Rifles Market Size

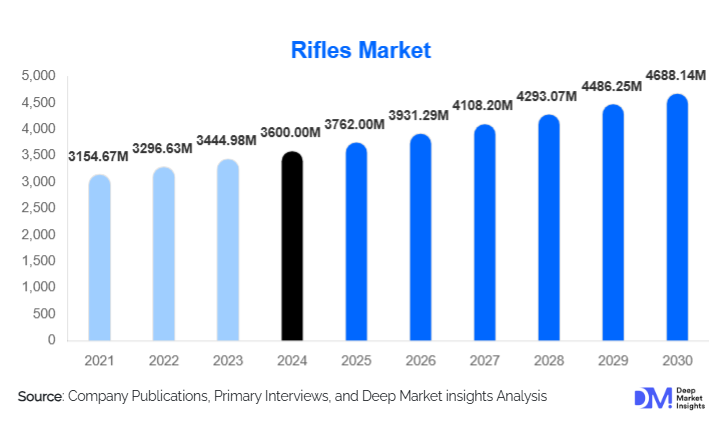

According to Deep Market Insights, the global rifles market size was valued at USD 3,600.00 million in 2024 and is projected to grow from USD 3,762.00 million in 2025 to reach USD 4,688.14 million by 2030, expanding at a CAGR of 4.5% during the forecast period (2025–2030). The rifles market growth is primarily driven by sustained global defense modernization programs, rising geopolitical tensions, increasing civilian participation in shooting sports and hunting, and continuous technological advancements in firearm design, materials, and modularity.

Key Market Insights

- Military and defense applications dominate the rifles market, accounting for more than half of global revenues due to long-term procurement contracts and higher per-unit pricing.

- Semi-automatic rifles remain the most widely adopted product type, driven by their versatility across military, law enforcement, and civilian use cases.

- North America leads global demand, supported by a strong civilian ownership culture and the largest defense procurement budget globally.

- Asia-Pacific is the fastest-growing regional market, fueled by rising defense spending in India, China, and Southeast Asia.

- Technological innovation is reshaping product differentiation, with modular designs, lightweight composites, and smart optics gaining traction.

- Regulatory frameworks continue to influence regional demand patterns, creating sharp contrasts between mature and emerging markets.

What are the latest trends in the rifles market?

Modular and Customizable Rifle Platforms

One of the most prominent trends in the rifles market is the shift toward modular and customizable weapon platforms. Modern rifles are increasingly designed with interchangeable barrels, stocks, handguards, and accessory rails, enabling end users to adapt a single platform to multiple operational requirements. This trend is particularly strong in military and law enforcement segments, where flexibility, reduced logistics complexity, and lifecycle cost optimization are key priorities. Civilian consumers are also embracing modularity, especially in sports shooting and tactical-style rifles, as customization enhances user experience and performance.

Integration of Smart and Digital Technologies

The adoption of smart technologies is gaining momentum, especially in premium and institutional rifle segments. Advanced optics, digital fire control systems, ballistic calculators, and biometric safety mechanisms are being integrated to improve accuracy, situational awareness, and operational safety. While smart rifles currently represent a smaller share of total market volume, they are among the fastest-growing sub-segments due to increasing adoption by special forces and law enforcement agencies. These innovations are also influencing training practices, maintenance cycles, and battlefield data integration.

What are the key drivers in the rifles market?

Rising Global Defense Expenditure

Increasing defense budgets across major economies remain the strongest growth driver for the rifles market. Governments are prioritizing infantry modernization initiatives to replace aging weapon systems with lighter, more accurate, and modular rifles. Countries in North America, Europe, and the Asia-Pacific are allocating substantial funds toward small arms procurement as part of broader military readiness and modernization programs, directly supporting long-term market expansion.

Growth in Civilian Shooting Sports and Hunting

Civilian participation in shooting sports, hunting, and recreational firearms usage continues to support steady demand for rifles. Competitive shooting events, hunting tourism, and expanding shooting range infrastructure are reinforcing replacement and upgrade cycles. In markets with established firearms ownership cultures, consumers increasingly prefer premium rifles with enhanced ergonomics, accuracy, and customization options.

