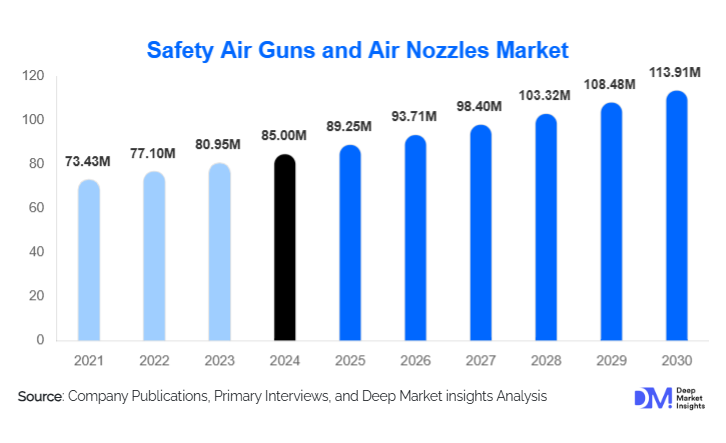

Safety Air Guns and Air Nozzles Market Size

According to Deep Market Insights, the global safety air guns and air nozzles market size was valued at USD 85.00 million in 2024 and is projected to grow from USD 89.25 million in 2025 to reach USD 113.91 million by 2030, expanding at a CAGR of 5% during the forecast period (2025–2030). The market growth is primarily driven by rising industrial automation, increasing emphasis on workplace safety standards, and adoption across key end-use industries such as automotive, electronics, and manufacturing.

Key Market Insights

- Safety air guns and nozzles are increasingly integrated into automated production lines, ensuring precise, efficient, and safe handling of debris, moisture, and dust.

- Regulatory compliance is a significant growth driver, with industries in North America and Europe replacing conventional air guns to meet OSHA, CE, and ISO safety standards.

- Technological innovations, including ergonomic designs, low-noise operation, and IoT-enabled air tools, are enhancing productivity and operational efficiency.

- Emerging markets in Asia-Pacific and Latin America offer substantial growth opportunities, driven by expanding industrial bases and infrastructure investments.

- Energy-efficient and sustainable air tools are gaining preference, aligning with global trends toward green manufacturing and reduced carbon footprints.

- Distribution channels are evolving, with direct sales dominating, supported by online B2B platforms for specialized industrial clients.

What are the latest trends in the safety air guns and air nozzles market?

Automation and Smart Air Tools Integration

Industrial automation is increasingly incorporating safety air guns and nozzles into production lines for cleaning, drying, and cooling applications. IoT-enabled air tools provide real-time monitoring of airflow, pressure, and maintenance requirements, improving operational efficiency and minimizing downtime. Adjustable airflow nozzles, low-noise designs, and ergonomic hand-held guns are now standard, appealing to safety-conscious manufacturers. Smart tools also help companies comply with strict safety regulations while optimizing energy consumption.

Energy Efficiency and Sustainable Manufacturing

Manufacturers are prioritizing energy-efficient designs that reduce compressed air usage, contributing to lower operating costs and environmental impact. Air nozzles with precision airflow and low-pressure operation are increasingly preferred in Europe and North America. Sustainability-focused buyers are driving demand for products that align with ISO 14001 environmental standards, while manufacturers are developing solutions that combine performance with reduced carbon footprints, making sustainability a core market trend.

What are the key drivers in the safety air guns and air nozzles market?

Industrial Growth and Automation

The rapid expansion of manufacturing, automotive, electronics, and packaging sectors is fueling demand for safety air guns and nozzles. Automated assembly lines require reliable tools for cleaning, drying, and material handling, supporting higher adoption rates. The move toward smart factories in Asia-Pacific and North America further strengthens this driver, as precision and workplace safety are paramount in automated environments.

Stringent Safety Regulations

Global standards such as OSHA (U.S.), EU Machinery Directive, and ISO 4414 encourage industries to replace high-pressure conventional air guns with certified safety alternatives. Compliance with these standards reduces workplace injuries and liability, making certified air guns and nozzles a priority purchase for industrial operators, particularly in North America and Europe.

Workplace Efficiency and Ergonomics

Modern manufacturing increasingly values operator comfort and efficiency. Lightweight, ergonomic safety air guns reduce fatigue, while adjustable air nozzles improve productivity. These tools also enhance safety, lowering injury risks, making them highly desirable across automotive and electronics manufacturing operations globally.

