Receipt Printers Market Size

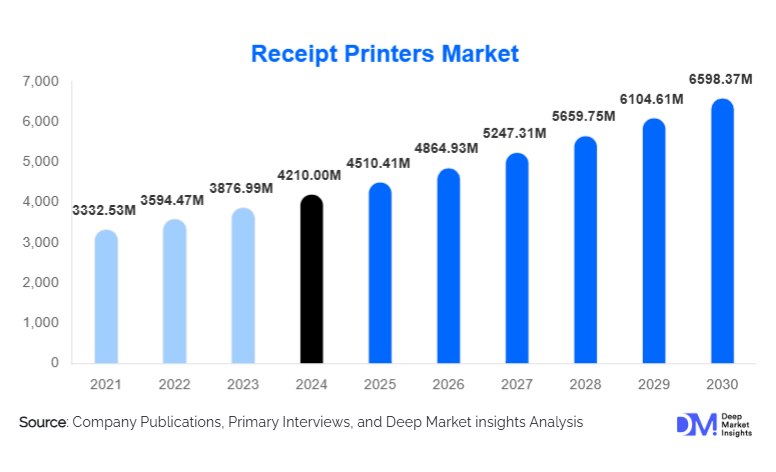

According to Deep Market Insights, the global receipt printers market size was valued at USD 4,210.00 million in 2024 and is projected to grow from USD 4,540.41 million in 2025 to reach USD 6,598.37 million by 2030, expanding at a CAGR of 7.86% during the forecast period (2025–2030). The receipt printers market growth is primarily driven by the continued expansion of organized retail and hospitality sectors, rising penetration of POS terminals, regulatory requirements for printed transaction records, and growing adoption of mobile and wireless billing solutions across logistics, transportation, and public services.

Key Market Insights

- Thermal receipt printers dominate the global market, accounting for over 70% of total demand due to low maintenance, high-speed printing, and cost efficiency.

- Retail and hospitality remain the largest end-use industries, supported by the global expansion of supermarkets, QSRs, and convenience store chains.

- Asia-Pacific leads global demand, driven by rapid digitization, SME expansion, and government-backed cashless payment initiatives.

- Wireless and cloud-connected receipt printers are gaining traction, enabling seamless integration with modern POS and ERP systems.

- Mobile receipt printers are the fastest-growing product category, fueled by last-mile delivery, field billing, and transportation ticketing use cases.

- Despite digital receipt adoption, regulatory mandates across banking, healthcare, and taxation continue to sustain long-term demand.

What are the latest trends in the receipt printers market?

Shift Toward Wireless and Cloud-Integrated Printers

The receipt printers market is witnessing a strong shift toward wireless connectivity, including Bluetooth, Wi-Fi, and NFC-enabled devices. These printers seamlessly integrate with cloud-based POS systems, enabling centralized monitoring, remote diagnostics, and real-time transaction tracking. Retailers and hospitality chains increasingly prefer cloud-compatible printers to reduce downtime, simplify maintenance, and support omnichannel operations. This trend is particularly strong among large retail chains and QSR brands that operate multi-location networks requiring standardized and scalable billing infrastructure.

Rising Adoption of Mobile and Portable Receipt Printers

Mobile receipt printers are gaining rapid adoption across logistics, transportation, utilities, and field service operations. Compact, battery-powered printers allow on-the-spot billing, proof-of-delivery receipts, and ticket issuance. Growth in e-commerce deliveries, ride-hailing services, and mobile ticketing systems is accelerating demand for ruggedized and lightweight portable printers. Manufacturers are focusing on durability, longer battery life, and seamless smartphone integration to cater to this expanding use case.

What are the key drivers in the receipt printers market?

Expansion of Organized Retail and Hospitality Chains

The global expansion of supermarkets, hypermarkets, convenience stores, and quick-service restaurants remains a primary growth driver. Receipt printers are a core component of POS systems, and high transaction volumes in retail environments drive consistent replacement and upgrade demand. Emerging economies are witnessing rapid retail formalization, significantly boosting printer installations across new stores.

