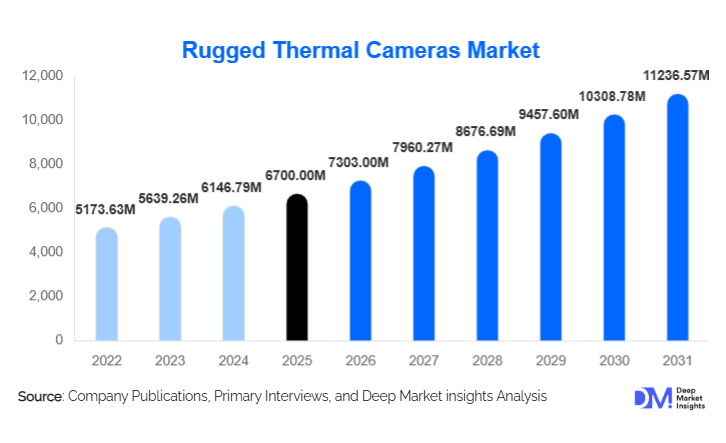

Rugged Thermal Cameras Market Size

According to Deep Market Insights, the global rugged thermal cameras market size was valued at USD 6,700.00 million in 2024 and is projected to grow from USD 7,303.00 million in 2025 to reach USD 11,236.57 million by 2030, expanding at a CAGR of 9.0% during the forecast period (2025–2030). Market growth is primarily driven by rising defense and homeland security spending, increasing adoption of predictive maintenance across industrial sectors, and growing demand for surveillance and monitoring solutions capable of operating in extreme environmental conditions.

Key Market Insights

- Defense and military applications dominate demand, accounting for the largest share due to the continuous modernization of surveillance, reconnaissance, and border security systems.

- Uncooled thermal cameras lead technology adoption, driven by lower costs, reduced maintenance, and expanding use in industrial and commercial environments.

- North America holds the largest market share, supported by high defense budgets, critical infrastructure monitoring, and advanced industrial automation.

- Asia-Pacific is the fastest-growing region, fueled by defense procurement in China and India and expanding energy and infrastructure investments.

- LWIR-based rugged thermal cameras dominate wavelength usage, preferred for outdoor, long-range, and all-weather detection.

- Integration of AI and Industrial IoT platforms is transforming rugged thermal cameras from passive imaging devices into intelligent decision-support tools.

What are the latest trends in the rugged thermal cameras market?

Shift Toward AI-Enabled and Intelligent Thermal Imaging

Manufacturers are increasingly integrating artificial intelligence and advanced analytics into rugged thermal cameras. AI-powered anomaly detection, automated hotspot identification, and real-time threat classification are becoming standard features, particularly in defense, critical infrastructure, and industrial safety applications. These capabilities significantly reduce human intervention, improve response times, and enhance operational efficiency. Edge AI processing is gaining traction, allowing cameras to analyze data locally in remote or bandwidth-constrained environments such as offshore platforms, border zones, and mining sites.

Growing Adoption in Predictive Maintenance and Asset Monitoring

Rugged thermal cameras are being rapidly adopted for predictive maintenance across power generation, utilities, oil & gas, and heavy manufacturing. Thermal imaging enables early detection of overheating components, electrical faults, and mechanical wear, reducing unplanned downtime and maintenance costs. Integration with cloud-based condition monitoring platforms and digital twins is expanding the role of rugged thermal cameras beyond inspection tools to core components of industrial digitalization strategies.

What are the key drivers in the rugged thermal cameras market?

Rising Defense and Homeland Security Expenditure

Geopolitical tensions, border security concerns, and increasing defense modernization programs are significantly driving demand for rugged thermal cameras. These systems are essential for night vision, target acquisition, perimeter surveillance, and unmanned systems. Continuous procurement cycles by defense forces globally ensure long-term, stable demand for ruggedized thermal imaging solutions.

Increasing Industrial Safety and Regulatory Compliance

Stricter safety regulations in energy, utilities, and industrial manufacturing are accelerating the adoption of rugged thermal cameras. Thermal imaging plays a critical role in fire prevention, electrical inspections, and hazardous area monitoring, particularly in environments where standard cameras cannot withstand heat, vibration, dust, or moisture.

What are the restraints for the global market?

