Refillable Cleanser Pumps Market Size

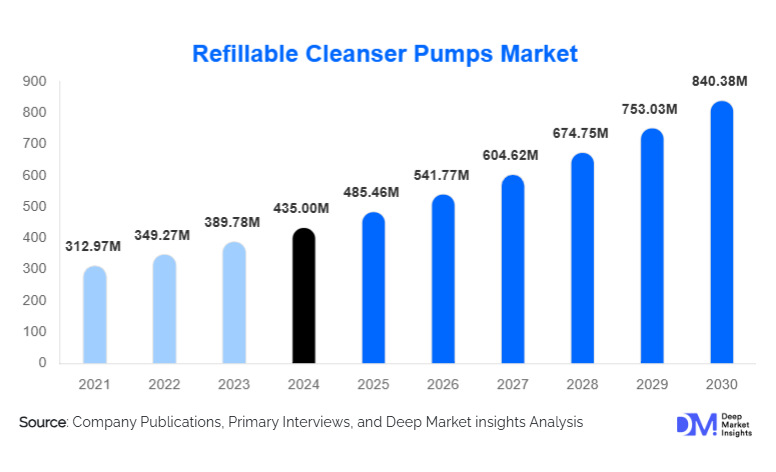

According to Deep Market Insights, the global refillable cleanser pumps market size was valued at USD 435 million in 2024 and is projected to grow from USD 485.46 million in 2025 to reach USD 840.38 million by 2030, expanding at a CAGR of 11.6% during the forecast period (2025–2030). The market growth is primarily driven by accelerating sustainability mandates, rising consumer preference for refill-based personal care products, and increasing adoption of circular packaging models by global skincare and hygiene brands.

Key Market Insights

- Refillable cleanser pumps are transitioning from niche to mainstream packaging solutions, supported by regulatory pressure on single-use plastics and brand-led sustainability commitments.

- Pouch-compatible and cartridge-based refill systems dominate adoption, as they reduce plastic consumption by up to 60–70% over product life cycles.

- Asia-Pacific leads global production and consumption, driven by strong cosmetic packaging manufacturing infrastructure in China, South Korea, and Japan.

- Europe remains the regulatory and sustainability innovation hub, with strict packaging waste directives accelerating refill adoption.

- Premium and dermatology skincare brands are the fastest-growing adopters, favoring airless and hygienic refillable pump technologies.

- Technological innovation in pump durability and mono-material designs is reshaping competitive differentiation.

What are the latest trends in the refillable cleanser pumps market?

Shift Toward Circular and Mono-Material Packaging

Brands are increasingly adopting mono-material refillable cleanser pumps to improve recyclability and compliance with extended producer responsibility regulations. Polypropylene-based pumps that can withstand multiple refill cycles are gaining traction, enabling brands to standardize packaging across global markets. Circular design principles, such as easy disassembly, refill compatibility, and lightweight construction, are now core requirements in OEM procurement contracts.

Growth of Airless and Hygienic Refill Systems

Airless refillable pumps are witnessing rapid adoption, particularly in facial cleansers and dermatology-grade formulations. These systems prevent contamination, extend shelf life, and support precise dosing, making them suitable for sensitive-skin products. Innovation in valve mechanisms and refill cartridges is allowing brands to combine hygiene with sustainability without compromising performance.

What are the key drivers in the refillable cleanser pumps market?

Rising Sustainability Commitments by Personal Care Brands

Global personal care companies are committing to aggressive packaging reduction targets, with many aiming to cut virgin plastic usage by 30–50% by 2030. Refillable cleanser pumps enable brands to meet these targets while maintaining premium aesthetics and functional performance. Sustainability labeling and ESG reporting are further incentivizing adoption.

Consumer Preference for Refill Economics

Refill packs are typically priced 20–40% lower than full packaged products, creating a strong value proposition for consumers. As refill behavior becomes normalized, the installed base of refillable pumps is expanding rapidly, generating recurring demand for durable dispensing systems.