Regulatory Requirements for Printed Transaction Records

In many countries, printed receipts remain mandatory for VAT compliance, consumer protection, warranty claims, and audit purposes. Sectors such as banking, healthcare, public utilities, and government services continue to require physical transaction documentation, ensuring sustained demand for receipt printers even as digital payments rise.

What are the restraints for the global market?

Gradual Adoption of Digital and Paperless Receipts

Some retailers in developed markets are increasingly offering digital receipts via email or mobile apps to reduce paper usage and operational costs. While adoption remains limited globally, this trend poses a long-term challenge to printed receipt volumes, particularly in environmentally conscious regions.

Volatility in Raw Material and Component Prices

Fluctuations in thermal paper prices and electronic component costs impact manufacturing margins. Supply chain disruptions and rising semiconductor prices can increase production costs, particularly affecting smaller manufacturers with limited pricing flexibility.

What are the key opportunities in the receipt printers industry?

Emerging Market Demand and SME Digitization

Rapid digitization of small and medium-sized enterprises in Asia-Pacific, Latin America, and Africa presents a major opportunity. Government-led digital payment initiatives and tax compliance reforms are driving demand for affordable receipt printers tailored for SMEs. Vendors offering low-cost, reliable devices stand to gain strong volume growth.

IoT-Enabled and Smart Printer Solutions

The integration of IoT capabilities into receipt printers enables predictive maintenance, remote monitoring, and analytics-driven performance optimization. Smart printers reduce downtime and total cost of ownership for large enterprises, creating opportunities for manufacturers to offer value-added services and long-term service contracts.

Product Type Insights

Thermal receipt printers dominate the global receipt printers market, accounting for approximately 72% of the 2024 market value. Their leadership is driven by a combination of high-speed printing, low noise levels, compact design, and the elimination of ink or toner consumables, which significantly reduces the total cost of ownership. Thermal printers are particularly well-suited for high-volume transaction environments such as retail checkout counters, quick-service restaurants, supermarkets, and pharmacies, where operational efficiency and reliability are critical. In addition, advancements in thermal printhead durability and print clarity have further strengthened their adoption across both developed and emerging markets.

From a form-factor perspective, fixed receipt printers remain the standard choice for POS counters due to their robustness, ease of integration, and suitability for continuous operation. However, mobile and portable receipt printers represent the fastest-growing sub-segment, driven by expanding use cases in logistics, transportation, last-mile delivery, field services, and mobile ticketing. Growth in this segment is supported by increasing demand for Bluetooth- and Wi-Fi-enabled devices, longer battery life, and ruggedized designs capable of operating in outdoor and mobile environments.

Application Insights

POS counters represent the largest application area for receipt printers globally, supported by widespread deployment across retail stores, supermarkets, convenience stores, and hospitality outlets. High transaction volumes and frequent hardware refresh cycles in these environments sustain steady demand for fixed thermal receipt printers. Retail digitization and omnichannel integration further reinforce POS-based printer installations. Kiosks and self-service terminals are emerging as a rapidly expanding application segment, particularly in airports, metro stations, parking facilities, cinemas, and quick-service restaurants. The growing preference for self-checkout, automated ticketing, and contactless transactions is driving adoption of compact, high-reliability receipt printers designed for unattended operations.

Mobile billing applications are gaining prominence across logistics, utilities, public transportation, and last-mile delivery services. Field agents and delivery personnel increasingly rely on portable receipt printers for real-time billing, proof-of-delivery documentation, and service confirmations. Meanwhile, industrial and warehouse environments continue to utilize receipt printers for transaction validation, shipment confirmation, and internal documentation, ensuring consistent demand from the logistics and supply chain sector.

Distribution Channel Insights

Direct enterprise sales dominate large-scale deployments, particularly among multinational retail chains, hospitality brands, transportation operators, and government agencies. These customers typically engage in bulk procurement and long-term supply contracts, favoring established manufacturers with global service capabilities and standardized product offerings. System integrators and POS solution providers play a critical role in the market by bundling receipt printers with billing software, POS terminals, scanners, and payment systems. Their expertise in customization, installation, and after-sales support makes them a preferred channel for complex, multi-location deployments.

