Rotogravure Printing Ink Market Size

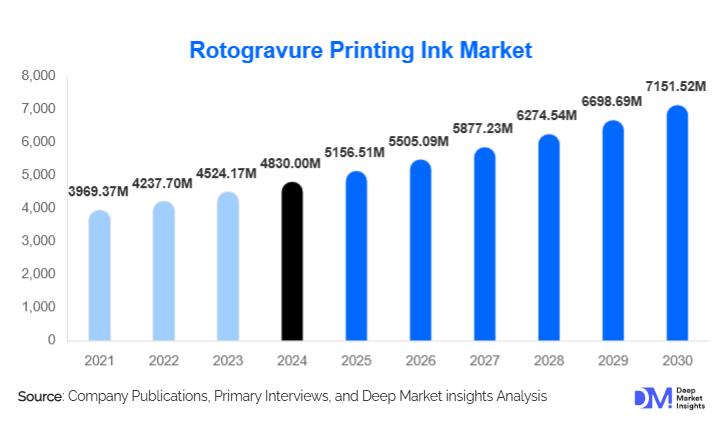

According to Deep Market Insights, the global rotogravure printing ink market size was valued at USD 4,830.00 million in 2024 and is projected to grow from USD 5,156.51 million in 2025 to reach USD 7,151.52 million by 2030, expanding at a CAGR of 6.76% during the forecast period (2025–2030). The rotogravure printing ink market growth is primarily driven by the rising consumption of flexible packaging, increasing demand for high-quality print finishes, and the rapid transition toward eco-friendly, low-VOC ink technologies.

Key Market Insights

- Flexible packaging applications dominate global demand, supported by strong growth in food, beverage, pharmaceutical, and FMCG packaging sectors.

- Solvent-based nitrocellulose inks remain the leading formulation, although water-based and UV-curable alternatives are rapidly gaining traction.

- Asia-Pacific commands the largest global share, driven by massive packaging output and export-oriented manufacturing in China and India.

- Europe and North America lead the shift to sustainable inks, due to strict VOC, food-contact, and environmental compliance regulations.

- Technological advancements such as specialty inks, high-pigment systems, and automation in ink blending are enabling premium packaging and enhancing print consistency.

- Consumer preference for high-quality, multi-color visuals continues to elevate rotogravure printing’s relevance, particularly in premium packaging formats.

What are the latest trends in the rotogravure printing ink market?

Shift Toward Eco-Friendly, Low-VOC & Water-Based Inks

A major industry trend is the accelerating transition from conventional solvent-based inks toward water-based, low-VOC, and hybrid resin systems. Regulatory pressure in Europe and North America is compelling converters to adopt environmentally compliant inks, while leading manufacturers are investing heavily in R&D to match the performance of solvent-based nitrocellulose systems. Water-based inks for flexible packaging, once limited by drying and adhesion challenges, are now achieving commercial scale due to advancements in polyurethane and acrylic resin technologies. This shift is reshaping procurement strategies across packaging converters and positioning sustainable inks as a key growth pillar.

Premiumization & Rise of Specialty Gravure Inks

Brand owners and FMCG companies increasingly demand vibrant, high-definition graphics to differentiate products on retail shelves. This is fueling the adoption of specialty gravure inks, metallic finishes, high-gloss coatings, tactile textures, UV-curable inks, and high-pigment systems. The trend is especially pronounced in cosmetics, luxury food, nutraceuticals, and personal-care packaging, where premium visual appeal strongly influences purchasing behavior. As substrates diversify, bio-films, compostable laminates, and sustainable multilayer structures, ink makers are developing highly customized formulations optimized for adhesion, migration limits, and print durability.

What are the key drivers in the rotogravure printing ink market?

Growing Global Consumption of Flexible Packaging

The strongest driver is the rising demand for flexible packaging, now the dominant packaging format worldwide. Surging consumption of packaged food, beverages, pharmaceuticals, and FMCG items is boosting demand for rotogravure printing inks, which are preferred for high-volume, multi-color, precision printing. The expansion of e-commerce, which requires durable, high-quality packaging, further accelerates ink demand. Emerging markets, particularly China, India, and Southeast Asia, are experiencing double-digit growth in packaged goods, reinforcing rotogravure’s long-term role in mass-scale packaging production.

Growth in High-Quality Commercial & Decorative Printing

Despite digitalization, sectors such as premium fashion magazines, decorative laminates, wallpapers, catalogs, and gift wraps continue to rely on rotogravure printing for superior color consistency and fine detailing. Commercial printers prefer gravure inks for their predictability across long print runs, ensuring minimal deviation in color density. The resurgence of decorative interior films and laminates further stimulates demand for high-performance gravure inks, especially polyurethane and acrylic-based formulations.

Regulatory Push Toward Sustainable & Food-Safe Ink Technologies

Stricter global regulations on VOC emissions, packaging safety, and ink migration limits, especially for food-contact packaging, are pushing manufacturers to innovate. Compliance with EU FCM standards, U.S. FDA regulations, and APAC food-packaging guidelines necessitates high-purity ink systems with enhanced performance characteristics. As converters upgrade to greener technologies, demand for modern resin systems (polyamide, polyurethane, acrylic) and UV/water-based formulations continues to surge.

What are the restraints for the global market?

