Rosemary Oil Market Size

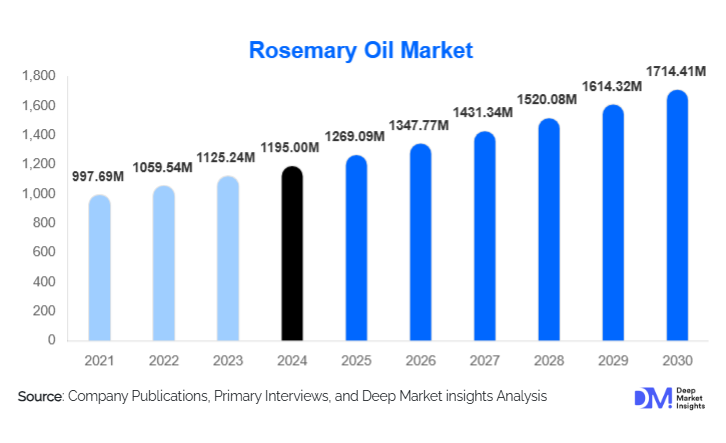

According to Deep Market Insights, the global rosemary oil market size was valued at USD 1,195 million in 2024 and is projected to grow from USD 1,269.09 million in 2025 to reach USD 1,714.41 million by 2030, expanding at a CAGR of 6.2% during the forecast period (2025–2030). This growth is underpinned by rising consumer preference for plant-based, clean-label ingredients, increasing adoption of rosemary oil in personal care and aromatherapy, and advances in high-purity extraction technologies.

Key Market Insights

- Natural and clean-label demand is surging globally, with rosemary oil increasingly adopted in cosmetics, wellness, and therapeutic applications due to its antioxidant and antimicrobial properties.

- Technological innovation in extraction is elevating product quality. Methods like supercritical CO₂ extraction are gaining traction, enabling producers to deliver high-purity oils for premium therapeutic and aromatic use.

- Online retail is emerging as a dominant distribution channel. E-commerce enables specialty and niche rosemary oil brands to reach global consumers directly, fueling market reach and volume.

- Cosmetics & personal care applications lead demand. Rosemary oil is widely used in hair serums, scalp treatments, anti-aging products, and natural deodorants, driven by increasing botanical formulation trends.

- Europe is currently the largest regional market, with strong consumer awareness, well-developed wellness and natural cosmetics industries, and robust regulatory frameworks supporting essential oil use. :contentReference[oaicite:0]{index=0}

- Asia-Pacific is the fastest-growing region, boosted by rising incomes, increasing interest in traditional and herbal wellness, and broadening distribution across health and beauty retail channels.

Latest Market Trends

Clean-Label Botanical Formulations

As consumers increasingly prioritize natural ingredients, rosemary oil has gained traction in clean-label personal care, food, and wellness products. Its multifunctional profile, antioxidant, anti-inflammatory, and antimicrobial, aligns well with current consumer demands. Cosmetic brands are integrating rosemary oil into hair care (e.g., scalp health, anti-dandruff), skin-care toners, and natural deodorants, while food manufacturers are leveraging its preservative qualities to meet clean-label demands. This shift is redefining how rosemary oil is positioned: not just as a fragrance or aromatherapy ingredient, but as a functional botanical active.

High-Purity & Sustainable Extraction Technologies

Producers are increasingly investing in advanced extraction techniques such as supercritical CO₂ and green-solvent extraction to obtain high-purity rosemary oil. These methods yield oils with richer active compound profiles (e.g., higher 1,8-cineole) and lower impurities, making them suitable for therapeutic, pharmaceutical, and premium aromatherapy applications. At the same time, sustainability initiatives, including organic cultivation, regenerative agriculture, and innovative nutrient application techniques, are gaining importance, reducing environmental impact and improving yield.

