Remote Control Car Market Size

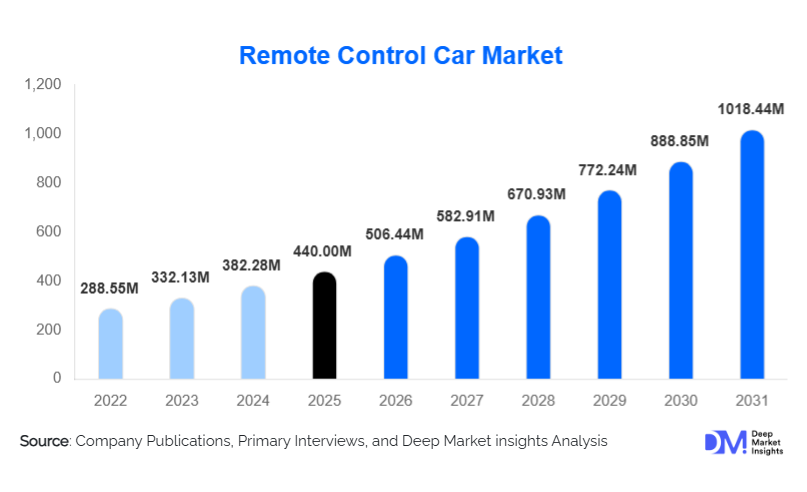

According to Deep Market Insights, the global remote control car market size was valued at USD 440 million in 2025 and is projected to grow from USD 506.44 million in 2026 to reach USD 1018.44 million by 2031, expanding at a CAGR of 15.1% during the forecast period (2026–2031). The market growth is primarily driven by increasing adoption of electric RC cars, rising popularity of hobbyist and competitive RC racing, and integration of smart and app-based control technologies that enhance user engagement.

Key Market Insights

- Technological innovation is redefining RC car experiences, with app-controlled vehicles, telemetry systems, and AI-assisted features attracting both children and adult hobbyists.

- Electric and 4WD RC cars dominate the premium segment, offering enhanced speed, durability, and safety compared to traditional nitro- or gas-powered models.

- Asia-Pacific is emerging as the fastest-growing market, fueled by rising disposable incomes, youth population growth, and expanding e-commerce adoption in countries like China and India.

- North America remains a major market, with the U.S. and Canada leading demand for high-end hobbyist-grade RC cars.

- Europe continues to drive mid-range RC car adoption, with increasing popularity of organized racing clubs and STEM-focused educational kits.

- Online distribution channels are increasingly dominant, enabling customers to access a wide variety of models, compare features, and purchase directly from brands.

What are the latest trends in the remote control car market?

Smart and App-Based RC Vehicles

Manufacturers are integrating smartphone and app-based controls to offer advanced features such as real-time telemetry, customizable drive modes, and GPS tracking. These innovations are attracting tech-savvy consumers and providing opportunities for subscription-based features, firmware updates, and enhanced user engagement. Connected RC cars also enable integration with online racing platforms, enabling global competitions and community interaction among hobbyists.

Growth of Competitive Racing and Hobbyist Communities

RC racing leagues and hobbyist clubs have expanded globally, particularly in North America, Europe, and the Asia-Pacific. These organized ecosystems drive demand for high-performance RC vehicles and replacement parts, while fostering brand loyalty and repeat purchases. Manufacturers are leveraging competitions and social media engagement to promote premium and professional-grade products, further expanding market reach.

What are the key drivers in the remote control car market?

Increasing Popularity of Hobbyist-Grade Vehicles

The rising interest in professional-grade and hobbyist RC cars is fueling growth. Consumers are investing in high-performance electric and 4WD models that provide superior speed, durability, and control. The expanding community of hobbyists and competitive racers encourages repeat purchases of upgraded vehicles and spare parts, reinforcing long-term market growth.

Integration of Educational and STEM Applications

RC cars are increasingly being used as educational tools to teach STEM concepts, including mechanics, electronics, and programming. Kits that allow customization and assembly appeal to schools, clubs, and parents seeking interactive learning experiences. This educational adoption expands the market beyond pure entertainment and drives premium pricing for modular and programmable models.

Growth of E-Commerce and Online Distribution

Digital channels provide easy access to a wide variety of RC cars, parts, and accessories, making it convenient for consumers to explore options and compare features. The surge in online shopping, particularly in emerging markets, is reducing barriers to adoption and enabling global reach for niche brands. Direct-to-consumer sales have become a key strategy for brand differentiation.

What are the restraints for the global market?

