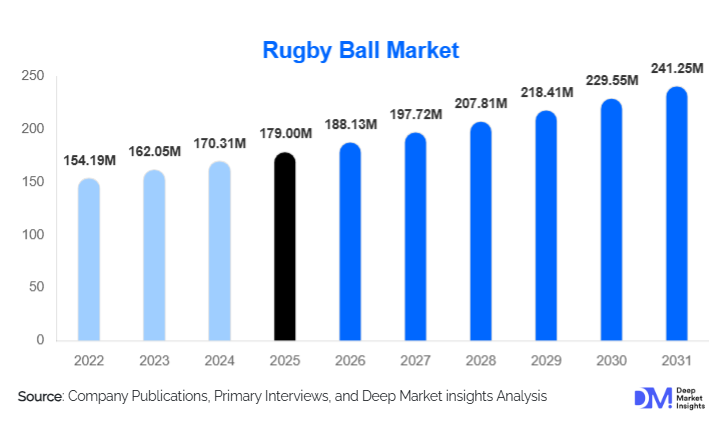

Rugby Ball Market Size

According to Deep Market Insights, the global rugby ball market size was valued at USD 179.00 million in 2025 and is projected to grow from USD 188.13 million in 2026 to reach USD 241.25 million by 2031, expanding at a CAGR of 5.1% during the forecast period (2026–2031). Market growth is primarily driven by the institutionalized nature of rugby as a sport, rising participation at school and grassroots levels, and steady procurement from professional leagues, clubs, and federations worldwide.

Key Market Insights

- Institutional demand from schools, clubs, and federations accounts for a significant share of global rugby ball consumption, ensuring predictable replacement cycles.

- Match-grade rugby balls dominate market value due to higher unit pricing, certification requirements, and frequent replacement in professional competitions.

- Europe remains the largest regional market, supported by strong rugby cultures in the U.K., France, and Ireland.

- Asia-Pacific is the fastest-growing region, driven by rugby development programs in Japan, Southeast Asia, and parts of South Asia.

- Women’s and youth rugby participation is accelerating demand for size-4 and junior rugby balls globally.

- Material innovation and surface grip enhancements are improving performance consistency and supporting premium pricing in the professional segment.

What are the latest trends in the rugby ball market?

Growth of School and Grassroots Rugby Programs

Expansion of school-level rugby programs is emerging as a major structural trend in the rugby ball market. Governments and rugby unions across Asia-Pacific, Latin America, and parts of Africa are actively promoting rugby as part of formal physical education curricula. This has resulted in bulk procurement of training and junior-size rugby balls, creating steady, volume-driven demand. Manufacturers are increasingly developing cost-efficient, high-durability products tailored specifically for institutional buyers, reinforcing long-term supplier relationships and repeat purchasing.

Premiumization of Match Balls

Professional leagues and international tournaments are increasingly adopting premium match balls featuring enhanced grip textures, improved seam bonding, and multi-layer laminations. These innovations are designed to deliver consistent performance under varied weather conditions, particularly in wet and cold climates. As broadcast exposure and commercialization of rugby increase, leagues are placing greater emphasis on equipment standardization, supporting higher average selling prices in the match-ball segment.

What are the key drivers in the rugby ball market?

Structured and Recurring Institutional Demand

Unlike many recreational sports products, rugby balls benefit from highly structured demand driven by leagues, unions, schools, and clubs. Match regulations and wear-and-tear requirements necessitate frequent replacement, particularly in professional and semi-professional environments. This creates predictable baseline demand and reduces exposure to short-term economic fluctuations.

Expansion of Emerging Rugby Nations

Countries such as Japan, the United States, Brazil, and several Southeast Asian nations are investing heavily in rugby development. New domestic leagues, increased international participation, and growing media exposure are translating directly into rising equipment demand, particularly for training and recreational rugby balls.

What are the restraints for the global market?

Limited Product Differentiation

Rugby balls are governed by strict dimensional, weight, and performance standards, limiting scope for visible differentiation. This constrains pricing power, particularly in the training and recreational segments, and intensifies competition among established manufacturers.

Raw Material Price Volatility

Fluctuations in natural rubber and synthetic polymer prices can impact production costs and margins. While premium brands can partially pass costs downstream, mass-market suppliers remain more exposed to margin pressure.

