Rugged Notebooks Market Size

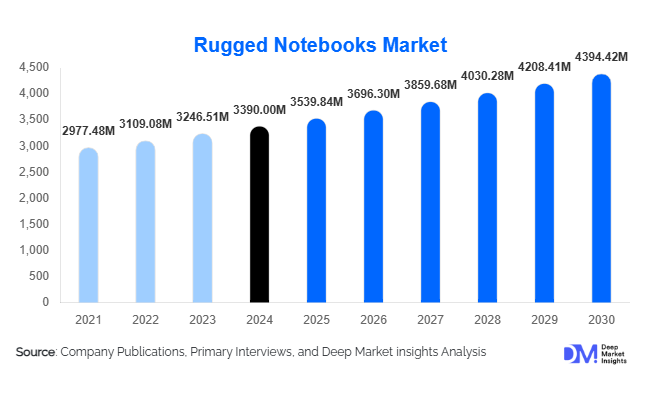

According to Deep Market Insights, the global rugged notebooks market size was valued at USD 3,390.00 million in 2024 and is projected to grow from USD 3,539.84 million in 2025 to reach USD 4,394.42 million by 2030, expanding at a CAGR of 4.42% during the forecast period (2025–2030). Rugged notebooks market growth is primarily driven by the rapid digitalization of field operations, increasing deployment of edge-computing solutions in harsh environments, and ongoing modernization programs in defense, public safety, utilities, and industrial sectors.

Key Market Insights

- Fully rugged notebooks account for the largest share of global revenue, driven by mission-critical use in defense, public safety, energy, and heavy industrial applications.

- Windows-based rugged notebooks dominate the operating system landscape, representing an estimated 80% of deployments owing to legacy software compatibility and enterprise integration.

- North America leads the global rugged notebooks market by value, supported by substantial defense, homeland security, and utilities spending.

- Asia-Pacific is the fastest-growing region, with strong demand from China, India, Japan, South Korea, and Southeast Asia, driven by infrastructure expansion and industrial automation.

- Defense, military, and public safety together represent roughly 45% of market demand, underscoring the strategic role of rugged notebooks in command, control, and field operations.

- Technological integration—AI acceleration, 5G connectivity, and edge analytics—is reshaping product roadmaps and increasing value per device.

What are the latest trends in the rugged notebooks market?

AI-Enabled and 5G-Ready Rugged Platforms

One of the most pronounced trends in the rugged notebooks market is the integration of AI-ready hardware and advanced connectivity. New-generation rugged notebooks are increasingly equipped with dedicated NPUs or GPU acceleration, enabling on-device analytics for video, sensor data, and predictive maintenance workloads. Combined with 4G/5G and Wi-Fi 6/6E/7 connectivity, these devices can function as intelligent edge nodes, running complex applications without relying solely on centralized data centers. This is particularly valuable for defense, public safety, and utilities, where latency-sensitive applications such as situational awareness, computer vision, and asset monitoring demand real-time processing. As organizations scale their industrial IoT deployments, AI-capable rugged notebooks are becoming a cornerstone of distributed computing architectures across plants, field assets, and mobile fleets.

Industrial IoT and Edge Computing Integration

The market is also seeing a strong shift toward rugged notebooks being tightly integrated into broader industrial IoT and automation ecosystems. Instead of acting merely as standalone field laptops, rugged notebooks increasingly serve as operator terminals for SCADA systems, digital work orders, and AR-assisted maintenance workflows. They are frequently paired with sensors, drones, and inspection tools, allowing technicians to capture and analyze data on-site—even in remote or hazardous locations. Manufacturers are offering configurable I/O, vehicle docking, and intrinsic safety options to meet specialized requirements in oil & gas, mining, utilities, and transportation. This convergence of rugged notebooks with edge gateways and industrial software platforms is driving higher specification devices, longer deployments, and deeper integration into enterprise workflows.

What are the key drivers in the rugged notebooks market?

