Rugged Handheld Devices Market Size

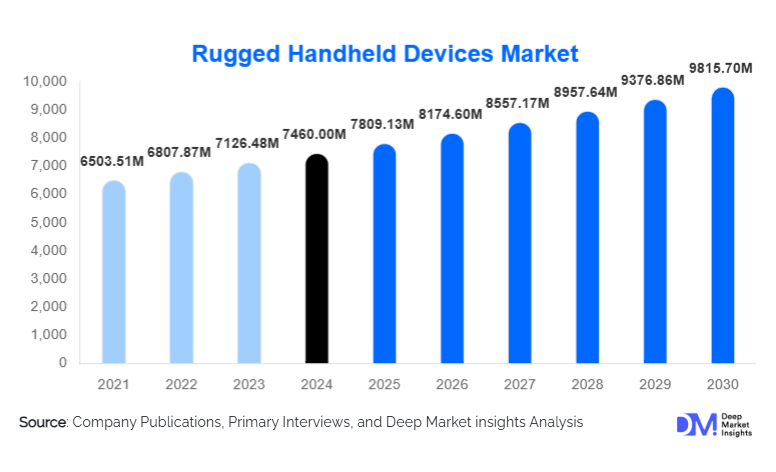

According to Deep Market Insights, the global rugged handheld devices market size was valued at USD 7,460.00 million in 2024 and is projected to grow from USD 7,809.13 million in 2025 to reach USD 9,815.70 million by 2030, expanding at a CAGR of 4.68% during the forecast period (2025–2030). The rugged handheld devices market growth is primarily driven by rising industrial digitalization, increased adoption of field mobility solutions, and accelerating demand for durable and mission-critical devices across logistics, manufacturing, utilities, defense, and public safety sectors.

Key Market Insights

- Fully rugged handheld devices dominate global adoption due to their balanced performance, durability, and cost-efficiency for industrial and logistics operations.

- Android-based rugged devices account for over 60% of deployments, driven by flexibility, lower development costs, and expanding enterprise app ecosystems.

- Industrial and manufacturing applications remain the largest end-use segment, supported by Industry 4.0 adoption and real-time workforce digitalization.

- North America leads the market with high penetration in utilities, warehousing, and defense applications.

- Asia-Pacific is the fastest-growing region, supported by manufacturing expansion, logistics modernization, and government-led digital infrastructure projects.

- Technological integration, including 5G, IoT connectivity, RFID/barcode systems, and rugged AI-enabled devices, is reshaping product capabilities and enterprise deployment models.

What are the latest trends in the rugged handheld devices market?

IoT-Enabled and 5G-Integrated Rugged Devices Accelerating Adoption

Rugged handheld devices are increasingly integrating advanced connectivity technologies, including 5G, Wi-Fi 6, NFC, and IoT sensor suites, which enhance real-time data transmission and operational visibility. Industries such as oil & gas, mining, logistics, and utilities are deploying rugged IoT handhelds for asset monitoring, hazard detection, predictive maintenance, and workforce management. These next-generation devices enable enterprises to transition to fully digital, cloud-connected ecosystems, reducing downtime and improving workforce safety. As 5G networks expand globally, rugged handheld device manufacturers are accelerating the introduction of ultra-low-latency, edge-compute-enabled units that support mission-critical operations in remote or harsh environments.

Software Ecosystem Expansion and Enterprise Mobility Integration

Enterprise mobility platforms, mobile device management (MDM), and rugged device-specific application stores are growing rapidly. Rugged handhelds now support sophisticated software suites for inventory management, route optimization, safety compliance, and industrial workflows. Manufacturers are collaborating with software providers to offer integrated solutions that include real-time diagnostics, remote provisioning, predictive maintenance analytics, and AI-powered quality control tools. This software-rich environment boosts the long-term value proposition of rugged devices, encouraging enterprises to phase out legacy PDAs and consumer-grade devices in favor of rugged handheld computers.

What are the key drivers in the rugged handheld devices market?

