Quadricycle and Tricycle Market Size

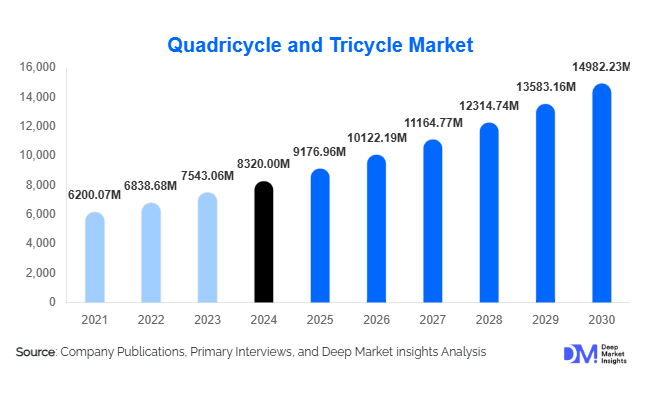

According to Deep Market Insights, the global quadricycle and tricycle market size was valued at USD 8,320.00 million in 2024 and is projected to grow from USD 9,176.96 million in 2025 to reach USD 14,982.23 million by 2030, expanding at a CAGR of 10.30% during the forecast period (2025–2030). The quadricycle and tricycle market growth is primarily driven by the rapid electrification of three-wheelers in emerging markets, rising demand for compact urban mobility solutions, and increasing adoption of micro-EVs and cargo trikes for last-mile delivery and fleet-based applications.

Key Market Insights

- Tricycles (motorized and pedal/e-assist) dominate the market, accounting for an estimated 85–90% of global revenue, driven by e-rickshaws and cargo three-wheelers in Asia and export markets.

- Asia-Pacific leads global demand, supported by large installed fleets and strong replacement cycles in India, China, and Southeast Asia, while Europe is the fastest-growing region for quadricycles and micro-EVs.

- Electric three-wheelers are gaining share rapidly, with several key markets already seeing EVs account for more than half of new three-wheeler registrations.

- Commercial applications, including passenger para-transit and goods delivery, represent around three-quarters of total market value, underlining the income-generating nature of these vehicles.

- Quadricycles and micro-EVs are emerging as alternatives to small city cars in dense European and urban cores, especially where low-emission zones and parking constraints are tightening.

- Technology integration, fleet connectivity, and modular cargo platforms are becoming key differentiators, especially for logistics, postal and shared-mobility operators.

What are the latest trends in the quadricycle and tricycle market?

Electrification and Micro-EVs Reshaping Urban Mobility

The most pronounced trend in the quadricycle and tricycle market is the shift from internal combustion engines to electric drivetrains. Electric three-wheelers, particularly e-rickshaws and cargo e-trikes, are replacing conventional CNG and diesel models across Asia and gradually expanding into Africa and Latin America. This shift is supported by government subsidies, low operational costs, and growing restrictions on high-emission vehicles in congested urban areas. At the same time, design-led micro-EVs and quadricycles are gaining traction in Europe and select urban centers worldwide, offering enclosed cabins, car-like comfort, and compact footprints suitable for narrow streets and limited parking. These vehicles occupy a space between e-bikes and small cars, aligning with city-level policies that encourage smaller, lighter vehicles while still providing everyday practicality.

Fleet-Centric Business Models and Last-Mile Logistics Adoption

Another key trend is the growing importance of fleet-based business models. Logistics operators, postal services, grocery delivery companies, and ride-hailing platforms are increasingly standardizing on electric three-wheelers, cargo trikes, and quadricycles for last-mile operations. This is driving demand for telematics-enabled platforms, swappable battery systems, and vehicles designed specifically for B2B use cases. Subscription-based and fleet-as-a-service models are emerging, allowing operators to avoid high upfront CapEx and instead pay monthly fees that bundle vehicles, servicing, and battery solutions. As quick-commerce, dark stores, and hyper-local delivery networks scale up, purpose-built quadricycles and e-trikes with modular cargo boxes, enhanced safety features, and route-optimization integration are becoming central to urban logistics strategies, pushing the market toward more sophisticated, connected and service-oriented offerings.

What are the key drivers in the quadricycle and tricycle market?

