Recycled Rubber Roofing Shingle Market Size

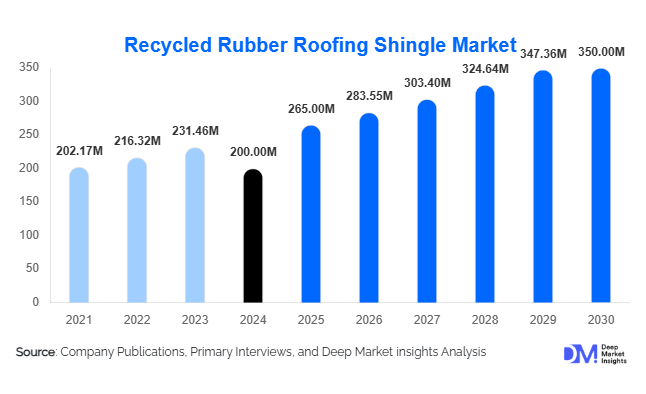

According to Deep Market Insights, the global Recycled Rubber Roofing Shingle Market size was valued at USD 200 million in 2024 and is projected to grow from USD 265 million in 2025 to reach USD 350 million by 2030, expanding at a CAGR of 7.0% during the forecast period (2025–2030). The market growth is driven by the global shift toward sustainable construction materials, rapid adoption of circular economy principles, and increasing government initiatives promoting eco-friendly building products.

Key Market Insights

- Growing preference for sustainable and recycled roofing materials is propelling demand across residential and commercial construction segments.

- Technological innovations in recycled rubber shingles, such as enhanced UV resistance and improved insulation, are expanding market appeal.

- North America dominates the global market, backed by robust recycling infrastructure and high green building penetration.

- Asia-Pacific is the fastest-growing region, driven by rapid urbanization, construction expansion, and sustainability mandates.

- Government incentives and green certifications like LEED and BREEAM are fostering demand for recycled roofing materials worldwide.

- Rising end-of-life tire recycling rates are ensuring an abundant raw material supply, supporting long-term market growth.

Latest Market Trends

Integration of Circular Economy Practices

Manufacturers are increasingly aligning with global circular economy goals by utilizing post-consumer tire waste as the primary feedstock for recycled rubber shingles. The shift reduces landfill waste while cutting carbon emissions compared to traditional asphalt roofing. Partnerships between roofing manufacturers and tire recyclers are becoming standard practice, ensuring steady supply chains and consistent product quality. Governments in the U.S., Canada, and Europe are offering tax credits and green procurement incentives, further accelerating adoption across public infrastructure projects and residential renovations.

Product Innovation and Performance Enhancement

Technological advancements are enabling manufacturers to develop lighter, more durable, and visually appealing shingles that mimic natural slate, cedar, or tile. New formulations include enhanced UV stability, fire resistance, and hail impact strength, meeting stringent building codes in extreme-weather regions. Premium products incorporating reflective coatings to improve energy efficiency are gaining traction in commercial buildings. The integration of recycled rubber with polymer composites is also extending shingle lifespan and reducing lifecycle costs, making the product more competitive with conventional roofing solutions.

Recycled Rubber Roofing Shingle Market Drivers

Rising Green Building and Sustainability Mandates

Governments worldwide are enforcing sustainable construction norms and encouraging green certifications. Builders and homeowners are increasingly opting for recycled materials to meet LEED and BREEAM standards. This regulatory momentum directly fuels demand for recycled rubber shingles, which reduce environmental impact while improving energy efficiency and building performance.

Increasing Tire Waste and Recycling Infrastructure

The global surge in tire disposal rates has created a large feedstock for recycling. With over one billion tires discarded annually, recycled rubber has become an accessible and cost-effective raw material. As recycling infrastructure expands in North America, Europe, and Asia-Pacific, manufacturers gain reliable access to consistent-quality rubber granules, reducing input volatility and improving scalability.

3Superior Product Performance Over Traditional Roofing

Recycled rubber shingles provide exceptional resistance to extreme weather, impact, and UV degradation compared to asphalt or wood shingles. Their lightweight, easy-installation nature and low maintenance costs appeal strongly to both residential and commercial property owners. The combination of longevity and reduced lifecycle cost positions them as an attractive alternative in high-performance roofing solutions.

Market Restraints

Higher Initial Costs Compared to Conventional Materials

Despite long-term benefits, recycled rubber roofing shingles typically cost 10–20% more upfront than asphalt shingles. This price gap can deter adoption among cost-sensitive consumers, especially in emerging markets where environmental benefits are secondary to affordability. Manufacturers are addressing this restraint by investing in scale economies and cost-efficient production technologies.

Limited Market Awareness and Supply Chain Reach

Many architects, builders, and homeowners remain unaware of the product’s advantages, leading to lower specification rates. Supply chain gaps, particularly in developing regions, further constrain adoption. Expanding distribution networks and targeted marketing campaigns are critical to overcoming these barriers.

Recycled Rubber Roofing Shingle Market Opportunities

Expansion into Emerging Economies

Countries across Asia-Pacific, Latin America, and the Middle East are investing heavily in urban infrastructure and green housing initiatives. Manufacturers can leverage these construction booms to establish regional production hubs and distribution partnerships. Early entry into these markets offers competitive advantages and first-mover benefits as sustainability norms strengthen.

