Racing Clutches Market Size

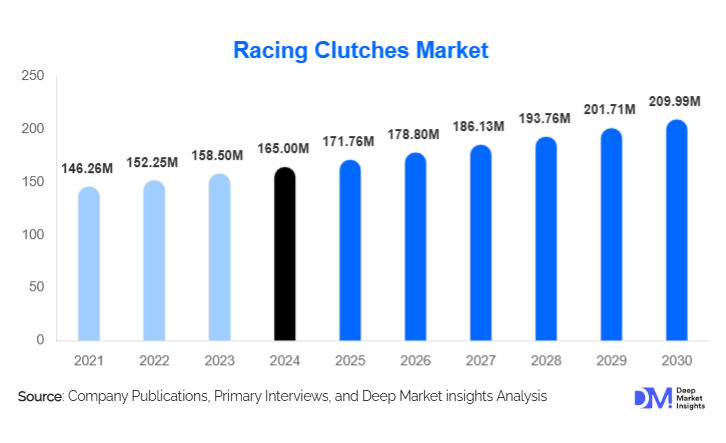

According to Deep Market Insights, the global racing clutches market size was valued at USD 165.00 million in 2024 and is projected to grow from USD 171.76 million in 2025 to reach USD 209.99 million by 2030, expanding at a CAGR of 4.1% during the forecast period (2025–2030). The racing clutches market growth is primarily driven by increasing motorsport participation, rising sales of high-performance vehicles, technological advancements in clutch materials, and growing aftermarket customization trends for racing enthusiasts.

Key Market Insights

- Multi-plate and ceramic clutches dominate the market due to superior torque handling, high thermal resistance, and durability, particularly for high-performance racing cars and motorcycles.

- OEM supply accounts for the largest distribution channel, as vehicle manufacturers increasingly integrate high-performance clutches in sports cars and racing motorcycles.

- North America leads global demand, supported by professional racing circuits, motorsport leagues, and a mature aftermarket for performance upgrades.

- Asia-Pacific is the fastest-growing region, driven by emerging motorsport leagues, growing motorcycle culture, and increasing high-performance vehicle production in China, India, and Japan.

- Technological advancements, including hybrid and lightweight materials like Kevlar-ceramic composites, dual-clutch systems, and IoT-enabled clutch monitoring, are shaping product development and adoption.

What are the latest trends in the racing clutches market?

High-Performance Material Adoption

Manufacturers are increasingly adopting ceramic, Kevlar, and hybrid materials for racing clutches to enhance heat resistance, reduce weight, and improve friction efficiency. These materials allow clutches to withstand extreme torque conditions in professional racing applications, resulting in longer service life and better performance. High-end motorsport teams, as well as aftermarket performance enthusiasts, are driving this demand for cutting-edge clutch materials.

Integration with Advanced Transmission Systems

Dual-clutch and automated transmission systems are becoming more prevalent in high-performance and racing vehicles. Racing clutches are now being designed for precision engagement with these systems, enhancing acceleration, gear-shift smoothness, and overall vehicle performance. This trend is also influencing OEM adoption rates, as automotive manufacturers aim to optimize performance for both street-legal sports cars and track-specific vehicles.

What are the key drivers in the racing clutches market?

Expansion of Motorsport Industry

The growth of global motorsport events, including Formula 1, MotoGP, GT racing, and regional championships, is a primary driver for racing clutch demand. Teams require high-performance clutches capable of rapid torque engagement and extreme durability under track conditions, boosting both OEM and aftermarket sales.

Rising Sales of High-Performance Vehicles

Increasing consumer preference for sports cars, supercars, and high-end motorcycles is driving demand for specialized racing clutches. Vehicles equipped with dual-clutch or manual transmission systems need advanced clutches, creating opportunities across racing and performance vehicle segments.