Urbanization, Congestion, and Demand for Compact Mobility

Accelerating urbanization and chronic congestion in major cities across Asia, Africa, Europe, and Latin America are core drivers of quadricycle and tricycle demand. Traditional cars and vans are increasingly impractical for short intra-city trips due to traffic, parking scarcity, and rising ownership costs. Quadricycles and three-wheelers offer a compact, agile alternative for both people and goods, with lower operating costs and easier maneuverability in dense neighborhoods. City governments are reinforcing this shift through low-emission zones, speed caps, and investments in micro-mobility infrastructure. For consumers and fleet operators, these vehicles often represent the most cost-effective way to solve first- and last-mile mobility challenges, combining flexibility with acceptable comfort levels in urban settings.

Policy Support, Electrification Incentives, and “Make Local” Programs

Government policy frameworks are another powerful growth driver. Many countries have implemented EV purchase subsidies, tax breaks, preferential electricity tariffs, or scrappage schemes targeting older three-wheelers. India, for example, combines EV incentives with domestic manufacturing initiatives, while several Southeast Asian and African markets are introducing pilot schemes for electric rickshaws and cargo trikes. In Europe, climate and air-quality targets incentivize adoption of electric quadricycles and micro-EVs for both private use and urban logistics. Local content requirements and “make local” programs are encouraging OEMs to invest in regional assembly, creating jobs and lowering landed costs. These policies collectively accelerate electrification, reduce TCO for fleet operators, and provide a stable regulatory signal that supports long-term planning and investment in quadricycle and tricycle platforms.

What are the restraints for the global market?

Regulatory Fragmentation and Limited Standardization

Despite supportive policies, regulatory fragmentation remains a significant restraint. Quadricycles and tricycles often fall into specialized or poorly defined vehicle categories with differing rules on licensing, safety equipment, permissible speed, and road access. In Europe, L-category rules for quadricycles vary in implementation by country, while in many emerging markets e-rickshaws and informal three-wheelers operate in regulatory grey zones. This lack of harmonization increases homologation and compliance costs for manufacturers and complicates cross-border trade. For fleet operators, uncertainty around future rules for road access, parking, and safety standards can delay investment decisions, slowing market growth and favoring incumbent, low-cost informal vehicles that may not meet modern safety or emissions expectations.

Safety Perceptions, Comfort Limitations, and Infrastructure Gaps

Another key restraint is the perception of quadricycles and tricycles as less safe or less aspirational than conventional cars. Open-bodied three-wheelers and basic e-rickshaws offer limited crash protection and sometimes operate with minimal safety features, leading to concerns among regulators, insurers, and higher-income consumers. In cold or extreme weather, comfort and protection from the elements can be inadequate compared to enclosed vehicles. Additionally, in many cities, supporting infrastructure—dedicated lanes, charging points suitable for small EVs, structured parking for fleets—is either lacking or underdeveloped. These factors can limit adoption, especially in premium or mainstream consumer segments, and slow the transition from older, informal three-wheeler fleets to modern, compliant electric models.

What are the key opportunities in the quadricycle and tricycle industry?

Fleet Electrification and Para-Transit Modernization

One of the largest opportunities lies in electrifying and formalizing existing para-transit and shared-mobility networks. Millions of ICE-powered three-wheelers currently serve as informal taxis across South Asia, Southeast Asia, Africa, and parts of Latin America. Replacing these with electric passenger trikes and standardized e-rickshaws opens up multi-billion-dollar opportunities in vehicle sales, battery-as-a-service, financing, and aftermarket support. OEMs and energy companies can partner with municipalities and mobility platforms to roll out structured e-rickshaw fleets with unified branding, digital payments, and trip aggregation, improving safety, earnings transparency, and environmental performance. This transition not only upgrades the user experience but also enables operators to collect data, optimize routes, and improve asset utilization, creating recurring revenue streams.

Last-Mile Logistics, Campus Mobility, and Micro-EV Niches

Another major opportunity is the integration of quadricycles, cargo trikes, and micro-EVs into last-mile logistics and specialized mobility niches. E-commerce, grocery delivery, food delivery, and postal networks increasingly require compact vehicles that can access congested, restricted, or pedestrianized zones. Purpose-built cargo e-trikes and quadricycles with modular boxes, temperature-controlled compartments, or swap-body systems can unlock new efficiencies in dense urban environments. Beyond logistics, there is rising demand for small electric utility vehicles in campuses, industrial parks, airports, resorts, hospitals, and gated communities. Manufacturers that develop robust, versatile platforms with connectivity, telematics, and flexible upfitting options can carve out high-margin segments, especially where these vehicles are purchased in fleets and integrated into long-term service contracts.