Integration of Advanced Roofing Technologies

Innovations such as embedded solar shingles, reflective coatings, and smart roofing sensors are unlocking new product categories. By combining recycled rubber shingles with energy-harvesting or climate-adaptive technologies, manufacturers can appeal to tech-savvy builders and eco-conscious consumers, expanding profit margins and product differentiation.

Government-Led Circular Economy Programs

National policies promoting waste reduction and material recovery present vast growth opportunities. Programs like the EU’s Circular Economy Action Plan and North America’s Tire Stewardship initiatives are incentivizing industries to adopt recycled products. Aligning with these frameworks can enhance brand credibility and access to public-sector projects, particularly in infrastructure upgrades and institutional buildings.

Product Type Insights

Rubber Slate Shingles dominate the market, holding approximately 45% of the global share in 2024. Their resemblance to natural slate, coupled with lighter weight and lower maintenance, makes them popular in high-end residential and institutional projects. Rubber Shake Shingles and Rubber Barrel Tile Shingles are gaining traction due to architectural diversity and superior weather resistance. Hybrid and composite shingles blending rubber with polymers or mineral fillers are expected to register the fastest growth rate during the forecast period, driven by performance enhancements and design flexibility.

Application Insights

The Residential Sector leads the global market with about 60% share in 2024, reflecting widespread use in home renovations, retrofits, and new builds. Eco-conscious homeowners are prioritizing sustainability and durability, favoring recycled materials that contribute to lower carbon footprints. Commercial and institutional segments are expanding rapidly, supported by government-led green building mandates. Industrial adoption remains limited but shows potential as manufacturing and logistics facilities aim to reduce operational emissions.

Distribution Channel Insights

Direct-to-builder and contractor sales account for the largest distribution channel, ensuring bulk purchasing and installation efficiency. Roofing material distributors and wholesalers provide regional reach and inventory availability, especially in the U.S. and Europe. Online retail and e-commerce are emerging rapidly, driven by rising homeowner awareness and DIY installation kits. OEM partnerships with integrated roofing system providers are another growing channel, enabling seamless adoption in large-scale construction projects.

Raw Material Source Insights

Post-consumer tire rubber-based shingles hold a majority share due to the abundant availability of end-of-life tires and established recycling networks. Post-industrial rubber is gaining momentum as manufacturers seek consistent quality and lower contamination levels. Mixed recycled content shingles, incorporating rubber with other waste materials such as slate dust or plastic polymers, represent an innovation frontier, optimizing strength and sustainability metrics.

| By Product Type | By Application | By Distribution Channel |

|---|---|---|

|

|

|

Regional Insights

North America

North America leads the global market with about 40% share in 2024 (USD 80 million). The United States dominates due to mature recycling ecosystems, strong consumer awareness, and stringent green construction standards. Canada follows, with steady adoption in residential retrofits and public building projects supported by government sustainability programs.

Europe

Europe accounts for roughly 25% of the global market (USD 50 million), driven by advanced waste management policies and the EU’s Green Deal initiatives. Demand is strong in Germany, the UK, and France, where energy-efficient building codes mandate sustainable material use. Increased R&D investments and architectural preferences for high-performance roofing are accelerating regional growth.

Asia-Pacific

Asia-Pacific represents about 20% market share in 2024 (USD 40 million) and is the fastest-growing region with double-digit CAGR potential. Rapid urbanization in China, India, and Southeast Asia, coupled with rising environmental awareness, is driving demand for green roofing materials. Government programs such as “Make in India” and “China’s 14th Five-Year Plan for Green Building” are fostering local manufacturing investments.

Middle East & Africa

The region holds around a 10–15% share (USD 30 million). Countries like the UAE, Saudi Arabia, and South Africa are investing in sustainable infrastructure and resort projects. Extreme climate resilience of rubber shingles makes them ideal for these geographies, and adoption is projected to increase steadily through 2030.

Latin America

Latin America has a smaller but growing base. Brazil and Mexico are leading markets, supported by eco-friendly housing initiatives and import demand for sustainable roofing materials from North America. Regional production facilities are anticipated to emerge as demand consolidates.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Recycled Rubber Roofing Shingle Market

- Westlake

- EcoStar

- Brava Roof Tile

- CeDUR

- Enviroshake

- F Wave

- Quarrix

- Eurocell

- Guardian Building Products

- Authentic Roof

- Polysand

- Euroshield

- DaVinci Roofscapes

- Revolution Roofing

- Global EcoTech Roofing

Recent Developments

- In April 2025, EcoStar introduced a new line of solar-integrated recycled rubber shingles designed for energy-efficient residential roofs.

- In March 2025, Westlake expanded its manufacturing facility in Ohio, increasing recycled rubber utilization by 30% to meet rising North American demand.

- In February 2025, Enviroshake launched its “Cool Roof” technology, incorporating reflective coatings to improve thermal performance in commercial buildings.

- In January 2025, Brava Roof Tile announced partnerships with tire recycling firms across Europe to ensure a sustainable feedstock supply for its new product line.