Technological Advancements

Innovations in clutch materials, such as Kevlar, ceramic, and sintered metal composites, are enabling higher torque capacity and thermal stability. IoT-enabled clutch systems for real-time performance monitoring are also emerging, particularly in professional racing, enhancing reliability and track performance.

What are the restraints for the global market?

High Cost of Racing Clutches

Premium pricing for high-performance clutches limits adoption in cost-sensitive markets. Amateur racing teams and recreational motorsport enthusiasts may opt for conventional alternatives, restricting market penetration and growth in emerging economies.

Complex Manufacturing and Maintenance

Advanced clutch systems require sophisticated manufacturing processes and regular maintenance. Limited technical expertise or service networks in certain regions can deter adoption, posing a challenge for market expansion.

What are the key opportunities in the racing clutches industry?

Emerging Motorsport Markets in APAC

Countries like China, India, and Japan are experiencing growing interest in motorsport culture, rising disposable incomes, and expanding vehicle performance awareness. Racing clutch manufacturers can capitalize on these emerging markets by expanding production and distribution networks.

Advanced Material and Technology Integration

Developing lightweight, heat-resistant, and high-friction clutch systems presents a significant opportunity. IoT-based clutch monitoring and hybrid material innovations can create premium offerings, increasing margins and brand differentiation.

Government and Infrastructure Initiatives

Investment in racing infrastructure, motorsport events, and track development in regions like the Middle East and APAC boosts demand. Companies can align with these initiatives to expand OEM and aftermarket sales, leveraging emerging racing circuits and growing professional participation.

Product Type Insights

Multi-plate clutches are the leading product type in the racing clutches market, accounting for 42% of the market in 2024. Their dominance is largely driven by their superior torque handling, faster engagement, and high thermal tolerance, which are essential for high-performance motorcycles, racing cars, and professional motorsport vehicles. These clutches are preferred in competitive racing applications due to their ability to sustain extreme torque without performance degradation. Ceramic clutches are gaining traction due to their lightweight construction, exceptional heat resistance, and longer service life, making them ideal for professional motorsport teams seeking reliability under high-speed track conditions. Single-plate and organic clutches continue to serve the entry-level or amateur racing segments, offering a balance between cost-effectiveness and performance, maintaining a moderate presence in markets with emerging motorsport participation. Innovations in material composites and friction technologies are expected to further enhance performance, driving adoption across both OEM and aftermarket channels.

Application Insights

High-performance racing cars represent 35% of the global demand for racing clutches, fueled by professional motorsport applications, track racing, and aftermarket performance upgrades. The demand in this segment is driven by the increasing production of sports cars and supercars with dual-clutch and manual transmission systems, which require specialized clutch assemblies for optimal performance. Motorcycles, including sports and racing bikes, constitute a significant portion of demand, particularly in APAC, where motorcycle culture and competitive racing leagues are prominent. Off-road vehicles and specialty racing vehicles, such as go-karts, rally cars, and dune buggies, form niche applications that are experiencing moderate but steady growth, contributing to market diversification. The trend toward electric and hybrid racing vehicles is also opening new application avenues, necessitating clutch systems designed to manage unique torque characteristics, high acceleration, and regenerative braking performance.

Distribution Channel Insights

The OEM supply chain dominates the distribution landscape, capturing 60% of market share in 2024, as racing clutches are increasingly integrated into high-performance vehicles at the manufacturing stage. The aftermarket segment is rapidly expanding due to rising vehicle customization, performance upgrades, and replacement demand, especially in regions with strong motorsport participation. Online platforms and specialized racing retailers facilitate access for enthusiasts and professional teams, offering direct purchase options, technical support, and customized solutions. The proliferation of e-commerce and digital marketplaces is further enhancing reach, allowing smaller manufacturers and boutique performance brands to penetrate markets previously dominated by OEMs. Subscription-based services and dedicated racing performance programs are emerging as innovative channels to strengthen customer engagement and recurring revenue streams.