What are the restraints for the global market?

High Initial Investment Costs

Safety air guns and advanced nozzles come at premium prices, which may restrict adoption among small and medium-sized manufacturers. Price sensitivity in emerging markets slows market penetration despite clear operational benefits and long-term cost savings.

Dependence on Compressed Air Infrastructure

Reliable compressed air systems are critical for optimal tool performance. In regions with underdeveloped industrial infrastructure, inconsistent air supply limits adoption. Without sufficient pressure and maintenance support, industries cannot fully leverage the benefits of advanced safety air tools.

What are the key opportunities in the safety air guns and air nozzles market?

Expansion into Emerging Industrial Hubs

Regions such as India, Vietnam, Indonesia, Brazil, and Mexico present growth opportunities due to expanding manufacturing bases and industrial infrastructure investments. Local production, partnerships, and distribution networks can help manufacturers tap into these high-demand markets.

Technological Innovation

R&D in ergonomic, smart, and IoT-enabled air guns and nozzles allows manufacturers to differentiate their offerings. Products with pressure regulation, real-time monitoring, and predictive maintenance capabilities appeal to industrial clients seeking efficiency and safety compliance.

Regulatory-Driven Replacement and Export Markets

Strict safety regulations in developed regions create a replacement market for outdated tools. Additionally, export-driven demand from countries like the U.S., Germany, and Japan offers growth opportunities for manufacturers focusing on high-quality, compliant air guns and nozzles.

Product Type Insights

Safety air guns dominate the market, accounting for approximately 55% of global market share in 2024, due to their extensive use in industrial cleaning and material handling applications. Blow-off and trigger-activated guns are increasingly favored for their precision and ergonomic design. Air nozzles, particularly stainless steel and adjustable designs, capture about 45% of the market, offering durability, safety, and energy efficiency in industrial applications.

Application Insights

The automotive and transportation industry leads end-use demand with a 30% market share in 2024. Electronics, pharmaceuticals, and food processing also represent key applications, as safety air guns and nozzles are essential for cleaning, drying, and material handling processes. Emerging applications include aerospace maintenance and precision manufacturing, driving incremental market growth and supporting export-oriented demand.

Distribution Channel Insights

Direct sales remain the dominant channel, accounting for 50% of market share in 2024, due to the technical nature of industrial air tools and the need for installation support and after-sales services. Distributors and dealers are critical in emerging markets, while online B2B platforms are gradually increasing in adoption, providing convenience and transparency for buyers.

| By Product Type | By Pressure Rating | By Material Type | By End-Use Industry | By Distribution Channel |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America accounts for approximately 25% of the global market in 2024, driven by stringent workplace safety regulations and high adoption of automated manufacturing processes. The U.S. leads demand, with strong industrial infrastructure supporting widespread use of certified safety air guns and nozzles.

Europe

Europe holds about 22% market share in 2024, with Germany, the UK, and France being key markets. High compliance standards, energy-efficient initiatives, and automation in the automotive and electronics industries are driving market growth. Europe also represents a major opportunity for premium and technologically advanced products.

Asia-Pacific

Asia-Pacific is the fastest-growing region due to industrial expansion in China, India, Japan, and Southeast Asia. Rising manufacturing output, infrastructure investments, and increasing exports create high demand for safety-compliant air guns and nozzles.

Latin America

Latin America is witnessing gradual adoption, particularly in Brazil, Mexico, and Argentina. Growth is driven by industrial modernization and demand for export-quality manufacturing processes.

Middle East & Africa

While Africa serves as a production hub for certain tools, demand is growing in the Middle East, led by the UAE and Saudi Arabia. Industrial expansion, oil and gas facilities, and high-income manufacturing projects are key drivers.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Safety Air Guns and Air Nozzles Market

- EXAIR Corporation

- Desoutter Industrial Tools

- Festo AG & Co. KG

- Norgren Ltd.

- ITW Blow Gun

- Pneumax S.p.A

- Camozzi Automation S.p.A

- SMC Corporation

- Bimba Manufacturing Company

- Atlas Copco AB

- CP Industries

- Parker Hannifin Corporation

- Walther Präzision GmbH

- Hilmor Industrial Tools

- Mattei Compressors