Retinol Beauty Products Market Size

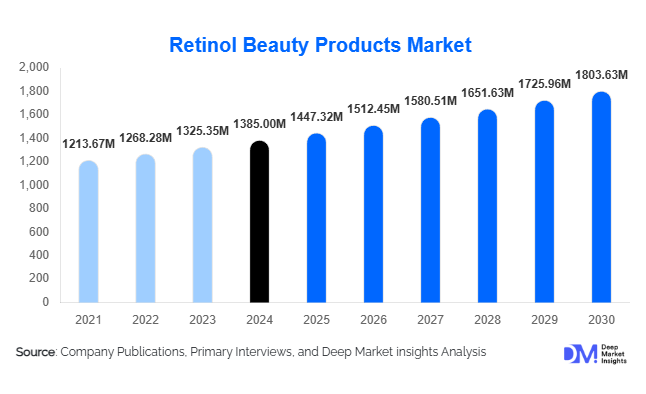

According to Deep Market Insights, the global retinol beauty products market size was valued at USD 1385.00 million in 2024 and is projected to grow from USD 1447.32 million in 2025 to reach USD 1803.63 million by 2030, expanding at a CAGR of 4.5% during the forecast period (2025–2030). The market growth is primarily driven by increasing awareness of anti-aging skincare, the rising adoption of advanced formulations such as retinol serums and oils, and the expansion of e-commerce and digital-first distribution channels targeting younger consumers globally.

Key Market Insights

- Premiumization of skincare products is accelerating market growth, with consumers increasingly opting for advanced retinol formulations such as oils, serums, and multi-active creams.

- Women continue to dominate the consumer base, representing over 70% of the market, particularly in anti-aging and pigmentation correction products.

- North America leads the global market, driven by high awareness, strong dermatology-recommended usage, and mature e-commerce penetration.

- Asia-Pacific is the fastest-growing region, led by rising middle-class incomes, increased skincare adoption in China and India, and the influence of K-beauty and J-beauty trends.

- E-commerce and direct-to-consumer channels are expanding rapidly, providing access to premium products and supporting digital marketing-driven growth.

- Innovation in delivery systems, such as encapsulated retinol and combination active formulations, is enhancing product efficacy and consumer appeal.

What are the latest trends in the retinol beauty products market?

Multi-Active and Sensitive-Skin Formulations

Companies are increasingly offering products that combine retinol with other active ingredients like peptides, hyaluronic acid, and antioxidants to address multiple skin concerns simultaneously. Sensitive-skin formulations, including microencapsulated retinol, are gaining popularity, as they reduce irritation and expand the potential consumer base. Consumers are seeking high-performance products that deliver visible results without causing redness or peeling, driving innovation across premium and mass-market tiers.

Digital and E-Commerce Expansion

Digital-first brands and established beauty companies are leveraging e-commerce platforms, social media marketing, and personalized skincare apps to increase product reach. Mobile apps, AI-driven skin analysis, and subscription models are enhancing engagement with consumers, particularly younger demographics. Online channels now account for 30–35% of total sales globally, with D2C platforms enabling brands to provide educational content, usage guidance, and loyalty programs, reinforcing adoption and repeat purchases.

What are the key drivers in the retinol beauty products market?

Rising Awareness of Anti-Aging Benefits

Consumers are increasingly conscious of preventive skincare and anti-aging benefits. Retinol, recognized for improving fine lines, wrinkles, pigmentation, and skin texture, is becoming a standard component of advanced skincare routines. Growth is driven by women aged 30–50, who represent the largest segment by spend, and by early-adopting younger consumers seeking preventive care. Educational campaigns and dermatologist endorsements further boost demand.

Formulation Innovation and Premiumization

Advanced delivery systems such as encapsulation, slow-release serums, and multi-active combinations allow brands to offer differentiated products at premium price points. Oils and serums are growing faster than traditional creams and lotions due to superior absorption and perceived efficacy. Premiumization strategies have increased average selling prices, especially in North America and Asia-Pacific.

