and Hybrid Yacht Segments

Growing environmental awareness and regulatory pressure are creating demand for eco-luxury yachts with hybrid propulsion, solar-assisted systems, and recyclable hull materials. Companies investing in low-emission designs and carbon-neutral operations can differentiate themselves and capture a rapidly expanding segment of sustainability-conscious buyers.

Emerging Markets and Coastal Economies

Countries such as Indonesia, Vietnam, the UAE, Saudi Arabia, and Brazil are expanding marina infrastructure and luxury tourism projects, generating new demand for sailing yachts. Partnerships with local manufacturers, regional assembly hubs, and tropical sailing designs present high-growth opportunities for global players.

Charter Fleet Expansion and Fractional Ownership

Increasing preference for chartering and shared ownership models is enabling wider adoption of sailing yachts without the high capital barrier of full ownership. Fleet operators and management companies can capitalize on this trend by providing modular, standardized yacht designs that reduce operational costs and improve customer accessibility.

Product Type Insights

Luxury sailing yachts dominate the market, particularly in the 20–40 meter range, catering to high-net-worth individuals seeking exclusivity, customization, and advanced technologies. Mid-range yachts (10–20 meters) are primarily driven by charter demand and first-time private owners. Entry-level yachts under 10 meters are gaining traction among recreational enthusiasts, sailing schools, and coastal tourism operators. Super-luxury yachts above 40 meters, while niche, represent a high-value market share with premium profit margins, driven by bespoke design and ultra-high-net-worth client demand.

Application Insights

Private ownership remains the largest application segment at 55% of the market, followed by commercial chartering. Sailing schools and training institutes are a growing niche, particularly in Europe and North America, providing skilled labor for yacht operations. Racing and competitive sailing represent a specialized but high-visibility segment, driving technological innovations and influencing consumer perception of performance-oriented yacht designs.

Distribution Channel Insights

Direct sales from OEMs to private owners and charter fleets dominate the market. Online platforms, digital marketplaces, and yacht brokers facilitate global sales, enabling buyers to compare models, customize layouts, and access charter networks. Subscription-based memberships, yacht clubs, and fractional ownership programs are emerging as new engagement channels. Marinas and yacht clubs remain critical for delivery, maintenance, and customer engagement.

Traveler Type Insights

Private owners represent the largest buyer segment, seeking long-term investment and lifestyle experiences. Charter customers are increasingly significant, particularly group travelers, corporate clients, and vacationers in Europe, North America, and the Asia-Pacific. Solo enthusiasts and couples drive demand for smaller, performance-oriented yachts, while family-oriented buyers prefer yachts with modular layouts, safety features, and multi-cabin designs.

Age Group Insights

Buyers aged 31–50 years account for the largest segment, combining disposable income with lifestyle aspirations. Younger buyers (18–30 years) increasingly prefer fractional ownership, chartering, and hybrid yachts for experiential sailing. Older buyers (51–65 years) dominate the luxury and ultra-luxury segment, emphasizing comfort, safety, and bespoke services. The 65+ segment is emerging in niche ultra-luxury yachts with accessibility-focused designs.

| By Yacht Length | By Hull Type | By Application | By Propulsion & Technology | By Material Type |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America holds 27% of the global market, led by the U.S. and Canada. High disposable incomes, established marina networks, and recreational boating culture support strong yacht adoption. Luxury private ownership and charter fleets are concentrated along the East Coast, Florida, and the Great Lakes.

Europe

Europe leads with 38% of the market, with France, Italy, Germany, and the Netherlands dominating demand. Regulatory support for low-emission yachts, established marine tourism, and a strong culture of recreational sailing underpin market growth. Europe is also the fastest-growing region for eco-luxury and hybrid sailing yachts.

Asia-Pacific

Asia-Pacific accounts for 18% of the market, driven by China, India, Australia, and Thailand. Rising HNWI populations, coastal tourism development, and luxury charter demand are boosting yacht adoption. Regional manufacturing and marina expansion are accelerating growth.

Middle East & Africa

This region holds 10% of the market, with the UAE and Saudi Arabia as key growth drivers. Strong luxury tourism infrastructure, high disposable income, and growing yacht charter markets support adoption. Africa also represents a critical hub for sailing regattas and high-value private yachts.

Latin America

Latin America accounts for 7% of the market, led by Brazil and Mexico. Demand is emerging for adventure-oriented private ownership and luxury chartering, with niche operators targeting affluent travelers.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Sailing Yacht Market

- Groupe Beneteau

- HanseYachts AG

- Fountaine Pajot

- Lagoon Catamarans

- Oyster Yachts

- Nautor Swan

- Perini Navi

- Baltic Yachts

- CNB Yachts

- X-Yachts

- Hallberg-Rassy

- Jeanneau

- Solaris Yachts

- Garcia Yachts

- Southern Wind Shipyard