End-Use Insights

The primary end-users of racing clutches include motorsport teams, high-performance car owners, motorcycle racers, and off-road enthusiasts. The fastest-growing end-use segments are high-performance racing cars and motorcycles, driven by increasing participation in professional and amateur racing leagues, as well as rising consumer demand for performance upgrades. Emerging applications in electric and hybrid racing vehicles present opportunities for specialized clutch designs capable of handling higher torque loads, rapid engagement, and energy-efficient operation. Export-driven demand from North America and Europe continues to support global growth, while emerging markets in APAC and the Middle East provide opportunities for long-term expansion. End-use industries in these segments are projected to grow at a CAGR of 7–9% during the forecast period, with aftermarket and OEM channels benefiting from increasing vehicle sales, motorsport events, and consumer inclination toward performance enhancements.

| By Product Type | By Application | By Distribution Channel | By End-Use Industry |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America accounted for 28% of the global market in 2024, led by the U.S., with strong motorsport infrastructure, established racing leagues, and a mature aftermarket for racing clutches. Key drivers include high disposable income, widespread motorsport participation, and the growing popularity of track-day and amateur racing events. Canada contributes through motorcycle racing culture and performance vehicle ownership. The presence of high-performance automotive OEMs and racing teams, coupled with frequent motorsport events such as NASCAR, IndyCar, and regional racing championships, supports sustained growth in both OEM and aftermarket segments.

Europe

Europe represented 25% of the 2024 market, with Germany, the U.K., and Italy leading demand. The primary drivers of growth include luxury sports car production, Formula 1 participation, and a well-established performance vehicle aftermarket. Germany dominates country-level demand due to high-volume production of high-performance cars, advanced motorsport culture, and R&D investments in racing technologies. The U.K. and Italy also exhibit strong demand due to motorsport events, racing schools, and high consumer adoption of aftermarket performance upgrades. Europe’s regulatory framework, encouraging vehicle safety and performance standards, further supportsthe adoption of high-quality racing clutches.

Asia-Pacific

APAC is the fastest-growing region, driven by China, India, and Japan, and is expected to maintain a CAGR of approximately 9% through 2030. Growth is fueled by rising middle-class wealth, increasing motorsport leagues, and a strong motorcycle and sports car culture. In China, government support for motorsports infrastructure and racing circuits is accelerating demand for high-performance components. India’s rapidly growing automotive sector, combined with rising interest in motorcycle racing and sports cars, is contributing to robust aftermarket and OEM demand. Japan benefits from established racing circuits, performance vehicle production, and consumer adoption of lightweight and ceramic clutch systems. Emerging motorsport events and hobbyist racing communities across APAC further drive regional growth.

Latin America

Latin America is gradually expanding, with Brazil and Argentina leading demand. Drivers include growing participation in motorsport, increasing adoption of high-performance vehicles, and rising consumer interest in aftermarket performance upgrades. Professional and amateur racing leagues are contributing to demand for specialized racing clutches, while imports of high-quality OEM and aftermarket components continue to grow to meet rising local interest.

Middle East & Africa

The Middle East, led by the UAE and Saudi Arabia, is experiencing rapid growth in racing clutch demand, driven by investments in motorsport infrastructure, racing events, and high-end automotive culture. Government-supported initiatives to host international racing leagues and build professional racing tracks are key growth drivers. Africa is benefiting from regional motorsport initiatives and professional racing leagues, particularly in South Africa, enhancing demand for OEM and aftermarket racing clutches. The rising popularity of luxury and high-performance vehicles in these regions further supports sustained market expansion.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Racing Clutches Market

- AP Racing

- Tilton Engineering

- Ogura Industrial Corp.

- Exedy Corporation

- Valeo

- Sachs Performance

- Borg & Beck Performance

- Clutch Masters

- ACT (Advanced Clutch Technology)

- McLeod Racing

- RAM Clutches

- Centerforce Performance Clutch

- OS Giken

- South Bend Clutch

- Fidanza Performance