E-commerce and Direct-to-Consumer Penetration

The expansion of online channels, social commerce, and digital marketing allows brands to reach younger consumers and emerging markets efficiently. Platforms that provide product education, user reviews, and subscription services enhance trust and repeat purchases. Digital-first brands can capitalize on trends such as male grooming and preventive skincare, which are increasingly driving market growth.

What are the restraints for the global market?

Skin Sensitivity and Regulatory Constraints

Retinol can cause irritation, redness, and peeling, which may limit adoption among certain consumer groups. Regulatory caps on retinol concentrations, particularly in the EU and some APAC markets, constrain formulation flexibility and may delay product launches. Brands must invest in research and consumer education to mitigate potential adverse effects.

Price Sensitivity in Mature Markets

In mature regions such as North America and Western Europe, competition is intense, and price-sensitive consumers may switch to lower-cost alternatives or basic skincare. High costs of advanced formulations and packaging, including encapsulated delivery systems and dark-glass bottles, can impact profit margins for mass-market products.

What are the key opportunities in the retinol beauty products market?

Emerging Markets and Untapped Demographics

Emerging markets in Asia-Pacific, Latin America, and MEA have low penetration of advanced skincare products. Young, urban consumers in China and India are adopting preventive skincare routines, providing opportunities for brands to expand through tailored products, pricing strategies, and digital engagement. Men’s grooming is also a fast-growing niche segment.

Innovation in Formulations and Delivery Systems

Advanced formulations, including encapsulated retinol, combination actives, vegan or “clean” products, and low-irritant variants, enable brands to differentiate themselves. Multi-functional products that address anti-aging, hydration, and pigmentation simultaneously are highly sought after. This innovation allows for premiumization, higher margins, and greater adoption across sensitive skin segments.

Digital Commerce and Personalization

Direct-to-consumer e-commerce and digital tools, such as AI-driven skincare analysis, subscription models, and educational content, create opportunities to increase adoption and loyalty. Personalized routines, targeted marketing, and community engagement enhance the consumer experience, supporting premium pricing and repeat sales.

Product Type Insights

Creams and lotions dominate the global retinol beauty products market, accounting for 43% (USD 405 million) of the total market in 2024. Their leading position is supported by familiarity, ease of use, and versatility across price tiers, making them accessible to mass-market consumers. Serums are the fastest-growing product type, driven by premium pricing, high active ingredient concentration, and rapid innovation cycles. Oils and balms are experiencing niche premium growth due to the rising natural and clean-beauty trend, while eye and neck treatments benefit from targeted anti-aging demand, particularly in mature markets. Cleansers and exfoliants serve as low-commitment entry points, effectively converting consumers to leave-on retinol products. Masks and peels leverage professional-strength claims, primarily distributed through salons and clinical channels, reflecting the rising trend of at-home and in-clinic premium treatments.

Application Insights

Anti-aging remains the largest and most clinically validated application, capturing the majority of sales globally. Hyperpigmentation and acne/blemish management are driven by high purchase motivation in pigment-concern markets and younger demographics, respectively, supporting premium pricing and repeat purchase cycles. Preventive and maintenance skincare encourages early adoption, particularly among younger users, enabling lower-dose mass-market offerings and expanding the overall retinol consumer base. Dermatology-recommended formulations continue to enhance adoption in professional settings, while men’s grooming is an emerging niche with strong growth potential due to increasing awareness of preventive skincare and professional-grade products.

Distribution Channel Insights

E-commerce and direct-to-consumer (D2C) channels are expanding rapidly, accounting for 30–35% of global sales. These channels provide access to premium and innovative formulations, especially in emerging markets, and enable personalized marketing, subscription models, and AI-driven skincare analysis. Specialty stores and pharmacies remain important for premium product sales, offering professional guidance and clinical credibility. Supermarkets and hypermarkets continue to serve mass-market segments, providing wide accessibility and convenience. Social media campaigns, influencer marketing, and digital-first engagement strategies are increasingly shaping consumer behavior, particularly among younger, tech-savvy demographics in Asia-Pacific and Latin America.