Vehicle Type Insights

Tricycles, particularly motorized three-wheelers used for passenger and cargo transport, dominate the global quadricycle and tricycle market. In 2024, tricycles are estimated to account for around 88% of total market revenue, with passenger e-rickshaws, shared-mobility trikes, and small cargo three-wheelers forming the backbone of urban mobility in many emerging economies. This dominance reflects their affordability, high utilization rates, and suitability for short-haul trips in congested areas. Quadricycles and micro-EVs, while still a smaller portion of the market, are growing rapidly in Europe and select urban regions where regulators promote downsized vehicles. These four-wheel microcars offer improved comfort and safety relative to open trikes and are increasingly positioned as practical second vehicles or fleet assets for city-center operations.

Application Insights

Commercial applications are the primary demand driver in the quadricycle and tricycle market. Passenger transport and para-transit—most notably e-rickshaws and shared trikes—represent a significant share, enabling affordable first- and last-mile connectivity for millions of commuters in Asia and parts of Africa and Latin America. Goods transport and last-mile delivery form the second major application segment, as cargo three-wheelers and e-trikes support e-commerce, groceries, food delivery, and small business logistics. Together, these commercial uses account for roughly 70–75% of global market value. Personal mobility, leisure, and tourism-focused applications represent a smaller but growing share, driven by recreational trikes in North America and Europe and by design-led micro-EVs and quadricycles purchased as compact, low-emission city runabouts.

Distribution Channel Insights

Distribution in the quadricycle and tricycle market is evolving from traditional dealership-driven models to more diversified channels. In many emerging markets, established auto and two-wheeler dealers maintain a stronghold on three-wheeler sales, especially where rural and small-town customers rely on physical showrooms and local financing relationships. At the same time, OEMs are increasingly working directly with fleet operators, logistics firms, and mobility platforms through dedicated B2B sales teams and corporate leasing programs. Digital channels are gaining importance, with online configurators, lead-generation platforms, and marketplace listings supporting discovery and comparison, particularly for quadricycles and micro-EVs in developed markets. For electric fleets, partnerships with energy providers, battery-swapping networks, and fleet-as-a-service platforms are emerging as critical distribution and support channels that bundle vehicles with energy, maintenance, and telematics.

End-User Insights

Fleet and mobility operators represent the most significant end-user group in the quadricycle and tricycle market. Logistics companies, ride-hailing and shared-mobility platforms, postal services, and institutional fleets collectively account for an estimated 60% of total market revenue, owing to their high vehicle volumes, structured replacement cycles, and focus on TCO. Individual consumers and small owner-operators form another substantial segment, particularly in emerging markets where a three-wheeler often serves as an income-generating asset for self-employed drivers. Government and municipal bodies, along with tourism and hospitality operators, represent smaller but increasingly important end users as they procure electric quadricycles, utility trikes, and micro-EVs for campus mobility, municipal services, and resort or attraction transport. This diversified end-user base helps buffer the market against cyclical downturns in any single sector.

Powertrain Insights

Internal combustion engines currently account for the majority of powertrains in the quadricycle and tricycle market, with petrol, diesel, CNG, and LPG three-wheelers together contributing about three-quarters of global revenue in 2024. These vehicles benefit from existing refueling infrastructure, entrenched user familiarity, and lower acquisition costs in many price-sensitive markets. However, electric powertrains are the fastest-growing segment, supported by policy incentives, falling battery costs, and superior operating economics for high-mileage fleets. Electric three-wheelers already represent a significant share of new sales in several countries, and electric quadricycles are gaining prominence in Europe. Over the forecast period, the share of battery electric models is expected to increase steadily, gradually eroding the dominance of ICE powertrains, particularly in urban and peri-urban applications.

| By Vehicle Type | By Power Source | By Application | By End User | By Price Range |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America accounts for a moderate share of the global quadricycle and tricycle market, with demand concentrated in recreational trikes, campus mobility vehicles, and early-stage last-mile logistics pilots. The U.S. is the dominant market, where three-wheeled vehicles such as touring trikes and powersport models appeal to enthusiasts seeking open-air, high-performance experiences. Quadricycles and micro-EVs are still niche in North America but are gaining attention in university campuses, corporate parks, and resort environments as low-speed mobility solutions. Growing interest in sustainable last-mile delivery is prompting logistics and retail players to experiment with cargo e-trikes and small electric quads, especially in dense urban cores where parking and emissions regulations are tightening.