Rosemary Oil Market Drivers

Growing Wellness & Aromatherapy Adoption

The global wellness trend is one of the biggest drivers for rosemary oil. As more consumers look for natural stress relief, mental clarity, and holistic health solutions, rosemary oil fits perfectly into aromatherapy, massage oils, diffusers, and therapeutic formulations. Its therapeutic benefits, such as improving circulation, reducing inflammation, and enhancing cognitive function, are particularly attractive in preventive healthcare and wellness-oriented use cases.

Surging Demand in Personal Care & Cosmetics

Growth in natural cosmetics and botanical hair-care products is fueling demand for rosemary oil. The oil’s anti-oxidative and antimicrobial properties make it a valuable ingredient in scalp treatments, anti-aging skin serums, and clean-label formulations. As more beauty brands market natural and “plant-powered” products, rosemary oil is becoming a key active ingredient to deliver both efficacy and consumer appeal.

Supply-Side Innovation & Efficiency

On the production side, improvements in rosemary cultivation and extraction are helping scale high-quality production. For instance, research into nanosized nutrient sprays has shown that rosemary plants can be grown more efficiently with lower fertilizer inputs while improving yield and oil-quality metrics. Such innovations help reduce cost, improve sustainability, and secure supply, all of which support market growth.

Market Restraints

Raw Material Variability and Agricultural Risks

Rosemary cultivation is sensitive to climatic conditions, soil quality, and farming practices. Variability in yield due to drought, pests, or other agricultural risks can disrupt raw material supply, causing cost fluctuations. This makes large-scale, consistent production challenging, particularly for high-purity oil manufacturers who demand steady quality.

High Production Costs & Capital Intensity

Extracting rosemary oil, especially via premium methods like CO₂ extraction, requires significant capital investment. Operational costs, energy consumption, and maintenance of advanced extraction facilities are high. Moreover, quality assurance, purity testing, and regulatory compliance impose further financial burdens. These cost pressures can limit market participation to well-funded players and constrain price competitiveness for smaller or new entrants.

Rosemary Oil Market Opportunities

Functional Foods, Nutraceuticals & Clean-Label Preservation

Rosemary oil’s antioxidant and antimicrobial properties make it well-suited for functional foods, nutraceuticals, and natural preservative solutions. Manufacturers can use it in supplements targeting cognitive health, immune support, or inflammation. In food applications, rosemary oil can act as a clean-label preservative, extending shelf life while offering a natural label claim, a compelling value proposition for clean-label food brands.

Premium Therapeutic-Grade Oils & High-Purity Applications

There is growing demand for therapeutic-grade rosemary oil in aromatherapy, pharmaceuticals, and high-end wellness products. Companies can leverage advanced extraction (e.g., supercritical CO₂) and certification (e.g., organic, ISO) to create differentiated, high-value offerings. Such products can command premium pricing and address the rising market of health-conscious, quality-sensitive consumers.

Geographic Expansion into Emerging Markets

Emerging markets, especially in Asia-Pacific (India, China, Southeast Asia) and parts of Latin America, present significant growth potential. These regions are witnessing a rapid shift toward natural personal care, herbal wellness, and aromatherapy. By establishing local cultivation, partnering with regional farms, and adapting products (e.g., hair-care blends for Indian scalp conditions), producers can tap into new demand. Further, export opportunities from traditional rosemary-growing regions (Mediterranean, North Africa) into these high-growth markets remain underexploited.

Product Segment Insights

Within the rosemary oil market, conventional rosemary oil dominates due to its broader production base, cost-effectiveness, and well-established supply chain. Steam-distilled oil is the most common extraction method, owing to its efficiency and suitability for a range of applications. Pure (100%) rosemary oil remains the most valuable form, driving premium segment revenues, particularly in therapeutic and aromatherapy applications. In end-use, the cosmetics & personal care sector leads demand, while online retail is becoming increasingly pivotal, helping niche and premium brands reach global consumers directly.