High Cost & Complexity of Transitioning to Eco-Friendly Inks

Shifting from solvent-based inks to water-based or UV-curable systems requires extensive reformulation, new machinery components, longer drying setups, and enhanced compatibility testing. Small and mid-sized converters often lack the resources to adopt new technologies quickly, limiting widespread market penetration. Performance gaps in certain substrates, especially high-speed film printing, also slow adoption, particularly in cost-sensitive markets like Southeast Asia and Africa.

Volatility of Raw Material Prices and Regulatory Burden

Ink manufacturers depend on resins, pigments, solvents, and additives, many of which face price fluctuations tied to petrochemical supply chains. Regulatory compliance, VOC standards, food-contact requirements, and waste management add additional overhead, compressing margins for manufacturers operating at scale. This economic pressure can restrain market growth, especially in highly competitive, price-sensitive regions.

What are the key opportunities in the rotogravure printing ink industry?

High-Growth Demand for Eco-Friendly Ink Systems

The global sustainability movement is creating a multi-billion-dollar opportunity for water-based, bio-based, and low-VOC gravure inks. Packaging producers are increasingly seeking inks that meet environmental certifications and minimize carbon footprint. Ink formulators that can offer performance-equivalent, eco-friendly options, especially for flexible packaging films, stand to capture significant market share.

Rapid Expansion of Packaging Manufacturing in Emerging Economies

India, China, Indonesia, Vietnam, and Brazil are witnessing explosive growth in packaged goods consumption. As packaging converters expand capacity, demand for rotogravure inks, especially cost-efficient nitrocellulose systems, continues to surge. Localized ink manufacturing, strategic partnerships with packaging firms, and plant expansions offer strong opportunities for global ink makers seeking to penetrate high-growth markets.

Innovation in Specialty, High-Pigment & Functional Inks

Advanced ink technologies for premium packaging, UV-curable systems, metallic inks, matte/gloss hybrids, barrier inks, and tactile surfaces represent lucrative niche segments. Demand for such inks is rising in cosmetics, luxury food packaging, and promotional materials. Technologies enabling fast drying, superior adhesion, and compatibility with biodegradable films are expected to define the next wave of competitive differentiation.

Product Type Insights

Solvent-based gravure inks remain the dominant product type, accounting for over half of global consumption due to proven performance at high speeds, excellent print consistency, and compatibility with a wide range of films. Nitrocellulose-based formulations lead this segment.

Water-based inks are the fastest-growing category, driven by environmental regulations and brand-owner sustainability commitments. These inks are rapidly gaining adoption in food and pharmaceutical packaging. Specialty inks, including UV-curable and metallic formulations, are growing in high-value applications such as cosmetics, luxury food packaging, and decorative laminates.

Application Insights

Flexible packaging dominates global demand, representing 45–50% of total consumption. High-speed gravure printing remains the preferred method for food, beverage, and FMCG packaging due to its precision and efficiency. Commercial printing, including magazines, laminates, gift wraps, and wallpapers, retains a sizable share, supported by demand for decorative and premium-quality visuals. Product labeling and specialty industrial applications are growing, particularly where durability and color consistency are critical.

Distribution Channel Insights

Direct B2B supply to packaging converters remains the primary channel, as large converters require customized formulations, technical support, and bulk procurement. Regional distributors and chemical suppliers play a major role in emerging markets, offering localized logistics advantages and serving smaller converters. Digital procurement platforms and direct manufacturer portals are expanding, enabling faster quoting, repeat ordering, and customized ink selection tools.

End-User / Customer Type Insights

Food and beverage packaging is the largest end-user segment, accounting for 25–30% of global demand. Pharmaceutical and personal care packaging represent high-growth segments due to demand for premium visuals and stricter compliance needs. Consumer goods and FMCG packaging generate steady demand, particularly in Asia-Pacific, where product volumes are high and cost-effective gravure printing remains standard.

| By Resin Type | By Technology / Ink Formulation | By Application | By End-Use Industry |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America holds approximately 25–30% of the global market, driven by stringent regulatory standards and strong demand for sustainable inks. The U.S. dominates the region, with mature packaging and premium commercial printing industries. Growth is steady, supported by innovation in water-based and UV-curable systems.

Europe

Europe represents 15–20% of global demand and is a leader in sustainability-oriented printing technologies. The region’s strict VOC and food-contact regulations accelerate the adoption of eco-friendly inks. Germany, Italy, France, and the U.K. form the core demand cluster, with strong manufacturing and packaging sectors.

Asia-Pacific

Asia-Pacific is the largest regional market, capturing 35–40% of global consumption. China and India dominate due to massive packaging production, cost-efficient manufacturing, and growing domestic consumption. Southeast Asia is emerging as a competitive hub for converters serving global export markets. APAC is also the fastest-growing region, with a projected CAGR of 7–9% through 2030.

Latin America

Latin America contributes 5–7% of the global market share. Brazil and Mexico lead demand, supported by growing packaging industries and increased consumption of processed foods and household goods. Economic variability moderates growth, but long-term prospects remain positive.

Middle East & Africa

MEA holds 3–5% of global demand. South Africa, the UAE, and Saudi Arabia are key markets, supported by rising retail sectors and investment in local packaging production. Growth is moderate, but demand for premium packaging is increasing in Gulf countries.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Rotogravure Printing Ink Market

- DIC Corporation

- Flint Group

- Siegwerk

- Sun Chemical

- Toyo Ink Group

- Nazdar Ink Technologies

- Wikoff Color Corporation

- ICPA

- Yasho Industries

- Fujifilm Sericol

- Royal Ink & Resin

- ColorJet Inks

- Sakata Inx

- Huber Group

- Altana AG (Actega Division)