Robotic Window Cleaners Market Size

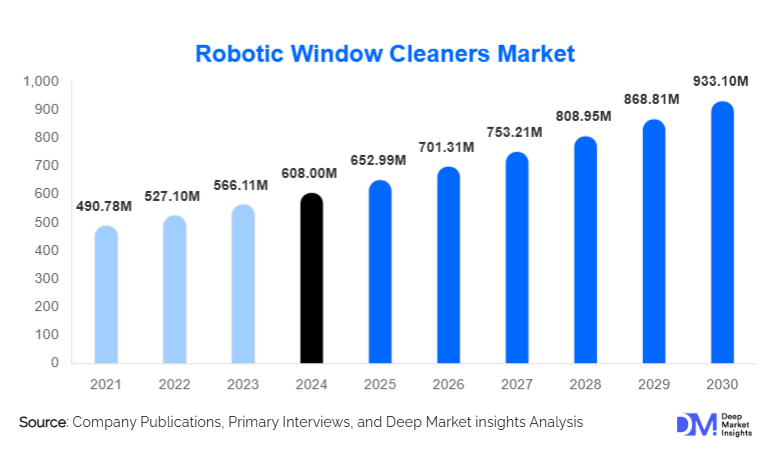

According to Deep Market Insights, the global robotic window cleaners market size was valued at USD 608.00 million in 2024 and is projected to grow from USD 652.99 million in 2025 to reach USD 933.10 million by 2030, expanding at a CAGR of 7.40% during the forecast period (2025–2030). Market expansion is being driven by increasing adoption of automation technologies, rising safety concerns around manual high-rise window cleaning, and accelerating demand for smart home robotics that reduce labor and improve operational efficiency.

Key Market Insights

- AI-enabled robotic window cleaners are rapidly gaining adoption across residential, commercial, and industrial settings due to improved navigation, surface mapping, and autonomous cleaning capabilities.

- Safety-driven demand in commercial high-rise buildings remains the largest growth catalyst, as facility managers increasingly replace manual window cleaning with automated systems.

- Asia-Pacific is the fastest-growing regional market, supported by rapid urbanization, government-led smart building initiatives, and rising disposable incomes.

- North America and Europe collectively dominate 52% of global demand, backed by widespread automation adoption and high labor costs encouraging robotic alternatives.

- Technological integration, including IoT connectivity, LiDAR navigation, and predictive maintenance algorithms, is transforming product capabilities and reducing operational downtime.

- Online distribution channels are expanding market accessibility, with major e-commerce platforms becoming primary sales hubs, especially for residential buyers.

What are the latest trends in the robotic window cleaners market?

AI-Driven Autonomous Cleaning Systems

AI and machine learning technologies are redefining robotic window cleaners through enhanced obstacle detection, smart route planning, and environment-responsive cleaning behavior. Modern devices use LiDAR, advanced sensors, and optical mapping to deliver more accurate edge detection and consistent cleaning outputs. These tools eliminate the inconsistencies of manual labor and improve safety by minimizing human involvement in dangerous high-rise cleaning tasks. Manufacturers are increasingly integrating adaptive algorithms that allow robots to adjust to weather, glass type, and dirt density, providing optimized efficiency for commercial façade cleaning.

IoT-Connected Smart Home and Smart Building Integration

With the rise of smart homes and intelligent commercial buildings, robotic window cleaners are being integrated into broader automation ecosystems. IoT connectivity allows users to remotely operate, schedule, and monitor cleaning progress via mobile applications. In commercial buildings, integration with building management systems (BMS) enables predictive maintenance, data-backed cleaning schedules, and operational analytics. This trend appeals strongly to tech-forward consumers and enterprise facility managers who prioritize automation, safety, and real-time monitoring to reduce maintenance costs.

What are the key drivers in the robotic window cleaners market?

Growing Safety and Labor Shortage Concerns

High-rise window cleaning is one of the most hazardous maintenance tasks globally. Strict workplace safety regulations in North America and Europe, combined with a shortage of skilled cleaning personnel, are pushing property managers to adopt robotic solutions. These robots reduce human exposure to heights, decrease liability costs, and ensure more consistent cleaning quality across large glass façades.

Rise of Smart Homes and Consumer Robotics

The global shift toward home automation has accelerated demand for robotic cleaning devices. Consumers seeking convenience and time-saving solutions are increasingly adopting window-cleaning robots alongside floor-cleaning and lawn-mowing robots. Integration with voice assistants, app control, and automated scheduling strengthens appeal among tech-savvy households, particularly in urban areas with large glass surfaces.

What are the restraints for the global market?

High Cost of Advanced Robotic Systems

The upfront cost of robotic window cleaners, especially advanced AI-enabled and industrial-grade models, remains a major barrier for mass adoption. Price sensitivity in emerging regions and low-cost availability of manual cleaning labor limit penetration in some markets. Businesses with limited budgets often defer purchases in favor of traditional methods.