Shift from Consumer Laptops to Lower-TCO Rugged Devices

Organizations are increasingly recognizing that consumer-grade laptops, even when used with protective cases, have high lifecycle costs in demanding environments. Frequent breakages, downtime, data loss, and repair cycles directly impact operations in sectors such as utilities, public safety, and logistics. Rugged notebooks, although more expensive upfront, deliver lower total cost of ownership over three to five years by reducing failure rates and extending usable lifespans. This economic rationale is a key driver behind fleet-wide refreshes, particularly in enterprises that have quantified the hidden costs of consumer devices in field roles. As more organizations formalize TCO analyses during procurement, fully and semi-rugged notebooks gain a structural advantage in mission-critical deployments.

Expansion of Mobile Workforces and Field Digitalization

The expansion of mobile and distributed workforces is another major driver. Utilities, telecom operators, logistics providers, construction firms, and public sector agencies are digitizing field workflows using GIS, work management, inspection, and incident-response applications. Rugged notebooks provide the ideal balance of screen size, keyboard input, processing power, and connectivity to support these applications in harsh or outdoor conditions. They enable technicians, engineers, and first responders to access enterprise systems, technical documentation, and real-time asset data on-site. As organizations continue their Industry 4.0 and smart infrastructure journeys, the number of field roles that require robust, always-on computing is rising, directly supporting rugged notebook adoption.

Technological Advancements and Product Differentiation

Continuous technological innovation is also driving market growth. Modern rugged notebooks feature high-brightness sunlight-readable displays, hot-swappable batteries, advanced thermal design, and support for a wide range of peripherals and specialized modules. Vendors are differentiating through modular architectures that allow customized I/O, secure communication modules, and sector-specific certifications (e.g., ATEX for hazardous environments). Enhanced security capabilities—such as TPM-based encryption, secure boot, smart-card readers, and compliance with government security standards—are crucial for defense and government buyers. These advancements not only attract new customers but also accelerate replacement demand among existing users looking to leverage better performance, security, and usability.

What are the restraints for the global market?

High Upfront Costs and Budget Constraints

Despite strong TCO advantages, rugged notebooks face resistance in budget-constrained environments due to higher initial purchase prices. Fully rugged and ultra-rugged models can cost several times more than mainstream business laptops, making capital budgeting a key hurdle—especially for smaller enterprises, municipal agencies, and emerging-market buyers. Procurement teams often prioritize short-term capital expenditure over long-term lifecycle savings, limiting adoption in non-mission-critical roles. In price-sensitive regions, this dynamic contributes to slower penetration of fully rugged devices and encourages the use of semi-rugged notebooks or protected consumer laptops as perceived “good enough” alternatives.

Competition from Rugged Tablets and Enhanced Consumer Devices

The rugged notebooks market also faces strong competition from rugged tablets, handhelds, and increasingly durable consumer laptops. In workflows where data entry is light and touch-based interfaces suffice—such as barcode scanning, light inspections, or route confirmation—rugged tablets and handhelds can offer more mobility and lower cost. At the same time, mainstream business laptops have improved durability with spill-resistant keyboards, reinforced chassis, and basic shock protection, narrowing the perceived gap for some office-leaning use cases. This competitive landscape can delay or reduce spending on rugged notebooks, as buyers evaluate multiple form factors and consider mixed-device strategies.

What are the key opportunities in the rugged notebooks industry?

Defense, Public Safety, and Critical Infrastructure Modernization

Global defense forces, law-enforcement agencies, and emergency services are investing heavily in digital command and control, connected vehicles, and secure field communications. Rugged notebooks are central to these modernization efforts, serving as mobile command terminals in vehicles, field HQs, and frontline operations. As agencies move toward network-centric warfare, real-time incident management, and integrated emergency response platforms, demand for secure, interoperable, and highly rugged devices will expand. Significant opportunities exist in multi-year modernization programs, cross-border defense collaborations, and public safety digitization, where rugged notebooks can be standardized across agencies and units for many years.

High-Growth Industrial and APAC Markets

Industrial sectors and emerging regions offer substantial room for expansion. In manufacturing, mining, oil & gas, and utilities, rugged notebooks are aligned with Industry 4.0 initiatives, predictive maintenance programs, and remote asset monitoring strategies. In Asia-Pacific, large-scale investments in infrastructure, transport, smart cities, and energy are fueling demand for resilient field computing. Policies promoting local manufacturing and technology self-reliance—such as “Make in India” and regional digital economy programs—create opportunities for vendors to localize production, form joint ventures, and tailor rugged notebooks to local network standards and language requirements. Companies able to combine strong technical performance with localized service, financing, and ecosystem partnerships are well-positioned to capture share in these high-growth markets.