Application Insights

Rosemary oil’s applications span multiple sectors. In cosmetics & personal care, it is used in hair care (scalp serums, shampoos), anti-aging formulations, and natural deodorants. In aromatherapy & wellness, the oil features in diffusers, massage oils, and inhalation products. In the nutrition & supplement space, it is valued for its antioxidant effects and cognitive benefits. Food manufacturers also use rosemary oil as a natural preservative and flavoring agent. Emerging applications include agriculture (biopesticide, plant-growth promoter) and therapeutic foods, leveraging its bioactive compounds.

Distribution Channel Insights

The rosemary oil market is distributed through a mix of channels. Online retail (e-commerce) is rapidly gaining ground, especially for high-purity, organic, and niche formulations. Specialty stores (health food stores, wellness shops) remain important for consumers seeking authentic botanical oils. Direct B2B sales serve personal care, food, and pharmaceutical manufacturers. Traditional retail, such as modern trade (supermarkets) and convenience stores, plays a smaller role but supports consumer access in developed markets.

End-User Insights

End users of rosemary oil can broadly be grouped into wellness consumers, cosmetic formulators, supplement makers, and food manufacturers. Wellness and aromatherapy brands are among the fastest-growing users, as demand for natural stress relief and holistic health products expands. Cosmetic formulators, especially in hair care and skin care, continue to drive large volumes of rosemary oil. Supplement companies are developing rosemary-based nutraceuticals targeting cognition, immunity, and oxidative stress. Meanwhile, food companies are increasingly utilizing rosemary oil as a natural preservative in clean-label products. The export-driven demand is strong: many consumer brands in Europe and North America source rosemary oil from major cultivation regions to formulate into their final products.

| By Product Type | By Extraction Method | By Application | By Distribution Channel | By End-Use Industry |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

Europe

Europe remains the largest regional market for rosemary oil, accounting for roughly 30–35% of the global market value in 2024. This dominance stems from well-established personal care and wellness industries, high consumer awareness around botanical actives, and favorable regulatory environments for natural ingredients. Countries such as France, Germany, Italy, and the U.K. are major demand centers, with strong adoption in skincare, haircare, and aromatherapy.

Asia-Pacific

The Asia-Pacific region is the fastest-growing market, with an estimated 20–25% share in 2024. Key drivers include rising disposable incomes, growing health consciousness, and a growing preference for natural wellness products. China and India are especially important: India’s traditional herbal and Ayurvedic heritage supports rosemary oil use in hair care, while China is driving demand through aromatherapy, skincare, and functional supplements.

North America

North America (U.S. & Canada) holds around 20–25% of the global rosemary oil market. High consumer demand for natural personal care products, robust e-commerce infrastructure, and strong wellness trends support growth. In the U.S., rosemary oil is particularly popular in hair and scalp treatments, clean-label skincare, and aromatherapy blends.

Latin America

Latin America contributes a smaller, but growing portion (approx. 5–10%) of the rosemary oil market. Brazil and Argentina are emerging markets, with increasing uptake of clean-label cosmetics and herbal wellness products. As local brands expand and cross-border trade strengthens, the region’s demand is expected to accelerate.

Middle East & Africa (MEA)

In MEA, North African countries (like Tunisia and Morocco) play a pivotal role as major producers of rosemary. Meanwhile, in the Gulf Cooperation Council (GCC) and South Africa, demand for natural wellness products is rising, though their share is relatively modest (around 5–10%) compared to Europe and APAC. The region’s growth is export-driven, with producers leveraging favorable climates and expanding value-added capacity.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Rosemary Oil Market

- Robertet Group

- Royal Aroma

- Reho Natural Ingredients

- Katyani Exports

- The Lebermuth Company

- Sai Exports India

- Albert Vieille

- Xi’an Fengzu Biological Technology

- Khyber Bio-Culture

- Amrit Fragrances

- Paras Perfumers

- Bordas S.A.

- Young Living

- doTERRA

- Biolandes SA

Recent Developments

- In 2025, research from the University of Hyderabad demonstrated that using nanosized nutrient sprays can significantly improve rosemary plant growth and oil yield, boosting 1,8-cineole content while reducing fertilizer use.