Rope Ladder Market Size

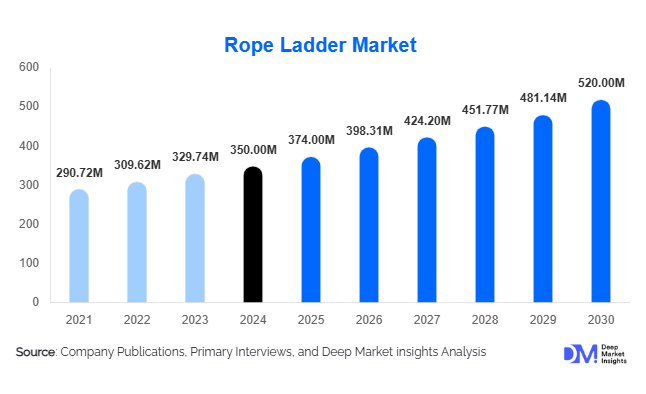

According to Deep Market Insights, the global rope ladder market size was valued at USD 350 million in 2024 and is projected to grow from USD 374 million in 2025 to reach USD 520 million by 2030, expanding at a CAGR of 6.5% during the forecast period (2025–2030). The rope ladder market growth is primarily driven by rising industrial and marine demand, increasing safety awareness, and growing recreational and adventure applications globally.

Key Market Insights

- Marine and shipping applications dominate the market, with stringent safety regulations driving demand for industrial-grade rope ladders on ships, offshore platforms, and ports.

- Synthetic fiber and metal-reinforced rope ladders are gaining traction, offering higher durability, weather resistance, and load-bearing capacity compared to traditional natural fiber ladders.

- Portable and telescopic rope ladders are increasingly preferred, especially in emergency services, construction, and residential applications, due to their compact and flexible design.

- Asia-Pacific leads the global market, fueled by rapid industrialization, urban infrastructure expansion, and growing adventure and recreational activities.

- E-commerce and online retail channels are expanding, providing consumers and small businesses with easier access to rope ladders across diverse applications.

- Technological integration, including modular, foldable, and telescopic designs, is enhancing functionality and attracting safety-conscious consumers.

What are the latest trends in the rope ladder market?

Adoption of Advanced Materials

Manufacturers are increasingly adopting synthetic fibers such as nylon and polyester, as well as metal-reinforced designs, to provide greater strength, durability, and weather resistance. These materials are especially favored in marine, industrial, and adventure applications where reliability and long service life are critical. Natural fiber ladders are still used in recreational and home settings, but are being gradually replaced by synthetic alternatives in high-performance applications.

Technologically Enhanced and Modular Ladders

Telescopic, foldable, and modular rope ladders are emerging as a key trend, providing space-efficient storage and multifunctional usability. These innovations appeal to both recreational users and industrial clients who require ladders that can be easily transported, deployed, or adjusted to varying heights. Emergency service providers and adventure parks are early adopters of these solutions, boosting market adoption and demonstrating the importance of practical, flexible designs in driving growth.

What are the key drivers in the rope ladder market?

Rising Industrial and Construction Demand

The global construction and industrial sectors are expanding rapidly, particularly in emerging economies. Rope ladders are widely used for scaffolding access, warehouse maintenance, and temporary installations, creating consistent demand. Growth in infrastructure projects, factory expansions, and industrial maintenance activities ensures that ladder requirements continue to rise steadily.

Marine & Shipping Industry Expansion

The global shipping and offshore industries are witnessing robust growth, driven by increased trade and naval expansion. Rope ladders are critical for safety and compliance on vessels and offshore platforms, resulting in long-term adoption. Maritime safety regulations across Europe, North America, and Asia further reinforce consistent demand for reliable, industrial-grade ladders.

Growing Recreational and Adventure Tourism

Adventure parks, obstacle courses, and home-based recreational activities are gaining popularity worldwide, increasing demand for durable and visually appealing rope ladders. These applications, often made from synthetic materials, are designed for safety and longevity, attracting families, schools, and adventure enthusiasts, particularly in the Asia-Pacific and Europe.

What are the restraints for the global market?

Safety Concerns and Quality Issues

Poor-quality rope ladders or improper installation can result in accidents, negatively impacting market perception. Manufacturers must adhere to strict quality standards and educate users on correct usage, which can create additional operational costs and compliance challenges.

