Ready-To-Move-In Luxury Homes Market Size

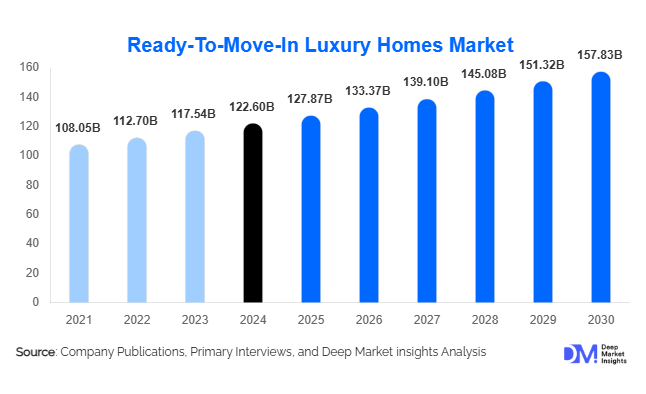

According to Deep Market Insights, the global ready-to-move-in luxury homes market size was valued at USD 122.60 billion in 2024 and is projected to grow from USD 127.87 billion in 2025 to reach USD 157.83 billion by 2030, expanding at a CAGR of 4.3% during the forecast period (2025–2030). The market growth is primarily driven by rising global wealth levels, increasing preference for immediate-possession residential assets, and strong demand for premium, low-risk real estate investments among high-net-worth and ultra-high-net-worth individuals.

Key Market Insights

- Ready-to-move-in luxury homes are increasingly preferred over under-construction properties due to reduced execution risk, transparent pricing, and faster rental yield generation.

- Luxury apartments and penthouses dominate global demand, driven by land scarcity and lifestyle-oriented high-rise developments in major urban centers.

- North America remains the largest regional market, supported by strong domestic wealth creation and institutional investor participation.

- Asia-Pacific is the fastest-growing region, fueled by the rapid expansion of HNWI populations in China, India, and Southeast Asia.

- Branded residences are gaining traction globally, commanding price premiums through hospitality-grade services and brand assurance.

- Smart home integration and sustainability features are becoming core differentiators in luxury residential buying decisions.

What are the latest trends in the ready-to-move-in luxury homes market?

Rise of Branded and Lifestyle Residences

Branded residences affiliated with global hospitality, fashion, and design brands are emerging as a major trend within the ready-to-move-in luxury homes market. These properties offer curated living experiences, concierge services, and asset-backed brand value, enabling developers to command 15–30% pricing premiums over comparable non-branded units. Cities such as Dubai, Miami, London, and Singapore are witnessing the rapid expansion of this segment as affluent buyers prioritize lifestyle assurance, liquidity, and long-term value preservation.

Technology-Enabled Smart Luxury Living

Luxury buyers are increasingly demanding integrated smart home ecosystems. Features such as AI-driven climate control, biometric security, voice-activated automation, energy optimization systems, and digital concierge services are becoming standard in premium RTMI properties. Developers investing in smart infrastructure are achieving faster absorption rates and stronger resale values, particularly among younger HNWI buyers and tech-savvy global investors.

What are the key drivers in the ready-to-move-in luxury homes market?

Growing Global HNWI and UHNWI Population

The continued expansion of global wealth is a fundamental driver of demand for ready-to-move-in luxury homes. High-net-worth individuals increasingly view luxury residential assets as a stable store of value, inflation hedge, and lifestyle upgrade. Wealth creation in technology, finance, and entrepreneurship hubs is directly translating into higher transaction volumes for premium residential real estate.

Preference for Immediate Possession and Risk Mitigation

Buyers are increasingly favoring completed luxury homes to avoid construction delays, regulatory risks, and cost overruns associated with under-development projects. Ready-to-move-in properties provide certainty of delivery, quality assurance, and immediate usability, making them especially attractive to international buyers and institutional investors.

What are the restraints for the global market?