Online and e-commerce channels are gaining increasing importance among SMEs, independent retailers, and small hospitality businesses. Competitive pricing, ease of comparison, and faster availability are driving online sales growth, particularly in emerging markets. In parallel, OEM partnerships with POS vendors remain a key go-to-market strategy for leading manufacturers, enabling seamless hardware-software integration and recurring replacement demand.

End-Use Industry Insights

Retail and e-commerce account for nearly 38% of global receipt printer demand, making it the largest end-use segment. Growth is driven by the expansion of organized retail, the rising number of POS terminals, and increased transaction frequency. E-commerce-driven returns processing and omnichannel retail models also contribute to sustained printer usage. Hospitality represents approximately 24% of global demand, supported by hotels, restaurants, cafes, and QSR chains that require fast, reliable receipt printing for order processing and billing. The rise of cloud kitchens and food delivery platforms further supports printer adoption.

Transportation and logistics are the fastest-growing end-use segment, expanding at over 9% CAGR. Parcel delivery, courier services, public transportation ticketing, and mobility platforms are driving demand for mobile and ruggedized receipt printers. Healthcare and pharmacies continue to generate stable demand due to billing accuracy, insurance documentation, and regulatory compliance requirements, while government and public utilities represent a steady, replacement-driven segment with long equipment lifecycles.

| By Product Type | By Application | By Distribution Channel | By End-Use Industry |

|---|---|---|---|

|

|

|

|

Regional Insights

Asia-Pacific

Asia-Pacific accounts for approximately 34% of the global receipt printers market in 2024, making it the largest regional market. Demand is led by China, India, and Japan, supported by rapid retail expansion, SME digitization, and government-led cashless payment initiatives. Large-scale rollout of POS terminals, growth of e-commerce logistics, and rising adoption of mobile billing in transportation and utilities are key growth drivers. India is the fastest-growing country in the region, with a CAGR exceeding 10%, driven by the formalization of retail, GST compliance requirements, and the rapid growth of small merchants adopting digital billing solutions.

North America

North America holds around 26% market share, driven primarily by strong replacement demand rather than new installations. High penetration of advanced POS systems, early adoption of wireless and cloud-connected receipt printers, and strict compliance requirements in retail and healthcare support steady demand. The U.S. remains the largest single-country market, benefiting from large retail chains, QSR expansion, and continued investments in self-service kiosks and automation.

Europe

Europe represents nearly 22% of global demand, with Germany, the U.K., and France leading adoption. Growth is supported by regulatory compliance requirements for transaction documentation, modernization of retail infrastructure, and widespread adoption of self-checkout systems. Sustainability initiatives are also influencing printer upgrades, with energy-efficient and paper-optimized models gaining preference across the region.

Latin America

Latin America accounts for approximately 10% of global demand, with Brazil and Mexico emerging as key growth markets. Growth is driven by SME formalization, tax compliance reforms, and increasing penetration of POS systems in retail and hospitality. Expansion of e-commerce and last-mile delivery services is accelerating the adoption of mobile receipt printers across the region.

Middle East & Africa

The Middle East & Africa region holds about 8% market share, led by the UAE and Saudi Arabia. Growth is supported by smart city initiatives, retail infrastructure investments, and the digital transformation of public services. Increasing adoption of electronic ticketing, parking management systems, and automated billing in transportation and utilities is driving demand. In Africa, the gradual formalization of retail and mobile-based commerce is creating long-term growth opportunities for entry-level and rugged receipt printer solutions.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Leading Players in the Receipt Printers Market

- Seiko Epson Corporation

- Star Micronics

- Zebra Technologies

- Bixolon

- Citizen Systems

- HP Inc.

- Toshiba Tec

- Diebold Nixdorf

- Fujitsu

- Panasonic

- Custom S.p.A.

- Posiflex Technology

- SNBC

- Woosim Systems

- TSC Auto ID