Europe

Europe is emerging as the leading region for quadricycles and micro-EVs, with a strong regulatory push toward low-emission mobility and compact vehicle formats. Countries such as France, Italy, Spain, and Germany are seeing increased adoption of electric quadricycles for urban commuting, neighborhood mobility, and youth transport, enabled by specific licensing rules that allow younger drivers to operate these vehicles. European OEMs and startups are investing heavily in design-driven micro-EVs that offer car-like comfort and safety at lower cost and size than traditional city cars. Cargo e-trikes and quadricycles are also gaining ground in last-mile logistics as cities implement low-emission zones and restrict diesel vans from historic centers, creating sustained demand for light electric commercial vehicles.

Asia-Pacific

Asia-Pacific is the largest regional market for quadricycles and tricycles, driven primarily by massive installed fleets and strong replacement demand in India, China, and Southeast Asia. In India, three-wheelers and e-rickshaws form a critical pillar of urban and peri-urban mobility, and electric models are rapidly gaining share due to favorable economics and supportive policies. China remains a key producer and user of trikes and low-speed EVs, both for domestic use and export to other regions. Southeast Asian countries such as Indonesia, Thailand, and the Philippines rely on three-wheelers and tricycles for everyday transport and light logistics. As governments across APAC step up EV adoption programs and tighten emissions norms, the region is expected to remain the core volume engine of the industry.

Latin America

Latin America represents a smaller but growing share of the quadricycle and tricycle market. In countries such as Brazil, Colombia, Peru, and Mexico, three-wheelers and trikes are commonly used as moto-taxis and for light freight in urban and peri-urban areas. Most vehicles are still ICE-powered, but policy discussions around air quality and fuel efficiency are prompting early interest in electrification. Import flows from India and China supply a significant portion of three-wheeler demand. As e-commerce and last-mile logistics develop further in Latin America, cargo three-wheelers and e-trikes have an opportunity to capture market share from conventional two-wheelers and small vans, especially in congested city centers.

Middle East & Africa

The Middle East & Africa region currently accounts for a modest share of global revenue but offers strong long-term growth potential. In many African countries, three-wheelers imported from India and Asia serve as vital para-transit and goods transport vehicles, particularly in secondary cities and rural areas. As urbanization accelerates and transport networks evolve, demand for both passenger and cargo trikes is expected to expand. In the Middle East, micro-EVs, golf-cart-style vehicles, and trikes are increasingly used in resorts, gated communities, industrial complexes, and tourism destinations. High-income Gulf markets are also exploring electric quadricycles and small utility vehicles as part of broader sustainability and smart-city initiatives, creating pockets of premium demand in an otherwise value-driven regional landscape.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Company Market Share

The quadricycle and tricycle market is moderately fragmented, with a combination of global OEMs and regional specialists. The top five manufacturers collectively account for approximately 35–40% of global market revenue, reflecting strong but not overwhelming concentration. Large Indian OEMs dominate the global three-wheeler and e-rickshaw space, supplying both domestic and export markets, while European players hold leading positions in quadricycles and micro-EVs. North American manufacturers focus primarily on recreational and touring trikes. Below the top tier, a long tail of regional manufacturers, niche micro-EV brands, and local assemblers compete on price, customization, and proximity to end users. Competitive dynamics are increasingly influenced by capabilities in electrification, connectivity, and fleet services rather than purely by hardware cost.

Top Manufacturers in the Quadricycle and Tricycle Market

- Bajaj Auto Ltd

- Mahindra & Mahindra Ltd.

- Piaggio & C. SpA

- TVS Motor Company Ltd.

- Atul Auto Ltd.

- Stellantis N.V.

- Ligier Group

- Aixam-Mega SAS

- Estrima SpA (Birò)

- Micro Mobility Systems AG

- XEV S.r.l.

- Polaris Inc.

- BRP Inc.

- Harley-Davidson, Inc.

- Nissan Motor Co., Ltd.

Recent Developments

- In December 2024, Wardwizard Innovations & Mobility launched four new electric three-wheelers in India aimed at boosting last-mile mobility and commercial transport.

- In January 2025, Montra Electric introduced the Super Cargo electric three-wheeler equipped with fast-charging capabilities to support delivery fleets and small businesses.

- In June 2025, Honda debuted the Fastport eQuad, a low-speed electric quadricycle developed for micro-logistics and dense urban delivery routes.