Accelerating Digital Transformation Across Industrial Sectors

Manufacturers, logistics operators, and utilities providers are increasingly adopting rugged handheld devices to modernize field operations, automate workflows, and enhance worker productivity. Rugged devices provide uninterrupted performance under extreme conditions, supporting critical tasks such as barcode/RFID scanning, inspection, asset tracking, and field diagnostics. The shift toward Industry 4.0 and smart manufacturing has significantly expanded enterprise investment in mobile computing tools, boosting demand for rugged hardware designed for harsh use environments.

Expansion of Field Service, Logistics, and Last-Mile Delivery

The rapid growth of e-commerce, warehousing automation, and digital supply chains is creating strong demand for rugged handheld computers capable of handling real-time inventory visibility, delivery verification, and warehouse mobility operations. Field service teams across utilities, telecom, and maintenance rely on rugged devices to access cloud-based work orders, capture data, and maintain constant communication. As companies prioritize efficiency and uptime, rugged handhelds that withstand drops, dust, moisture, and temperature fluctuations continue to outperform consumer-grade alternatives.

Increased Government, Military, and Public Safety Procurement

Rugged handheld devices are essential tools for mission-critical operations across defense, emergency response, border security, and law enforcement. Governments worldwide are expanding digital infrastructure, modernizing public safety communication systems, and equipping frontline teams with secure, durable, and cyber-resilient mobile devices. Features such as encrypted communication, biometric authentication, GPS tracking, and real-time situational awareness drive adoption in high-security environments and long-term government procurement cycles.

What are the restraints for the global market?

High Upfront Costs and Budget Constraints

Rugged handheld devices typically cost significantly more than consumer-grade smartphones or tablets due to reinforced components, specialized certifications, and industrial-grade materials. For SMEs or emerging markets, high capital expenditure can slow adoption, leading some businesses to continue using non-rugged alternatives despite higher long-term maintenance costs. Budget limitations in public-sector procurement can also delay refresh cycles and reduce the frequency of large-scale device upgrades.

Complex Integration and Rapid Technology Obsolescence

Many organizations, particularly in traditional industries, use legacy software, outdated infrastructure, or customized proprietary systems. Integrating rugged handheld devices into such environments may require additional middleware, software upgrades, or specialized IT support. Rapid evolution of operating systems, especially Android, accelerates hardware refresh requirements and introduces compatibility challenges for rugged device manufacturers and enterprise users alike.

What are the key opportunities in the rugged handheld devices industry?

Industrial Automation and Industry 4.0 Deployment

As industries embrace automated workflows, robotics, IoT, and real-time analytics, rugged handheld devices play a crucial role in enabling seamless data collection and operational visibility. There is a significant opportunity for manufacturers to develop devices specifically optimized for high-speed connectivity, industrial IoT networks, digital twins, and predictive maintenance. Customized rugged solutions for sectors such as oil & gas, mining, and utilities will see rising demand as companies digitize complex field operations.

Government Infrastructure Modernization and Public Safety Digitalization

Governments worldwide are investing in digital public services, smart-city infrastructure, law enforcement modernization, and defense technology upgrades. Rugged handheld devices optimized for secure communication, real-time GIS mapping, incident management, and advanced authentication represent a large procurement opportunity. Manufacturers offering compliant (ATEX/MIL-STD/IP) devices with strong cybersecurity and long lifecycle support can secure long-term contracts in this expanding segment.

Product Type Insights

Rugged mobile computers dominate the market, capturing approximately 55–60% of global revenue in 2024. Their versatility in logistics, warehousing, manufacturing, and field service operations makes them indispensable for high-frequency scanning, real-time data processing, and workflow automation. Rugged tablets are gaining traction among utility workers and field inspectors who require larger screens for schematics and diagnostics, while rugged smartphones appeal to teams needing communication-first devices. The shift toward 5G-enabled and sensor-rich rugged devices is further strengthening product demand across mobility-intensive industries.