End-User Insights

Women dominate the market, representing 74% of global consumption, driven by high adoption of anti-aging and pigmentation products. Men’s grooming is the fastest-growing end-user segment, supported by increasing awareness and willingness to invest in preventive skincare. Dermatology and professional clinics are critical for premium product credibility, particularly in North America and Europe, where clinical endorsement influences consumer trust and willingness to pay for high-end formulations. Younger demographics are increasingly adopting preventive skincare, creating long-term loyalty and higher lifetime value.

| By Product Type | By Application | By Distribution Channel | By End-User |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America accounts for 34% of the global market (USD 320 million) in 2024, led by the U.S. and followed by Canada. The region benefits from high consumer awareness, mature retail channels, and a strong presence of dermatology-endorsed products. The high prevalence of clinical-grade retinol and direct-to-consumer medical aesthetics channels is a key growth driver, allowing premium formulations to thrive. E-commerce penetration and brand trust further support adoption. CAGR is projected at 6.1% through 2030, reflecting sustained growth in the premium and professional skincare segment.

Europe

Europe holds 25% of the global market, with Germany, France, and the U.K. leading consumption. Growth is moderated by stringent regulatory frameworks and a focus on clean-beauty standards, which drives innovation in stabilized and gentle retinol formulations. Consumers’ emphasis on ingredient transparency, product safety, and sustainability encourages brands to invest in premium, ‘natural’ retinol options. Dermatology endorsements and retail credibility also strengthen adoption. CAGR is estimated at 4.8% through 2030, with Germany and the U.K. serving as key hubs for clinical-grade and eco-conscious product launches.

Asia-Pacific

Asia-Pacific is the fastest-growing region, with China and India driving the market (USD 215 million in 2024, 22.7% of global share). The region is supported by younger demographics, rising awareness of brightening and anti-aging benefits, and the strong influence of K-beauty and J-beauty trends. Massive e-commerce marketplaces, influencer marketing, and social media adoption facilitate high-volume growth, while rising middle-class incomes support both premium and mass-market segments. CAGR is projected at 7.1% through 2030. Regional growth is further fueled by demand for multi-active and preventive formulations among digitally savvy urban consumers.

Latin America

Latin America, led by Brazil, Argentina, and Mexico, is an emerging market with growing adoption of retinol beauty products. Cultural affinity for beauty, influencer-led marketing, and social media visibility are key drivers, coupled with the increasing affordability of mid-premium and professional-grade products. Dermatology and clinical channels are gaining prominence, supporting premium growth. Outbound e-commerce and access to imported premium products further strengthen the market. CAGR is expected at 6.5% through 2030, reflecting rising adoption among urban consumers seeking both efficacy and prestige in skincare products.

Middle East & Africa (MEA)

MEA represents 8% of the global market (USD 75 million). Growth is driven by premiumization, high concern for photo-damage and pigmentation, and strong demand for imported premium retinol products in affluent markets such as the UAE, Saudi Arabia, and South Africa. Consumers increasingly seek anti-aging, brightening, and multi-functional formulations. E-commerce adoption and luxury-focused retail channels also support market expansion. CAGR is projected at 5.9% through 2030, with premium imported products leading growth in both GCC countries and South African urban centers.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Retinol Beauty Products Market

- Johnson & Johnson

- L’Oréal Group

- Procter & Gamble

- Unilever

- The Estée Lauder Companies

- Shiseido Company, Limited

- Beiersdorf AG

- Amorepacific Corporation

- Kao Corporation

- Colgate-Palmolive Company

- Avon Products

- Revlon

- Oriflame

- Mary Kay

- Herbalife

Recent Developments

- In 2025, L’Oréal launched an encapsulated retinol serum targeting sensitive skin, expanding premium e-commerce offerings globally.

- In 2025, Estée Lauder introduced a multi-active retinol cream combining peptides and hyaluronic acid for anti-aging and hydration, targeting North America and Asia-Pacific markets.

- In 2024, Shiseido expanded its retinol skincare line in India and China through online channels, catering to emerging urban consumers.