Continuous Product Innovation

Advancements in materials science, manufacturing precision, and ergonomic design are significantly improving rifle performance. The use of lightweight alloys, advanced polymers, and CNC machining has enhanced durability while reducing weight. These innovations are encouraging both institutional and civilian buyers to upgrade existing inventories, positively impacting market growth.

What are the restraints for the global market?

Stringent Firearms Regulations

Strict regulatory frameworks governing firearm ownership, licensing, and trade pose a major restraint on market growth, particularly in Europe, parts of Asia, and Latin America. Frequent regulatory changes and compliance requirements increase operational complexity for manufacturers and distributors, limiting civilian market expansion in several regions.

Volatility in Raw Material Prices

Fluctuations in the prices of steel, aluminum, and advanced composites impact production costs and profit margins. Supply chain disruptions and rising input costs can reduce pricing flexibility, particularly for mid-sized manufacturers operating in highly competitive segments.

What are the key opportunities in the rifles industry?

Defense Localization and Offset Programs

Governments are increasingly promoting domestic arms manufacturing through localization mandates and offset programs. Initiatives such as “Make in India” and similar policies in the Middle East and Southeast Asia present significant opportunities for technology transfer, joint ventures, and local assembly partnerships, enabling manufacturers to expand regional footprints while reducing import dependency.

Expansion in Emerging Civilian Markets

Emerging economies with evolving hunting traditions, sports shooting communities, and private security needs offer untapped potential for civilian rifle sales. Rising disposable incomes and expanding retail infrastructure are expected to support long-term growth in these markets.

Product Type Insights

Semi-automatic rifles lead the global rifles market, accounting for approximately 38% of total market revenue in 2024, driven by widespread adoption across military, law enforcement, and civilian applications. Bolt-action rifles remain highly relevant in hunting and precision shooting segments, valued for their accuracy and reliability. Automatic rifles are primarily restricted to military use and represent a smaller but high-value segment. Lever-action and pump-action rifles maintain niche demand, particularly in traditional hunting markets.

Caliber Insights

Medium-caliber rifles (5.57–7.62 mm) dominate the market with an estimated 42% share in 2024, supported by NATO standardization and balanced performance attributes. Small-caliber rifles are widely used for training and recreational shooting, while large-caliber rifles cater to specialized military and long-range precision applications.

Application Insights

Military and defense applications represent the largest application segment, contributing nearly 56% of global market revenue in 2024. Law enforcement demand is steadily growing due to urban security challenges and counter-terrorism initiatives. Civilian applications, including hunting and sports shooting, form a significant volume-driven segment, supported by replacement demand and recreational usage.

Distribution Channel Insights

Government and defense procurement contracts dominate distribution channels, accounting for approximately 48% of global sales. Licensed retail and specialty stores are critical for civilian sales, while direct-to-agency sales are common for law enforcement procurement. Online licensed platforms are gradually gaining traction in regions with supportive regulatory environments.

| By Product Type | By Caliber | By Application | By Distribution Channel | By Technology |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America accounts for approximately 41% of the global rifles market in 2024, led overwhelmingly by the United States. Strong civilian ownership, advanced defense infrastructure, and sustained military spending support regional dominance. Replacement demand and premium product adoption are key growth drivers.

Europe

Europe holds around 24% market share, with demand concentrated in Germany, France, the United Kingdom, and Eastern Europe. Military modernization programs and export-oriented manufacturing underpin market stability, despite strict civilian regulations.

Asia-Pacific

Asia-Pacific is the fastest-growing region, expanding at a CAGR of over 8%. India, China, South Korea, and Southeast Asian countries are increasing defense spending and domestic production, driving rapid demand growth.

Latin America

Latin America represents a smaller but emerging market, driven by Brazil and Mexico. Demand is largely linked to law enforcement and civilian security needs, with regulatory constraints limiting broader expansion.

Middle East & Africa

The Middle East and Africa account for approximately 7% of global demand, supported by defense procurement in Saudi Arabia, the UAE, and Israel. Ongoing security challenges and defense investments continue to support steady growth.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Rifles Market

- FN Herstal

- Heckler & Koch

- Colt’s Manufacturing Company

- SIG Sauer

- Smith & Wesson

- Beretta

- Sturm, Ruger & Co.

- CZ Group

- Israel Weapon Industries (IWI)

- Kalashnikov Concern

- Remington Arms

- Steyr Arms

- Barrett Firearms

- Norinco

- Zastava Arms