High Initial Capital and Lifecycle Costs

Advanced rugged thermal cameras, especially cooled systems, require significant upfront investment and specialized maintenance. These high costs can limit adoption among small and mid-sized enterprises, particularly in developing markets, slowing penetration outside defense and large industrial users.

Export Controls and Technology Restrictions

Thermal imaging technologies are subject to export regulations and defense trade controls in several countries. These restrictions can delay cross-border transactions, limit addressable markets, and increase compliance costs for manufacturers, acting as a restraint on market expansion.

What are the key opportunities in the rugged thermal cameras industry?

Expansion of Border Surveillance and Smart Infrastructure

Governments worldwide are investing heavily in smart border surveillance, critical infrastructure protection, and smart city initiatives. Rugged thermal cameras play a vital role in all-weather, day-and-night monitoring of borders, airports, ports, highways, and utilities. Large-scale public infrastructure programs present long-term opportunities for both established manufacturers and new technology-focused entrants.

Emergence of Extreme-Environment Commercial Applications

New commercial applications are emerging in offshore wind farms, LNG terminals, autonomous mining operations, and marine navigation. These environments demand high-durability, corrosion-resistant, and long-lifecycle imaging systems. Vendors that tailor rugged thermal cameras for these niche but high-growth applications can unlock premium pricing and long-term service contracts.

Product Type Insights

Handheld rugged thermal cameras dominate the market, driven by widespread use in military patrols, industrial inspections, and emergency response. Fixed-mount and PTZ rugged thermal cameras are increasingly deployed for perimeter security, critical infrastructure monitoring, and transportation surveillance. Wearable rugged thermal cameras, including helmet- and body-mounted systems, are gaining traction in defense and law enforcement for situational awareness and tactical operations.

Technology Insights

Uncooled thermal cameras account for the majority of deployments due to their cost-effectiveness, compact design, and suitability for industrial and commercial use. Cooled thermal cameras, while representing a smaller share, remain critical in long-range detection, high-sensitivity military applications, and advanced surveillance systems where superior image quality is required.

End-Use Industry Insights

Defense and military represent the largest end-use segment, accounting for approximately 38% of global demand in 2024. Industrial manufacturing and utilities form the second-largest segment, driven by predictive maintenance and safety monitoring needs. Oil & gas, mining, marine, and transportation sectors are experiencing accelerating adoption, particularly in harsh and remote operating environments.

Distribution Channel Insights

Direct OEM sales dominate the market, as rugged thermal cameras are often customized and sold through long-term contracts, particularly in defense and infrastructure projects. System integrators and EPC contractors play a crucial role in large-scale deployments, while authorized industrial distributors support aftermarket sales and standardized industrial applications.

| By Product Type | By Technology | By Wavelength | By End-Use Industry | By Distribution Channel |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America leads the global rugged thermal cameras market, accounting for approximately 36% of 2024 revenue. The United States drives regional demand through defense spending, homeland security programs, and advanced industrial automation. Adoption is also strong in utilities, transportation, and critical infrastructure monitoring.

Europe

Europe represents a significant share of the market, supported by defense collaborations, industrial safety regulations, and energy transition investments. Countries such as Germany, the U.K., France, and Italy are key contributors, with rising demand for surveillance, rail safety, and smart infrastructure monitoring.

Asia-Pacific

Asia-Pacific is the fastest-growing region, with China and India leading demand through military modernization, border security, and large-scale infrastructure development. Rapid industrialization and expanding energy projects are further accelerating the adoption of rugged thermal cameras across the region.

Latin America

Latin America is an emerging market, driven by mining, oil & gas, and infrastructure projects in countries such as Brazil, Chile, and Mexico. While overall adoption remains moderate, growth potential is strong in industrial safety and resource extraction applications.

Middle East & Africa

The Middle East and Africa region shows robust demand driven by oil & gas infrastructure, border surveillance, and critical asset protection. Countries such as Saudi Arabia, UAE, Israel, and South Africa are key markets, supported by high security spending and harsh operating environments that necessitate rugged imaging solutions.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Leading Manufacturers in the Rugged Thermal Cameras Market

- FLIR Systems (Teledyne)

- L3Harris Technologies

- Leonardo S.p.A.

- BAE Systems

- Thales Group

- Raytheon Technologies

- Hensoldt

- Xenics

- Axis Communications

- Hikvision

- Dahua Technology

- Opgal

- InfraTec

- SATIR

- Workswell