Technical Limitations in Complex Architectural Designs

Although robotics technology is advancing rapidly, many robotic window cleaners still struggle with curved, textured, or unusually shaped surfaces. Adhesion challenges on weathered or coated glass also reduce performance efficiency. These limitations restrict deployment in certain architectural environments and necessitate ongoing manual cleaning support.

What are the key opportunities in the robotic window cleaners industry?

Integration with Smart Building and ESG Compliance Frameworks

Global focus on sustainability, reduced water usage, and safe operations is driving commercial buildings to adopt automated cleaning technologies. Robotic systems help reduce accidents and ensure adherence to ESG and LEED building maintenance norms. Opportunities lie in integrating robots with building management software to support predictive cleaning cycles, energy-efficient operations, and compliance reporting.

Rapid Urbanization and High-Rise Construction in Asia-Pacific

China, India, Indonesia, Vietnam, and the Middle East are experiencing significant high-rise construction, creating large-scale demand for façade cleaning automation. Government smart city programs further support adoption by encouraging digitalization and modern maintenance standards. The rise of premium residential towers in APAC offers additional opportunities for B2C robotic cleaner adoption.

Product Type Insights

Suction-based robotic window cleaners dominate the market with approximately 46% share in 2024. Their strong holding power, adaptability to various window surfaces, and affordability make them more accessible for both residential and commercial use. While magnetic robots require dual-sided window access, suction robots offer single-sided cleaning, making them far more versatile for high-rise exteriors. AI-enabled hybrid suction models are also contributing significantly to this category’s growth, especially in markets prioritizing safety and automation.

Application Insights

Commercial applications lead the market with around 48% share in 2024, driven by the need for safe, consistent, and cost-efficient cleaning of office towers, malls, hotels, and corporate campuses. Window robots reduce labor costs and comply with strict workplace safety norms. Residential applications are expanding rapidly, supported by growing smart home adoption and urban apartment living. Industrial and institutional sectors, such as airports, hospitals, and manufacturing plants, are emerging as new high-growth segments as automation spreads across facility maintenance operations.

Distribution Channel Insights

Online channels account for nearly 55% of global sales, driven by e-commerce dominance in consumer electronics and home automation devices. Platforms such as Amazon, Alibaba, and brand-owned D2C websites provide easy comparison and access to international models. Offline channels, including specialty electronics and appliance retailers, remain essential in emerging markets where physical demonstration influences purchasing decisions. For commercial buyers, direct B2B sales channels are gaining traction due to customization needs and after-sales service requirements.

| By Product Type | By Application | By Window Type | By Control Type | By Distribution Channel |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America represents 28% of the global market in 2024, driven by early technology adoption, high labor costs, and strict safety regulations in commercial maintenance. The U.S. leads regional demand, particularly from high-rise commercial complexes and luxury residential buildings adopting automated cleaning solutions.

Europe

Europe accounts for 24% of global demand, supported by sustainable building policies, widespread automation, and strong adoption of smart home devices. Germany, France, and the U.K. dominate demand, with increasing use of robotic cleaners in commercial property management and hospitality sectors.

Asia-Pacific

APAC is the fastest-growing region, expected to expand at over 28% CAGR. China and Japan lead innovation and consumption, while India and Southeast Asia witness sharp increases in robotic adoption due to rapid urbanization and rising disposable incomes. Government-led smart city programs across the region accelerate commercial deployments.

Latin America

Demand is gradually rising in Brazil, Mexico, and Argentina as commercial infrastructure modernizes. Although the region represents a smaller share today, increasing retail automation and e-commerce penetration are boosting residential robotic cleaner adoption.

Middle East & Africa

High-rise developments in the UAE, Saudi Arabia, and Qatar are significantly driving adoption, with robotic solutions becoming standard in premium real estate and hospitality projects. Africa shows early-stage growth led by South Africa’s commercial sector.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Robotic Window Cleaners Market

- HOBOT Technology

- Ecovacs Robotics

- Xiaomi (Smart Home Division)

- Alfawise Robotics

- Gladwell (Gecko Series)

- Cop Rose Robotics

- Mamibot Manufacturing

- Liectroux Robotics

- Windowmate

- ECIL Robot Systems

- Magiclean Robotics

- SkyBot Clean Solutions

- Winbot Series (under Ecovacs brand family)

- Kärcher Robotics Division

- Ubotia Tech

Recent Developments

- In March 2025, HOBOT Technology launched its AI-powered HOBOT-500 series featuring LiDAR mapping and predictive cleaning algorithms for high-rise applications.

- In January 2025, Ecovacs Robotics introduced cross-platform IoT integration, allowing its Winbot lineup to sync with smart home ecosystems, including Alexa, Google Home, and Xiaomi Mi Home.

- In October 2024, Kärcher announced a commercial robotic window cleaning platform designed for airports, shopping malls, and multi-story corporate buildings, integrating autonomous docking and water recycling systems.