Application Insights

Industrial applications, including manufacturing, oil & gas, mining, construction, and utilities, represent the largest segment, contributing nearly 40% of global demand. Logistics applications are expanding rapidly as global supply chains deploy rugged handhelds for warehouse management, order fulfillment, and fleet coordination. Field service operations use rugged devices for digital work orders, GPS routing, and diagnostics. Defense and public safety applications continue to grow, driven by demand for secure, mission-grade communication devices and situational awareness tools. Emerging applications include smart-city monitoring, environmental surveying, and remote infrastructure inspection.

Distribution Channel Insights

Enterprise-direct sales channels dominate the rugged handheld devices market due to high-volume procurement by industrial, government, and logistics organizations. Systems integrators and specialized rugged device distributors play a major role in customizing solutions for complex industrial environments. Online B2B platforms and manufacturer-direct e-commerce portals are growing steadily, enabling centralized procurement and configuration management for global enterprises. Subscription-based hardware-as-a-service (HaaS) models are emerging, reducing upfront investment for rugged devices and increasing adoption among mid-sized organizations.

End-Use Industry Insights

Manufacturing and industrial companies represent the largest end-use segment due to the need for durable, IoT-connected devices on factory floors and outdoor sites. Logistics and transportation are the fastest-growing segments, driven by e-commerce expansion and digital warehousing. Defense, emergency response, and public safety agencies continue to adopt rugged handhelds for secure communication and real-time field coordination. Emerging industries such as renewable energy, environmental services, and smart-city infrastructure are incorporating rugged handhelds for inspection, monitoring, and compliance workflows.

| By Product Type | By Ruggedness Level | By Operating System | By Application / End-Use | By Distribution Channel |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America holds the largest share of the rugged handheld devices market, approximately 30–35% in 2024, driven by advanced logistics networks, high industrial automation, and strong procurement from defense and public safety agencies. The U.S. leads demand due to widespread adoption in warehousing, automotive production, utilities maintenance, and emergency services. Strong IT infrastructure and early adoption of IoT and 5G technologies further accelerate market growth.

Europe

Europe accounts for 20–25% of the global market, supported by mature manufacturing hubs, stringent industrial safety standards, and the adoption of rugged devices in transportation, utilities, and field service sectors. Germany, the U.K., France, and the Nordics are key contributors, with growing interest in rugged devices for renewable energy, rail networks, and precision manufacturing.

Asia-Pacific

Asia-Pacific is the fastest-growing regional market, representing about 28–32% of 2024 global revenue. China and India drive large-scale adoption due to logistics expansion, rapid industrialization, and government-led digitalization initiatives. Southeast Asia’s manufacturing and warehouse growth also contributes significantly. Japan and South Korea represent mature markets with strong demand for rugged devices in automotive, electronics, and robotics ecosystems.

Latin America

Latin America is emerging as a promising market, driven by growth in mining, agriculture, utilities, and logistics. Brazil and Mexico are leading adopters, with increasing use of rugged handhelds in industrial safety, field service, and supply chain management. Infrastructure modernization and e-commerce expansion will further accelerate adoption.

Middle East & Africa

MEA demand is rising steadily, fueled by investments in oil & gas, construction, utilities, and public safety modernization. Gulf countries, including the UAE, Saudi Arabia, and Qatar, are rapidly deploying rugged devices for industrial automation and smart-city initiatives. In Africa, rugged handhelds are increasingly used in mining, power distribution, and logistics, especially in remote and harsh environments.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Rugged Handheld Devices Market

- Panasonic Corporation

- Honeywell International

- Zebra Technologies

- Datalogic S.p.A

- Getac Technology Corporation

- Handheld Group

- Juniper Systems

- Caterpillar Inc. (CAT Phones)

- Aaeon Technologies

- MilDef Group

- Unitech Electronics

- Bluebird Corporation

- CipherLab

- Advantech Co., Ltd.

- RuggON Corporation

Recent Developments

- In March 2025, Zebra Technologies introduced a new 5G-enabled rugged mobile computer series designed for high-density warehouse environments.

- In January 2025, Panasonic expanded its TOUGHBOOK lineup with an ultra-rugged Android handheld featuring AI-powered predictive maintenance tools.

- In May 2024, Getac launched a cloud-integrated rugged device management platform to enhance remote monitoring and lifecycle optimisation.