Safety Helmets Market Size

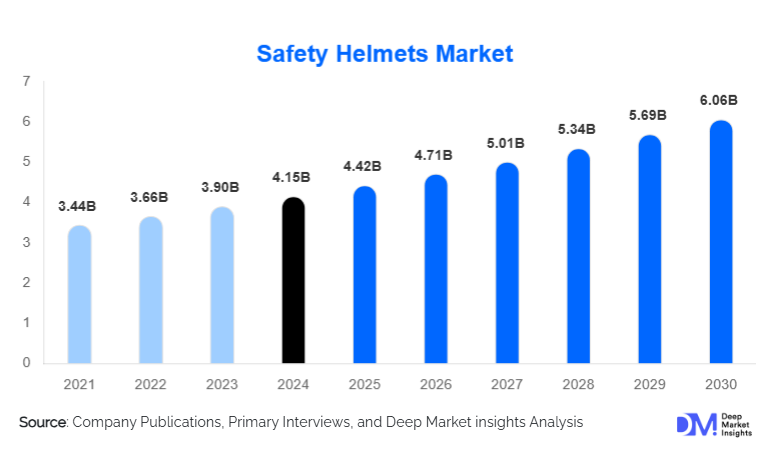

According to Deep Market Insights, the global safety helmets market size was valued at USD 4.15 billion in 2024 and is projected to grow from USD 4.42 billion in 2025 to reach USD 6.06 billion by 2030, expanding at a CAGR of 6.5% during the forecast period (2025–2030). The safety helmets market growth is primarily driven by stricter occupational safety regulations, rising infrastructure and industrial activity worldwide, and increasing employer focus on reducing workplace injuries and fatalities across high-risk industries.

Key Market Insights

- Construction remains the largest demand contributor, supported by global infrastructure expansion and mandatory head protection norms.

- Asia-Pacific dominates global consumption, led by China and India due to large industrial workforces and rapid urban development.

- HDPE-based helmets hold the largest material share, owing to cost efficiency and suitability for mass deployment.

- Type I helmets continue to dominate volumes, though Type II helmets are gaining traction in developed markets.

- Direct B2B procurement accounts for the majority of sales, driven by bulk contracts from construction firms and manufacturers.

- Smart and sensor-enabled helmets are emerging as a premium growth segment, especially in mining and oil & gas.

What are the latest trends in the safety helmets market?

Adoption of Smart and Connected Safety Helmets

The safety helmets market is witnessing increasing adoption of smart helmets equipped with sensors, real-time impact detection, location tracking, and fatigue monitoring. These solutions are particularly gaining traction in mining, oil & gas, and large-scale construction projects where worker monitoring and predictive safety management are critical. Smart helmets enable employers to reduce accident response times and improve compliance with safety audits. Although currently representing a small share of total volumes, smart helmets command significantly higher average selling prices and are expected to grow at a double-digit rate over the forecast period.

Shift Toward Lightweight and Ergonomic Designs

Manufacturers are increasingly focusing on lightweight, ergonomically designed helmets that improve worker comfort without compromising safety. Advanced polymer blends and composite materials are being adopted to reduce helmet weight, enhance ventilation, and improve wearability for long working hours. This trend is particularly relevant in hot climates and labor-intensive industries such as construction and manufacturing, where comfort directly impacts compliance and productivity.

What are the key drivers in the safety helmets market?

Stricter Occupational Safety Regulations

Government-mandated workplace safety regulations remain the most significant driver of the safety helmets market. Regulatory bodies across North America, Europe, and the Asia-Pacific enforce mandatory helmet usage in construction sites, factories, mines, and energy installations. Increased inspections, penalties for non-compliance, and alignment with international safety standards have made safety helmets a non-discretionary procurement item for employers.

Growth in Global Infrastructure and Industrial Activity

Large-scale infrastructure development, particularly in the Asia-Pacific, the Middle East, and Africa, is fueling sustained demand for safety helmets. Rapid urbanization, transportation projects, power generation facilities, and industrial park developments are expanding the global workforce exposed to hazardous environments. This directly translates into higher demand for certified head protection equipment.

What are the restraints for the global market?

Raw Material Price Volatility

Fluctuations in the prices of key raw materials such as HDPE, ABS, and polycarbonate pose a challenge for helmet manufacturers. As these materials are derived from petrochemicals, price volatility impacts production costs and profit margins, particularly in price-sensitive emerging markets.

Competition from Low-Cost Unorganized Players

In developing regions, unorganized manufacturers offering low-cost, non-certified helmets create pricing pressure for established brands. These products often fail to meet safety standards, but their affordability limits premium product penetration and affects overall market value growth.

What are the key opportunities in the safety helmets industry?

Smart PPE Integration in High-Risk Industries

The integration of digital technologies into personal protective equipment presents a major opportunity for helmet manufacturers. Smart helmets designed for mining, oil & gas, and utilities enable real-time monitoring, compliance tracking, and predictive maintenance of worker safety. As industrial employers increasingly adopt digital safety management systems, demand for connected helmets is expected to rise significantly.

Infrastructure-Led Demand in Emerging Economies

Government-led infrastructure initiatives across Asia-Pacific, the Middle East, and Africa offer long-term growth opportunities. Large public investments in transportation, energy, and urban development are creating sustained procurement pipelines for safety helmets, particularly through bulk government and contractor tenders.

Product Type Insights

Construction safety helmets dominate the global safety helmets market, accounting for approximately 38% of total revenue in 2024. This leadership is primarily driven by sustained growth in residential, commercial, and infrastructure construction worldwide, coupled with the strict enforcement of occupational safety regulations that mandate helmet usage at construction sites. Large-scale public infrastructure programs, urban redevelopment projects, and private real estate investments continue to generate consistent demand for construction-grade helmets, making this segment the most volume-intensive globally.