High Transaction Costs and Luxury Taxes

Luxury homes are subject to elevated transaction costs, including stamp duties, luxury taxes, and property levies, which can materially increase acquisition costs. In some regions, regulatory tightening and additional taxation on high-value real estate transactions may temporarily suppress demand.

Macroeconomic and Interest Rate Volatility

Fluctuating interest rates and broader macroeconomic uncertainty can impact leveraged purchases and investor sentiment. Although luxury buyers are less debt-dependent than mass-market buyers, prolonged monetary tightening cycles may moderate short-term transaction volumes.

What are the key opportunities in the ready-to-move-in luxury homes industry?

Cross-Border and Residency-Linked Real Estate Demand

Residency-by-investment programs, long-term visas, and relaxed foreign ownership regulations are creating strong cross-border demand for luxury homes. Markets in the Middle East, Southern Europe, and Southeast Asia are particularly benefiting from international capital inflows seeking mobility, lifestyle, and asset diversification.

Sustainable and ESG-Oriented Luxury Developments

Sustainability-focused luxury homes incorporating green building certifications, renewable energy systems, and water-efficient designs are gaining traction. ESG-compliant projects are attracting both institutional investors and environmentally conscious affluent buyers, creating long-term differentiation and valuation premiums.

Property Type Insights

Luxury apartments and penthouses account for the largest share of the market, representing approximately 38% of global revenue in 2024, driven by high-density urban development and premium amenities. Villas and bungalows dominate suburban and resort destinations, appealing to buyers seeking privacy and larger living spaces. Branded residences are the fastest-growing property type, supported by strong investor confidence and higher liquidity. Luxury townhouses and condominiums continue to perform well in master-planned communities offering gated security and shared lifestyle infrastructure.

Price Band Insights

The USD 3–5 million price band leads the market with roughly 34% share, balancing exclusivity and affordability for global HNWI buyers. Properties priced between USD 5–10 million are expanding rapidly in global gateway cities, while ultra-luxury homes above USD 10 million remain a niche but high-margin segment driven by UHNWIs and family offices.

Buyer Profile Insights

High-net-worth individuals represent the largest buyer group, accounting for nearly 46% of transactions globally. Ultra-high-net-worth individuals dominate the ultra-luxury segment, while non-resident and expatriate buyers are increasingly active in international second-home and investment markets. Institutional and family office buyers are expanding their presence, particularly in rental-yield-focused luxury assets.

| By Property Type | By Price Band | By Buyer Profile | By Location Type | By Construction Typology | By Sales Channel |

|---|---|---|---|---|---|

|

|

|

|

|

|

Regional Insights

North America

North America accounts for approximately 32% of the global ready-to-move-in luxury homes market, led by the United States. Cities such as New York, Miami, Los Angeles, and San Francisco attract strong domestic and international demand due to financial concentration, lifestyle appeal, and rental yield stability.

Europe

Europe holds around 21% market share, with the United Kingdom, France, Germany, Spain, and Italy as key markets. Demand is supported by investor residency programs, heritage cities, and a strong appeal for second-home ownership.

Asia-Pacific

Asia-Pacific represents nearly 29% of the global market and is the fastest-growing region, expanding at over 8.5% CAGR. China, India, Singapore, Australia, and Hong Kong are major demand centers, supported by rapid wealth accumulation and urban luxury development.

Middle East & Africa

The Middle East, led by the UAE and Saudi Arabia, is witnessing strong growth due to investor-friendly policies, luxury branding, and global connectivity. Africa remains niche, driven primarily by resort and second-home demand.

Latin America

Latin America accounts for approximately 6% of the market, led by Brazil and Mexico. Demand is concentrated in premium urban and coastal destinations, with gradual growth in international buyer participation.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Ready-To-Move-In Luxury Homes Market

- Emaar Properties

- DLF Limited

- DAMAC Properties

- Sun Hung Kai Properties

- CapitaLand

- Hongkong Land

- Brookfield Residential

- Related Companies

- China Vanke

- Hines

- Nakheel

- Sobha Group

- Meraas

- Lendlease

- Mitsubishi Estate