Advancements in Pump Durability and Design

Improved resin formulations, reinforced springs, and anti-backflow mechanisms have significantly increased pump lifespan. These advancements reduce failure rates and improve consumer satisfaction, supporting repeat usage across multiple refill cycles.

What are the restraints for the global market?

Higher Initial Cost Compared to Disposable Pumps

Refillable cleanser pumps cost approximately two to three times more than conventional disposable pumps, creating adoption barriers for low-margin mass brands. While lifecycle costs are lower, upfront pricing remains a challenge in price-sensitive markets.

Limited Refill Infrastructure in Developing Regions

Uneven availability of refill pouches, cartridges, and in-store refill stations restricts adoption in parts of Latin America, Africa, and Southeast Asia. Standardization of refill formats remains a key hurdle to global scalability.

What are the key opportunities in the refillable cleanser pumps market?

Regulatory-Driven Packaging Transitions

Stricter packaging waste regulations in Europe and parts of Asia are accelerating mandatory shifts toward refillable systems. Manufacturers offering compliant, recyclable, and traceable pump designs are well-positioned to secure long-term OEM contracts.

Expansion of Premium and Dermatology Skincare

Premium and clinical skincare brands are rapidly adopting refillable cleanser pumps to reinforce sustainability credentials while maintaining hygiene and performance. This segment supports higher margins and faster innovation cycles.

Smart and Technology-Integrated Refill Systems

Emerging opportunities include RFID-enabled pumps for refill tracking, smart dosing mechanisms, and compatibility with automated refill stations. These innovations align with digital retail and smart-store concepts.

Product Type Insights

Standard lotion pumps account for the largest market share, supported by broad compatibility and cost efficiency. Airless pumps represent the fastest-growing product type, particularly in facial cleansers and premium skincare. Foaming and metered-dose pumps serve niche applications where controlled dispensing and sensory experience are critical.

Application Insights

Facial cleansers represent the largest application segment, accounting for approximately 33% of the 2024 market, driven by premium skincare growth. Hand wash and sanitizers form a significant secondary segment due to high usage frequency, while body wash applications continue to expand in refill-friendly household formats.

Distribution Channel Insights

OEM and B2B supply contracts dominate distribution, accounting for over 60% of market revenue. Brand-owned manufacturing and long-term supplier partnerships ensure quality consistency and regulatory compliance. E-commerce component sales are emerging for indie and DTC brands seeking flexible sourcing.

End-Use Industry Insights

Mass-market personal care brands represent the largest end-use segment, contributing around 40% of total demand. However, premium and dermatology skincare brands are the fastest-growing, expanding at 14–15% CAGR. Hospitality and institutional users are also adopting refillable pumps to reduce plastic waste in high-consumption environments.

| By Material Type | By Pump Mechanism | By Refill Compatibility | By Application | By End-Use Industry |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

Asia-Pacific

Asia-Pacific leads the global market with approximately 39% share in 2024. China alone accounts for nearly 22% of global demand, supported by large-scale cosmetic packaging manufacturing and strong domestic brand adoption. South Korea and Japan contribute significantly through premium skincare exports.

Europe

Europe holds around 31% of the global market, driven by Germany, France, and the U.K. Strict packaging waste regulations and high consumer environmental awareness make Europe the fastest adopter of refill systems.

North America

North America accounts for approximately 21% of global demand, led by the U.S. Growth is supported by DTC brands, premium skincare, and sustainability-driven consumer behavior.

Latin America

Latin America represents about 5% of the market, with Brazil and Mexico showing gradual adoption as refill infrastructure improves.

Middle East & Africa

The region accounts for roughly 4% of demand, led by the UAE and South Africa, primarily through hospitality and premium personal care segments.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Refillable Cleanser Pumps Market

- AptarGroup

- Silgan Holdings

- Albéa Group

- Berry Global

- Raepak

- RPC Group

- Cosmopak

- Weener Plastics

- Lumson

- Guala Dispensing

- SR Packaging

- HCP Packaging

- Aekyung Industrial

- Taixing K.K. Plastic

- Yuyao Lucky Commodity