Industrial and manufacturing safety helmets represent the second-largest product category, supported by increasing automation, factory modernization, and heightened regulatory oversight in manufacturing environments. As factories adopt advanced machinery and robotics, employers are investing in certified head protection to minimize accident-related downtime and comply with workplace safety audits. Meanwhile, specialized helmets used in mining, electrical work, oil & gas, and firefighting account for a smaller share by volume but contribute disproportionately to market value. These helmets command premium pricing due to advanced features such as electrical insulation, thermal resistance, impact absorption, and compatibility with communication and breathing apparatus, making them critical in high-risk operational environments.

Material Insights

HDPE-based safety helmets hold the largest material share, accounting for approximately 42% of the global market in 2024. Their dominance is driven by a combination of durability, lightweight characteristics, chemical resistance, and cost efficiency, making them ideal for large-scale deployment in construction and general industrial applications. HDPE helmets are particularly favored in emerging markets where high-volume procurement and affordability are key purchasing criteria.

ABS helmets occupy a strong position in mid-range applications that require enhanced impact resistance and improved temperature tolerance. These helmets are commonly used in manufacturing, utilities, and transportation sectors where safety requirements exceed basic protection standards. Polycarbonate and composite material helmets are witnessing faster growth despite a lower volume share, driven by rising demand in premium and specialized applications. Their superior strength-to-weight ratio, electrical insulation properties, and resistance to extreme environments make them increasingly popular in oil & gas, mining, utilities, and emergency response operations.

Distribution Channel Insights

Direct sales channels dominate the safety helmets market, contributing over 55% of total revenue in 2024. Large construction companies, industrial manufacturers, utilities, and government bodies prefer direct procurement through long-term supply agreements to ensure consistent quality, regulatory compliance, and cost efficiencies. These contracts often involve bulk purchases and standardized specifications, reinforcing the dominance of direct B2B sales.

Industrial safety distributors play a critical role in serving small and mid-sized enterprises that require flexible order quantities and localized supply support. These distributors provide value-added services such as product training, compliance guidance, and after-sales support. Meanwhile, e-commerce platforms are emerging as a fast-growing distribution channel, particularly for replacement demand, SMEs, and contractors. Digital procurement platforms offer pricing transparency, faster delivery, and wider product selection, making them increasingly attractive in mature and digitally enabled markets.

End-Use Industry Insights

The construction industry represents the largest end-use segment, contributing nearly 40% of the global safety helmets market value. This dominance is driven by the high concentration of manual labor, exposure to falling objects, and strict enforcement of head protection regulations across construction sites worldwide. Ongoing infrastructure investments in transportation, energy, and urban development continue to reinforce construction as the primary demand driver.

Manufacturing and utilities follow as major end-use segments, supported by increasing automation, stricter factory safety compliance, and the growing complexity of industrial operations. Mining and oil & gas industries, while smaller in workforce size, generate higher per-unit revenue due to the use of premium, high-specification helmets designed for extreme conditions. Emerging end-use applications such as renewable energy installations, large-scale logistics warehouses, and data center construction are also contributing to incremental demand, particularly in developed and high-growth economies.

| By Product Type | By Material | By End-Use Industry | By Distribution Channel |

|---|---|---|---|

|

|

|

|

Regional Insights

Asia-Pacific

Asia-Pacific leads the global safety helmets market with approximately 44% share in 2024, driven by rapid industrialization, large-scale infrastructure development, and a massive industrial workforce. China accounts for the largest share within the region, supported by extensive manufacturing activity, construction output, and government-led infrastructure projects. India is the fastest-growing market in Asia-Pacific, fueled by rapid urbanization, expansion of transportation and energy infrastructure, and increasing enforcement of occupational safety standards across construction and manufacturing sectors. Rising awareness of worker safety and growing domestic PPE manufacturing capacity further support regional growth.

North America

North America holds around 24% of the global safety helmets market, led by the United States. Regional demand is driven primarily by replacement cycles rather than workforce expansion, as safety helmet usage is already well-established. High regulatory standards, frequent safety audits, and strong adoption of advanced Type II and smart helmets are key growth drivers. Increased investment in utilities, renewable energy projects, and infrastructure rehabilitation is further supporting steady demand across the region.

Europe

Europe accounts for approximately 21% of global demand, with Germany, the United Kingdom, and France as the leading markets. Growth is supported by stringent worker safety regulations, widespread adoption of certified PPE, and a strong preference for high-quality, ergonomically designed helmets. The region also benefits from growing investment in renewable energy, industrial automation, and infrastructure modernization, which sustains demand for both standard and premium safety helmets.

Middle East & Africa

The Middle East & Africa region represents the fastest-growing market, with growth exceeding the global average. Demand is driven by large-scale construction and infrastructure megaprojects in countries such as Saudi Arabia and the UAE, alongside sustained mining activity across Africa. Expanding oil & gas operations and increasing government focus on worker safety compliance are further accelerating helmet adoption. As safety regulations strengthen across the region, demand for certified and higher-specification helmets is expected to rise significantly.

Latin America

Latin America exhibits steady growth, led by Brazil and Mexico, where demand is supported by mining, energy, and industrial expansion. Infrastructure development, combined with increasing enforcement of occupational safety standards, is improving helmet penetration across construction and industrial sectors. While price sensitivity remains a factor, gradual shifts toward certified safety equipment are supporting long-term market growth in the region.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Leading Companies in the Safety Helmets Industry

- 3M

- Honeywell

- MSA Safety

- Uvex Group

- Delta Plus

- JSP

- Centurion Safety Products

- Dräger

- Pyramex

- Cintas

- Radian Safety

- Lakeland Industries

- Bullard

- Ansell

- Portwest