High Cost of Premium RC Cars

High-end hobbyist and professional-grade RC cars can be expensive, limiting their adoption to affluent consumers and serious hobbyists. Entry-level buyers may prefer affordable toy-grade models, creating a divide in market accessibility. Cost factors also include batteries, replacement parts, and maintenance for high-performance vehicles.

Regulatory and Safety Constraints

RC cars, particularly high-speed models, are subject to safety and import regulations in various countries. Compliance with technical standards, battery safety norms, and local import restrictions can limit market penetration and increase operational costs for manufacturers, especially in emerging markets.

What are the key opportunities in the remote control car market?

Smart and Connected Vehicle Integration

Advanced connectivity, app-based control, and AI-assisted features present a major opportunity for manufacturers to differentiate products and command premium pricing. Subscription models, firmware updates, and community integration create recurring revenue streams and enhance user engagement.

Emerging Markets Expansion

Countries in the Asia-Pacific region, particularly China and India, are experiencing rapid growth in RC car adoption. Rising middle-class incomes, increased youth populations, and expanding e-commerce infrastructure provide opportunities for both established and new entrants to penetrate underserved markets with tailored products.

STEM and Educational Applications

RC cars are increasingly utilized in STEM learning programs and robotics education, driving demand for programmable and modular kits. Partnerships with schools, educational institutions, and after-school programs create opportunities for manufacturers to expand beyond recreational segments and tap into a structured educational market.

Product Type Insights

Electric RC cars dominate the global market, accounting for approximately 45% of the 2025 market share, due to their safety, ease of use, and superior performance. Nitro-powered models follow with 25% market share, preferred by enthusiasts seeking realistic combustion-engine experiences. Gas-powered RC cars hold 15%, while hybrid or specialty models occupy the remaining share. The trend indicates a gradual shift toward electric and app-controlled models in both hobbyist and beginner segments.

Application Insights

Hobbyist and recreational use remains the largest application segment, representing 55% of market revenue in 2025. Educational and STEM-focused RC kits are growing rapidly, driven by schools and training programs. Competitive racing constitutes 20% of the market, fueled by organized leagues and global competitions. Other applications include promotional activities, collectibles, and outdoor adventure experiences.

Distribution Channel Insights

Online sales dominate the market, accounting for 50% of revenue in 2025, due to the convenience of e-commerce platforms and direct-to-consumer websites. Specialty stores and offline retail channels hold 35%, catering to hobbyists who prefer in-store demonstrations and expert guidance. Emerging channels include subscription-based kits and membership clubs for enthusiasts, creating repeat purchase opportunities.

Age Group Insights

Children under 12 years hold 30% of the market, driven by toy-grade models. Teenagers (13–18 years) account for 25%, favoring competitive and customizable kits. Adults and hobbyists dominate 45% of revenue, focusing on professional-grade vehicles, upgrades, and racing competitions. Growth is strongest among adult hobbyists due to increased disposable income and community-driven engagement.

| By Product Type | By Vehicle Design | By Drive Mechanism | By Control Method | By User Type |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America holds 35% of the 2025 RC car market, with the U.S. leading demand for hobbyist and competitive-grade vehicles. Canada also contributes significantly, supported by organized racing clubs and STEM-focused educational programs. High disposable income and early adoption of technological innovations sustain growth in the region.

Europe

Europe accounts for 25% of global revenue, with Germany, the U.K., and France driving adoption. Consumers increasingly prefer eco-friendly electric RC cars and participate in organized racing. Hobbyist communities and STEM education initiatives further support market expansion.

Asia-Pacific

Asia-Pacific is the fastest-growing region, led by China, India, and Japan. Rising middle-class incomes, youth engagement, and expanding e-commerce platforms fuel adoption. Professional-grade RC cars and app-controlled vehicles are gaining popularity, particularly among teenagers and adults.

Latin America

Brazil, Mexico, and Argentina are emerging markets with growing interest in recreational RC cars. Adoption is slower due to affordability constraints, but it is gradually increasing through online channels and hobbyist clubs.

Middle East & Africa

Growth in the Middle East is driven by high-income populations in the UAE, Saudi Arabia, and Qatar, favoring premium models. Africa, while largely a production and export region, shows growing domestic demand for educational and recreational RC kits in urban centers.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Remote Control Car Market

- Traxxas

- Tamiya

- HPI Racing

- Redcat Racing

- Horizon Hobby

- Tekno RC

- Kyosho

- Losi

- Thunder Tiger

- AULDEY

- Maisto

- World Tech Toys

- Carrera RC

- Team Associated

- ECX Racing