Product Type Insights

By product type, fully rugged notebooks dominate the global market, accounting for an estimated half of total revenue. These devices are engineered to meet stringent environmental and military standards, including MIL-STD-810 and high IP ratings, making them suitable for defense, public safety, energy, and heavy industrial operations where failure is not an option. Fully rugged models often feature sealed ports, shock-mounted components, high-brightness displays, and hot-swappable batteries, allowing operation in extreme temperatures, dust, moisture, and vibration. Semi-rugged notebooks occupy the mid-range, targeting logistics, light industrial, and field-office applications where enhanced durability is required but conditions are less extreme. Ultra-rugged or military-grade notebooks, while smaller in volume, command premium pricing and are tailored to specialized defense, aerospace, and critical mission roles, contributing disproportionately to profit pools.

Application Insights

Across applications, defense, military, and public safety remain the largest end-use cluster, representing roughly 45% of rugged notebook demand. Typical deployments include tactical command systems, vehicle-mounted units in patrol cars and emergency response vehicles, and field terminals for mission planning and reconnaissance. Industrial manufacturing and automation form the next major application area, using rugged notebooks for machine interfaces, quality control, and maintenance in environments where dust, vibration, and temperature fluctuations are common. Energy and utilities applications span power plants, grid maintenance, oil & gas fields, and renewable energy sites, where technicians rely on rugged notebooks for SCADA access, inspection logging, and asset data capture. Transportation and logistics applications include fleet management, yard and port operations, and rail maintenance, while construction, telecom, healthcare, and research add further niche demand. Overall, the common theme across applications is the need for reliable, connected computing under operational stress.

Distribution Channel Insights

Distribution in the rugged notebooks market is predominantly business- and government-focused, with direct sales and value-added resellers (VARs) forming the core channels. Large defense agencies, national police forces, utilities, and global industrial enterprises typically procure via direct relationships with OEMs or through large systems integrators who bundle rugged notebooks with software, connectivity, and integration services. VARs and integrators play a crucial role in customizing solutions—such as vehicle docking, sector-specific software, and managed services—making them key to winning complex tenders. Online and e-commerce channels are gaining importance for small and medium-sized businesses, enabling easier access to standardized configurations and faster procurement cycles. However, due to the technical complexity, certification requirements, and need for after-sales support, high-value deals still predominantly flow through direct and partner-led enterprise sales models.

End-User Type Insights

From an end-user perspective, government and public sector buyers make up a significant share of rugged notebook demand, driven by defense, homeland security, public safety, and civil infrastructure projects. These customers typically pursue long procurement cycles, standardized platforms, and strict compliance with security and environmental standards. Large enterprises in industrial manufacturing, energy, utilities, logistics, and telecom represent the next major user group, often deploying rugged notebooks across multiple facilities, fleets, and countries as part of global digitalization strategies. Small and medium-sized businesses are an emerging growth segment, leveraging rugged notebooks for specialized field teams, project-based work, and rental fleets, although adoption is moderated by budget constraints. Increasingly, managed service providers and system integrators act as indirect end users, bundling rugged devices into broader solutions delivered on a subscription or service basis.

Deployment Environment Insights

Deployment environments for rugged notebooks can be broadly grouped into vehicle-mounted, field-portable, and fixed-site industrial installations. Vehicle-mounted deployments are critical in public safety, defense, and logistics, where notebooks are docked in patrol cars, fire trucks, ambulances, military vehicles, and commercial fleets, providing real-time dispatch information, navigation, and data capture. Field-portable usage dominates in utilities, construction, mining, and maintenance operations, where technicians carry devices to remote assets, often relying on battery power, wireless connectivity, and robust enclosures to perform inspections, diagnostics, and reporting. Fixed-site industrial deployments occur in factories, warehouses, and control rooms that experience dust, vibration, or temperature variations unsuited to consumer laptops. Across all environments, requirements for long battery life, sunlight-readable displays, glove-compatible touch, and reliable connectivity are shaping product designs and accessories ecosystems.

| Product Type | End-Use Industry | Region |

|---|---|---|

|

|

|

Regional Insights

North America

North America remains the largest regional market for rugged notebooks, accounting for an estimated 35% of global revenue. The United States drives the majority of demand, supported by substantial defense and homeland security budgets, extensive use of rugged devices in federal and state agencies, and widespread adoption in utilities, oil & gas, logistics, and field services. Canadian demand, while smaller, is underpinned by natural resources, public safety, and utilities sectors that operate in harsh climatic conditions. Strong vendor presence, well-developed service networks, and a mature ecosystem of systems integrators reinforce North America’s leadership and support ongoing replacement cycles.