Raw Material Price Volatility

Fluctuating prices of synthetic fibers, metals, and natural materials affect production costs and profit margins. This price sensitivity poses a challenge for manufacturers, particularly for export-oriented operations or low-margin consumer products.

What are the key opportunities in the rope ladder market?

Emerging Markets in Asia-Pacific and LATAM

Rapid urbanization, industrialization, and construction activities in countries like China, India, and Brazil create significant demand for industrial, marine, and residential rope ladders. New entrants and existing manufacturers can capitalize on region-specific requirements, such as weather-resistant designs or compact ladders for dense urban environments.

Technological Innovations in Ladder Design

Advanced telescopic, modular, and foldable rope ladders present opportunities for differentiation and premium pricing. Adventure parks, emergency services, and defense sectors are early adopters, providing a pathway for new product lines and higher-margin offerings in the global market.

Regulatory-Driven Safety Demand

Stringent building codes and maritime safety regulations worldwide are driving recurring demand for rope ladders. Compliance-driven adoption in residential, industrial, and marine sectors ensures consistent sales, particularly for certified and high-quality products. Manufacturers can secure long-term contracts with government institutions and safety-focused organizations.

Product Type Insights

Portable rope ladders dominate the market, accounting for 35% of the 2024 market (USD 122.5 million). Their flexibility, compactness, and emergency-use suitability make them ideal for residential, recreational, and industrial applications. Fixed and telescopic ladders are growing steadily, driven by industrial and adventure sector adoption.

Material Insights

Synthetic fiber rope ladders lead globally with 45% market share (USD 157.5 million), favored for durability, weather resistance, and ease of maintenance. Metal-reinforced ladders are critical for industrial and marine applications, while natural fiber ladders are primarily used in recreational or eco-conscious markets.

End-Use Insights

Marine & shipping represents the largest end-use segment, accounting for 30% of the market (USD 105 million). Industrial and construction applications follow closely, with recreational and residential uses showing the fastest growth at 7% CAGR. New applications include renewable energy and rooftop maintenance, driving export-oriented demand from APAC to North America and Europe.

Distribution Channel Insights

Retail & e-commerce is rapidly growing, accounting for 25% of the market (USD 87.5 million). Online platforms, direct manufacturer websites, and specialized distributors provide ease of access and enable global reach. Direct sales dominate industrial and marine sectors, while e-commerce growth is strongest in residential and recreational segments.

| By Product Type | By Material | By End-Use Industry | By Distribution Channel |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America accounts for 15% of the market (USD 52.5 million), driven by marine, industrial, and recreational adoption. Safety regulations, disposable income, and strong e-commerce penetration support growth. The U.S. leads demand, followed by Canada.

Europe

Europe holds 18% of the market (USD 63 million), with Germany and the U.K. as primary contributors. Demand is shaped by industrial applications, maritime safety, and adventure recreation. The region is also investing in advanced materials and modular designs.

Asia-Pacific

Asia-Pacific dominates globally with a 40% market share (USD 140 million). China leads industrial and marine demand, India drives construction and residential growth, while Japan and South Korea show steady adoption in recreational and emergency services. APAC is also the fastest-growing region due to urbanization and adventure tourism expansion.

Middle East & Africa

MEA accounts for 8% of the market, with the UAE and Saudi Arabia leading industrial and residential applications. Africa remains important for regional export supply and maritime applications.

Latin America

LATAM holds 6% of the market, primarily driven by Brazil and Argentina. Demand is focused on marine, construction, and adventure applications, with increasing interest in premium and modular products.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Rope Ladder Market

- Werner Co.

- Louisville Ladder Inc.

- Bil-Jax, Inc.

- Gorilla Ladders

- Youngman Group

- Little Giant Ladder Systems

- Suncast Corporation

- Hasegawa Ladder Co., Ltd.

- Alaco Ladder Company

- Century Ladders

- Metaltech Ladder Systems

- Taymor Industries

- Harper Ladders

- Escalade, Inc.

- Atlas Ladders

Recent Developments

- In March 2025, Werner Co. launched a new series of telescopic and foldable rope ladders for emergency services and industrial applications, enhancing safety and portability.

- In January 2025, Louisville Ladder Inc. introduced synthetic fiber rope ladders for marine applications, improving durability and compliance with international maritime safety standards.

- In November 2024, Bil-Jax, Inc. expanded its product portfolio to include modular rope ladders for adventure parks and recreational use, catering to growing consumer demand in APAC and Europe.