What are the key opportunities in the rugby ball market?

Women’s Rugby and Inclusive Participation

Women’s rugby is expanding rapidly across Europe, North America, and Asia-Pacific, creating incremental demand for size-4 balls and league-approved match equipment. Manufacturers aligning product development and sponsorship strategies with women’s leagues stand to capture long-term growth opportunities.

Technology-Enhanced Ball Design

Opportunities exist in material science and surface engineering, including advanced grip coatings, improved air retention systems, and enhanced durability. These innovations support premium pricing and stronger brand differentiation in professional and semi-professional segments.

Product Type Insights

Match balls account for approximately 34% of global market revenue in 2025, driven by demand from professional leagues, international tournaments, and broadcast-level competitions that require certified specifications. Training balls represent the largest volume segment, supported by consistent procurement from schools, academies, and amateur clubs. Recreational and mini rugby balls contribute incremental demand through retail, youth programs, and promotional distribution, particularly in emerging markets.

Material Insights

Synthetic rubber and polyurethane composite balls dominate the market, accounting for nearly 57% of total market value, due to superior durability, weather resistance, and consistent grip across varied playing conditions. These materials are preferred in competitive and institutional settings for their longer lifecycle. Natural rubber balls remain relevant in entry-level and recreational segments, where affordability and casual play requirements drive purchasing decisions.

End-Use Insights

Professional and semi-professional clubs contribute roughly 29% of total demand, supported by frequent replacement cycles, higher performance specifications, and league compliance standards. Schools and educational institutions represent the fastest-growing end-use segment, expanding at a CAGR exceeding 6.5%, driven by curriculum integration, grassroots development initiatives, and government-supported sports participation programs.

Distribution Channel Insights

Specialty sports retailers and online direct-to-consumer channels collectively account for over 50% of global sales, reflecting buyer preference for product expertise and brand authenticity. Online channels are growing fastest as manufacturers strengthen D2C strategies, expand regional fulfillment, and institutional buyers increasingly adopt digital procurement platforms for bulk purchasing.

| By Product Type | By Material Type | By Size Category | By End Use | By Distribution Channel |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

Europe

Europe leads the global rugby ball market with approximately 38% share in 2025, driven primarily by the U.K., France, and Ireland. Well-established domestic leagues, dense club networks, and mandatory rugby programs at school and university levels create consistent replacement demand. Regular international tournaments and strong grassroots-to-professional pathways further sustain year-round equipment consumption.

Oceania

Oceania accounts for around 22% of global demand, led by New Zealand and Australia. The region records the highest per-capita rugby ball usage globally, supported by rugby’s status as a mainstream sport across schools, clubs, and national competitions. Continuous training intensity and high match frequency drive above-average wear-and-replacement cycles.

Asia-Pacific

Asia-Pacific represents approximately 21% of the market and is the fastest-growing region. Japan anchors regional demand through professional league expansion and international event exposure, while Southeast Asia and South Asia are emerging growth markets. Federation-led development programs, youth training initiatives, and rising school-level adoption are accelerating volume growth.

North America

North America holds roughly 12% of global market share, with the United States driving regional growth. Expansion of collegiate rugby, amateur leagues, and youth participation programs is increasing equipment penetration. Growing visibility of international tournaments and structured domestic competitions supports gradual but steady demand expansion.

Latin America, Middle East & Africa

These regions collectively account for around 7% of global demand, led by Brazil, South Africa, and select Middle Eastern countries. Growth is supported by targeted investments in rugby infrastructure, national team development, and school-level participation programs. Demand remains concentrated in urban centers and competitive hubs, with gradual expansion into emerging markets.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Company Market Share

The rugby ball market is moderately concentrated, with the top five players collectively accounting for approximately 58% of global market share. Competitive positioning is driven by brand credibility, federation approvals, and long-term supply agreements.

Key Players in the Rugby Ball Market

- Gilbert Rugby

- Canterbury

- Adidas

- Mitre

- Rhino Rugby

- Macron

- Kooga

- Puma

- Decathlon

- Under Armour

- Spartan Sports

- Burley Sekem

- Grays International

- Vector X

- Nivia Sports