Europe

Europe represents a mature and technologically advanced market, contributing roughly one-quarter of global rugged notebook sales. Countries such as Germany, France, and the U.K. lead adoption, driven by advanced manufacturing, logistics, defense modernization, and critical infrastructure projects. European buyers tend to prioritize compliance with stringent environmental, safety, and data-protection standards, favoring rugged devices with robust security and sustainability credentials. Growth is further supported by EU-funded infrastructure and digital transformation programs, as well as ongoing upgrades in rail, utilities, and emergency services. While competition is intense, high technical requirements and long qualification cycles create opportunities for entrenched vendors and specialized European providers.

Asia-Pacific

Asia-Pacific is the fastest-growing region in the rugged notebooks market, accounting for around 30% of global demand and poised for above-average growth through 2030. China and India are major drivers, with investment in infrastructure, smart cities, transportation corridors, and defense modernization creating strong demand for rugged field computing. Japan and South Korea represent technologically mature markets, with adoption anchored in automotive, electronics manufacturing, public safety, and utilities. Southeast Asian economies, including Indonesia, Thailand, Malaysia, and Vietnam, are emerging growth pockets, leveraging rugged notebooks for mining, agriculture, logistics, and construction. Regional industrial policies and incentives to localize manufacturing are encouraging OEMs to establish assembly, customization, and service footprints within APAC, reinforcing long-term demand.

Latin America

Latin America accounts for an estimated 5–7% of the global rugged notebooks market, with Brazil and Mexico leading regional demand. In Brazil, adoption is concentrated in energy, mining, agribusiness, logistics, and public safety, where rugged devices support operations in remote and challenging environments. Mexico benefits from integration into North American industrial supply chains, using rugged notebooks across manufacturing, automotive, and logistics sectors. Other markets such as Chile, Colombia, and Argentina show growing usage in mining, utilities, and security, though overall demand is constrained by macroeconomic volatility and budget limitations. As multinational companies deploy standardized rugged platforms across global operations, Latin America increasingly benefits from spillover deployments and regional expansion of large integrators.

Middle East & Africa

The Middle East & Africa region contributes another 5–7% of global rugged notebook revenue but holds significant strategic importance. In the Gulf Cooperation Council (GCC) countries—including Saudi Arabia, the UAE, and Qatar—demand is driven by energy, petrochemicals, large-scale infrastructure projects, and internal security initiatives. Africa’s demand is centered on South Africa and select emerging economies, where rugged notebooks support mining, utilities, transportation, and public safety. As governments invest in smart city projects, border security, and critical infrastructure, rugged devices are being deployed in control rooms, field teams, and mobile units. While growth potential is high, political risk, procurement complexity, and variable infrastructure remain challenges that vendors address through partnerships with regional integrators and distributors.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Company Market Share

The rugged notebooks market share is moderately concentrated, with leading OEMs capturing the majority of global revenue. The top five manufacturers are estimated to account for approximately 85–90% of the global rugged notebooks market, reflecting high barriers to entry, including engineering complexity, certification costs, long qualification cycles, and the need for robust service networks. The global leader alone is believed to hold a share in excess of 40% in rugged notebooks, with the next tier of players each occupying mid- to high-teen percentages. Below the top tier, a fragmented ecosystem of regional and niche vendors serves specialized defense, industrial, and OEM/ODM requirements.

Key Players in the Rugged Notebooks Market

- Panasonic Connect (TOUGHBOOK)

- Dell Technologies

- Getac Technology Corporation

- Lenovo Group

- HP Inc.

- Twinhead International (Durabook)

- Zebra Technologies (Xplore)

- MilDef Group

- Advantech Co., Ltd.

- MobileDemand

- Emdoor Information

- AAEON Technology

- Acer Inc. (Enduro Series)

- ASUS

- Kontron AG